Everfi Module 2: Employment and Taxes is an educational program that aims to help individuals understand the complex world of employment and taxes. This module provides valuable information on topics such as the benefits of employment, the hiring process, and the types of taxes that are deducted from employee paychecks.

Understanding the basics of employment and taxes is crucial for individuals who are entering the workforce for the first time or for those who need a refresher. By completing this module, participants will gain a comprehensive understanding of how taxes are calculated, the importance of filing tax returns, and the role of the Internal Revenue Service (IRS) in administering tax laws.

One of the key areas covered in this module is the various types of taxes that individuals encounter throughout their careers. Participants will learn about federal income taxes, Social Security taxes, and Medicare taxes. By gaining an understanding of these taxes and how they are calculated, individuals can better manage their personal finances and make informed decisions about their employment.

In addition to taxes, this module also covers important information about employment benefits. Participants will learn about different types of benefits, such as health insurance and retirement plans, and how these benefits can impact overall compensation. Understanding the value of benefits can help individuals make informed decisions about their employment options and negotiate better compensation packages.

Everfi Module 2 Employment and Taxes Answers

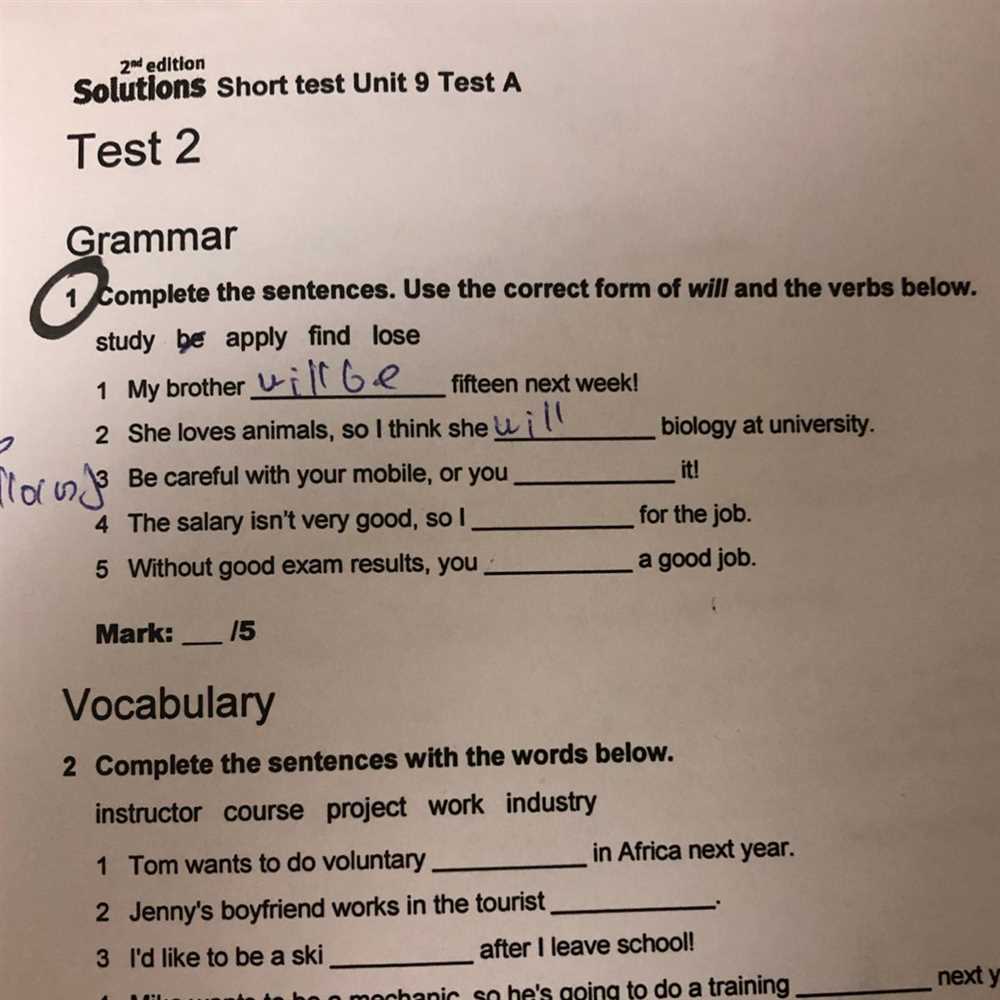

In Everfi Module 2, Employment and Taxes, participants learn about essential concepts related to taxation and employment. This module covers topics such as the difference between gross pay and net pay, the various types of taxes, and how to complete a W-4 Form.

One of the key concepts covered in Everfi Module 2 is understanding the difference between gross pay and net pay. Gross pay is the total amount of money earned before any deductions, such as taxes and benefits, are taken out. Net pay, on the other hand, is the amount of money a person actually receives after deductions are made. Participants learn about the various factors that can affect their net pay, such as income tax, Social Security tax, and Medicare tax.

In addition to understanding the difference between gross pay and net pay, participants also learn about the different types of taxes they may have to pay. This includes federal income tax, which is a tax levied by the federal government on an individual’s income, and state income tax, which is a tax levied by the state government on an individual’s income. Participants also learn about the importance of completing a W-4 Form, which is used by employers to determine how much federal income tax to withhold from an employee’s paycheck.

Overall, Everfi Module 2 provides participants with a comprehensive understanding of employment and taxation. By completing this module, participants gain the knowledge and skills necessary to navigate the complex world of taxes and make informed financial decisions.

What is Everfi Module 2: Employment and Taxes?

Everfi Module 2: Employment and Taxes is an educational online module designed to provide individuals with the necessary knowledge and skills to navigate the world of employment and taxes. This module is part of the larger Everfi financial literacy program, which aims to empower individuals to make informed financial decisions and become financially responsible.

In Everfi Module 2: Employment and Taxes, participants will learn about various aspects of employment, such as job hunting, interviews, and workplace communication, as well as the importance of earning and saving money. The module also dives into the complex world of taxes, teaching individuals about different types of taxes, how to fill out tax forms, and the importance of timely tax payments.

The module is designed to be interactive and engaging, using real-life scenarios and practical examples to help individuals understand the concepts and apply them in their own lives. Participants will be able to navigate through different lessons and sections, complete quizzes and assessments, and track their progress as they move through the module.

By completing Everfi Module 2: Employment and Taxes, individuals will gain the necessary knowledge and skills to effectively manage their finances and make informed decisions in their personal and professional lives. Understanding employment and taxes is crucial for financial independence and success, and this module serves as a valuable resource in building that knowledge foundation.

Understanding Employment and Taxes

When it comes to employment and taxes, it is crucial to have a clear understanding of the terms and processes involved. This knowledge will not only help you navigate your own financial responsibilities, but also empower you to make informed decisions about your career and financial future.

Employment: Before diving into the intricacies of taxes, it is important to have a solid understanding of employment. Employment refers to the relationship between an employer and an employee, where the employee agrees to provide services in exchange for compensation, often in the form of wages or salary.

Taxes: Taxes are a mandatory contribution that individuals and businesses are required to pay to the government to fund public expenditures. This includes funding for areas such as public infrastructure, healthcare, education, and defense. Taxes are typically calculated based on income and may vary depending on factors such as filing status, deductions, and credits.

Income Taxes: One of the key aspects of understanding employment and taxes is comprehending how income taxes work. Income taxes are taxes imposed on an individual’s earnings from employment, investments, or other sources of income. The amount of income tax an individual owes is determined by their taxable income, which is the total amount of income subject to taxation after deductions and exemptions are taken into account.

Withholding Taxes: Employers are responsible for withholding a portion of an employee’s wages or salary for income taxes. This is known as withholding tax. The withheld amount is then remitted to the government on the employee’s behalf. It is important for employees to understand their own tax withholding to ensure that the correct amount is being withheld and to avoid any surprises at tax time.

Filing Taxes: Lastly, it is important to understand the process of filing taxes. Individuals are required to file their income tax returns annually with the government. This involves reporting their income, deductions, and credits to determine their final tax liability. Filing taxes accurately and on time is essential to avoid penalties and ensure compliance with tax laws.

Overall, understanding employment and taxes is crucial for individuals to effectively manage their finances and comply with their financial obligations. By educating yourself about how employment and taxes work, you can make informed decisions about your career, finances, and ensure financial stability and success in the long run.

Key Concepts Covered in Everfi Module 2

In Everfi Module 2, participants learn about important concepts related to employment and taxes. This module provides essential knowledge and skills for navigating the workforce and understanding the role of taxes in the economy. It covers a range of topics, including different types of income, tax forms, and strategies for minimizing tax liability.

1. Types of Income:

The module introduces participants to various types of income that individuals can earn, such as wages, salaries, tips, and self-employment income. It explains how these different types of income are taxed differently and provides examples to help clarify the concepts.

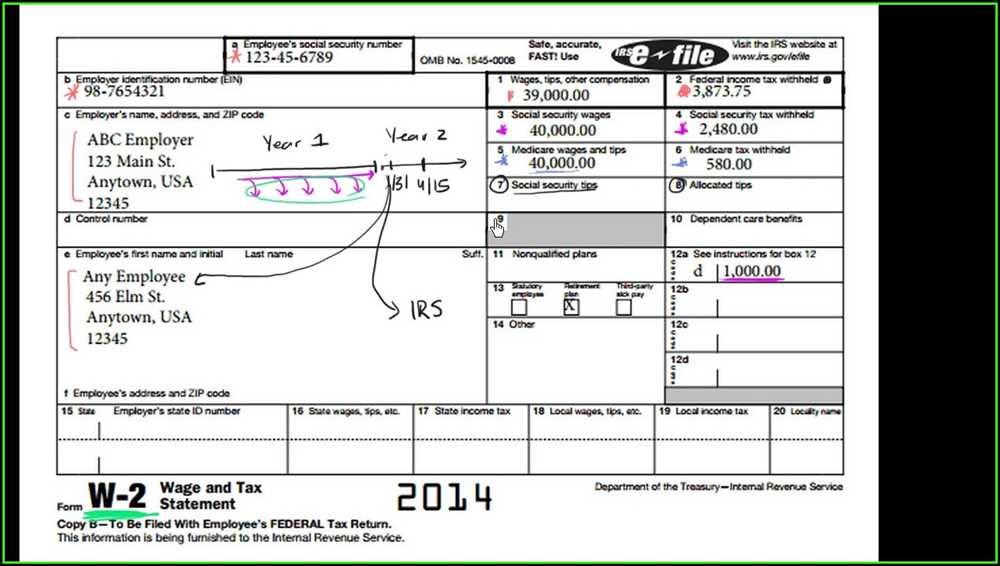

2. Tax Forms:

Participants learn about the different tax forms that individuals may need to fill out and submit, such as Form W-2 and Form 1099. The module explains when and how these forms are used, as well as the importance of accurately reporting income and deductions.

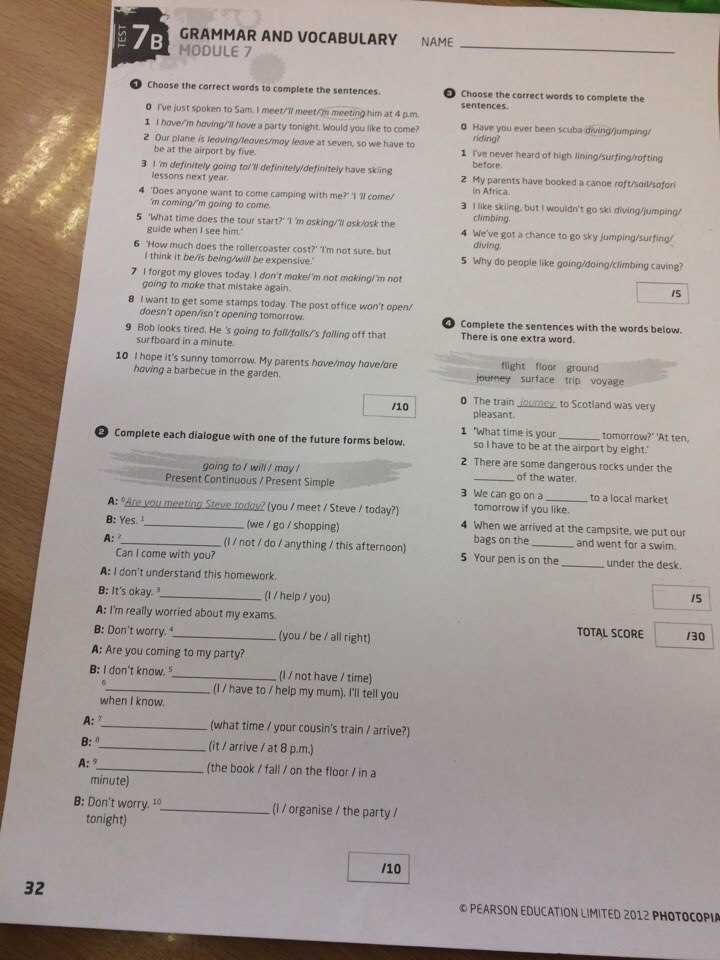

3. Withholding and Payroll Taxes:

Participants gain an understanding of the concept of withholding and how it affects their paychecks. The module explains how employers withhold taxes from employees’ wages and the purpose of payroll taxes, such as Social Security and Medicare taxes.

4. Tax Deductions and Credits:

The module discusses the importance of tax deductions and credits in reducing one’s overall tax liability. Participants learn about common deductions and credits, such as the standard deduction, education credits, and home mortgage interest deduction.

5. Budgeting and Financial Planning:

The module emphasizes the importance of budgeting and financial planning in managing one’s finances effectively. Participants learn practical strategies for creating a budget, tracking expenses, and saving money for future needs and goals.

- Understanding the concepts covered in Everfi Module 2 is essential for individuals who are entering or already in the workforce. It equips them with the knowledge and skills needed to navigate their finances and make informed decisions about taxes and employment.

- By understanding the different types of income and how they are taxed, individuals can better plan for their tax obligations and avoid surprises when tax season arrives.

- Participants also learn about the importance of accurately reporting their income and deductions on tax forms to avoid penalties and maximize their potential refunds.

- Additionally, learning about tax deductions and credits can help individuals save money, as they can identify opportunities to reduce their taxable income and claim credits that lower their overall tax liability.

- The module’s focus on budgeting and financial planning is crucial for individuals to establish healthy financial habits and achieve their financial goals.

.

Tips and Strategies for Completing Everfi Module 2

Everfi Module 2 on employment and taxes provides valuable information on the important aspects of starting a job, understanding taxes, and managing personal finances. To successfully complete this module and gain a thorough understanding of the material, here are some tips and strategies to consider:

1. Take your time to read and comprehend the content

Do not rush through the module. Take the time to carefully read and comprehend each section. The information provided can be complex, but it is vital to grasp the concepts to make informed financial decisions. Take notes if necessary to help reinforce your understanding.

2. Engage with the interactive activities

The module includes interactive activities that allow you to apply what you’ve learned. These activities range from simulations to quizzes and are designed to reinforce key concepts. Engage with these activities and take advantage of the immediate feedback provided.

3. Seek clarification if needed

If you come across any concepts or terms that are unclear, don’t hesitate to seek clarification. Reach out to your teacher or classmates for assistance. Understanding the material is crucial for effective application in real-life situations.

4. Review and assess your progress

As you progress through the module, periodically review the content you’ve covered to reinforce your understanding. Take note of any areas that you find challenging and make an effort to revisit them. Evaluating your progress will help identify areas for improvement.

5. Apply the knowledge to real-life scenarios

Making the connection between the module content and real-life situations is crucial. Look for opportunities to apply the knowledge gained to your personal finances or hypothetical scenarios. This will enhance your understanding and help you make informed financial decisions in the future.

By following these tips and strategies, you can navigate Everfi Module 2 on employment and taxes effectively and acquire valuable knowledge that will contribute to your financial literacy and readiness for the workforce.

Frequently Asked Questions for Everfi Module 2

Here are some frequently asked questions about Everfi Module 2: Employment and Taxes:

1. What is the purpose of Module 2?

Module 2 of Everfi focuses on educating individuals about the basics of employment and taxes. It covers various topics such as employment options, income sources, tax deductions, and filing tax returns. The purpose of this module is to provide users with essential knowledge and skills to navigate the world of work and understand how taxes impact their financial well-being.

2. How long does it take to complete Module 2?

The time required to complete Module 2 varies depending on the individual’s pace and level of engagement. On average, it may take approximately 45 minutes to 1 hour to complete all the lessons and activities included in this module. It is important to allocate sufficient time to fully understand the concepts and interact with the interactive elements of the module.

3. Are there any quizzes or assessments in Module 2?

Yes, Module 2 includes quizzes and assessments to test the user’s understanding of the topics covered. These assessments are designed to reinforce the learned content and measure the user’s knowledge and comprehension. Users are encouraged to take these assessments seriously and review their answers to identify any areas that need further clarification.

4. Can I revisit and review module content after completion?

Absolutely! After completing Module 2, users have the ability to revisit and review the content at any time. This is particularly helpful if users need to refresh their memory or dive deeper into specific topics. Users can access the module through their Everfi account and navigate through the lessons and activities as needed.

5. Are there any additional resources available for further learning?

Yes, Everfi provides supplementary resources for users who want to deepen their understanding of employment and taxes. These resources may include videos, articles, and interactive tools that offer practical tips and insights. Users are encouraged to explore these additional resources to enhance their knowledge and make informed decisions regarding employment and taxes.