Chapter 4 of the Consumer Credit answer key provides a comprehensive guide for understanding the intricacies of consumer credit. This chapter dives deep into the various aspects of consumer credit, including its definition, types, and important considerations. Whether you are a consumer looking to gain a better understanding of your credit options or a professional in the finance industry, this answer key is a valuable resource.

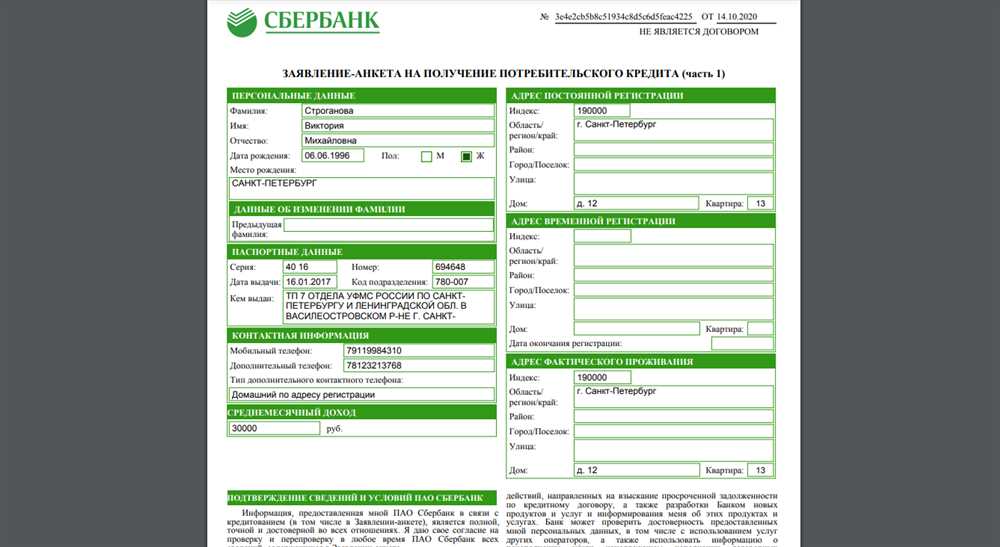

The answer key begins with an overview of consumer credit, explaining that it is the borrowing of money or obtaining goods or services with the understanding that payment will be made at a later date. It covers the importance of credit scores and credit reports in the borrowing process, emphasizing their role in determining a consumer’s creditworthiness.

Furthermore, the key provides detailed explanations of the different types of consumer credit, such as installment loans, revolving credit, and open-end credit. It highlights the benefits and drawbacks of each type, empowering consumers to make informed decisions about their credit options. The key also delves into essential concepts, including interest rates, credit limits, and repayment terms.

In addition to discussing the different types of consumer credit, the answer key explores critical considerations for consumers, such as responsible borrowing, credit card debt management, and credit counseling resources. It emphasizes the importance of using credit wisely, budgeting effectively, and understanding the potential consequences of excessive debt.

Overall, Chapter 4 of the Consumer Credit answer key offers a comprehensive guide to understanding consumer credit. It equips readers with the knowledge and tools necessary to navigate the complex world of credit, empowering them to make informed decisions and achieve financial success.

Chapter 4 Consumer Credit Answer Key

In this chapter, we will discuss the answer key for Chapter 4 of the Consumer Credit textbook. This answer key is a valuable resource for students to check their understanding and assess their progress in learning about consumer credit. It provides the correct answers to the questions and exercises in the chapter, allowing students to compare their responses and identify any areas where they may need additional review or practice. The answer key covers various topics related to consumer credit, including credit scores, credit reports, credit cards, loans, and regulations governing consumer credit.

Section 1: Understanding Consumer Credit

- Question 1: What is consumer credit?

- Answer: Consumer credit refers to the ability of individuals to borrow money or obtain goods and services with the promise of future payment.

- Question 2: Why is understanding consumer credit important?

- Answer: Understanding consumer credit is important because it affects a person’s financial well-being and capacity to make purchases. It also impacts creditworthiness and financial opportunities.

Section 2: Credit Scores and Reports

- Question 3: What is a credit score?

- Answer: A credit score is a numerical representation of an individual’s creditworthiness, based on their credit history and other factors.

- Question 4: How can consumers improve their credit scores?

- Answer: Consumers can improve their credit scores by making timely payments, keeping credit card balances low, and managing credit responsibly.

Section 3: Credit Cards and Loans

- Question 5: What are the advantages and disadvantages of credit cards?

- Answer: The advantages of credit cards include convenience, rewards programs, and the ability to build credit. The disadvantages include high interest rates and the potential for overspending.

- Question 6: What are the different types of loans?

- Answer: The different types of loans include personal loans, auto loans, student loans, and mortgages.

This answer key serves as a comprehensive guide for students studying consumer credit. It enables them to review their understanding of key concepts and evaluate their progress in mastering the material. By using the answer key alongside the textbook, students can enhance their learning experience and ensure a thorough comprehension of consumer credit.

Understanding Consumer Credit

Consumer credit plays a significant role in our daily lives, allowing individuals to make purchases and fulfill financial needs without immediate payment. However, it is crucial to understand the ins and outs of consumer credit to make informed decisions and avoid potential pitfalls. This key understanding begins with the definition of consumer credit.

Consumer credit refers to the borrowing of money or access to goods and services with the agreement to pay back the borrowed amount, often with interest, over a specified period. It encompasses various forms, including credit cards, personal loans, auto loans, and mortgages. Consumer credit allows individuals to manage their finances effectively and make large purchases that might not be feasible with their current cash flow.

Consumers should be aware of the key terms and concepts associated with consumer credit, such as interest rates, credit limits, credit scores, and repayment terms. Interest rates are the percentage of the borrowed amount that lenders charge as compensation for the risk they assume. They can significantly impact the total cost of credit and the monthly payments. Credit limits indicate the maximum amount individuals can borrow using a specific credit account. Understanding credit limits is crucial to avoid exceeding them and potentially damaging one’s credit score.

The credit score is a numerical representation of an individual’s creditworthiness, primarily based on their borrowing and repayment history. It is used by lenders to determine the borrower’s risk and the terms of the credit offer. Repayment terms outline the schedule and conditions for repaying the borrowed amount, including the monthly payment amount, due dates, and any penalties or fees for late or missed payments.

By understanding consumer credit and its associated terms, individuals can make wise financial decisions, effectively manage their debts, and maintain a healthy credit score. This knowledge empowers consumers to navigate the credit landscape confidently, avoid unnecessary debt, and leverage credit as a tool for achieving their financial goals.

Importance of Consumer Credit

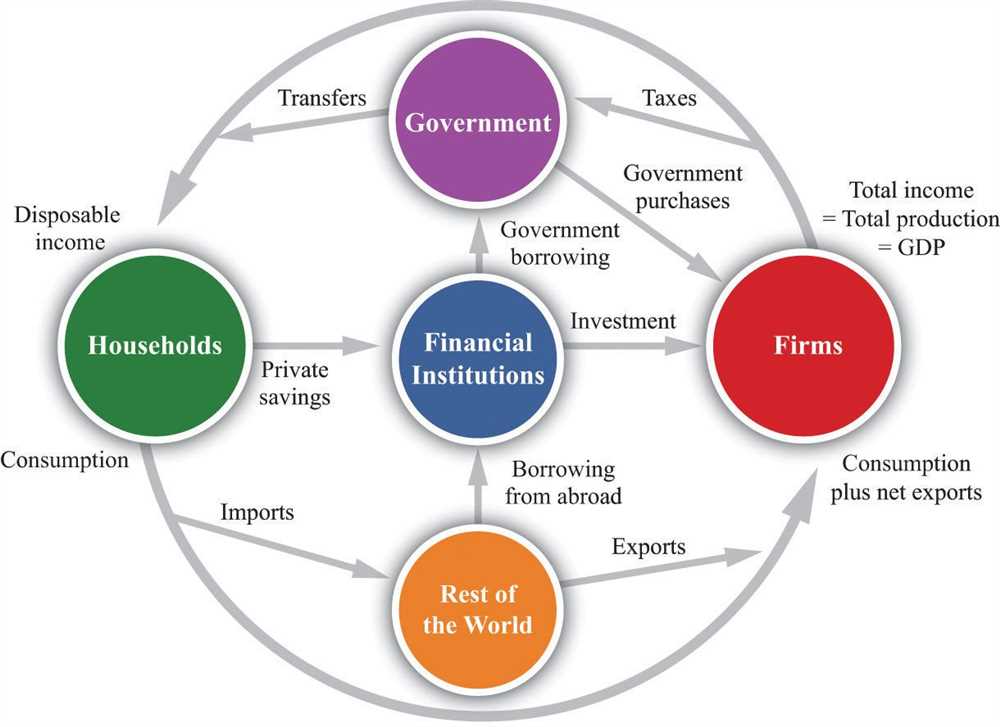

Consumer credit plays a vital role in our economy and in the lives of individuals. It provides people with the ability to make purchases and access goods and services that they may not be able to afford otherwise. Consumer credit allows individuals to spread the cost of a purchase over time, making it more manageable and accessible. This is particularly important for big-ticket items such as cars, homes, and higher education.

Consumer credit also contributes to economic growth by stimulating spending and investment. When individuals have access to credit, they are more likely to make purchases, which in turn helps support businesses and creates jobs. In addition, consumer credit allows individuals to invest in their education or start a business, which can lead to long-term financial stability and economic growth.

Consumer credit can also provide individuals with a safety net in times of financial hardship. It can help cover unexpected expenses, such as medical bills or car repairs, and provide a temporary solution to financial difficulties. This can be particularly important for low-income individuals who may not have access to other forms of financial assistance.

- Consumer credit has the potential to improve people’s quality of life by giving them access to essential goods and services. It allows individuals to purchase items that can enhance their overall well-being, such as a reliable vehicle for transportation or a home for their family.

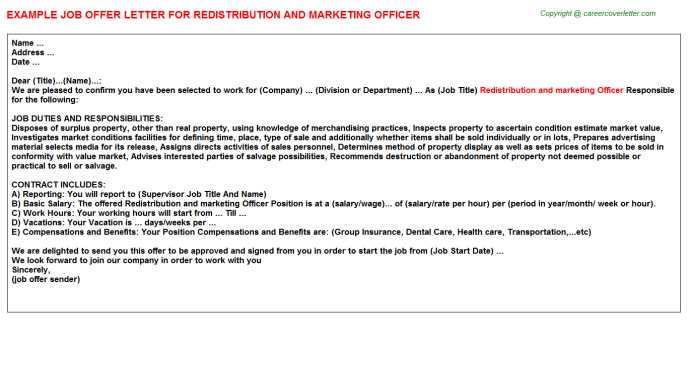

- Consumer credit can also help individuals build a credit history and improve their credit score. This can be beneficial for future financial endeavors, such as getting a mortgage or applying for a job. A good credit history demonstrates financial responsibility and can provide individuals with more opportunities and better terms.

- Consumer credit provides individuals with the flexibility to manage their finances and make choices based on their needs and circumstances. It allows people to pay for purchases over time, rather than all at once, which can help them budget their income and expenses more effectively.

In conclusion, consumer credit plays a significant role in our economy and the lives of individuals. It enables people to access essential goods and services, stimulates economic growth, provides a safety net in times of financial hardship, and offers flexibility in managing finances. However, it is important for individuals to use consumer credit responsibly and be aware of the potential risks and consequences.

Section 2: Types of Consumer Credit

Consumer credit refers to the various forms of borrowing that individuals engage in to finance their purchases. Understanding the different types of consumer credit is crucial for consumers to make informed decisions about their financial health. This section will explore some of the common forms of consumer credit and their characteristics.

1. Installment Credit: Installment credit is a type of consumer credit where the borrower receives a specific amount of money and agrees to repay it in fixed monthly installments over a predetermined period. This form of credit is commonly used for purchasing big-ticket items like vehicles or appliances. The interest rates and repayment terms may vary depending on the borrower’s creditworthiness and the lender’s policies.

2. Revolving Credit: Revolving credit allows the borrower to access a predetermined credit limit, from which they can borrow and repay multiple times. The borrower has the flexibility to decide how much they want to borrow and can repay the outstanding balance in full or make minimum payments. Credit cards are a common example of revolving credit. The interest rates for revolving credit are typically higher compared to installment credit.

- 2.1. Credit Cards: Credit cards are widely used for making purchases and can provide various benefits like rewards or cashback. However, if the balance is not paid in full by the due date, interest charges will apply. It’s important for consumers to use credit cards responsibly to avoid falling into debt.

- 2.2. Lines of Credit: Lines of credit are similar to credit cards, but they typically have higher credit limits and are often used for larger expenses like home renovations or education. Borrowers can access the funds as needed and only pay interest on the amount borrowed.

3. Open-End Credit: Open-end credit is an ongoing line of credit that enables the borrower to borrow and repay multiple times without a predetermined repayment period. It is commonly used for purchases like utilities or mobile phone bills, where the amount owed varies each month. The interest rates for open-end credit can be higher, and late payments may result in additional fees.

4. Secured Credit: Secured credit requires the borrower to provide collateral, such as a vehicle or property, to secure the loan. If the borrower fails to repay, the lender can seize the collateral to recover the outstanding balance. Secured credit usually offers lower interest rates compared to unsecured credit since the collateral reduces the lender’s risk.

5. Unsecured Credit: Unsecured credit does not require collateral and is based solely on the borrower’s creditworthiness. Personal loans and credit cards are common examples of unsecured credit. Lenders may charge higher interest rates for unsecured credit to compensate for the increased risk.

By understanding the different types of consumer credit, individuals can make informed decisions about their borrowing needs and choose the most appropriate form of credit based on their financial circumstances and goals.

Installment Credit

Installment credit is a type of consumer credit where borrowers receive a specific amount of money from a lender and agree to repay the loan in equal installments over a set period of time. This type of credit is commonly used for large purchases such as cars, appliances, and furniture.

With installment credit, borrowers typically have a fixed interest rate that is added to each monthly payment. This allows borrowers to budget their expenses and know exactly how much they need to pay each month. The length of the loan term can vary, but is often between one and five years.

Advantages of installment credit:

- Structured repayment plan: Borrowers know exactly how much they need to pay each month, making it easier to budget and plan their finances.

- Fixed interest rate: Having a fixed interest rate means that borrowers’ monthly payments stay the same throughout the life of the loan, providing stability and predictability.

- Ability to make larger purchases: Installment credit allows consumers to make larger purchases by spreading out the cost over time, rather than having to pay upfront.

Disadvantages of installment credit:

- Interest costs: Borrowers will pay interest on the loan, which adds to the overall cost of the purchase.

- Potential for debt: If borrowers are not careful with their spending habits, they may accumulate more debt than they can comfortably manage, leading to financial stress.

- Possible prepayment penalties: Some lenders may charge prepayment penalties if borrowers want to pay off the loan early, limiting their ability to save on interest costs.

Overall, installment credit can be a useful tool for consumers who need to make large purchases but do not have the full amount upfront. It provides a structured repayment plan and allows borrowers to spread out the cost over time. However, it is important for borrowers to carefully consider their financial situation and make sure they can comfortably manage the monthly payments before taking on installment credit.