Understanding multipliers is crucial in the field of macroeconomics, as they provide insight into the overall impact of changes in various economic factors. In this article, we will explore the concepts and calculations of multipliers in the context of AP Macroeconomics Topic 3.2.

Multipliers refer to the changes in equilibrium output and income that result from changes in a certain economic variable, such as government spending or investment. These changes can have a significant impact on the overall economy, and understanding how multipliers work is essential for analyzing the effects of economic policies.

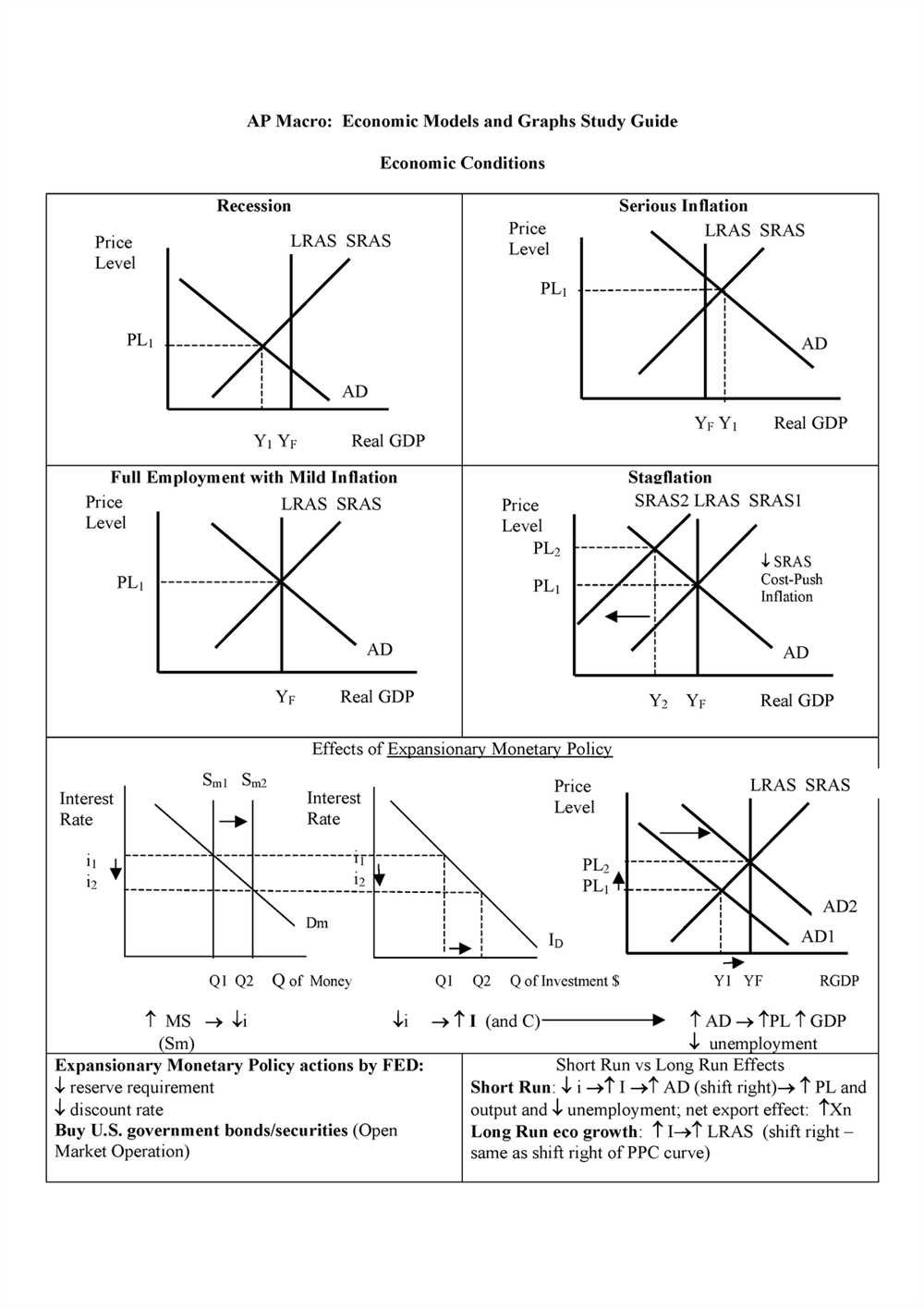

One of the key calculations for multipliers is the spending or fiscal multiplier. This multiplier represents the change in equilibrium output that results from a change in government spending. It helps economists determine the overall impact of increased or decreased government spending on the economy, and plays a crucial role in policy-making decisions.

Another important type of multiplier is the investment or capital multiplier, which measures the change in equilibrium output resulting from changes in investment. This multiplier allows economists to analyze the effects of changes in investment levels on economic growth and overall output.

Understanding Multipliers in Macroeconomics

In macroeconomics, one of the key concepts that economists use to analyze the impact of government spending or changes in aggregate demand is the multiplier effect. The multiplier effect refers to the idea that a change in one component of aggregate demand can lead to a larger change in real GDP. Understanding multipliers is crucial for policymakers, as it helps them quantify the impact of their decisions on the overall economy.

There are different types of multipliers that economists use, such as the government spending multiplier, the tax multiplier, and the multiplier associated with changes in investment. The government spending multiplier measures the impact of an increase in government spending on real GDP. This is because when the government increases its spending, it creates a demand for goods and services, which in turn leads to increased production and income for businesses and individuals. The tax multiplier, on the other hand, measures the impact of changes in taxes on real GDP. When taxes are reduced, households have more disposable income, which leads to increased consumption and overall economic activity.

The multiplier effect works through the concept of marginal propensity to consume (MPC). The MPC represents the fraction of additional income that households spend on consumption. For example, if the MPC is 0.8, it means that out of every additional dollar earned, households spend 80 cents on consumption. The larger the MPC, the larger the multiplier effect, as more income is spent on consumption, leading to increased demand and production.

It is important to note that while the concept of the multiplier effect is powerful, it does have its limitations. For instance, it assumes that the economy is operating below its full capacity, and that there are no constraints such as limited resources or inflation. Additionally, the multiplier effect may be affected by other factors, such as imports or changes in interest rates. Therefore, policymakers must carefully consider these factors when using multipliers to estimate the impact of their decisions.

Definition of Multipliers in Macroeconomics

In macroeconomics, multipliers refer to the concept of measuring the impact of a change in a particular economic variable on the overall economy. These multipliers help economists understand how changes in one aspect of the economy can affect other sectors and determine the overall magnitude of the impact.

The Keynesian multiplier, for example, is a popular concept that measures how changes in government spending can stimulate economic growth. According to this theory, an increase in government spending will lead to an increase in national income, as the increased government expenditure will generate additional income for businesses and individuals. The Keynesian multiplier measures the ratio of the final increase in national income to the initial increase in government spending.

Another type of multiplier is the income multiplier, which measures how changes in income can lead to changes in consumer spending. When individuals receive additional income, they tend to spend a portion of it, known as the marginal propensity to consume (MPC). The income multiplier measures the total increase in national income that results from an initial increase in income.

Multipliers are important tools for policymakers as they provide insights into the potential ripple effects of policy changes. By utilizing multipliers, policymakers can make informed decisions, such as determining the optimal level of government spending or identifying the potential impact of changes in tax policy on the overall economy.

Summary:

- Multipliers in macroeconomics measure the impact of a change in one economic variable on the overall economy.

- Keynesian multiplier measures how changes in government spending can stimulate economic growth.

- Income multiplier measures how changes in income can lead to changes in consumer spending.

- Multipliers are important tools for policymakers to make informed decisions.

Explaining the Concept of Multipliers in Macroeconomics

In the field of macroeconomics, the concept of multipliers plays a crucial role in understanding the relationship between changes in economic variables. Multipliers are used to measure the magnitude of the effects that changes in one variable have on other related variables within an economy. These effects can be both positive and negative, and understanding them is essential for policymakers and economists alike.

One of the key multipliers is the government spending multiplier. This multiplier measures the impact that an increase in government spending has on the overall output of an economy. When the government increases its spending, it injects money into the economy, stimulating demand and generating a ripple effect throughout various sectors. The government spending multiplier captures the cumulative effect of this initial injection, as the increased demand leads to increased production and income, which in turn leads to further increases in spending and output.

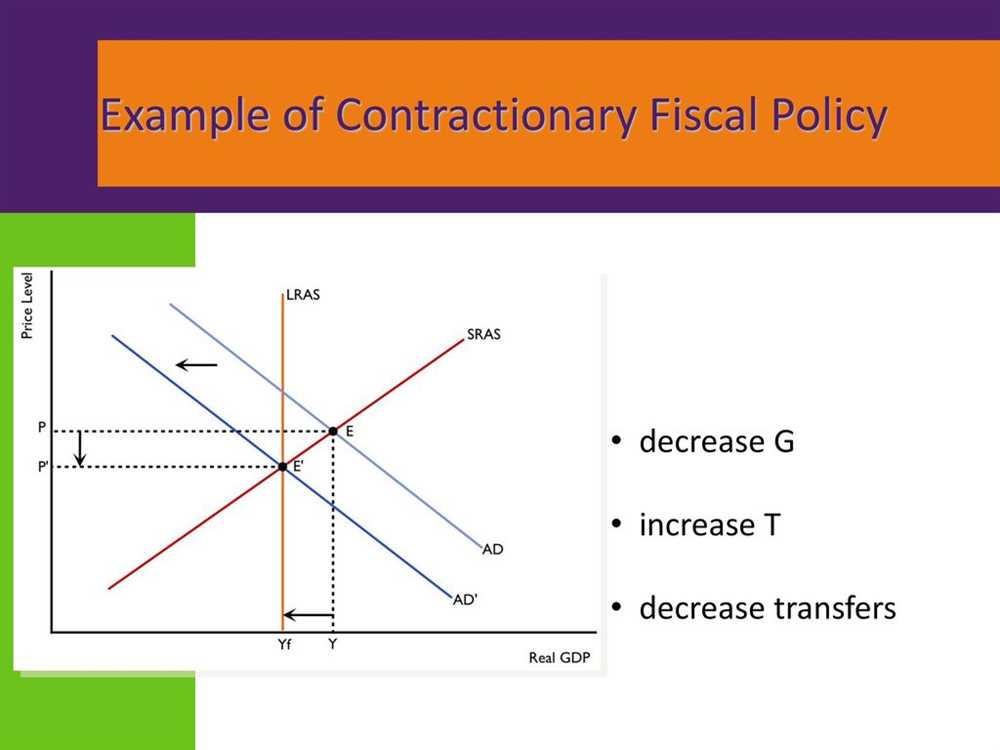

Similarly, the tax multiplier measures the impact that changes in taxes have on aggregate demand and output. When taxes are reduced, individuals and businesses have more disposable income, which leads to increased spending and stimulates economic activity. This multiplier captures the overall effect of this increased spending on the economy, including the indirect effects through the multiplier process.

Understanding the concept of multipliers allows policymakers to assess the potential effects of their policy decisions. By analyzing the size and direction of the multipliers, policymakers can anticipate the extent to which changes in government spending or taxes can impact the economy and make informed decisions accordingly. For example, a higher government spending multiplier suggests that an increase in government expenditure will have a larger impact on GDP, while a higher tax multiplier suggests that a reduction in taxes will have a larger effect on stimulating economic growth.

In conclusion, multipliers in macroeconomics provide a quantitative measure of the effects that changes in economic variables have on the overall output and performance of an economy. By understanding and analyzing these multipliers, policymakers and economists can gain insights into the potential impacts of their policy decisions and make informed choices to stimulate economic growth and stability.

Types of Multipliers in Macroeconomics

In macroeconomics, multipliers are used to measure the effect of an initial change in a certain economic variable on the overall economy. There are several types of multipliers that economists use to understand the potential impact of various economic policies and shocks.

1. Fiscal Multiplier: The fiscal multiplier represents the effect of changes in government spending or taxation on the economy. When the government increases its spending or decreases taxes, it injects more money into the economy, which leads to an increase in aggregate demand. The fiscal multiplier measures the extent to which this initial increase in government spending or decrease in taxes impacts GDP. It helps policymakers understand the potential impact of fiscal policies on economic growth.

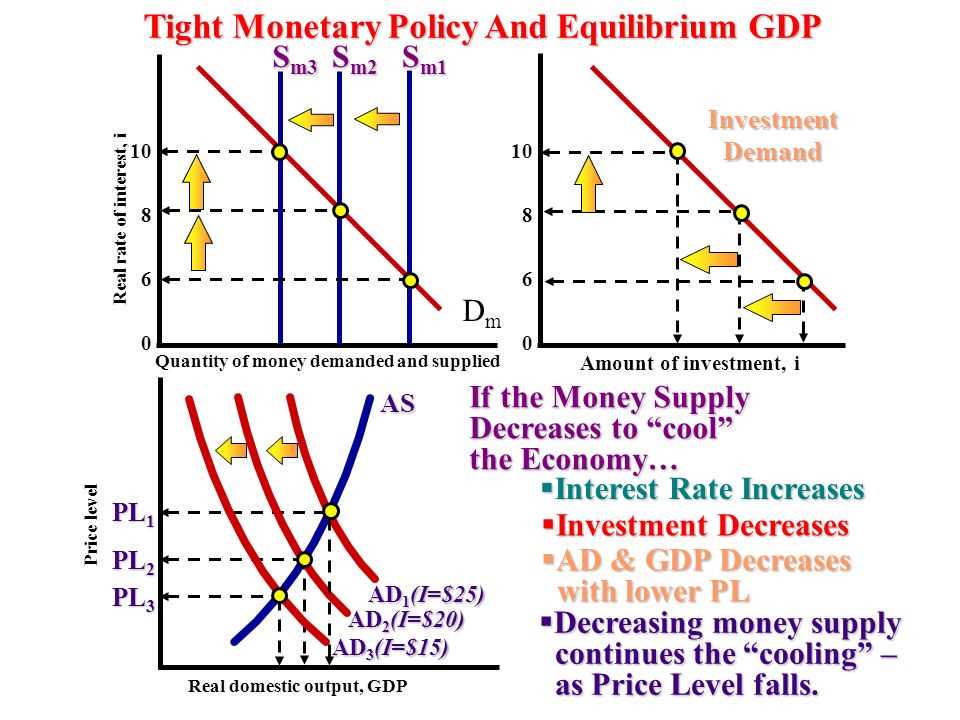

2. Investment Multiplier: The investment multiplier measures the effect of changes in investment on the overall economy. When businesses increase their investment in new capital goods, it leads to higher aggregate demand and economic growth. The investment multiplier helps economists and policymakers understand the potential impact of changes in investment on GDP and employment.

3. Money Multiplier: The money multiplier represents the effect of changes in the money supply on the overall economy. It measures the potential impact of a change in the monetary base (currency in circulation and reserves held by banks) on the money supply and ultimately on aggregate demand. The money multiplier helps central banks understand the potential impact of their monetary policy actions on the economy.

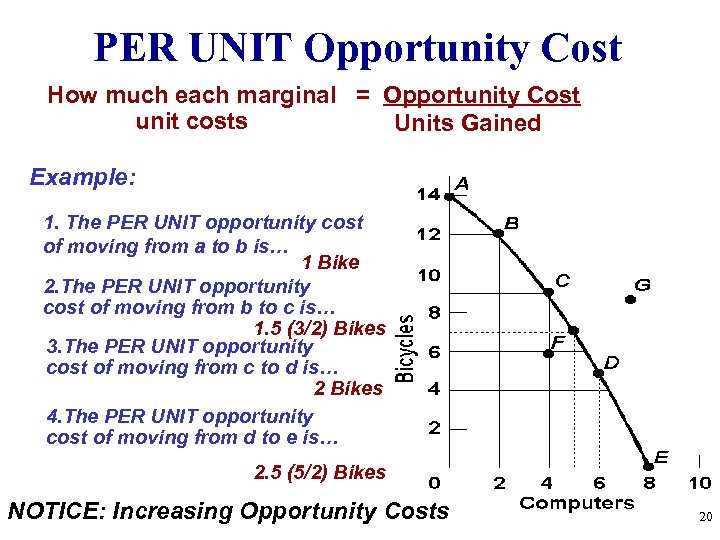

4. Import Multiplier: The import multiplier measures the effect of changes in imports on the overall economy. When imports increase, it leads to a decrease in domestic production and can have a negative impact on GDP. The import multiplier helps economists understand the potential impact of changes in imports on the economy and informs policymakers about the implications of trade policies.

These different types of multipliers provide insights into how changes in various economic variables can affect the overall economy. By understanding the magnitude of these multipliers, policymakers can make informed decisions and design effective economic policies to promote growth and stability.

Examining Different Types of Multipliers in Macroeconomics

Multipliers play a crucial role in macroeconomics, as they help us understand the impact of various economic policies and shocks on key macroeconomic variables. In this article, we will examine different types of multipliers and their implications for the economy.

Fiscal Multiplier: The fiscal multiplier measures the impact of changes in government spending or taxation on overall economic output. A higher fiscal multiplier suggests that a given change in fiscal policy will have a larger effect on the economy. The fiscal multiplier is influenced by factors such as the marginal propensity to consume and the responsiveness of investment to changes in income. Governments often use fiscal multipliers to assess the effectiveness of their policies in stimulating or restraining economic growth.

Investment Multiplier: The investment multiplier measures the impact of changes in investment on overall economic output. When firms increase their investment spending, it creates a ripple effect that boosts income and output in other sectors of the economy. The investment multiplier depends on the marginal propensity to consume, as increased income from investment spending stimulates further consumption. The investment multiplier is an important indicator of the economy’s sensitivity to changes in investment levels and is closely linked to business cycle dynamics.

Money Multiplier: The money multiplier measures the impact of changes in the money supply on overall economic activity. When the central bank increases the money supply, it can lead to an expansion of credit and increased lending by commercial banks. This stimulates economic activity and can lead to higher output. The money multiplier depends on the willingness of banks to lend and the demand for credit in the economy. It is an important tool for central banks to manage monetary policy and control inflation.

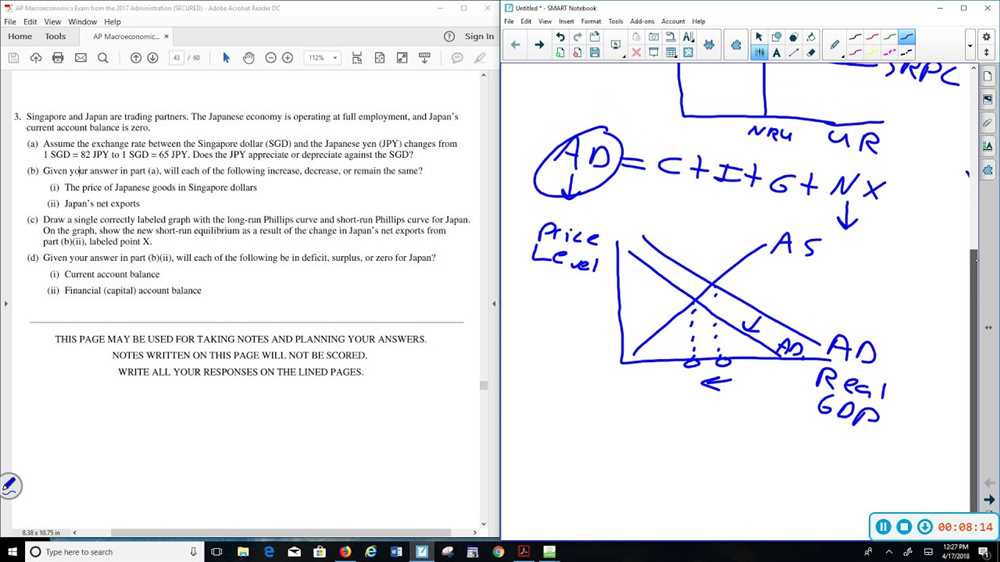

Trade Multiplier: The trade multiplier measures the impact of changes in exports or imports on overall economic output. When there is an increase in exports, it boosts income and output in the exporting country. Similarly, an increase in imports can have a negative impact on domestic output. The trade multiplier depends on factors such as the elasticity of demand for exports and imports, as well as the relative size of the export and import sectors. Understanding the trade multiplier is crucial for analyzing the effects of international trade on the economy.

Overall, different types of multipliers provide insights into the complex interconnections within an economy and help policymakers make informed decisions. By understanding these multipliers, economists can better analyze the impacts of various economic shocks and policies on key macroeconomic variables such as output, employment, and inflation.

How Multipliers Impact the Economy

Multipliers play a crucial role in the functioning of the economy as they determine the overall impact of an initial change in spending or investment. In simple terms, a multiplier represents the ripple effect that occurs when spending or investment occurs. Understanding how multipliers work is essential for policymakers and economists in order to assess the potential impacts of their decisions and interventions.

The multiplier effect is best explained with an example: Let’s say the government decides to invest $100 million in infrastructure projects. This initial injection of funds creates a chain reaction within the economy. The construction companies, for instance, will hire new workers and purchase raw materials to meet the increased demand for their services. As a result, these workers and suppliers will have more income, which they will in turn spend on various goods and services. This increased spending by the construction companies’ workers and the suppliers will create additional income and demand in other sectors of the economy, leading to further job creation and economic growth.

There are two types of multipliers that can impact the economy:

- Government Spending Multiplier: This multiplier shows the impact of changes in government spending on aggregate demand and the overall economy. When the government increases its spending, there is not only a direct increase in demand for goods and services but also an indirect increase as the recipients of the increased government spending spend their income on various goods and services. The size of the government spending multiplier depends on various factors, such as the marginal propensity to consume and the marginal tax rate.

- Investment Multiplier: This multiplier shows the impact of changes in investment on the economy. When firms or individuals increase their investment, it leads to an increase in demand for capital goods, which in turn stimulates production in those industries producing capital goods. This leads to an increase in the incomes of workers in those industries and subsequently an increase in their consumption. The investment multiplier depends on factors such as the marginal propensity to consume and the marginal tax rate.

In conclusion, multipliers have a significant impact on the economy by magnifying the effects of initial changes in spending or investment. They help stimulate economic growth, create jobs, and increase aggregate demand. Understanding the size and effects of multipliers is crucial for policymakers and economists in order to make informed decisions and interventions that can effectively stimulate economic activity.