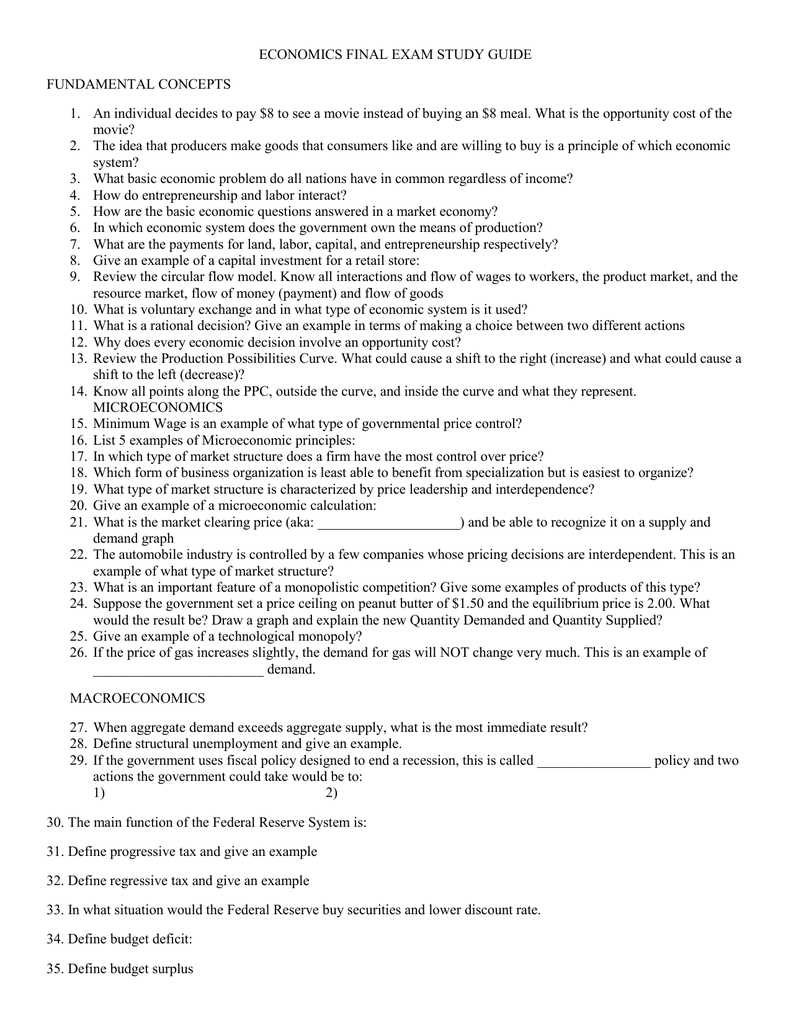

If you’re studying economics and preparing for your final exam in 2021, it’s essential to have a comprehensive understanding of the key concepts and theories. To help you with your revision, this article provides a PDF format of economics final exam questions and answers. Whether you’re a student or a teacher looking for practice materials, these questions cover various topics and test your knowledge on different economic principles.

The PDF contains a mix of multiple-choice, short answer, and essay-type questions, allowing you to practice different types of exam questions. Each question is accompanied by a detailed answer, explaining the reasoning and concepts involved. This provides you with valuable insights into how to approach similar questions during your final exam.

Topics covered in the PDF include microeconomics, macroeconomics, supply and demand, market structures, international trade, fiscal and monetary policy, economic growth, and more. By going through these questions and answers, you can reinforce your understanding of the subject matter and identify any areas that require additional revision.

Preparing for your economics final exam can be challenging, but with the right resources and practice, you can improve your chances of success. Utilize this PDF of economics final exam questions and answers to enhance your preparation and gain the confidence you need to excel in your exam.

Economics Final Exam Questions and Answers PDF 2021

Preparing for an economics final exam can be a daunting task, but having access to a well-structured and comprehensive study guide can greatly increase your chances of success. In today’s digital age, many students find it helpful to have a PDF version of the questions and answers to aid their revision process.

This Economics Final Exam Questions and Answers PDF for 2021 is a valuable resource that covers a wide range of topics in economics. It includes questions on both micro and macroeconomics, ensuring that you have a solid understanding of key concepts and theories in the field. Utilizing this PDF as a study tool will help you assess your knowledge and test your grasp of economic principles.

The PDF is organized in a user-friendly format, with questions presented in a clear and concise manner. Each question is accompanied by a detailed answer that explains the reasoning behind it, ensuring that you not only know the correct response but also understand why it is correct. This is a valuable feature that allows you to deepen your understanding of economic concepts and apply them in different scenarios.

Whether you are preparing for a final exam, reviewing for a midterm, or simply want to enhance your knowledge of economics, this PDF will prove to be an essential resource. It provides a comprehensive overview of the subject, highlights key concepts, and allows you to practice applying economic theories to real-world situations. By utilizing this study guide effectively, you will be well-equipped to excel in your economics exam.

An Overview of Economics

Economics is a social science that studies the allocation of scarce resources to satisfy unlimited wants and needs. It involves analyzing how individuals, households, businesses, and governments make choices with limited resources to achieve their objectives. Economics can be divided into two main branches: microeconomics and macroeconomics.

Microeconomics focuses on the behavior of individual economic agents, such as consumers, producers, and workers. It examines how supply and demand interact in specific markets to determine prices and quantities. Microeconomics also studies factors that influence individual decision-making, such as income, prices, preferences, and incentives.

Macroeconomics, on the other hand, looks at the economy as a whole. It examines aggregate variables, such as national income, unemployment, inflation, and economic growth. Macroeconomics analyzes the factors that determine the overall level of economic activity, including government policies, monetary policy, and international trade.

Economics uses various models and tools to understand and predict economic phenomena. These include graphs, equations, statistical analysis, and economic indicators. Economists use these tools to develop theories, test hypotheses, and make policy recommendations. The field of economics is constantly evolving, as new data and theories are developed to better understand the complex interactions of individuals and societies in the global economy.

Key Concepts in Economics:

- Scarcity: The fundamental economic problem of limited resources versus unlimited wants.

- Opportunity Cost: The cost of choosing one option over another; the value of the next best alternative.

- Supply and Demand: The forces that determine the prices and quantities of goods and services in a market.

- Gross Domestic Product (GDP): The total value of goods and services produced by a country in a given period.

- Inflation: The increase in the general level of prices over time.

- Unemployment: The number of people who are without work but actively seeking employment.

- Monetary Policy: The actions taken by the central bank to manage the money supply and interest rates to influence economic activity.

- Fiscal Policy: The use of government spending and taxation to influence the economy.

- International Trade: The exchange of goods and services between countries.

Microeconomics Exam Questions and Answers

Microeconomics is a branch of economics that focuses on individual households and firms, and how they make decisions regarding the allocation of scarce resources. It is an essential field of study for understanding the behavior of consumers, producers, and the market as a whole. In this article, we will explore some common microeconomics exam questions and provide answers to help you prepare for your upcoming exams.

1. What is the concept of demand?

Demand refers to the quantity of a good or service that consumers are willing and able to buy at a given price. It is influenced by factors such as income, the price of related goods, preferences, and population. The law of demand states that as the price of a good or service increases, the quantity demanded decreases, and vice versa.

2. Explain the concept of supply.

Supply, on the other hand, refers to the quantity of a good or service that producers are willing and able to sell at a given price. It is affected by factors such as the cost of production, technology, and the price of inputs. The law of supply states that as the price of a good or service increases, the quantity supplied also increases, and vice versa.

3. What is the difference between elastic and inelastic demand?

Elastic demand refers to a situation where the quantity demanded is highly responsive to changes in price. In other words, a small change in price leads to a significant change in quantity demanded. On the other hand, inelastic demand occurs when the quantity demanded is relatively unresponsive to changes in price. A change in price leads to a proportionately smaller change in quantity demanded.

4. How does a monopoly differ from perfect competition?

A monopoly occurs when there is only one seller in the market, giving them significant control over price and quantity. In contrast, perfect competition is a market structure with many buyers and sellers, where no individual firm has control over price. A monopoly can restrict output and charge higher prices due to lack of competition, while in perfect competition, prices are determined by market forces of supply and demand.

These are just a few examples of the types of questions you may encounter in a microeconomics exam. It is essential to study and understand key concepts such as demand, supply, elasticity, and market structures to perform well in your exams. Good luck!

Macroeconomics Exam Questions and Answers

Macroeconomics is a branch of economics that focuses on the behavior and performance of an entire economy. It looks at factors such as inflation, unemployment, economic growth, and fiscal policies that influence the overall health of a nation’s economy. For students studying macroeconomics, it is important to have a solid understanding of key concepts and be able to apply them to real-world scenarios. Here are some example exam questions and answers to help you prepare for your macroeconomics final exam.

Question 1:

Explain the concept of GDP and how it is calculated.

Answer:

Gross Domestic Product (GDP) is the total value of all final goods and services produced within a country’s borders in a given period of time. It is calculated by adding up the value of consumption (C), investment (I), government spending (G), and net exports (NX) (exports minus imports). Mathematically, GDP can be represented as: GDP = C + I + G + NX.

Question 2:

What is the difference between fiscal policy and monetary policy?

Answer:

Fiscal policy refers to the use of government spending and taxation to influence the overall health of the economy. It involves decisions made by the government regarding how much to spend on public goods and services, and how much tax revenue to collect. By adjusting these factors, the government can try to stimulate or slow down the economy.

Monetary policy, on the other hand, is the responsibility of the central bank and involves managing the money supply and interest rates to achieve economic goals. The central bank can increase or decrease the money supply to influence interest rates, which in turn affects borrowing and spending by individuals and businesses.

Question 3:

Explain the relationship between inflation and unemployment.

Answer:

The relationship between inflation and unemployment is often depicted by the Phillips Curve. The Phillips Curve suggests that there is a trade-off between inflation and unemployment in the short run. When inflation is high, unemployment tends to be low, and vice versa. This is known as the short-run Phillips Curve. However, in the long run, this trade-off disappears and there is a natural rate of unemployment that is unaffected by inflation. This is known as the long-run Phillips Curve.

In summary, when inflation is low, unemployment tends to be high, and when inflation is high, unemployment tends to be low in the short run. However, in the long run, there is no fixed relationship between inflation and unemployment.

Question 4:

What is the difference between fiscal deficit and national debt?

Answer:

Fiscal deficit refers to the amount by which a government’s total expenditures exceed its total revenues in a given period. It is an indication of how much the government has borrowed to finance its spending. The fiscal deficit can be financed through borrowing from individuals, financial institutions, or by printing more money.

National debt, on the other hand, refers to the accumulation of all past deficits minus surpluses. It represents the total amount of money that a government owes to its creditors. National debt is an important indicator of a country’s financial health and its ability to pay back its debts over time.

These macroeconomics exam questions and answers provide a glimpse into the complex concepts and theories that students need to understand in order to succeed in their final exams. It is important to study these topics thoroughly and be able to apply them to different scenarios in order to demonstrate a deep understanding of macroeconomics.

International Economics Exam Questions and Answers

Below are a few sample questions and answers related to international economics:

1. Explain the concept of comparative advantage in international trade.

Comparative advantage refers to the ability of a country or an individual to produce a particular good or service at a lower opportunity cost compared to another country or individual. It is based on the principle of specialization, where each country focuses on producing the goods or services in which it has a comparative advantage and can produce most efficiently. This concept of comparative advantage forms the basis for international trade, as countries can benefit by trading goods and services that they can produce at a lower cost in exchange for goods and services produced more efficiently by other countries.

2. What are the main factors that influence exchange rates?

Exchange rates, or the price of one currency in relation to another, are influenced by various factors including:

- Economic fundamentals: Factors such as inflation rates, interest rates, and economic growth can impact exchange rates. Higher inflation rates or lower interest rates, for example, may lead to a depreciation of a currency.

- Political stability: Political instability, conflicts, and changes in government policies can affect exchange rates. A country with a stable political environment may attract more foreign investments, leading to a stronger currency.

- Market speculation: Speculators trading large amounts of currency can influence exchange rates in the short term.

- Trade balance: The balance of imports and exports can also impact exchange rates. A country with a trade surplus may experience a stronger currency, while a trade deficit may lead to a weaker currency.

- Market interventions: Central banks and governments may intervene in the foreign exchange market to stabilize exchange rates, which can influence their value.

3. What are the advantages and disadvantages of free trade?

Free trade refers to a policy where goods and services can be traded between countries without significant barriers such as tariffs or quotas. It is often promoted as a way to boost economic growth and increase consumer welfare, but it also has its advantages and disadvantages:

Advantages:

- Increased market access: Free trade allows countries to access larger markets and expand their customer base, leading to more opportunities for businesses and potentially higher profits.

- Efficiency gains: Specialization and comparative advantage can lead to increased efficiency and productivity as countries focus on producing goods and services they are most efficient at producing.

- Lower prices: Free trade can lead to lower prices for consumers as imported goods can be produced more efficiently in other countries, fostering competition.

Disadvantages:

- Job displacement: Free trade can result in job losses in industries that are unable to compete with imports. This can lead to unemployment and income inequality in affected regions.

- Dependency on imports: Reliance on imported goods may leave a country vulnerable to supply disruptions or price fluctuations in the global market.

- Loss of domestic industries: In some cases, free trade might lead to the decline or disappearance of certain domestic industries that are unable to compete with imports.

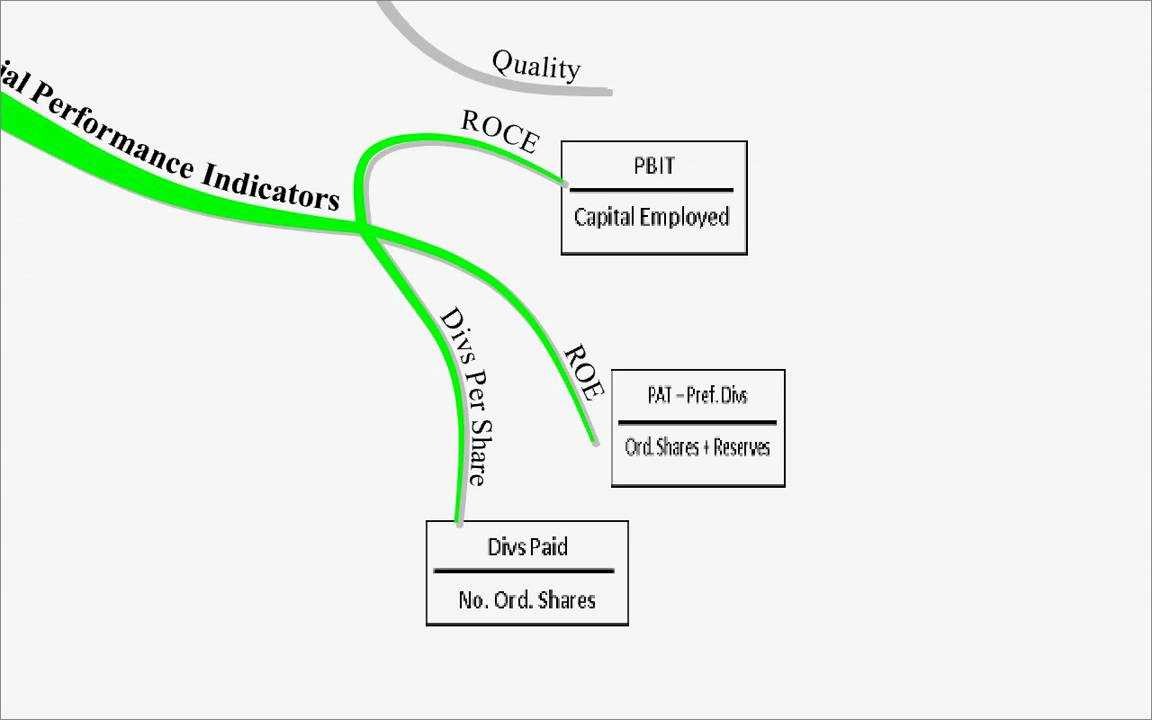

Financial Economics Exam Questions and Answers

In the field of financial economics, understanding the concepts and theories is crucial for making informed decisions in investing, managing risk, and evaluating financial markets. Here are some common exam questions and their answers to help you prepare for your financial economics test.

1. What is the difference between risk and uncertainty?

Answer: Risk refers to a situation where the probability and potential outcomes of an event are known, allowing for the calculation of expected values. Uncertainty, on the other hand, refers to a situation where the probabilities and potential outcomes are unknown or difficult to quantify. In financial economics, risk can be managed through diversification and hedging, while uncertainty requires subjective judgment and decision-making.

2. What is the efficient market hypothesis (EMH)?

Answer: The efficient market hypothesis states that financial markets are efficient and that stock prices fully reflect all available information. In other words, it suggests that it is impossible to consistently achieve above-average returns through trading strategies, as the market quickly incorporates any new information. This hypothesis has implications for active investing versus passive investing strategies.

3. What is the relationship between interest rates and bond prices?

Answer: Interest rates and bond prices have an inverse relationship. When interest rates rise, bond prices fall, and vice versa. This is because when interest rates increase, the fixed interest payments of existing bonds become less attractive relative to newly issued bonds with higher interest rates. Therefore, the demand for existing bonds decreases, causing their prices to decline.

4. What are the factors that influence the demand and supply of currencies in the foreign exchange market?

Answer: The demand and supply of currencies in the foreign exchange market are influenced by several factors, such as interest rates, inflation rates, economic indicators, political stability, and market expectations. Higher interest rates, lower inflation rates, positive economic indicators, political stability, and positive market expectations can increase the demand for a currency, leading to its appreciation. Conversely, lower interest rates, higher inflation rates, negative economic indicators, political instability, and negative market expectations can decrease the demand for a currency, causing its depreciation.

5. What is the concept of portfolio diversification?

Answer: Portfolio diversification involves spreading investments across different assets or asset classes to reduce risk. By diversifying, an investor can decrease the impact of a single investment’s performance on their overall portfolio. Diversification works on the principle that different assets have different risks and returns, and when combined in a portfolio, the overall risk is reduced. It is important to note that diversification does not eliminate risk completely, but rather helps manage and minimize it.

Environmental Economics Exam Questions and Answers

As part of an economics final exam, students may be required to answer questions related to environmental economics. This field of study focuses on the economic analysis of environmental issues and policies. Here are some sample exam questions along with their corresponding answers:

1. What is the concept of externalities, and how do they relate to environmental economics?

Externalities refer to the costs or benefits imposed on third parties as a result of an economic activity. In the context of environmental economics, externalities often arise from pollution or resource depletion. For example, a factory emitting pollutants into the air imposes negative externalities on the surrounding community in the form of health hazards or decreased property values. Environmental economics aims to analyze and address these externalities by considering their economic implications and finding efficient policy solutions.

2. Describe the economic concept of “market failure” and provide an example in the context of environmental issues.

Market failure occurs when the allocation of resources in a market is not efficient from a societal perspective. This can happen due to various reasons, such as externalities, imperfect information, or the presence of public goods. In the context of environmental issues, a common example of market failure is the tragedy of the commons. When a resource, such as a fishing ground or a forest, is held in common and not owned by anyone, individuals have an incentive to exploit the resource to their own benefit, leading to overconsumption and depletion. As a result, government intervention or the establishment of property rights is often needed to prevent or mitigate such market failures.

3. Explain the concept of “green taxes” and discuss their potential benefits and drawbacks.

Green taxes, also known as environmental taxes or Pigouvian taxes, are levies imposed on activities with negative environmental externalities, such as pollution or carbon emissions. The goal of green taxes is to internalize the costs of these externalities by making polluters bear the financial burden. The potential benefits of green taxes include incentivizing firms to reduce their environmental impact, promoting the use of cleaner technologies, and generating revenue for environmental programs. However, drawbacks include potential regressive effects on low-income households and the risk of businesses relocating to jurisdictions with lower tax rates.

4. Discuss the concept of “sustainability” and its importance in environmental economics.

Sustainability refers to the ability to meet the needs of the present generation without compromising the ability of future generations to meet their own needs. In the context of environmental economics, sustainability is of paramount importance as it involves balancing economic growth with environmental protection and resource conservation. Sustainable development requires considering long-term environmental impacts and incorporating them into economic decision-making. Environmental economists analyze and develop policies that promote sustainable practices, such as the adoption of renewable energy sources, conservation of biodiversity, and the efficient use of resources.

Overall, environmental economics plays a crucial role in understanding and addressing the economic dimensions of environmental issues. By incorporating principles of economics into environmental policy and decision-making, it helps guide sustainable and efficient solutions for a better future.