Understanding government spending and budgeting is essential for individuals and businesses alike. In order to assess the effectiveness and efficiency of government programs, it is important to have access to accurate financial information. One tool that can help in this process is the Government Spending Worksheet.

The Government Spending Worksheet is a valuable resource that allows individuals to track and analyze how tax dollars are being used. It provides a detailed breakdown of various government expenditures, including education, healthcare, defense, and infrastructure. By completing this worksheet, individuals can gain a better understanding of where their tax dollars are being allocated and how these funds are impacting their communities.

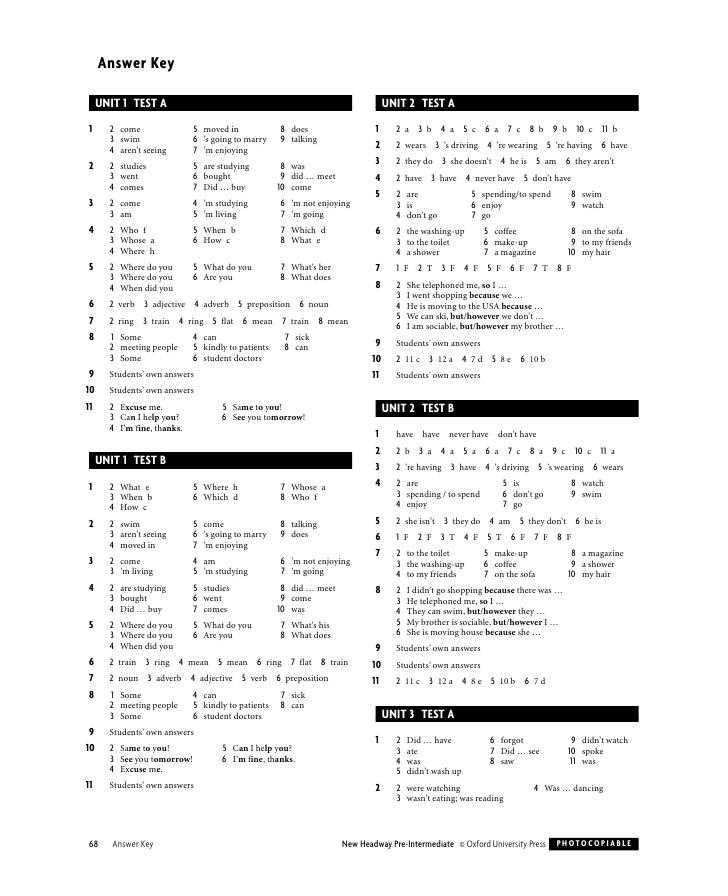

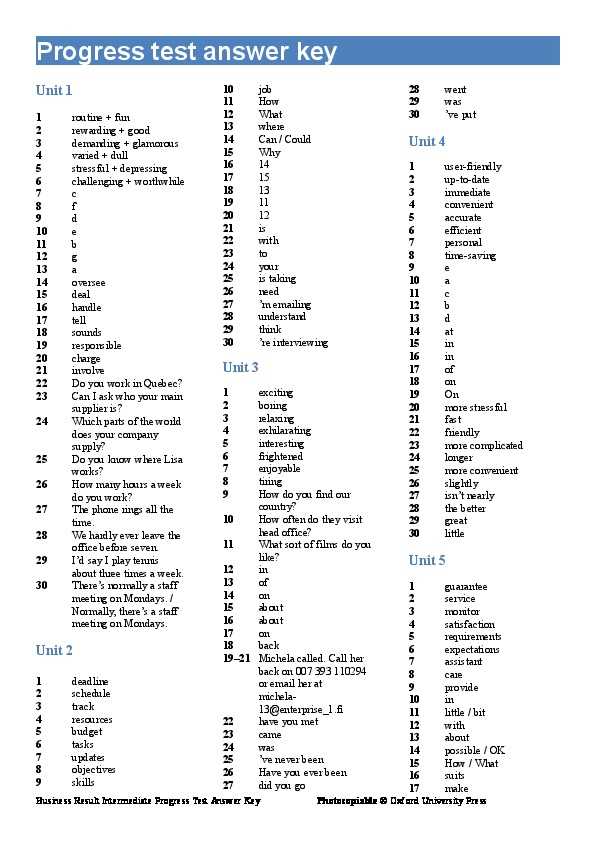

The answer key for the Government Spending Worksheet is a comprehensive guide that provides the correct answers to the various questions and exercises included in the worksheet. It serves as a reference tool, allowing individuals to check their answers and ensure that they have accurately completed the worksheet. The answer key also provides explanations and additional information, helping individuals deepen their understanding of government spending and budgeting.

With the help of the Government Spending Worksheet Answer Key, individuals can gain a clearer picture of how their tax dollars are being used and evaluate the effectiveness of different government programs. This knowledge can empower individuals to engage in informed discussions about government spending and advocate for changes based on their findings. Whether you are a concerned citizen, a student studying public policy, or a business owner, the Government Spending Worksheet and its answer key can be powerful tools in understanding and assessing government spending.

Understanding Government Spending: A Comprehensive Worksheet

Government spending is a complex and important topic that affects every citizen. It is crucial to understand where and how the government allocates its resources to ensure the efficient use of taxpayer money. To help citizens gain a better understanding of government spending, a comprehensive worksheet can be a useful tool. This worksheet aims to provide an in-depth analysis of government spending, including its sources, purposes, and impacts.

Sources of Government Revenue:

The worksheet starts by presenting an overview of the various sources of government revenue. These include taxes, such as income tax, sales tax, and corporate tax, as well as non-tax revenues like fees and fines. Understanding the sources of government revenue is essential to comprehend how different sectors contribute to the overall budget.

Purposes of Government Spending:

Next, the worksheet delves into the purposes of government spending. It categorizes spending into different sectors, such as healthcare, education, defense, infrastructure, and social welfare. Each sector is explored in detail, highlighting the importance of government expenditure in fulfilling societal needs and promoting economic growth.

Impact of Government Spending:

The third section of the worksheet focuses on the impact of government spending. It examines both the short-term and long-term effects of government expenditure on the economy and the population. This includes analyzing the role of government spending in job creation, income redistribution, and economic stability. It also discusses the potential risks and challenges associated with excessive spending and budget deficits.

Conclusion:

In conclusion, a comprehensive worksheet on government spending provides citizens with a valuable resource to enhance their understanding of how taxpayer money is utilized. By comprehending the sources, purposes, and impacts of government spending, individuals can make informed decisions and actively participate in discussions regarding budget allocation and fiscal policies. This worksheet serves as a basis for fostering transparency, accountability, and responsible fiscal management.

What is Government Spending?

Government spending refers to the amount of money that a government allocates for various purposes and programs. It encompasses the expenditures made by the government on goods and services, as well as its investments and transfer payments. Government spending is an essential component of fiscal policy, which is used to achieve economic objectives, promote social welfare, and maintain public infrastructure and services.

The government spends money on a wide range of areas, including defense, education, healthcare, social security, infrastructure development, and public administration. These expenditures are often financed through taxes, borrowing, or printing money, depending on the financial situation and economic policies of a country.

Government spending plays a crucial role in stimulating economic growth and addressing societal needs. It can stimulate aggregate demand and create jobs through investments in infrastructure, education, and healthcare. Additionally, government spending on social welfare programs, such as healthcare and social security, can help alleviate poverty and provide a safety net for vulnerable populations.

However, excessive government spending can also lead to negative consequences. It can contribute to budget deficits and lead to inflation if not financed properly. Therefore, it is crucial for governments to strike a balance between spending on essential services and programs and maintaining fiscal sustainability.

In summary, government spending is the allocation of funds by a government for various purposes and programs. It plays a vital role in promoting economic growth, addressing societal needs, and maintaining public infrastructure and services. However, careful management and prioritization are essential to ensure the sustainability of public finances.

The Importance of Tracking Government Spending

Tracking government spending is crucial for ensuring transparency, accountability, and efficiency in a country’s financial management. It allows citizens to understand how their tax dollars are being allocated and spent, and enables them to hold their elected officials accountable for their stewardship of public funds.

Transparency: Tracking government spending provides transparency by allowing citizens to see where and how their tax dollars are being used. This information can be accessed through fiscal reports, budget documents, and public records. By making this information readily available, governments can promote trust and confidence among their citizens, as well as deter corruption and misuse of public funds.

Accountability: With access to information on government spending, citizens can hold their elected officials accountable for their decisions and actions. By scrutinizing the budget allocations and expenditures, citizens can identify any potential wasteful spending, inefficiencies, or misappropriation of funds. This accountability helps ensure that public funds are being used responsibly and for the benefit of the country and its citizens.

Efficiency: Tracking government spending can also help identify areas where efficiency improvements can be made. By analyzing how funds are allocated and spent, governments can identify areas of overlap, bottlenecks, or ineffective processes. This information can then be used to make data-driven decisions to optimize resource allocation and improve the overall efficiency of government operations.

In conclusion, tracking government spending is essential for promoting transparency, accountability, and efficiency in financial management. By providing citizens with access to information on how their tax dollars are being used, governments can foster trust and confidence, deter corruption, and ensure that public funds are being used responsibly. Additionally, tracking government spending allows for the identification of areas where improvements can be made, leading to more efficient government operations and better allocation of resources.

Government Spending Worksheet: An Overview

Government spending plays a vital role in the economy and the overall well-being of a country. It is essential to understand the different aspects of government spending to make informed decisions and analyze its impact on various sectors and individuals. The Government Spending Worksheet provides a comprehensive overview of the different categories of government expenditure and their significance.

The worksheet consists of a series of questions and prompts that help individuals and policymakers examine the various components of government spending. It covers areas such as social programs, defense, infrastructure, education, healthcare, and more. By answering these questions, individuals can gain insights into how government funds are allocated and understand the priorities and objectives of public spending.

- Social Programs: This section focuses on government spending on programs aimed at assisting individuals and families in need. It includes welfare programs, unemployment benefits, housing subsidies, and food assistance programs. Understanding the allocation and effectiveness of social programs is crucial in evaluating their impact on poverty reduction and societal well-being.

- Defense: Government spending on the military and national defense is another significant area covered in the worksheet. It examines the budget allocated to the armed forces, weapons acquisition, and defense research. Examining defense spending is vital for understanding national security priorities and evaluating the balance between defense needs and other societal demands.

- Infrastructure: This section focuses on government spending on infrastructure development, including transportation, energy, and public facilities. It looks into investments in roadways, bridges, airports, and public transportation systems. Analyzing infrastructure spending is essential for evaluating the quality of public services, promoting economic growth, and addressing infrastructure deficiencies.

- Education: Government spending on education is crucial for the development of human capital and ensuring equal opportunities. The worksheet explores investments in primary, secondary, and higher education, including funding for schools, teacher salaries, and educational resources. Examining education spending helps evaluate the quality of education, access to educational resources, and the effectiveness of educational policies.

- Healthcare: The worksheet also covers government spending on healthcare, including public health programs, medical research, and healthcare services. It examines funding for hospitals, clinics, pharmaceuticals, and health insurance programs. Understanding healthcare spending is essential to assess the accessibility and affordability of healthcare services and evaluate the overall performance of the healthcare system.

The Government Spending Worksheet offers a comprehensive overview of the different areas of government spending and their implications for society. By analyzing these categories of expenditure, individuals and policymakers can make informed decisions, allocate funds effectively, and address the diverse needs of the population.

Key Components of a Government Spending Worksheet

The government spending worksheet is a crucial tool in tracking and managing the financial resources of a government entity. It provides an organized and structured format for recording and analyzing expenses, ensuring transparency and accountability in public spending. The worksheet consists of several key components that help in effectively managing the government’s finances.

1. Budget Categories: The worksheet includes different categories that represent various areas of government expenditure, such as healthcare, education, infrastructure, defense, etc. These categories provide a clear breakdown of the funds allocated to each sector, allowing for better analysis and decision-making.

2. Expense Tracking: The worksheet allows for the tracking of expenses related to each budget category. It provides a systematic process for recording expenses, including the date, description, amount, and purpose of each expenditure. This helps in monitoring the utilization of funds and identifying any discrepancies or potential areas of improvement.

3. Revenue Sources: Another important component of the government spending worksheet is the inclusion of revenue sources. It provides a comprehensive overview of the various sources of income for the government, such as taxes, grants, loans, etc. This information is crucial for understanding the overall financial position of the government and assessing its capacity for spending.

4. Budget Targets: The worksheet also includes budget targets for each budget category. These targets establish the desired level of expenditure for a specific period, helping in guiding financial decisions and ensuring adherence to the overall budgetary plan. By comparing actual expenses to the set targets, it becomes easier to identify any areas of overspending or underspending.

5. Analysis and Reporting: The government spending worksheet serves as a tool for analysis and reporting. It allows for the generation of reports that provide insights into the government’s financial performance, including expenditure trends, budget compliance, and potential areas of improvement. These reports help in making informed decisions and fostering transparency in government spending.

In conclusion, the government spending worksheet is a vital tool for managing and monitoring the financial resources of a government entity. By incorporating key components such as budget categories, expense tracking, revenue sources, budget targets, and analysis and reporting, the worksheet facilitates effective financial management and promotes transparency in government spending.

Income Sources

When it comes to government spending, it is important to have a clear understanding of where the money comes from. This helps determine the budget and prioritize areas of expenditure. In general, the government derives its income from various sources.

Taxes: One of the primary sources of government income is taxes. Individuals and businesses are required to pay taxes on their income, property, and consumption. These taxes, including income tax, sales tax, and property tax, contribute to the government’s revenue stream.

Government Investments: The government also earns income through investments. It invests in various sectors such as stocks, bonds, and real estate, and the returns from these investments provide additional revenue. This income can be used to fund government initiatives and projects.

Fees and Fines: Another source of income for the government is fees and fines. This includes fees for government services such as issuing licenses and permits, as well as fines for violations of laws and regulations. These fees and fines help to offset the costs of providing these services and maintain order in society.

International Trade: The government also earns income through international trade. Import and export duties, tariffs, and trade agreements contribute to the government’s revenue. This income can be used to support domestic industries, promote economic growth, and maintain international relations.

Borrowing: In some cases, the government may borrow money to meet its financial obligations. This borrowing can come from domestic sources such as issuing government bonds or from international institutions. While borrowing provides immediate funds, it also adds to the government’s debt burden, which needs to be carefully managed.

Overall, understanding the various sources of government income is crucial in order to make informed decisions about government spending. It allows for better budgeting, allocation of resources, and financial planning to meet the needs of the country and its citizens.