For those studying finance or looking to understand how interest works, the concept of compound interest is crucial. Compound interest is the interest calculated on the initial sum of money as well as any accumulated interest from previous periods. To get a better grasp of the concept, many teachers and instructors provide worksheets to their students. One such worksheet is the 4 4 compound interest worksheet, which tests students’ understanding of calculating compound interest in various scenarios. In this article, we will provide the answer key for the 4 4 worksheet compound interest, helping students verify their solutions and learn from their mistakes.

The 4 4 worksheet compound interest consists of several questions, each presenting a different compound interest problem. Students are required to calculate the total amount of money after a given time period, considering the principal amount, interest rate, and compounding frequency. The worksheet may also include questions where students need to calculate the principal amount or the interest rate given the total amount and other variables. By working on such problems, students can strengthen their mathematical skills and gain a deeper understanding of how interest can impact the growth of an investment.

With the 4 4 worksheet compound interest answer key, students can cross-check their solutions and assess their understanding of the topic. This answer key provides the correct solutions for each question on the worksheet, helping students identify any mistakes or misconceptions they might have. Additionally, the answer key may provide explanations or step-by-step calculations for each problem, aiding students in their learning process. By reviewing the answer key, students can learn from their mistakes, gain confidence in their abilities, and improve their ability to solve compound interest problems.

Overall, the 4 4 worksheet compound interest answer key is a valuable resource for students studying finance or anyone looking to understand compound interest. By using this answer key, students can ensure the accuracy of their solutions, learn from their mistakes, and strengthen their understanding of compound interest calculations. Whether preparing for an exam or wanting to deepen their knowledge, the answer key provides a helpful tool for students to assess their progress and enhance their skills in compound interest calculations.

What is Compound Interest?

Compound interest refers to the process of earning interest on both the principal amount of money and any previously earned interest. Unlike simple interest, where interest is only calculated on the original principal, compound interest increases exponentially over time. This is due to the fact that the interest is added to the principal, and then the following interest calculations are based on the new total.

In simple terms, compound interest can be thought of as “interest on interest”. This means that over time, the initial investment grows at an accelerated rate. The longer the investment remains untouched, the greater the effect of compound interest. It is a powerful concept that allows individuals and businesses to grow their wealth over time.

One of the key factors that affects compound interest is the frequency with which it is calculated and added to the principal. Common periods include daily, monthly, quarterly, and annually. The more frequently interest is compounded, the greater the overall amount of interest earned over time.

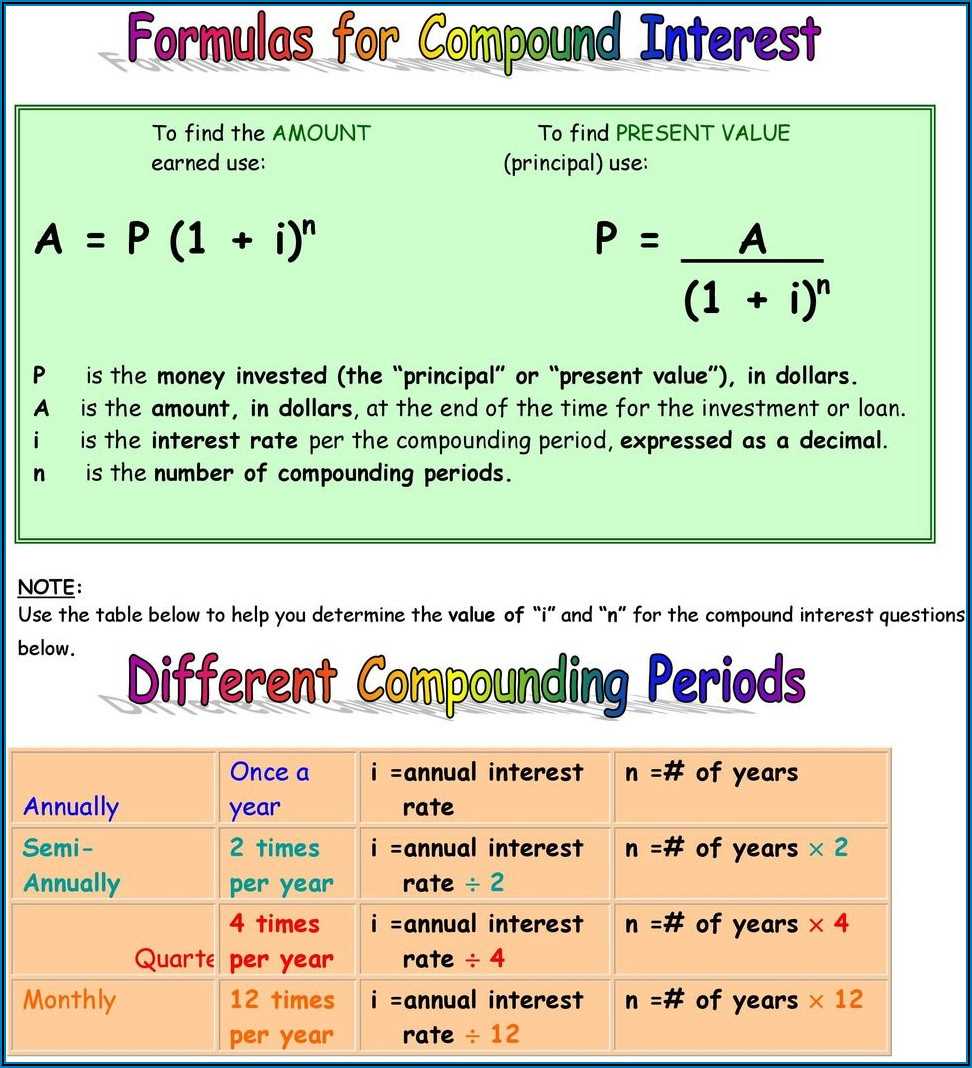

Calculating compound interest involves using the formula A = P(1 + r/n)^(nt), where A is the total amount, P is the principal, r is the interest rate, n is the number of times interest is compounded per year, and t is the number of years. It is important to consider the interest rate, compounding period, and time horizon when determining the future value of an investment.

Compound interest is a fundamental concept in finance and plays a crucial role in various financial calculations, such as determining investment returns, loan repayments, and savings growth. By understanding how compound interest works, individuals and businesses can make informed decisions to maximize their financial opportunities and achieve their long-term goals.

The Importance of Compound Interest in Finance

Compound interest is a fundamental concept in finance that plays a crucial role in helping individuals and businesses grow their wealth over time. It refers to the process of earning interest on both the original principal amount and the previously earned interest. This compounding effect allows for exponential growth and can significantly impact an individual’s financial stability and future goals.

One of the key benefits of compound interest is its ability to accelerate the growth of investments. By reinvesting the interest earned, individuals can benefit from the power of compounding and see their initial investment grow exponentially over time. This can be particularly advantageous for long-term investments such as retirement savings or building a nest egg. The longer money is left to compound, the greater the potential returns become.

Compounding interest can also help individuals overcome inflation. As the value of money decreases over time due to inflation, the interest earned on investments can help offset the loss in purchasing power. By consistently reinvesting the interest, individuals can stay ahead of inflation and maintain the growth of their investments.

Moreover, compound interest can provide financial security and stability in the face of unexpected expenses or emergencies. By regularly contributing to an investment or savings account that generates compound interest, individuals can build a safety net for unforeseen circumstances. The cumulative effect of compound interest can create a significant reserve of funds that can be accessed when needed, reducing the impact of financial setbacks.

In conclusion, compound interest is a powerful tool in finance that can help individuals and businesses grow their wealth and achieve financial goals. Through the process of compounding, investments can grow exponentially, overcome inflation, and provide stability in times of uncertainty. It is essential for individuals to understand and utilize compound interest to maximize their financial potential and secure a prosperous future.

Why is Compound Interest Important?

Compound interest is a concept that plays a crucial role in personal finance and investment strategies. It refers to the interest earned on both the initial amount invested or borrowed, as well as the accumulated interest from previous periods. This compounding effect can significantly impact one’s financial growth over time.

1. Increased Earnings: Compound interest allows individuals to earn interest not only on their initial investment but also on the interest earned in previous periods. This compounding effect can lead to exponential growth of their savings or investment portfolio over time. By reinvesting the earned interest, individuals can potentially maximize their earnings and achieve their financial goals faster.

2. Long-term Financial Security: Compound interest is a powerful tool in building wealth and ensuring long-term financial security. By consistently saving or investing and taking advantage of compound interest, individuals can grow their assets steadily over time. This can help finance important life goals such as retirement, purchasing a home, or funding their children’s education.

3. Debt Management: Compound interest also affects individuals who have borrowed money. If they have a loan or credit card debt with compound interest, the outstanding balance will grow over time if not paid off in full. This reinforces the importance of paying off debts as soon as possible to avoid excessive interest charges and to ultimately save money in the long run.

4. Investment Opportunities: Understanding compound interest is essential when making investment decisions. By knowing how interest compounds, investors can determine the potential return on their investments and evaluate the most profitable options. This knowledge can help individuals make informed decisions about how to allocate their resources and generate significant long-term gains.

In conclusion, compound interest is important as it allows individuals to maximize their earnings, achieve long-term financial security, manage debts effectively, and make informed investment decisions. By harnessing the power of compound interest, individuals can enhance their financial well-being and work towards their financial goals more efficiently.

Understanding the 4 4 Worksheet Compound Interest Answer Key

When it comes to understanding compound interest, the 4 4 Worksheet Compound Interest Answer Key is an essential tool. This worksheet provides a step-by-step explanation of how compound interest works and allows students to practice solving various compound interest problems.

The answer key for the 4 4 Worksheet Compound Interest provides detailed solutions to each problem, allowing students to check their work and understand where they went wrong, if they made any mistakes. This not only helps students learn from their errors but also reinforces the correct approach to solving compound interest problems.

Compound interest is the concept of earning interest on both the initial amount of money deposited or invested (known as the principal) and any interest that has already been accumulated. It is different from simple interest, which only accrues on the principal amount. This means that with compound interest, the amount of interest earned increases over time.

The 4 4 Worksheet Compound Interest Answer Key breaks down the calculations and formulas needed to solve compound interest problems. It includes explanations of how to find the total value of an investment after a certain number of years, as well as how to calculate the interest earned annually or semi-annually.

The answer key also helps students understand the impact of different factors on compound interest, such as the interest rate, the number of compounding periods per year, and the length of time the money is invested. This allows students to grasp the power of compound interest and how it can significantly increase the value of an investment over time.

Overall, the 4 4 Worksheet Compound Interest Answer Key is an invaluable resource for students learning about compound interest. It provides them with the necessary guidance and practice to confidently solve compound interest problems and understand the underlying concepts.

What is the Purpose of the 4 4 Worksheet?

The purpose of the 4 4 worksheet is to provide students with a practical way to understand and apply the concepts of compound interest. Compound interest is a fundamental concept in finance and economics, and the worksheet helps students develop their mathematical skills and problem-solving abilities in this area.

The 4 4 worksheet presents students with various scenarios involving compound interest, such as calculating the final amount of a loan or investment after a given period of time. The worksheet provides a step-by-step guide on how to calculate compound interest, including the formulas and calculations involved.

By completing the 4 4 worksheet, students can practice their knowledge and skills in compound interest, which can be applied in real-life situations such as personal finance, investments, and banking. The worksheet helps students understand the significance of compound interest and how it can impact their financial decisions.

Furthermore, the 4 4 worksheet encourages critical thinking and problem-solving skills. Students need to analyze each scenario, understand the given information, and apply the appropriate formulas and calculations to find the correct answer. This process helps students develop their analytical skills, logical reasoning, and attention to detail.

In conclusion, the 4 4 worksheet serves as a valuable tool for students to grasp the concept of compound interest and enhance their mathematical and problem-solving abilities. It enables them to apply their knowledge in real-life financial situations and prepares them for future finance-related endeavors.

Explaining Compound Interest Calculations

Compound interest is a concept used in finance to calculate the growth or accumulation of an investment over time. It is different from simple interest, as it takes into account not only the original amount invested, but also the interest that is constantly being added to the principal. This leads to exponential growth, where the interest earned on the investment is reinvested to earn even more interest.

To calculate compound interest, you need three key pieces of information: the principal amount (initial investment), the interest rate, and the time period. The formula for compound interest is as follows:

A = P(1 + r/n)^(nt)

- A represents the final amount or accumulated value of the investment.

- P is the principal amount or initial investment.

- r is the annual interest rate (expressed as a decimal).

- n represents the number of times that interest is compounded per year.

- t is the time period, usually measured in years.

The formula can be adjusted depending on the compounding frequency. For example, if interest is compounded annually, the value of “n” would be 1. If it is compounded quarterly, “n” would be 4, and so on. This allows for more accurate calculations based on the specific terms of the investment.

Compound interest can have a significant impact on the growth of an investment over time. By reinvesting the earned interest, the amount of interest earned continues to increase, resulting in exponential growth. This can be particularly advantageous for long-term investments, where the effects of compound interest are maximized.

How is Compound Interest Calculated?

Compound interest is a concept used in financial calculations that allows for the growth of an initial principal amount over time. It is different from simple interest, as it takes into account not only the original amount invested or borrowed, but also any interest that has accumulated on that amount.

To calculate compound interest, you need to know three key factors: the principal amount, the interest rate, and the time period. The formula for compound interest is:

A = P(1 + r/n)^(nt)

- A is the final amount, including both the principal and the interest.

- P is the principal amount, or the initial amount invested or borrowed.

- r is the annual interest rate expressed as a decimal.

- n is the number of times that interest is compounded per year.

- t is the time period, usually expressed in years.

By plugging in the values for P, r, n, and t into the formula, you can calculate the compound interest and the final amount. It’s important to note that compound interest can have a significant impact on long-term investments or loans, as the interest earned or charged accumulates over time.

Understanding how compound interest is calculated can help individuals make informed decisions about saving, investing, and borrowing money. It can also highlight the benefits of starting early and allowing interest to compound over a longer period of time.