Understanding taxes and government spending is essential for any individual or business in today’s society. Chapter 14 of this worksheet provides answers and insights into various aspects of taxation and how governments allocate their funds. This article aims to explore the key concepts covered in this chapter and shed light on the importance of taxation and government spending.

One of the main topics discussed in Chapter 14 is the different types of taxes that individuals and businesses are subject to. These include income taxes, sales taxes, property taxes, and excise taxes. The chapter provides detailed explanations of how these taxes are calculated and collected and how they impact individuals and businesses.

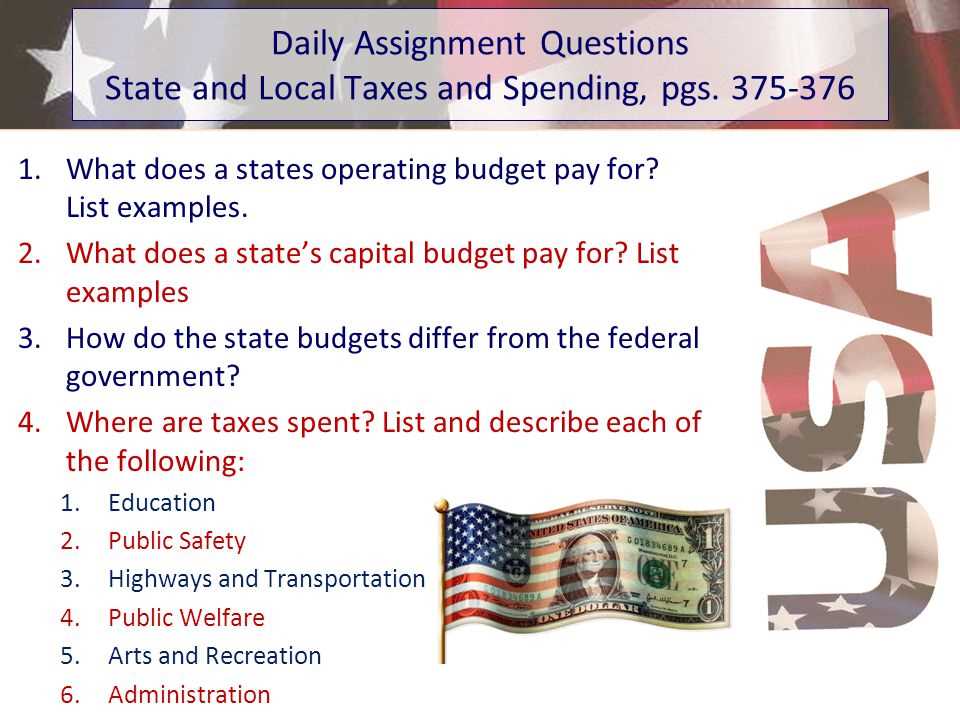

Another important aspect covered in the chapter is government spending. The chapter explores how governments allocate their funds to different areas such as education, healthcare, defense, and infrastructure. Understanding how government spending works is crucial for individuals and businesses to make informed decisions and plan their finances accordingly.

Furthermore, the chapter delves into the concept of tax deductions and credits. It explains how individuals and businesses can reduce their tax liabilities through various deductions and credits available to them. Understanding these opportunities can help individuals and businesses optimize their tax strategies and maximize their savings.

In conclusion, Chapter 14 of the worksheet on taxes and government spending provides valuable answers and insights into the complex world of taxation. By understanding the different types of taxes, how governments allocate their funds, and the opportunities for tax deductions and credits, individuals and businesses can navigate the tax landscape with confidence and make informed financial decisions.

Chapter 14 Taxes and Government Spending Worksheet Answers

In chapter 14 of the economics textbook, students are introduced to the concepts of taxes and government spending. This chapter explores how the government raises revenue through taxes and then uses that revenue to fund various programs and services.

One key concept covered in this chapter is the difference between progressive, regressive, and proportional taxes. Progressive taxes, such as the income tax, require individuals with a higher income to pay a higher percentage of their income in taxes. Regressive taxes, on the other hand, tend to take a higher percentage of income from individuals with lower incomes, such as sales taxes. Proportional taxes, also known as flat taxes, require individuals to pay the same percentage of their income in taxes regardless of their income level.

Another important topic covered in this chapter is government spending. Students learn about the different types of government spending, including transfer payments, public goods, and subsidies. Transfer payments are payments made by the government to individuals or households, such as Social Security and unemployment benefits. Public goods are goods and services that benefit society as a whole, such as national defense and public parks. Subsidies, on the other hand, are financial assistance provided by the government to certain industries or businesses to support their operations.

The worksheet answers for chapter 14 provide students with the opportunity to apply their understanding of these concepts. They may be asked to analyze different tax systems and determine whether they are progressive, regressive, or proportional. They may also be asked to identify examples of government spending and explain the purpose and impact of these expenditures.

In conclusion, chapter 14 of the economics textbook provides important insights into the complex world of taxes and government spending. By understanding these concepts, students can gain a better understanding of how governments generate revenue and allocate resources to fund various programs and services.

Understanding Taxes: Key Concepts Explained

Taxes play a crucial role in the functioning of a government and are a key concept in economics. Whether it’s income taxes, sales taxes, or corporate taxes, understanding how taxes work is essential for individuals and businesses alike. Here are some key concepts to help you get a better grasp of taxes.

1. Taxable Income

When it comes to income taxes, understanding taxable income is vital. Taxable income refers to the portion of your income that is subject to taxation after deductions and exemptions. Deductions can include expenses such as mortgage interest, medical expenses, and student loan interest. Exemptions are deductions for yourself, your spouse, and any dependents. The lower your taxable income, the lower your tax liability.

2. Progressive Tax System

Most tax systems follow a progressive approach, meaning that as your income increases, the percentage of tax you pay also increases. This is achieved through tax brackets, where different income ranges are taxed at different rates. For example, someone earning $50,000 per year may be taxed at a lower rate than someone earning $100,000 per year. The aim of a progressive tax system is to distribute the tax burden more equitably among different income levels.

3. Tax Credits

Tax credits are reductions in your tax liability directly, rather than deductions from your taxable income. They provide a dollar-for-dollar reduction in the amount of tax you owe. For example, if you have a $1,000 tax credit, it means you can subtract $1,000 from your tax bill. Common tax credits include the Child Tax Credit, the Earned Income Tax Credit, and the American Opportunity Tax Credit.

4. Government Spending

Taxes are not only used to fund government operations but also to finance government spending. Governments use tax revenues to provide services such as education, healthcare, infrastructure development, and defense. Understanding how tax dollars are allocated and spent is important in evaluating the effectiveness of government programs and policies. It is important for citizens to stay informed and engage in discussions about government spending priorities.

In conclusion, understanding key tax concepts such as taxable income, progressive tax systems, tax credits, and government spending is essential for making informed decisions about personal finances and participating in discussions about economic policies. By having a solid grasp of these concepts, individuals and businesses can navigate the complex world of taxes more effectively and advocate for equitable tax systems that benefit society as a whole.

Overview of Government Spending and Revenue

The government plays a crucial role in the economy by collecting revenue through taxes and allocating it through government spending. This process helps fund public goods and services, such as infrastructure, education, healthcare, and national defense.

Government revenue: The primary source of government revenue is taxation. Taxes can be imposed on individuals, businesses, and goods and services. The government collects income taxes, payroll taxes, corporate taxes, and various other taxes to generate revenue. Additionally, the government may generate revenue through fees, fines, and tariffs.

Government spending: Once the government collects revenue, it allocates it through government spending. Government spending can be categorized into two broad categories: mandatory spending and discretionary spending. Mandatory spending includes programs like Social Security, Medicare, and Medicaid, which are funded automatically without requiring annual appropriations. Discretionary spending includes areas like defense, education, transportation, and environmental protection. The government also spends on interest payments on its debt.

The government’s role in spending and revenue is influenced by various factors, such as economic conditions, political priorities, and societal needs. The budgetary process involves the creation, implementation, and oversight of the government’s spending and revenue plans. This process involves Congress, the President, and other government agencies and committees.

Challenges and debates: Government spending and revenue are often the subject of debate and policy discussions. There are ongoing debates about the appropriate level of taxation, the allocation of government funds, and the impact of government spending on the economy. Balancing the need for revenue to fund essential services while minimizing the burden on individuals and businesses is a complex challenge for policymakers.

In conclusion, government spending and revenue are fundamental components of the economy. Through taxation and spending, the government funds public goods and services, supporting economic growth and societal well-being. The allocation of government funds and the management of revenue are subjects of ongoing policy debates as policymakers strive to strike a balance between funding essential programs and minimizing the impact on businesses and individuals.

The Importance of Taxes in Funding Government Programs

Taxes play a crucial role in funding government programs and services. They provide the necessary financial resources for governments to carry out their duties and responsibilities, such as maintaining infrastructure, providing public education, healthcare, and social welfare programs. Without taxes, the government would struggle to function and provide essential services to its citizens.

One of the primary reasons taxes are vital for funding government programs is because they ensure an equitable distribution of resources. Through taxes, wealthier individuals and businesses contribute a larger portion of their income, helping to promote social and economic equality. This redistribution of wealth allows the government to provide assistance to those who are less fortunate and in need, creating a safety net for society’s most vulnerable members.

Furthermore, taxes enable governments to invest in the long-term development and growth of a nation. Funds generated from taxes can be allocated towards infrastructure projects, such as building roads, bridges, and public transportation systems. These investments not only improve the quality of life for citizens but also stimulate economic activity and create job opportunities. By funding these initiatives through taxes, governments can lay the foundation for a prosperous and sustainable future.

In addition, taxes help regulate and incentivize certain behaviors. Governments often use taxes as a means to discourage undesirable activities, such as excessive consumption of tobacco and alcohol, by applying higher taxes on these products. Conversely, tax incentives are offered to promote positive behaviors, such as investing in renewable energy sources or conducting research and development. By utilizing taxes in this manner, governments can influence individuals and businesses to make choices that benefit society as a whole.

In conclusion, taxes are essential for funding government programs and services. They not only provide the necessary financial resources but also promote social and economic equality, drive long-term development, and incentivize desired behaviors. It is through taxation that governments can fulfill their obligations to their citizens and work towards creating a better and more equitable society.

Types of Taxes and Their Impact on Individuals and Businesses

Taxes are a necessary part of funding government operations and providing public services. There are several types of taxes that individuals and businesses may be required to pay, each with their own impact on the economy and the pockets of taxpayers.

Income taxes are one of the most common types of taxes that individuals and businesses are required to pay. This tax is typically based on the amount of income earned, and it varies depending on the individual’s or business’s tax bracket. Income taxes can have a significant impact on individuals’ financial situations, as they can reduce disposable income and affect purchasing power. For businesses, income taxes can affect their profitability and ability to invest in growth and expansion.

Sales taxes are another type of tax that individuals and businesses may encounter. These taxes are typically levied on the sale of goods and services, with the tax rate varying depending on the jurisdiction. Sales taxes can have a direct impact on individuals’ purchasing decisions, as the higher the tax rate, the more expensive goods and services become. For businesses, sales taxes can affect consumer demand and pricing strategies, as they need to consider the potential impact of taxes on their customers’ willingness to buy.

Property taxes are taxes assessed on the value of real estate and other types of property. These taxes are typically levied by local governments and are used to fund local services such as schools and infrastructure. Property taxes can have a significant impact on homeowners, as they can increase the cost of living and housing affordability. For businesses, property taxes can affect their cost structure, particularly if they own or rent significant amounts of property for their operations.

Corporate taxes are taxes levied on the profits earned by corporations. These taxes can vary depending on the jurisdiction and can have a significant impact on a corporation’s profitability. Corporate taxes can affect investment decisions and the ability of businesses to compete globally. The impact of corporate taxes on individuals can vary, depending on factors such as the ownership structure of the corporation and how the taxes are passed on to shareholders or consumers.

In conclusion, taxes come in various forms, and they have different impacts on individuals and businesses. Understanding the different types of taxes and their effects is crucial for making informed financial decisions. Whether it’s income taxes reducing individuals’ disposable income or corporate taxes affecting business profitability, taxes play a significant role in the economy.

How Taxes Are Collected and Administered

When it comes to funding government programs and services, taxes play a crucial role. Taxes are collected from individuals, businesses, and other entities to generate revenue for the government. The process of tax collection and administration involves several steps and entities to ensure compliance and fairness.

1. Tax Collection: Tax collection begins with the taxpayer. Individuals and businesses are required to report their income and other financial information to the tax authorities, typically the Internal Revenue Service (IRS) in the United States. This information is then used to calculate the amount of tax owed.

2. Tax Filing: Taxpayers are required to file their tax returns each year, providing detailed information about their income, deductions, and credits. The tax return serves as a declaration of the taxpayer’s financial situation, and it is used to determine the proper amount of tax liability.

3. Tax Payment: Once the tax liability has been calculated, taxpayers are required to make the necessary tax payments. This can be done through various methods, such as direct payment, electronic funds transfer, or installment agreements. Failure to pay taxes can result in penalties and interest charges.

4. Tax Audits: To ensure compliance, tax authorities may conduct audits to verify the accuracy of tax returns. During an audit, the taxpayer’s financial records and supporting documents may be reviewed to identify any discrepancies or errors. Audits can be conducted randomly or based on specific criteria.

5. Tax Enforcement: Tax authorities have the power to enforce tax laws and collect unpaid taxes. This can be done through various means, such as wage garnishments, property liens, and legal actions. The goal is to ensure that taxpayers meet their tax obligations and that the government has the necessary funds to operate.

Overall, the collection and administration of taxes is a complex process that involves cooperation between taxpayers, tax authorities, and other relevant entities. It is essential for maintaining a functioning government and providing the necessary resources for public services and programs.