In the world of business, transactions are the lifeblood that keeps companies running. Whether it’s buying goods, selling products, or exchanging services, every interaction between a company and its customers or suppliers is a business transaction. These transactions are crucial for the financial health of a company, as they determine its revenue and expenses.

Problem 3 10 in the field of accounting involves describing business transactions. It’s important to accurately record and describe these transactions to maintain a clear and transparent financial record. Answering this problem requires an understanding of the different types of transactions, such as cash transactions, credit transactions, and exchanges of goods or services. The key to describing these transactions lies in providing specific and detailed information about the nature, date, parties involved, and monetary value of the transaction.

Accuracy is paramount when describing business transactions, as it helps ensure the integrity and reliability of a company’s financial statements. Whether recording a sale, a purchase, or any other type of transaction, providing an answer key allows for consistency and standardization in the documentation process. By using a standardized answer key, companies can communicate their financial activities effectively to stakeholders, such as investors, lenders, and regulatory authorities.

Overall, Problem 3 10 describing business transactions answer key plays a vital role in maintaining accurate financial records and facilitating effective communication in the business world. By accurately and clearly describing transactions, companies can ensure transparency, build trust, and make informed financial decisions based on reliable information.

What is Problem 3 10 Describing Business Transactions Answer Key?

The Problem 3 10 Describing Business Transactions Answer Key is a solution guide that provides answers and explanations for the problems and questions in Problem 3 10 of a business transactions course. This answer key is commonly used by students and instructors as a reference to check their work and understand the steps and concepts involved in solving the problems.

This particular problem set focuses on describing various types of business transactions, their effects on the accounting equation, and the appropriate journal entries. The answer key provides step-by-step solutions and explanations for each question, ensuring that students can fully grasp the concepts and apply them correctly in similar scenarios.

- The Problem 3 10 Describing Business Transactions Answer Key includes:

- A detailed explanation of the accounting equation and its components.

- Examples and explanations of different types of business transactions, such as sales, purchases, expenses, and revenues.

- Guidance on how to determine the effects of these transactions on the accounting equation.

- Illustrations of journal entries for each transaction, demonstrating the correct recording process.

- Tips and strategies for analyzing and summarizing financial information based on the recorded transactions.

By using the Problem 3 10 Describing Business Transactions Answer Key, students can ensure that they are correctly understanding and applying the concepts taught in their business transactions course. It serves as a valuable resource for self-study, exam preparation, and clarification of any doubts or uncertainties regarding the topic.

Understanding the Problem

Before we can find a solution to Problem 3 10, it is important to have a clear understanding of the problem itself. The problem description states that we need to describe business transactions and their effects on the accounting equation. This means that we need to analyze the given transactions and identify the changes they cause in the assets, liabilities, and owner’s equity of a business.

To effectively describe the business transactions, we need to have a good understanding of the accounting equation, which states that assets equal liabilities plus owner’s equity. This equation forms the foundation of double-entry bookkeeping, where every transaction has an equal effect on both sides of the equation. By recognizing the impact of each transaction on the accounting equation, we will be able to accurately describe the changes in the financial position of the business.

To achieve this, we can utilize several strategies. One approach is to carefully read and analyze each transaction, identifying the specific accounts affected and the direction of the change (increase or decrease) for each account. We can then organize this information into a clear and concise description that accurately reflects the transaction’s effects on the business’s financial position.

Furthermore, it may be helpful to create a table or list to keep track of the changes in each account. By organizing the information in a systematic manner, we can ensure that we accurately capture the impact of each transaction and avoid any discrepancies or errors in our descriptions.

Overall, understanding the problem and having a solid grasp of the accounting equation will allow us to successfully describe the business transactions and their effects on the financial position of the business. By approaching each transaction with a systematic and analytical mindset, we can ensure that our descriptions are accurate and comprehensive.

Why is it Important to Describe Business Transactions?

Describing business transactions is essential for several reasons. Firstly, accurate and detailed descriptions allow for better record-keeping and organization of financial data. When transactions are properly described, it becomes easier to track and analyze the flow of money within a business. This information is crucial for making informed decisions, identifying trends, and forecasting future financial performance.

Furthermore, describing business transactions provides clarity and transparency. It ensures that all parties involved in a transaction have a clear understanding of the terms and conditions. This helps to minimize misunderstandings and disputes, as everyone is on the same page regarding what was agreed upon. Detailed descriptions also serve as valuable evidence in case of any legal or audit requirements, as they provide a clear record of the transaction and its associated details.

In addition, describing business transactions accurately is crucial for compliance with financial reporting standards and regulations. Clear descriptions help to ensure that financial statements are prepared in accordance with accounting principles and guidelines. This is important for maintaining the integrity and credibility of financial reporting, both internally within the organization and externally for stakeholders, such as investors, lenders, and regulatory bodies.

Overall, the importance of describing business transactions lies in its ability to provide accurate financial information, promote transparency and understanding among parties involved, and ensure compliance with accounting standards and regulations. It plays a fundamental role in effective financial management and decision-making, allowing businesses to operate efficiently and responsibly.

The Significance of Accurate Business Transaction Description

Accurate description of business transactions is of utmost significance for several reasons. First and foremost, it ensures transparency and accountability in financial reporting. When transactions are accurately described, stakeholders can easily understand and assess the financial health of the business. This is particularly important for investors, lenders, and potential business partners who rely on financial statements to make informed decisions.

Furthermore, accurate transaction description helps in identifying and rectifying errors or discrepancies in financial records. By providing clear and detailed information about the nature, timing, and amount of transactions, businesses can easily spot any inconsistencies and take necessary actions. This is crucial for maintaining the integrity of financial data and preventing fraudulent activities.

Moreover, accurate transaction description facilitates effective communication between different departments within a business. It provides a common language and reference point for employees involved in financial activities, ensuring that everyone is on the same page. This helps in streamlining business processes and minimizing misunderstandings or errors that can arise due to vague or ambiguous transaction descriptions.

Accurate transaction description also plays a vital role in compliance with regulatory requirements. Government agencies and regulatory bodies often require businesses to provide detailed information about their transactions to ensure compliance with laws and regulations. By maintaining accurate transaction descriptions, businesses can avoid penalties and legal complications.

In conclusion, accurate business transaction description is crucial for ensuring transparency, identifying errors, facilitating communication, and complying with regulatory requirements. Businesses should prioritize the accuracy and clarity of their transaction descriptions to maintain the integrity of their financial data and foster trust with stakeholders.

Common Challenges in Describing Business Transactions

Describing business transactions accurately is crucial for effective communication and decision-making within an organization. However, a number of challenges can arise when trying to convey the details of these transactions in a clear and concise manner.

One common challenge is the use of technical jargon and complex terminology. Business transactions often involve specialized terms and concepts that can be confusing for those who are not familiar with the industry or field. It is important to find a balance between using precise language to accurately describe the transaction and ensuring that the information is easily understandable to a wider audience. It may be helpful to provide explanations or definitions of key terms when describing the transaction.

Another challenge is capturing all the relevant details of a transaction. Business transactions can involve multiple parties, various types of goods or services, and different financial elements such as prices, discounts, and taxes. It can be difficult to capture all these details accurately and concisely. Using a structured format, such as a table or a bullet-point list, can help to ensure that all the necessary information is included and organized in a clear manner.

In addition, describing business transactions can also be challenging due to the dynamic nature of the business environment. Transactions can change or evolve over time, and it is important to capture and communicate these changes accurately. Providing regular updates or revisions to the transaction description can help to ensure that everyone involved has the most up-to-date information.

Overall, effectively describing business transactions requires careful attention to language, organization, and accuracy. By addressing these common challenges, organizations can enhance communication, improve decision-making, and ultimately drive business success.

Ambiguity and Lack of Clarity

Ambiguity and lack of clarity can be detrimental to any business transaction. When communication between parties is not clear and concise, misunderstandings can easily arise, leading to delays, disputes, and potential financial losses.

One common source of ambiguity is vague terminology or jargon. Using industry-specific language without providing clear definitions can confuse parties who are not familiar with the terminology. For example, if a contract uses terms such as “net profit margin” or “capital expenditure,” it is important to define these terms to avoid any misunderstanding or misinterpretation.

Another form of ambiguity can stem from the lack of specific details or instructions. When important information is missing or incomplete, it becomes difficult for both parties to understand their rights, obligations, and expectations. This can result in delays in project completion, disputes over deliverables, and even legal complications.

To avoid ambiguity and lack of clarity in business transactions, it is essential to communicate effectively. This includes clearly defining terms and concepts, providing specific details and instructions, and ensuring that all parties involved have a clear understanding of the transactional terms and expectations.

Additionally, it is important to document all agreements and conversations in writing to serve as a record and point of reference. This can help prevent misunderstandings and provide a clear framework for resolving any disputes that may arise in the future.

In summary, ambiguity and lack of clarity can create significant challenges in business transactions. By promoting clear communication, providing specific details and instructions, and documenting agreements, businesses can minimize misunderstandings and ensure smoother and more successful transactions.

Techniques and Strategies for Describing Business Transactions

When it comes to describing business transactions, there are several techniques and strategies that can be used to provide clear and accurate information. Utilizing these techniques can help ensure that the details of the transaction are effectively communicated to all parties involved.

Categorical Classification: One strategy for describing business transactions is to categorically classify them based on their nature. This can involve grouping transactions by type, such as sales transactions, purchasing transactions, or financial transactions. By organizing transactions into categories, it becomes easier to analyze and understand the different aspects and implications of each transaction.

Chronological Order: Describing business transactions in chronological order is another effective technique. This involves presenting the transactions in the order in which they occurred, starting with the earliest transaction and ending with the most recent. This approach provides a clear timeline of events and helps in understanding the sequence of transactions and their impact on the business.

Use of Key Financial Terms: In order to accurately describe business transactions, it is important to use key financial terms and indicators. These terms provide specific and concise information about the transaction, making it easier for others to understand the financial implications and outcomes. Key financial terms can include revenue, expenses, assets, liabilities, and equity.

Quantitative and Qualitative Analysis: When describing business transactions, it is important to provide both quantitative and qualitative analysis. Quantitative analysis involves presenting numerical data and figures, such as sales figures or profit margins, while qualitative analysis focuses on the qualitative aspects of the transaction, such as the reasoning behind the transaction or the impact on the business strategy. Combining quantitative and qualitative analysis provides a comprehensive understanding of the transaction.

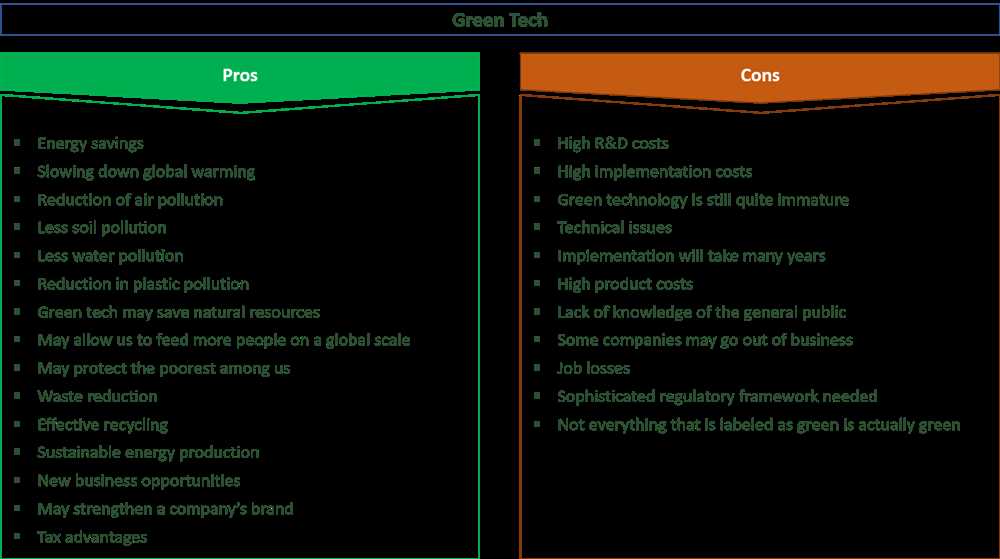

Use of Visuals: To enhance the description of business transactions, the use of visuals can be highly effective. This can include charts, graphs, or diagrams that visually represent the transaction and its impact. Visuals provide a clear and concise way to convey information and make it easier for others to understand the transaction.

Overall, employing techniques such as categorical classification, chronological order, the use of key financial terms, quantitative and qualitative analysis, and the use of visuals can greatly enhance the description of business transactions. By ensuring clear and accurate communication, these techniques and strategies contribute to the effective analysis and understanding of business transactions.