Derivative analysis is an essential tool in the world of big data, enabling us to uncover hidden patterns and derive meaningful insights. In this article, we will explore the concept of Big 10 derivative analysis and its application in various fields.

Big 10 refers to the ten largest and most influential companies in the technology industry, such as Apple, Google, Microsoft, and Amazon. These companies generate massive amounts of data every second, ranging from customer behavior to financial transactions. By analyzing the derivatives of this data, we can gain valuable insights into market trends, consumer preferences, and business strategies.

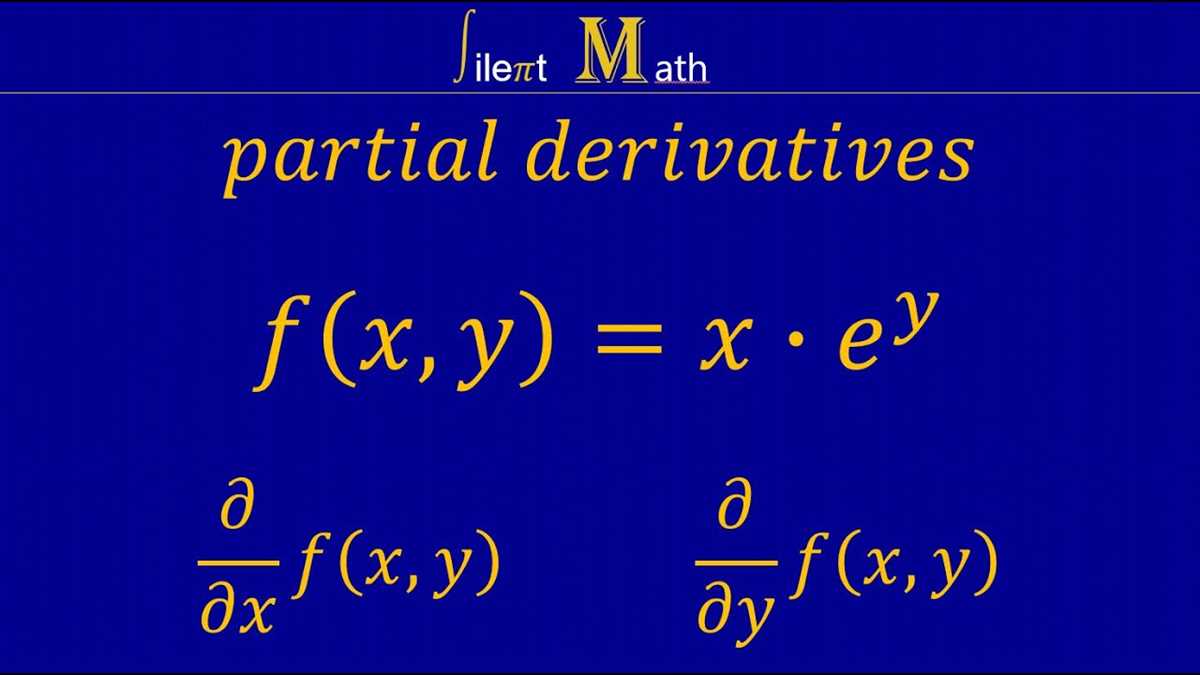

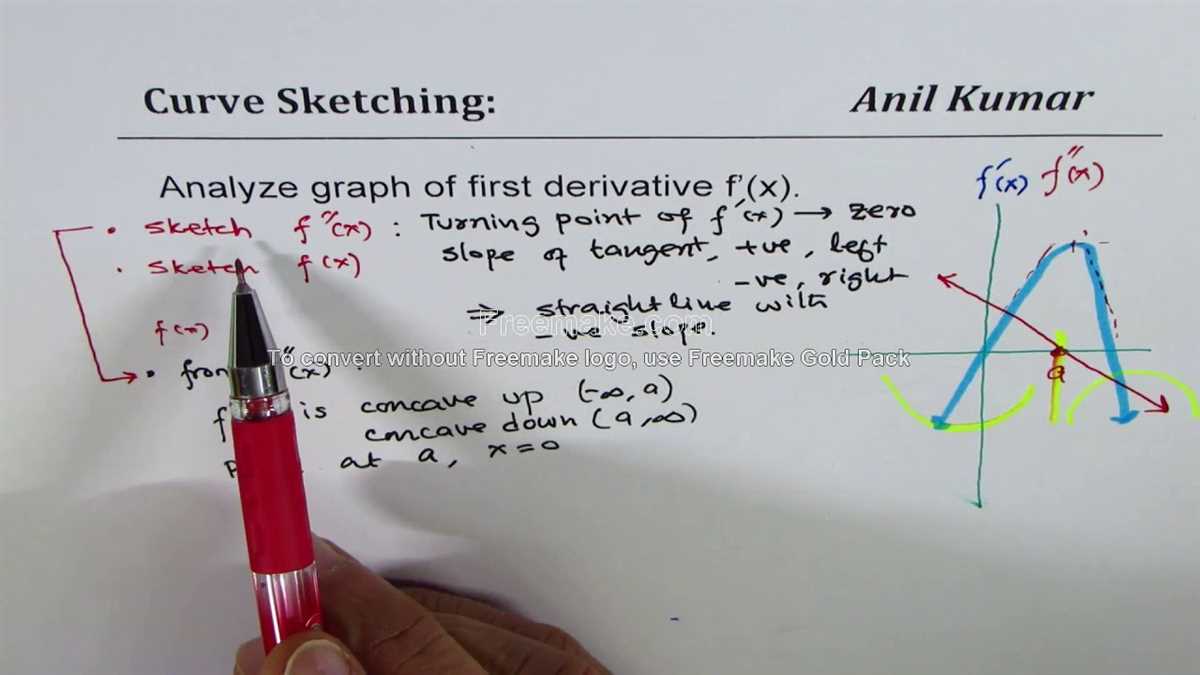

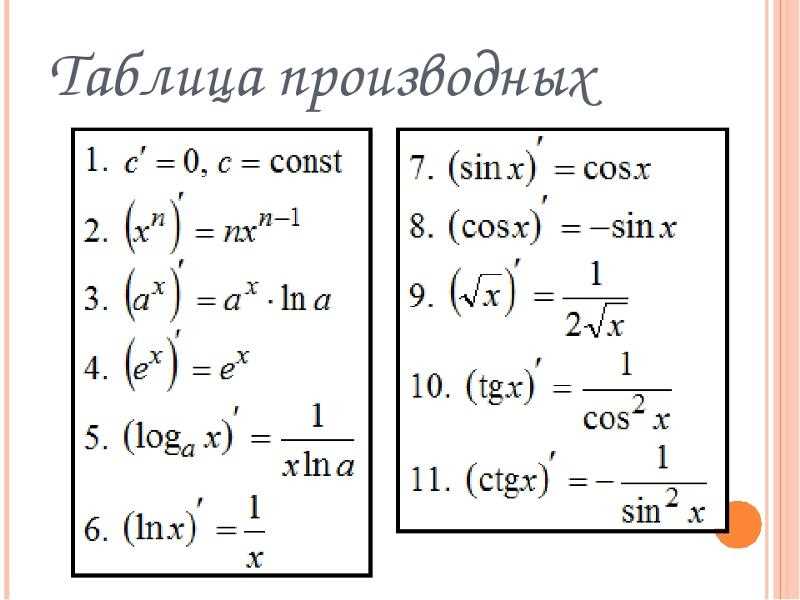

Derivative analysis involves examining the rate of change of data over time. By calculating derivatives, we can determine patterns, trends, and anomalies that might not be readily apparent otherwise. For example, analyzing the derivative of customer engagement data can reveal the most effective marketing campaigns or identify potential issues in the user experience.

One of the key benefits of Big 10 derivative analysis is its ability to inform decision-making. By understanding how specific variables affect business outcomes, companies can make more informed choices, optimize their strategies, and drive better results. Moreover, derivative analysis can help businesses anticipate future trends and adapt their operations accordingly.

What is derivative analysis?

Derivative analysis is a method used by investors and financial analysts to examine and evaluate financial derivatives, such as options, futures, and swaps. It involves studying the characteristics and behavior of these financial instruments to make informed investment decisions.

A derivative is a financial instrument that derives its value from an underlying asset or benchmark. It allows investors to speculate on or hedge against price movements, interest rates, and other market factors. Derivative analysis helps investors understand the risks and potential rewards associated with these instruments.

There are several key aspects of derivative analysis:

- Price analysis: Derivative analysts analyze the price movements of the underlying asset and the derivative itself. They examine historical price data, trends, and patterns to identify potential opportunities and risks.

- Risk assessment: Derivative analysis involves assessing the various risks associated with derivatives, including market risk, counterparty risk, and liquidity risk. Analysts evaluate the probability and potential impact of these risks on the investment.

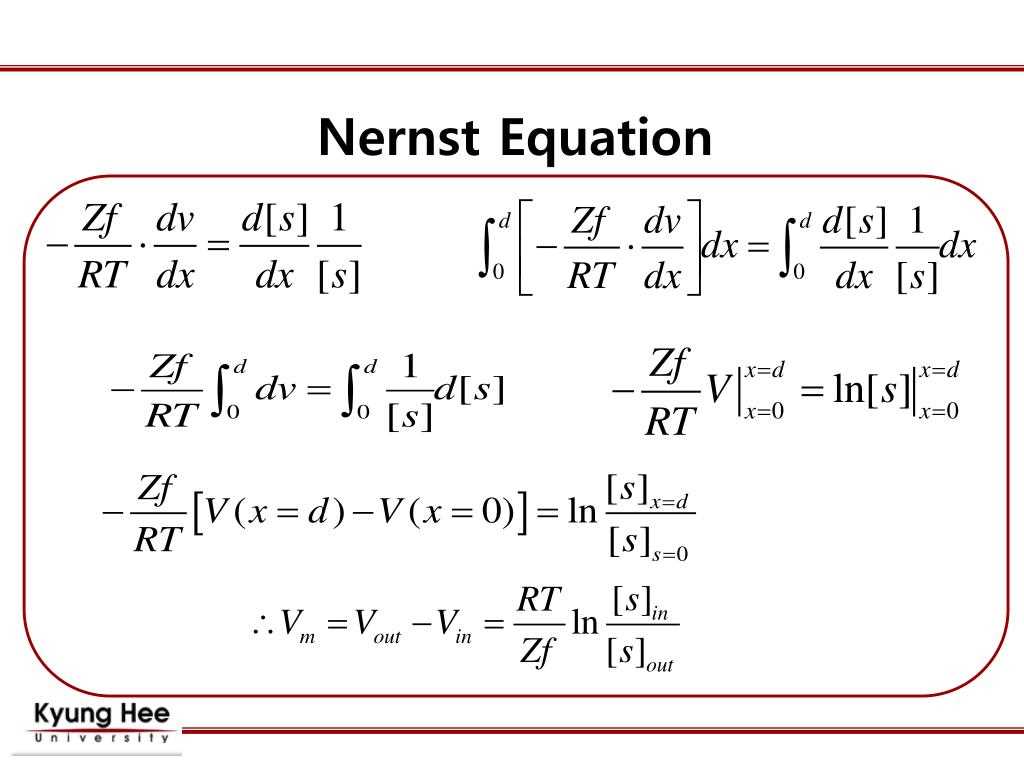

- Valuation: Derivative analysts use various models and techniques to determine the fair value of derivatives. This involves estimating future cash flows, discounting factors, and volatility assumptions.

- Performance evaluation: Analysts assess the performance of derivatives in relation to their expected returns and risks. They compare actual outcomes with projected results and analyze any deviations or discrepancies.

- Strategy development: Based on their analysis, derivative experts develop investment strategies and recommendations. They may suggest hedging strategies, speculative trades, or portfolio diversification techniques to optimize risk-adjusted returns.

Overall, derivative analysis plays a crucial role in the decision-making process for investors and financial institutions. It helps them understand, assess, and manage the complexities of derivatives, allowing them to make informed investment decisions in a rapidly changing financial landscape.

Why is derivative analysis important?

Derivative analysis plays a crucial role in the world of finance and investment. It provides valuable insights into the performance, risks, and potential profitability of financial instruments, such as options, futures, and swaps. By analyzing derivatives, investors and financial institutions can make informed decisions and develop strategies to hedge against risks or maximize returns.

One of the key reasons why derivative analysis is important is its ability to assess and quantify risk. Derivatives often involve complex financial products and market variables, making it necessary to understand the potential risks involved. By analyzing derivatives, investors can evaluate the sensitivity of their portfolio to changes in market conditions and identify potential sources of risk. This allows them to make adjustments or implement risk management strategies to protect their investments.

Furthermore, derivative analysis is essential in determining the fair value of financial instruments. Derivatives derive their value from underlying assets or benchmarks, and their prices can fluctuate based on various factors such as interest rates, market volatility, and supply and demand dynamics. Through rigorous analysis, financial professionals can estimate the fair value of derivatives, helping investors make informed decisions about buying or selling these instruments.

- Derivative analysis also aids in portfolio diversification. By incorporating derivatives with different risk profiles and correlations, investors can spread their risk and potentially enhance overall portfolio performance.

- Additionally, derivative analysis is crucial for regulatory compliance. Financial institutions are required to assess the risk exposure of their derivative holdings for reporting and compliance purposes, and accurate analysis is essential to meet these obligations.

- Lastly, derivative analysis helps investors explore new investment opportunities. By understanding the intricacies of different derivative instruments and their performance drivers, investors can identify opportunities for arbitrage, speculation, or hedging strategies.

Understanding the Big 10 derivatives

Derivatives are financial instruments that derive their value from an underlying asset. The Big 10 derivatives refer to ten specific types of derivatives that are frequently used in financial markets. These derivatives play an important role in managing risk, hedging positions, and speculating on future price movements.

One of the most commonly traded derivatives is the forward contract. A forward contract is an agreement between two parties to buy or sell an asset at a predetermined price on a future date. It allows market participants to lock in a future price, providing protection against price fluctuations. This derivative is commonly used in commodity markets, such as oil, where producers and consumers can hedge against price volatility.

- Another important derivative in the Big 10 is the options contract. An options contract gives the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period of time. This contract provides flexibility to investors and can be used to hedge against potential losses or profit from market movements. There are two types of options: call options and put options.

- Futures contracts are also part of the Big 10 derivatives. A futures contract is similar to a forward contract, but it is standardized and traded on an exchange. It obligates the parties involved to buy or sell an asset at a predetermined price and date. Futures contracts are commonly used in financial markets for speculation and hedging purposes.

- A popular derivative in the Big 10 is the swap. A swap is an agreement between two parties to exchange cash flows based on different financial instruments. It allows participants to manage interest rate risk, currency risk, and credit risk. Interest rate swaps, in particular, are widely used to hedge against changes in interest rates.

- Other derivatives in the Big 10 include credit default swaps, equity swaps, commodity swaps, and mortgage-backed securities. These derivatives provide investors with a range of options to manage their portfolios and exposure to various risks.

Understanding the Big 10 derivatives is essential for investors and market participants to make informed decisions and effectively manage risk. These financial instruments offer various strategies and opportunities for investors to optimize their returns and protect their investments.

How to Perform Derivative Analysis on the Big 10 Derivatives?

Performing derivative analysis on the Big 10 derivatives involves a systematic examination of various factors that can affect the value and performance of these financial instruments. Here are some steps to help you navigate through the process.

1. Understand the underlying assets: Start by gaining a thorough understanding of the underlying assets that the Big 10 derivatives are based on. This could include stocks, bonds, commodities, or currencies. Understanding the drivers and characteristics of these assets is essential for analyzing the derivatives accurately.

2. Assess market trends: Analyze the current market trends and anticipate future movements in the underlying assets. Consider factors such as supply and demand dynamics, geopolitical events, interest rate changes, and economic indicators. These trends will impact the value and performance of the derivatives.

3. Evaluate risk factors: Identify and evaluate the risk factors associated with the Big 10 derivatives. This includes assessing factors such as market risk, credit risk, counterparty risk, liquidity risk, and legal and regulatory risks. Understanding the potential risks helps in estimating the potential returns and making informed investment decisions.

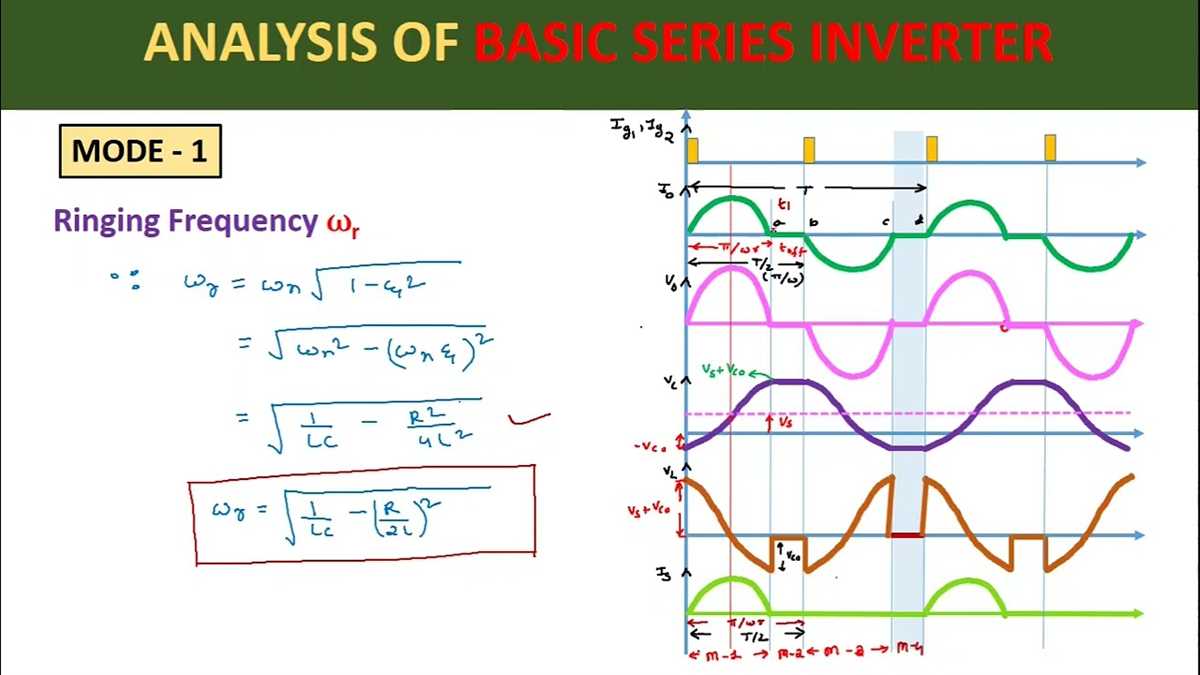

4. Conduct quantitative analysis: Utilize quantitative techniques to analyze the derivatives. This could involve using mathematical models to calculate option valuations, implied volatility, hedging strategies, and other relevant metrics. Quantitative analysis provides a quantitative basis for understanding the potential returns and risks.

5. Compare and select derivatives: Compare the various Big 10 derivatives available and select the ones that align with your investment objectives and risk appetite. Consider factors such as liquidity, fees, leverage, and the suitability of the derivatives for your investment portfolio.

6. Monitor and adjust: Continuously monitor the performance of the derivatives and make adjustments as necessary. Regularly review your portfolio and make changes based on market conditions, new information, and changes in your investment goals.

By following these steps, you can perform a comprehensive derivative analysis on the Big 10 derivatives and make well-informed investment decisions based on your analysis.

Common challenges in Big 10 derivative analysis

Derivative analysis in the Big 10 market presents several common challenges that analysts need to address. These challenges can significantly impact the accuracy and reliability of the derived insights. It’s important to understand and overcome these challenges to make informed decisions and mitigate risks in derivative trading.

- Data quality and reliability: Obtaining accurate and reliable data is crucial for derivative analysis. However, in the Big 10 market, data quality can be a challenge due to diverse sources, data inconsistencies, and potential data manipulation. Analysts need to implement robust data validation techniques and ensure data integrity for meaningful analysis.

- Complexity of derivative instruments: The Big 10 market offers a wide range of derivative instruments, each with its own complexity and unique characteristics. Understanding the intricacies and nuances of these instruments is vital for accurate analysis. Analysts need to continuously update their knowledge and expertise to effectively analyze and interpret these complex derivatives.

- Market volatility: The Big 10 market is known for its volatility, which can pose challenges in derivative analysis. Sudden market movements, price fluctuations, and unexpected events can significantly impact the performance of derivative instruments. Analysts need to develop robust risk management strategies and adapt to changing market conditions to mitigate potential losses.

- Limited historical data: Derivative analysis relies heavily on historical data to identify patterns, trends, and correlations. However, in the Big 10 market, limited historical data for new derivative instruments can hinder accurate analysis. Analysts need to apply advanced statistical techniques and develop models based on the available data to make reliable predictions.

- Regulatory challenges: The Big 10 market is subject to complex and evolving regulatory frameworks that govern derivative trading. Compliance with these regulations is crucial for conducting derivative analysis ethically and legally. Analysts need to stay updated with the regulatory changes and ensure their analysis follows the prescribed guidelines and standards.

Overall, derivative analysis in the Big 10 market comes with a set of challenges that demand expertise, adaptability, and attention to detail. By addressing these challenges and leveraging advanced analytical techniques, market participants can make well-informed decisions and maximize their returns while managing risks effectively.