When it comes to saving money, many people wonder if having multiple savings accounts is a good idea. While there isn’t a one-size-fits-all answer, having 2-3 savings accounts can provide flexibility and help you achieve your financial goals.

The first reason to consider opening multiple savings accounts is to separate your savings goals. Having different accounts dedicated to specific goals, such as an emergency fund, a vacation fund, and a down payment fund, allows you to track your progress towards each goal individually. It also makes it less tempting to dip into one fund for another purpose.

Secondly, having multiple savings accounts can help with budgeting and organization. By allocating a certain amount of money to each account each month, you can easily see how much you have set aside for each goal. This can prevent overspending and ensure that you are staying on track with your savings plans.

Lastly, having multiple savings accounts can offer different interest rates and benefits. Some banks may offer higher interest rates for specific types of savings accounts, such as a high-yield savings account or a certificate of deposit (CD). By opening different accounts, you can take advantage of these higher rates and maximize your earnings.

In conclusion, while having 2-3 savings accounts may not be necessary for everyone, it can provide advantages in terms of goal separation, budgeting, and interest rates. Consider your financial goals and needs to determine if having multiple savings accounts is the right choice for you.

What are 2-3 savings accounts?

Savings accounts are a popular financial tool for individuals to save money. They offer a secure place to store funds, with the added benefit of earning interest on the balance. While most people are familiar with traditional savings accounts, there are also specialized variations, such as 2-3 savings accounts, that provide unique features for specific financial goals.

A 2-3 savings account is a type of savings account that offers tiered interest rates based on the account balance. Typically, these accounts have two or three tiers, with different interest rates applicable to each tier. The interest rates may increase as the balance reaches higher thresholds. This structure incentivizes individuals to save more and rewards them with higher interest rates for doing so.

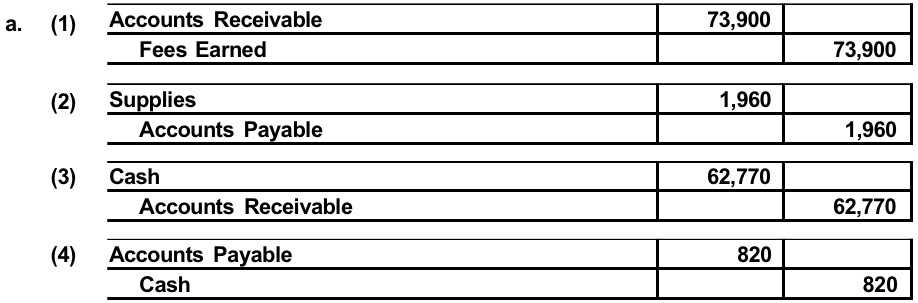

For example: A 2-3 savings account may have three tiers:

- Up to $1,000: 0.5% interest rate

- $1,000 – $5,000: 1.0% interest rate

- Above $5,000: 1.5% interest rate

The benefits of 2-3 savings accounts include:

- Better interest rates: By earning tiered interest rates, individuals can potentially maximize their savings returns.

- Flexibility: These accounts allow individuals to start saving with a lower balance and gradually build it up over time.

- Incentive to save: The tiered structure encourages individuals to save more to reach higher interest rates, promoting healthy saving habits.

It’s important to note that the exact terms and conditions of 2-3 savings accounts may vary between financial institutions. It’s always advisable to compare different account options and understand the minimum balance requirements, fees, and any additional features before opening a savings account.

Understanding the Concept of Multiple Savings Accounts

When it comes to saving money, having multiple savings accounts can be a smart and effective strategy. By opening different accounts for different purposes, individuals can easily keep track of their financial goals and allocate funds accordingly. Whether it’s saving for an emergency fund, a vacation, or a big purchase, having separate accounts can provide a clear and organized approach to managing money.

Benefits of Multiple Savings Accounts:

- Goal-based saving: One of the main benefits of having multiple savings accounts is the ability to assign specific goals to each account. By separating funds based on different financial objectives, individuals can focus their savings efforts on achieving these goals. For example, one account can be designated for short-term goals like saving for a new car, while another account can be dedicated to long-term goals like retirement.

- Budgeting and tracking progress: With multiple savings accounts, it becomes easier to create a budget and track progress towards each goal. By assigning a certain amount of money to each account on a regular basis, individuals can see how close they are to achieving their goals. This can provide motivation and help stay on track with saving.

- Flexibility and control: Having separate savings accounts gives individuals the flexibility and control to manage their finances in a way that works best for them. It allows for easy customization and adjustment of savings strategies depending on individual circumstances and changing financial goals.

Considerations for Multiple Savings Accounts:

- Account fees and minimum balances: Before opening multiple savings accounts, it’s important to consider the fees and minimum balance requirements of each account. Some banks may charge fees or require a certain minimum balance for each account, which can affect the overall savings strategy.

- Consolidation and simplification: While multiple savings accounts can be beneficial, it’s also important to avoid excessive complexity. Having too many accounts can lead to confusion and make it harder to manage finances effectively. It’s important to find a balance between having separate accounts for specific goals and keeping the overall savings system simple and manageable.

- Regular monitoring: Lastly, it’s crucial to regularly monitor each savings account to ensure progress is being made towards achieving the goals. By reviewing the accounts on a periodic basis, adjustments can be made if necessary to keep savings on track.

Overall, understanding the concept of multiple savings accounts can empower individuals to take control of their financial goals and make progress towards achieving them. By using this strategy, individuals can allocate funds more effectively and stay motivated on their savings journey.

Why Should You Consider Having 2-3 Savings Accounts?

Having multiple savings accounts can offer several benefits and can be an effective strategy to help you manage and grow your money. Here are some reasons why you should consider having 2-3 savings accounts:

Diversification:

By dividing your savings into multiple accounts, you can diversify your funds. Each account can be designated for a specific purpose or goal, such as an emergency fund, a down payment for a house, or a vacation fund. This allows you to allocate your savings strategically and ensures that you have funds available for different needs without dipping into other savings.

Budgeting and Tracking:

Having separate savings accounts can help you stay organized and track your progress towards different financial goals. By assigning a specific purpose to each account, it becomes easier to understand where your money is going and how much you have saved for each specific goal. This can make it easier to create a budget, prioritize your savings, and make informed financial decisions.

Interest Optimization:

Some savings accounts offer higher interest rates or bonuses for maintaining a certain minimum balance. By having multiple accounts, you can take advantage of these promotions and earn more interest on your savings. Additionally, having multiple accounts can help you spread your savings across different financial institutions, diversifying your exposure and potentially maximizing your overall returns.

Emergency Preparedness:

Keeping a separate emergency fund in its own account can provide you with the security and peace of mind to handle unexpected expenses without disrupting your other savings goals. Having a dedicated emergency fund ensures that you have a financial safety net to rely on in times of need, whether it’s for medical bills, car repairs, or unforeseen circumstances.

In conclusion, having 2-3 savings accounts can offer you a range of benefits, including diversification, improved budgeting and tracking, interest optimization, and emergency preparedness. Consider evaluating your financial goals and needs to determine if multiple savings accounts would be beneficial for you.

The Benefits of Diversifying Your Savings

Diversifying your savings is a smart financial strategy that involves spreading your funds across multiple savings accounts or investment options. By diversifying, you minimize the risk of loss and increase the potential for growth. Here are some key benefits of diversifying your savings:

- Reduced Risk: Putting all your savings into a single account or investment exposes you to higher risk. If that account or investment performs poorly, you may lose a significant portion of your savings. Diversifying helps mitigate this risk by spreading your funds across different accounts and assets.

- Increased Growth Potential: Different savings accounts and investment options offer varying rates of return. By diversifying, you can take advantage of multiple investment opportunities and potentially increase your overall returns. For example, you may choose to allocate some funds to a high-yield savings account, while also investing in stocks or bonds.

- Flexibility: Diversifying your savings provides flexibility in managing your finances. If one account or investment is underperforming, you can rely on other accounts to balance out your overall savings. This flexibility allows you to adapt to changing financial situations and make informed decisions.

- Protection against Inflation: Inflation can erode the value of your savings over time. By diversifying, you can safeguard your funds against inflation. Some investment options, such as stocks or real estate, have historically outperformed inflation rates, allowing your savings to maintain their purchasing power.

- Access to Different Features: Different savings accounts may come with various features, such as higher interest rates, bonus offers, or different withdrawal restrictions. By diversifying, you can take advantage of these features and tailor your savings strategy to meet your specific needs and goals.

Diversifying your savings is a prudent way to manage your financial future. It helps protect your savings, increase earning potential, and adapt to changing economic circumstances. By allocating your funds across a range of accounts and investments, you can ensure a robust and diversified portfolio that maximizes financial security and growth.

How to Manage Multiple Savings Accounts Effectively

Saving money is an important aspect of financial planning, and having multiple savings accounts can help you organize your funds and reach your financial goals more effectively. However, managing multiple savings accounts can sometimes be challenging. Here are some strategies to help you manage your accounts efficiently:

1. Clearly Define Your Savings Goals

Before opening multiple savings accounts, it’s crucial to clearly define your savings goals. Determine what you’re saving for, whether it’s an emergency fund, a down payment for a house, or a vacation. Having specific goals will help you allocate funds to the appropriate accounts.

2. Allocate Funds Based on Priorities

Once you’ve established your savings goals, allocate your funds to different accounts based on priorities. Consider the importance and urgency of each goal when deciding how much money to allocate to each account. This way, you can ensure that you’re making progress towards all your financial objectives simultaneously.

3. Automate Regular Transfers

To make managing multiple savings accounts easier, set up automatic transfers. Schedule regular transfers from your primary account to each savings account based on your budget and savings goals. Automating these transfers will ensure that you consistently save money without the need for manual transfers.

4. Track Your Progress

It’s essential to track your progress regularly to stay motivated and make adjustments if necessary. Use a spreadsheet, a budgeting app, or any other tool to monitor the balance and growth of each savings account. This will give you a clear picture of your overall financial progress and help you stay on track towards achieving your goals.

5. Review and Reevaluate

Periodically review your savings accounts and reevaluate your goals. As your financial situation changes, your savings priorities may also change. Adjust the allocation of your funds accordingly to ensure that your money is working towards your current goals effectively.

Managing multiple savings accounts requires intentional planning and organization. By following these strategies, you can effectively manage your accounts and make progress towards your financial goals.

Tips for organizing and tracking your savings

Having multiple savings accounts can be a great way to organize your finances and work towards different financial goals. However, managing these accounts and keeping track of your savings can be a challenge. Here are some tips to help you stay organized and effectively track your savings progress.

1. Set clear savings goals

Before you start organizing your savings, it’s important to set clear and specific goals for each account. Whether you’re saving for a down payment on a house, a vacation, or an emergency fund, clearly defining your goals will help you stay focused and motivated.

2. Use descriptive account names

When setting up multiple savings accounts, give each account a descriptive name that reflects its purpose. For example, instead of naming an account “Savings Account 1,” you could name it “Emergency Fund” or “Vacation Fund.” This will make it easier for you to identify each account and remember its purpose.

3. Automate your savings

Take advantage of automatic transfers or deposits to help you save consistently. Set up recurring transfers from your checking account to each of your savings accounts, based on your budget and savings goals. This way, you won’t have to rely on remembering to manually transfer money each month.

4. Track your progress regularly

Make it a habit to review your savings accounts regularly. Keep track of how much you’ve saved towards each goal and evaluate if you’re on track. By regularly monitoring your progress, you can make adjustments if needed and celebrate milestones along the way.

5. Consider using a budgeting tool

Using a budgeting tool or app can help you effectively manage and track your savings. These tools can give you a clear overview of your finances, including your savings goals and progress. They can also send you reminders when bills are due or when it’s time to make savings deposits.

By following these tips, you can better organize and track your savings accounts, keeping you on the path to achieving your financial goals.

Are there any drawbacks to having 2-3 savings accounts?

The idea of having multiple savings accounts can be appealing as it allows for better organization and management of finances. However, there are some potential drawbacks to consider before opening 2-3 savings accounts.

One drawback is the complexity it adds to managing your money. With multiple accounts, it can be challenging to keep track of balances, interest rates, and transaction histories. This can lead to confusion and potentially result in missed opportunities or unnecessary fees.

Another drawback is the potential loss of interest earnings. Most savings accounts offer interest based on the average balance within the account. By spreading your money across multiple accounts, the average balance in each account may be lower, resulting in lower interest earnings overall.

Furthermore, having multiple savings accounts may increase the temptation to spend. The convenience of having separate accounts for different goals or purposes may make it easier to justify dipping into those accounts for non-essential expenses. This can hinder progress towards financial goals and undermine the purpose of having separate accounts in the first place.

Lastly, managing multiple savings accounts can also be time-consuming. Regularly monitoring and transferring funds between accounts can be a hassle, especially if each account is held with a different financial institution. This may require additional paperwork, online logins, and potential fees for transfers.

In conclusion, while having 2-3 savings accounts can offer some benefits, such as better organization and management of funds, there are also potential drawbacks to consider. These include increased complexity in managing finances, potential loss of interest earnings, increased temptation to spend, and added time-consuming tasks. It is important to weigh the pros and cons before deciding to open multiple savings accounts.

Exploring the potential disadvantages

Savings accounts can offer many benefits, but it’s important to also consider their potential disadvantages before making a decision. Here are a few drawbacks to keep in mind:

- Low interest rates: While savings accounts provide a safe place to store your money, the interest rates they offer are often much lower compared to other investment options. This means that the return on your savings might be minimal, especially when considering inflation.

- Limited access to funds: Most savings accounts have restrictions on how often you can withdraw money. This can be a disadvantage if you need quick access to your funds in case of emergencies or unexpected expenses.

- Inflation risk: Savings accounts may not protect your money from inflation. Inflation can erode the purchasing power of your savings over time, potentially reducing the value of your money in real terms.

- Opportunity cost: By locking your money into a savings account, you may miss out on other investment opportunities that could potentially offer higher returns. Depending on your financial goals, this could be a missed opportunity for growth.

It’s important to consider these potential disadvantages alongside the benefits of savings accounts. Ultimately, the decision to open a savings account depends on your specific financial goals, risk tolerance, and the overall state of the economy.

In conclusion, while savings accounts can provide a safe and secure way to save money, they may not offer the best returns or flexibility. It’s crucial to evaluate your individual financial circumstances and explore other investment options before committing to a savings account.

Q&A:

Are there any potential disadvantages to exploring new technology?

Yes, there can be potential disadvantages to exploring new technology. For example, it can lead to job losses and unemployment as automation and artificial intelligence replace human workers. Additionally, there can be negative effects on the environment if new technology is not designed with sustainability in mind.

What are some potential drawbacks of exploring new business opportunities?

Some potential drawbacks of exploring new business opportunities include increased competition, financial risks, and the uncertainty of success. It requires investment of time, money, and resources, and there is always a chance of failure. Additionally, entering new markets may require adapting to different cultural norms and regulations, which can be challenging.

What are the potential disadvantages of exploring new travel destinations?

Exploring new travel destinations can have potential disadvantages such as cultural shock, language barriers, and safety concerns. When visiting unfamiliar places, travelers may experience discomfort or feel out of place due to different customs and traditions. Language barriers can make communication difficult, and travelers may encounter safety risks in unfamiliar environments.

Are there any potential disadvantages to exploring new diets or nutritional plans?

Yes, there can be potential disadvantages to exploring new diets or nutritional plans. One possible disadvantage is the risk of nutrient deficiencies if the diet is not well-balanced or lacks certain essential nutrients. Additionally, extreme or restrictive diets may not be sustainable in the long term and can lead to unhealthy relationships with food.

What are the potential disadvantages of exploring new educational methods?

Some potential disadvantages of exploring new educational methods include resistance to change from students or teachers, the need for additional training or resources, and the potential for ineffective or unproven strategies. Implementing new educational methods can be challenging and require a shift in mindset and teaching practices. It may take time for students and teachers to adapt to new approaches, and there is a risk that the new methods may not produce the desired outcomes.