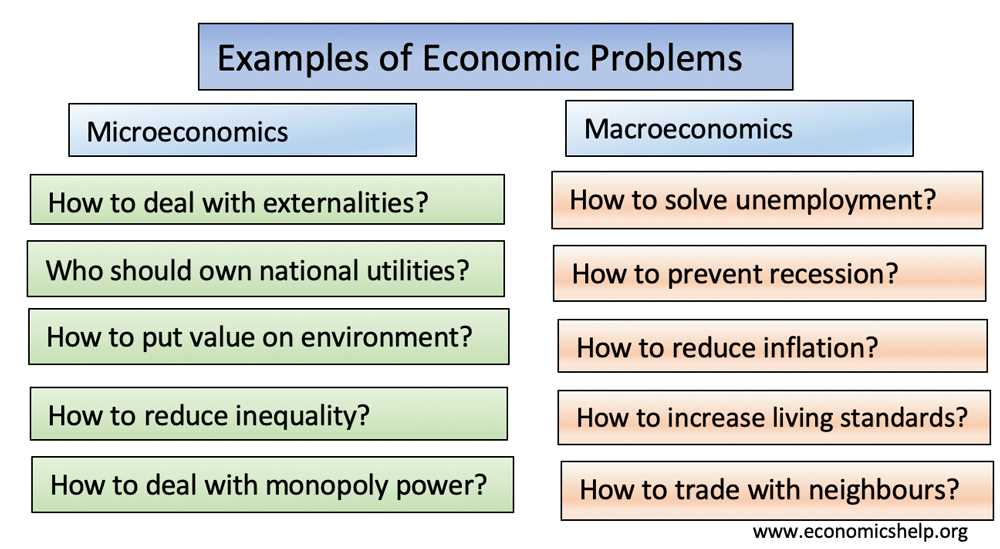

Inflation is a phenomenon that affects economies worldwide, influencing various aspects of people’s lives, from prices and wages to investment decisions and government policies. Understanding the types of inflation is crucial for policymakers and economists in formulating effective strategies to manage and control it.

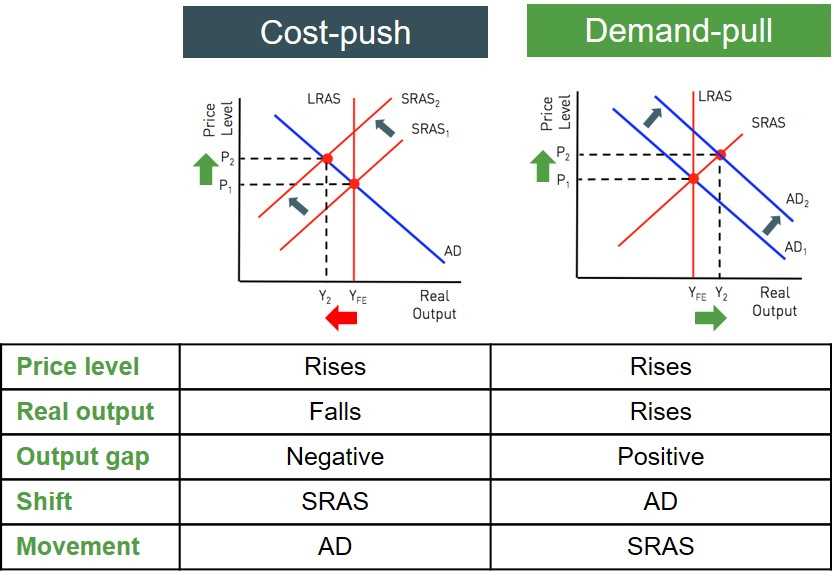

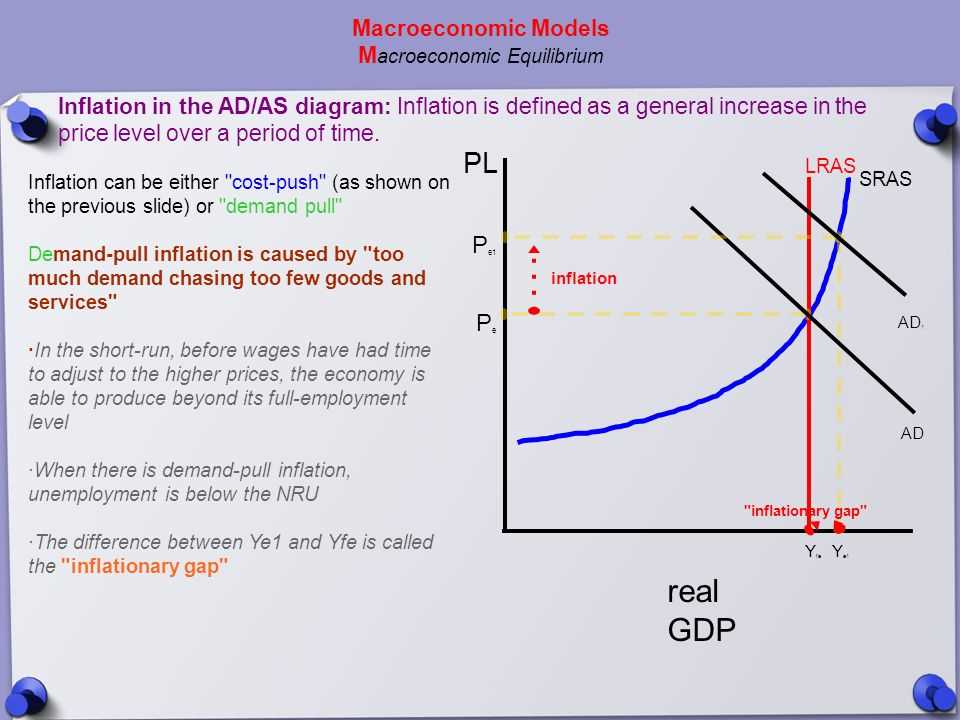

One type of inflation is demand-pull inflation, which occurs when the aggregate demand for goods and services exceeds the available supply. This type of inflation is typically associated with economic growth, as increased consumer spending drives up prices. It can be caused by factors such as robust consumer confidence, low interest rates, and fiscal stimulus measures.

Another type of inflation is cost-push inflation, which is driven by rising production costs. When the cost of inputs, such as raw materials or labor, increases, businesses pass on these higher costs to consumers by raising prices. Cost-push inflation can arise from factors such as increases in wages, taxes, or the price of imported goods.

Finally, there is built-in inflation, which is a result of inflation expectations becoming embedded into the economy’s structure. When people anticipate that prices will rise in the future, they demand higher wages to compensate for the expected increase in the cost of living. This, in turn, leads to higher production costs and a cycle of wage-price increases.

Understanding the different types of inflation is crucial for policymakers in managing the economy and ensuring price stability. By identifying the underlying factors driving inflation, policymakers can implement appropriate measures to mitigate its negative impacts and maintain a healthy economic environment.

Macroeconomics Activity 3 7 Answers: Types of Inflation

Inflation is a key concept in macroeconomics that measures the rate at which the general level of prices for goods and services is rising and, subsequently, purchasing power is falling. Various types of inflation can occur in an economy, each with its own causes and effects. In this activity, we will explore the different types of inflation and their implications.

1. Demand-Pull Inflation: Demand-pull inflation occurs when aggregate demand exceeds the economy’s ability to produce goods and services. This typically happens when consumers have high levels of income and spending, leading to an increase in the demand for goods and services. As the demand outpaces the supply, prices start to rise, causing inflation. Demand-pull inflation can be sparked by factors such as increased government spending, expansionary monetary policy, or an increase in exports.

2. Cost-Push Inflation: Cost-push inflation occurs when the input costs for businesses, such as wages or raw materials, increase, leading to higher prices for the final products. This type of inflation is usually driven by factors such as rising energy prices, an increase in labor costs, or scarcity of key resources. Cost-push inflation can be detrimental to businesses and consumers, as it reduces purchasing power and can lead to a decline in economic activity.

3. Built-In Inflation: Built-in inflation, also known as wage-price spiral, refers to a self-perpetuating cycle where wages and prices continue to rise in response to each other. It starts when workers demand higher wages to keep up with rising prices, and businesses, in turn, increase prices to cover the higher labor costs. This leads to an increase in workers’ wage demands, and the cycle continues. Built-in inflation can be challenging to break, as it becomes ingrained in the expectations and behavior of workers and businesses.

4. Hyperinflation: Hyperinflation occurs when prices rise rapidly and out of control, resulting in a complete loss of confidence in the currency. This type of inflation is usually caused by excessive money supply growth, often due to government deficits financed by printing money. Hyperinflation can have devastating effects on an economy, leading to a breakdown of the financial system, a sharp decline in living standards, and social unrest.

Understanding the different types of inflation is essential for policymakers and economists to develop appropriate measures to control and manage inflation. Each type requires a different approach to mitigate its effects and maintain price stability in the economy.

Understanding Inflation and Its Impact on the Economy

Inflation is a phenomenon characterized by a sustained increase in the general price level of goods and services in an economy over a period of time. It erodes the purchasing power of money, as individuals are required to spend more to purchase the same quantity of goods and services. Inflation can have a significant impact on the economy, affecting various aspects such as interest rates, investments, wages, and consumer spending.

One of the key impacts of inflation is on interest rates. As prices rise, lenders demand higher interest rates to compensate for the declining value of money over time. This, in turn, increases the cost of borrowing for businesses and individuals, leading to a decline in investment and consumer spending. Higher interest rates also affect financial markets, as they can decrease the attractiveness of stocks and bonds, causing investors to shift their investments to other assets.

Inflation also affects wages and salaries. When prices rise, individuals demand higher wages to maintain their purchasing power. This can lead to wage negotiations and labor disputes, causing disruptions in the labor market. Moreover, if wages increase faster than productivity, it can lead to higher production costs for businesses, which may result in reduced profitability and potentially job losses.

Furthermore, inflation can have an impact on consumer spending. As the prices of goods and services increase, individuals have less disposable income to spend on other items or save for the future. This can dampen consumer confidence and lead to a decrease in consumer spending, which is a significant driver of economic growth. Reduced consumer spending can then have a ripple effect on businesses, leading to lower profits and potentially job cuts.

In conclusion, inflation is a complex economic phenomenon that can have far-reaching consequences for an economy. It affects interest rates, investments, wages, and consumer spending, among other factors. Policymakers and central banks often aim to maintain price stability and keep inflation within a target range to ensure economic stability and promote sustainable growth.

Types of Inflation Explained

Inflation is an important economic phenomenon that refers to the general increase in prices in an economy over time. It is often measured through consumer price indexes (CPI) or the producer price index (PPI). There are various types of inflation that can occur, each with its own causes and effects on the economy. Understanding these types of inflation can help policymakers and individuals make informed decisions.

1. Demand-Pull Inflation

Demand-pull inflation occurs when aggregate demand exceeds the available supply of goods and services in an economy. This can be caused by factors such as strong consumer demand, expansionary fiscal policies, or government spending. When demand exceeds supply, sellers increase prices to balance the market, leading to inflation. This type of inflation is often associated with periods of economic growth and can lead to overheating in the economy.

2. Cost-Push Inflation

Cost-push inflation, also known as supply-side inflation, happens when the cost of production for businesses increases. This can be due to factors such as rising wages, higher raw material costs, or increased taxes and regulations. When businesses face higher production costs, they pass on these expenses to consumers by raising prices, leading to inflation. Cost-push inflation can result in a decrease in real wages and reduced purchasing power for consumers.

3. Built-in Inflation

Built-in inflation, also referred to as wage-price spiral, is a self-perpetuating cycle of inflation. It occurs when workers demand higher wages to keep up with rising prices, and businesses respond by increasing prices to cover the increased labor costs. The cycle continues as workers keep demanding higher wages, and prices keep rising. Built-in inflation is often caused by high inflation expectations and can be challenging to break as it becomes ingrained in the economy.

4. Hyperinflation

Hyperinflation is an extreme type of inflation characterized by a rapid and uncontrollable increase in prices. It often occurs during periods of political instability or economic crises. Hyperinflation erodes the value of the local currency rapidly, leading to a loss of confidence in the economy. It can have severe consequences, such as a collapse in the banking system and social unrest.

Understanding these different types of inflation is essential for policymakers and individuals as each type requires different strategies for managing and combating inflation. By identifying the causes, policymakers can implement appropriate monetary and fiscal policies to control inflation and maintain price stability in the economy.

Demand-Pull Inflation: Causes and Consequences

Demand-pull inflation occurs when aggregate demand increases at a faster rate than the overall supply of goods and services. This imbalance leads to an increase in the general price level, resulting in inflation. There are several causes of demand-pull inflation, including increased consumer spending, government spending, and investment activities.

One of the main causes of demand-pull inflation is increased consumer spending. When individuals have more disposable income, they tend to spend more on goods and services. This increased demand puts pressure on producers to increase prices to meet the higher levels of demand. Similarly, when government spending increases, such as through infrastructure projects or welfare programs, it stimulates demand and can lead to inflation if the supply of goods and services cannot keep up.

Another factor that contributes to demand-pull inflation is increased investment activities. When businesses invest in new equipment, technology, or expansion, it can result in higher levels of production. However, if the supply cannot keep up with the increased demand, prices will rise. This is particularly true in industries where there are limited production capacities, such as oil or natural resources.

- Consequences of demand-pull inflation:

One consequence of demand-pull inflation is a decrease in purchasing power. As prices rise, individuals and businesses need to spend more money to purchase the same goods and services. This can lead to a decrease in the standard of living and a reduction in consumer confidence. Additionally, demand-pull inflation can create a vicious cycle where workers demand higher wages to keep up with rising prices, which in turn leads to higher production costs for businesses.

Furthermore, demand-pull inflation can have a negative impact on imports and exports. When the general price level increases in a country experiencing demand-pull inflation, its goods and services become relatively more expensive compared to other countries. This can lead to a decrease in export demand and an increase in import demand, resulting in a trade imbalance. Also, demand-pull inflation can erode the competitiveness of domestic industries and lead to a decrease in investment.

In conclusion, demand-pull inflation is caused by an increase in aggregate demand that outpaces the supply of goods and services. Increased consumer spending, government spending, and investment activities can all contribute to this type of inflation. The consequences of demand-pull inflation include a decrease in purchasing power, potential wage-price spirals, and negative impacts on exports and investment. Policymakers should carefully monitor and manage aggregate demand to prevent and mitigate the effects of demand-pull inflation.

Cost-Push Inflation: Factors and Effects

Cost-push inflation is a type of inflation that occurs when there is an increase in the cost of production for goods and services. This increase in costs is usually caused by a rise in the prices of raw materials, labor, or other inputs. When producers face higher costs, they often pass these costs on to consumers in the form of higher prices. This can lead to a decrease in purchasing power and an overall increase in the price level.

There are several factors that can contribute to cost-push inflation. One factor is an increase in the price of raw materials, such as oil, which can drive up production costs for many goods and services. Additionally, an increase in wage rates can also contribute to cost-push inflation. When workers demand higher wages, businesses may have to increase prices to cover these higher labor costs. Similarly, an increase in taxes or regulations can also lead to higher production costs and ultimately, cost-push inflation.

Cost-push inflation can have several effects on the economy. One of the main effects is a decrease in consumer purchasing power. When the prices of goods and services increase, consumers may have to spend more money to maintain the same standard of living. This can lead to a decrease in consumer spending, which can in turn impact economic growth. Additionally, cost-push inflation can also lead to a decrease in business investment. When businesses face higher production costs, they may have less money available to invest in new projects or expansions. This can slow down economic growth and limit job creation.

In conclusion, cost-push inflation is a type of inflation that occurs when there is an increase in the cost of production. Factors such as increases in raw material prices, wage rates, and taxes can all contribute to this type of inflation. The effects of cost-push inflation include decreased consumer purchasing power and a decrease in business investment, which can have an impact on overall economic growth. Understanding the causes and effects of cost-push inflation is important for policymakers and economists to effectively manage and mitigate its effects on the economy.

Structural Inflation: Causes and Solutions

Structural inflation refers to a type of inflation that arises from underlying structural issues in an economy. It is characterized by a persistent increase in prices due to imbalances in the supply and demand of goods and services.

There can be several causes of structural inflation. One common cause is supply-side constraints. This can occur when there is a shortage of key resources, such as raw materials or skilled labor, which leads to an increase in production costs and ultimately higher prices for consumers. Additionally, changes in government policies or regulations can also contribute to structural inflation by impacting the cost of production and distribution.

To tackle structural inflation, it is important to address the root causes of the problem. One possible solution is to invest in infrastructure and technological advancements to overcome supply-side constraints. This can involve improving transportation networks, enhancing education and vocational training programs, and promoting innovation and research and development.

Another approach is to reform regulations and policies that may be hindering the efficient functioning of markets. This can involve reducing bureaucratic red tape, streamlining approval processes, and fostering competition to encourage efficiency and productivity gains. Additionally, governments can implement targeted social safety net programs to alleviate the potential negative effects of structural inflation on vulnerable populations.

In conclusion, structural inflation is a complex issue that requires a comprehensive and tailored approach to address its underlying causes. By investing in infrastructure, promoting technological advancements, and implementing market-oriented reforms, policymakers can mitigate the effects of structural inflation and promote sustainable economic growth.