Managing personal finances can often be a challenging task. However, with the right tools and resources, it becomes much easier to keep track of income and expenses. One effective tool that can assist in this process is Banzai, a popular personal finance software. Banzai provides individuals with a comprehensive platform to monitor and manage their financial activities, allowing them to make informed decisions about their spending and saving habits.

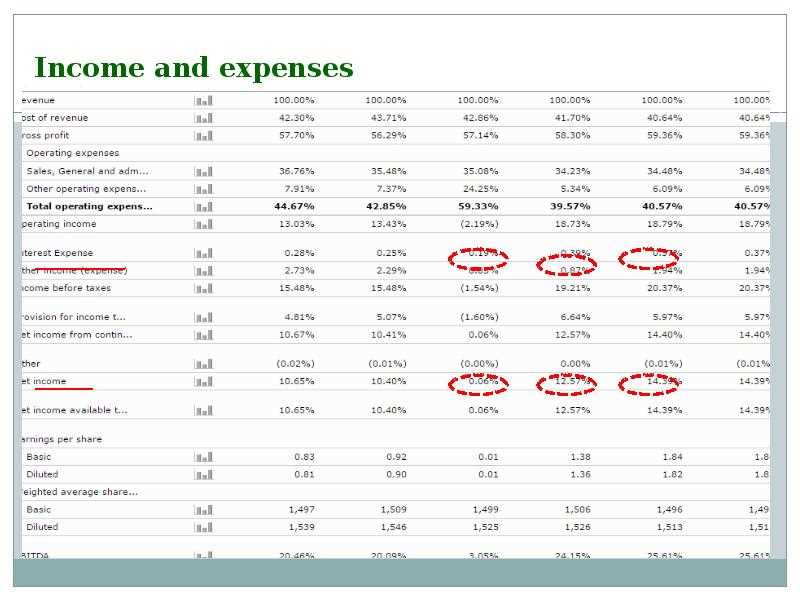

One of the key features of Banzai is its ability to track income and expenses. With a simple and intuitive interface, users can easily input and categorize their income and expenses, gaining a clear view of their financial situation. Banzai also provides valuable insights and analysis, allowing users to identify trends and patterns in their spending habits.

Another advantage of using Banzai is its ability to create budget goals. By setting specific financial targets, individuals can effectively manage their income and expenses, ensuring that they are on track to achieve their financial goals. Banzai provides users with tools to create and monitor budgets, allowing for better control and allocation of funds.

In conclusion, Banzai offers a powerful solution for managing income and expenses. With its user-friendly interface, insightful analysis, and budgeting capabilities, individuals can gain a better understanding of their financial situation and make informed decisions about their financial future.

Banzai income and expenses. Answer key

Understanding income and expenses is crucial for managing personal finances effectively. With Banzai, an online financial education platform, users can learn and practice these concepts in a fun and interactive way. The Banzai income and expenses activity helps users understand the relationship between their income and the expenses they incur.

Upon completing the Banzai income and expenses activity, users can check their understanding by referring to the answer key provided. The answer key outlines the correct answers for each question in the activity, allowing users to assess their comprehension and identify any areas that may require further attention.

Key concepts covered in the Banzai income and expenses activity:

- Income: Users learn about different sources of income, such as salaries, allowances, and investments. They also gain an understanding of the impact of taxes on their income.

- Expenses: Users explore various types of expenses, including fixed expenses (e.g., rent, utilities) and variable expenses (e.g., groceries, entertainment). They learn to prioritize their expenses and differentiate between wants and needs.

- Budgeting: Users discover the importance of budgeting to ensure that their income covers their expenses. They learn how to create a budget, allocate funds to various expense categories, and track their spending.

The Banzai income and expenses activity, along with the answer key, provides users with a comprehensive understanding of managing their income and expenses. By practicing these concepts in a realistic and engaging simulation, users can develop the necessary skills to make informed financial decisions and achieve their financial goals.

What is Banzai income and expenses?

Banzai income and expenses is a financial education program designed to help individuals understand and manage their personal finances. The program provides interactive simulations and real-life scenarios to teach important money management skills, such as budgeting, tracking income and expenses, and making informed financial decisions.

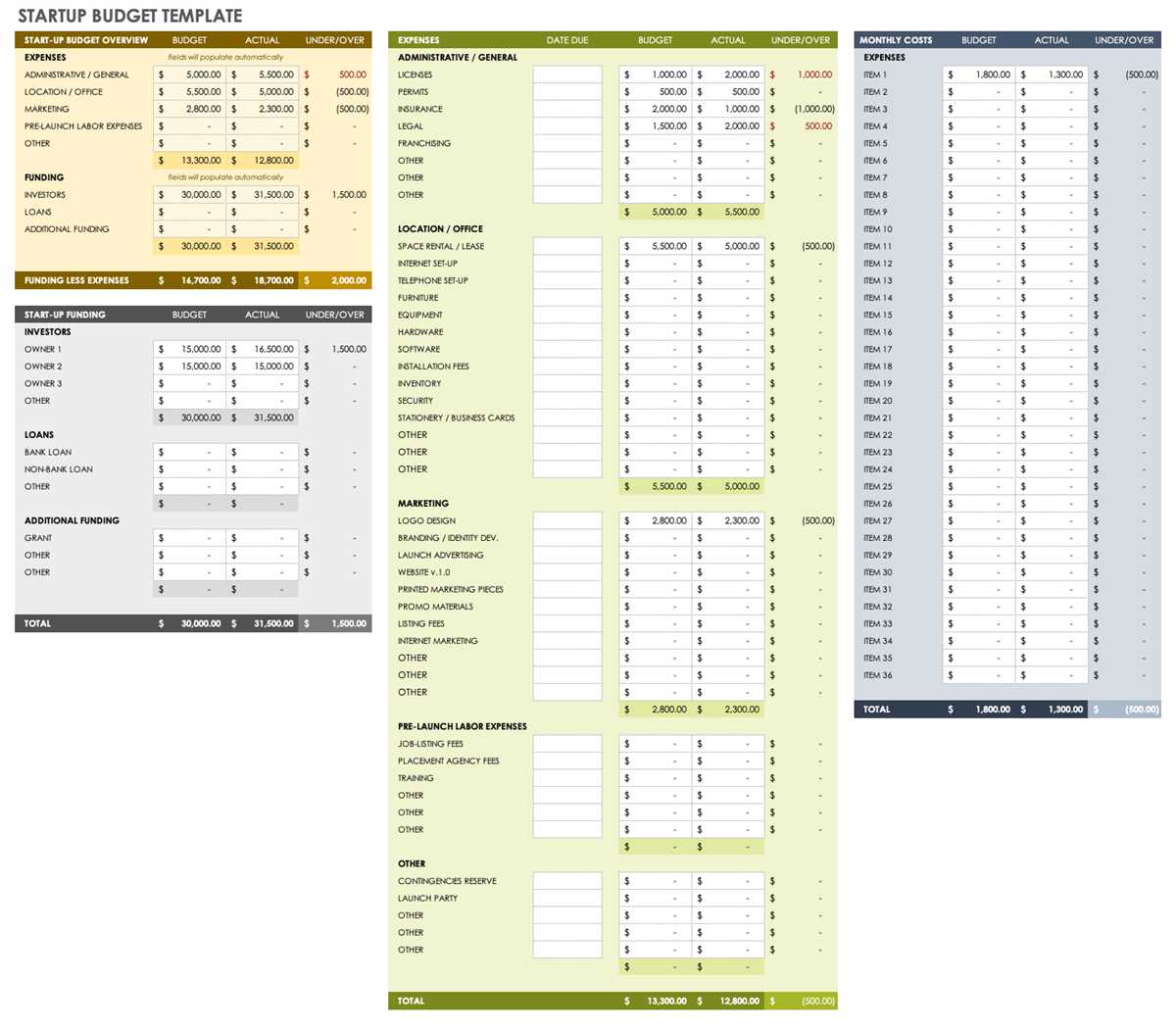

Budgeting: Banzai income and expenses teaches users how to create and stick to a budget. It emphasizes the importance of setting financial goals, prioritizing expenses, and making responsible spending choices. The program provides virtual tools and resources to help users plan and manage their income and expenses effectively.

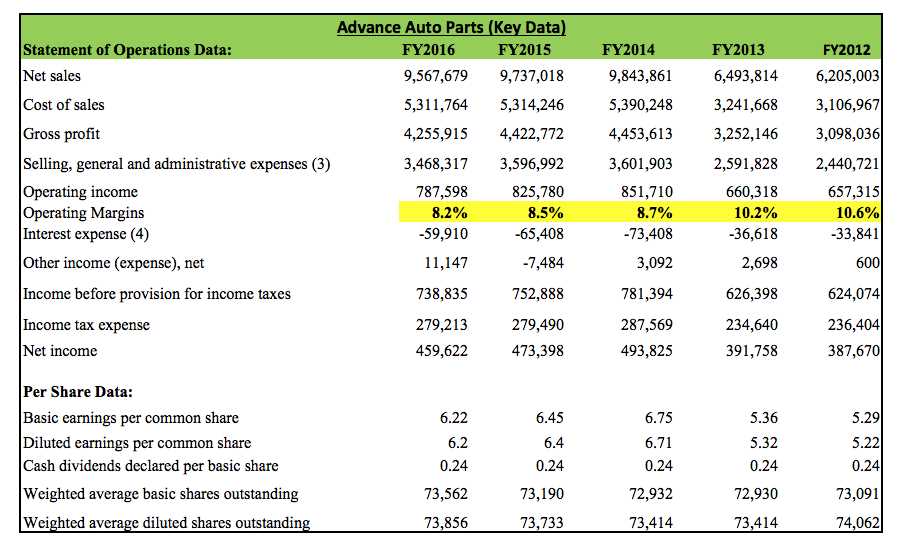

Tracking Income and Expenses: Banzai income and expenses helps users track their income and expenses accurately. It educates users on the different sources of income, such as salary, wages, and other earnings, and teaches them how to classify and record expenses, such as bills, groceries, and entertainment. Users learn how to categorize their expenses and track their spending habits to gain a better understanding of their financial situation.

Making Informed Financial Decisions: Banzai income and expenses empowers individuals to make informed financial decisions. It presents real-life scenarios and challenges users to make choices based on their financial goals and circumstances. Users learn about the impact of their decisions on their overall financial well-being and gain valuable insights into financial planning and goal-setting.

Overall, Banzai income and expenses is a comprehensive financial education program that equips individuals with the knowledge and skills they need to manage their income and expenses effectively. By practicing budgeting, tracking income and expenses, and making informed financial decisions, users can improve their financial literacy and work towards achieving their financial goals.

Why should you use Banzai income and expenses?

Tracking income and expenses is essential for individuals and businesses alike. It helps to understand where the money is coming from and where it is going. Banzai income and expenses is a powerful tool that can simplify this process, making it easier to manage your finances.

Accurate tracking: Banzai income and expenses provides a user-friendly interface that allows you to log and categorize every income and expense transaction. This ensures that you have an accurate record of your financial activities, which is especially important for tax purposes or when evaluating your financial health.

- Convenient organization: With Banzai income and expenses, you can easily categorize your income and expenses into different groups, such as rent, utilities, groceries, and entertainment. This makes it easier to understand your spending habits and identify areas where you can cut back or make improvements.

- Financial planning: By tracking your income and expenses with Banzai, you can gain valuable insights into your financial situation. You can analyze your spending patterns, set budget goals, and track your progress over time. This can help you make informed decisions about your finances and plan for the future.

- Collaboration and sharing: Banzai income and expenses allows you to collaborate and share your financial data with others. This can be useful for couples or families who want to track their combined income and expenses, or for businesses that need to share financial information with their team members or accountant.

Security and privacy: Banzai income and expenses takes the security of your financial data seriously. Your information is encrypted and stored securely, ensuring that it is protected from unauthorized access. Additionally, Banzai income and expenses respects your privacy and does not share your data with third parties.

In summary, Banzai income and expenses is a comprehensive financial tool that can simplify the process of tracking income and expenses. With its user-friendly interface, convenient organization, financial planning features, collaboration options, and strong security measures, it can help individuals and businesses stay on top of their finances and make better financial decisions.

How does Banzai income and expenses work?

Banzai income and expenses is a tool provided by Banzai, an online platform for financial education. This tool is designed to help users understand and manage their income and expenses effectively. With Banzai income and expenses, users can track their income, categorize their expenses, and create a budget based on their financial goals.

When using Banzai income and expenses, users can start by inputting their monthly income. This could include their salary, any additional income streams, or even allowances. The tool allows for customization, so users can add as many income sources as necessary. Once the income is entered, users can then categorize their expenses into different categories such as housing, transportation, food, and entertainment.

The tool provides a clear overview of monthly expenses, allowing users to see where their money is being spent. This can help users identify areas where they can potentially cut back on expenses and save more. Banzai income and expenses also allows users to set financial goals and track their progress. Users can specify how much they want to save each month or how much they want to allocate towards debt repayment, and the tool will help them stay on track.

Overall, Banzai income and expenses is a user-friendly and practical tool for managing personal finances. It provides a comprehensive overview of income and expenses, allows for customization and goal-setting, and helps users make informed financial decisions.

Key features of Banzai income and expenses

Banzai income and expenses is a powerful tool that helps individuals and businesses effectively track their financial status. With its user-friendly interface and comprehensive features, Banzai ensures accurate and efficient management of income and expenses.

Expense tracking: One of the key features of Banzai income and expenses is its ability to track expenses in real-time. Users can easily input and categorize their expenses, making it effortless to monitor and analyze spending patterns. This feature provides valuable insights into where money is being spent and helps users make informed financial decisions.

Income management: Banzai income and expenses simplifies the process of managing income by offering features that allow users to easily input and categorize their income sources. Whether it’s salary, bonuses, or investment returns, Banzai ensures that all sources of income are accurately recorded. This makes it easier for users to calculate their total income and plan accordingly.

Budgeting tools: Another notable feature of Banzai income and expenses is its budgeting tools. Users can set personalized budgets for different expense categories and track their progress in real-time. Banzai provides visual representations of budget allocations and alerts users when they exceed their set limits. This helps individuals and businesses stay on track and make necessary adjustments to their spending habits.

Comprehensive reporting: Banzai income and expenses offers detailed reporting capabilities, allowing users to generate customized reports that provide a comprehensive overview of their financial status. These reports can include income and expense breakdowns, spending trends, and savings analysis. Users can easily export these reports in different formats, making it convenient for financial analysis and tax reporting purposes.

Data security: Banzai income and expenses prioritizes data security and ensures that users’ financial information is protected. The platform utilizes encryption and secure servers to safeguard sensitive data, providing users with peace of mind when managing their finances.

In conclusion, Banzai income and expenses is a feature-rich financial management tool that simplifies income and expense tracking, offers budgeting tools, provides comprehensive reporting, and prioritizes data security. With its wide range of functionalities, Banzai helps individuals and businesses effectively manage their finances and make informed financial decisions.

Getting Started with Banzai Income and Expenses

Managing your income and expenses is an essential part of personal financial management. Banzai Income and Expenses is a versatile tool that can help you stay organized and make informed financial decisions. Here are some steps to help you get started:

1. Sign up and create an account

Visit the Banzai website and sign up for an account. You will be prompted to provide some information such as your name, email address, and password. Once you have created an account, you can start using Banzai Income and Expenses.

2. Set up your income sources

Identify all your sources of income, such as salary, freelance work, or investment dividends. In Banzai Income and Expenses, you can create different income categories and set the frequency and amount for each income source. This will help you track and analyze your total monthly income.

3. Add your expenses

List all your regular and occasional expenses, such as rent or mortgage payments, utility bills, groceries, transportation, and entertainment. Banzai Income and Expenses allows you to categorize your expenses and set the budget for each category. This will enable you to keep track of your spending habits and identify areas where you can cut back if necessary.

4. Track your income and expenses

Regularly update your income and expenses in Banzai Income and Expenses. This can be done manually by entering the amounts or by linking your bank accounts and credit cards to automatically import the transactions. Keeping track of your finances will help you understand your cash flow and make informed decisions.

5. Analyze your financial data

Explore the various tools and features in Banzai Income and Expenses to analyze your financial data. View summary reports, charts, and graphs to gain insights into your income, expenses, and budget. Use this information to identify trends, make adjustments, and set financial goals for the future.

6. Seek guidance from financial professionals

If you need help or have specific financial goals, consider seeking guidance from financial professionals. Banzai Income and Expenses also provides access to reliable financial resources and educational content to enhance your financial literacy.

Getting started with Banzai Income and Expenses can empower you to take control of your finances and make sound financial decisions. Start using it today to experience the benefits of better financial management!