Acquiring advanced skills in financial modeling is essential for professionals looking to excel in the field of finance. A strong understanding of key concepts and practical tools enables individuals to create detailed models, conduct in-depth analysis, and provide valuable insights. Whether you are preparing for a certification or advancing your career, mastering these techniques can significantly improve your performance and decision-making abilities.

Preparing for an assessment in financial modeling requires more than just theoretical knowledge. Practical application of complex formulas, data manipulation, and problem-solving skills are critical for success. Knowing how to approach such tasks with accuracy and efficiency is a valuable asset that can set you apart from your peers in a competitive job market.

To succeed, it is important to focus on common challenges, practice consistently, and understand the tools that professionals rely on daily. By focusing on practical exercises and leveraging reliable resources, individuals can boost their confidence and readiness for any financial modeling tasks ahead.

Understanding the Financial Modeling Training Program

Successfully mastering the tools and techniques for financial analysis requires a structured approach. This comprehensive program is designed to provide individuals with hands-on experience and in-depth knowledge to confidently tackle financial modeling tasks. The training emphasizes a practical learning path that builds essential skills for professionals who want to advance in the field of finance.

Core Concepts and Skills Developed

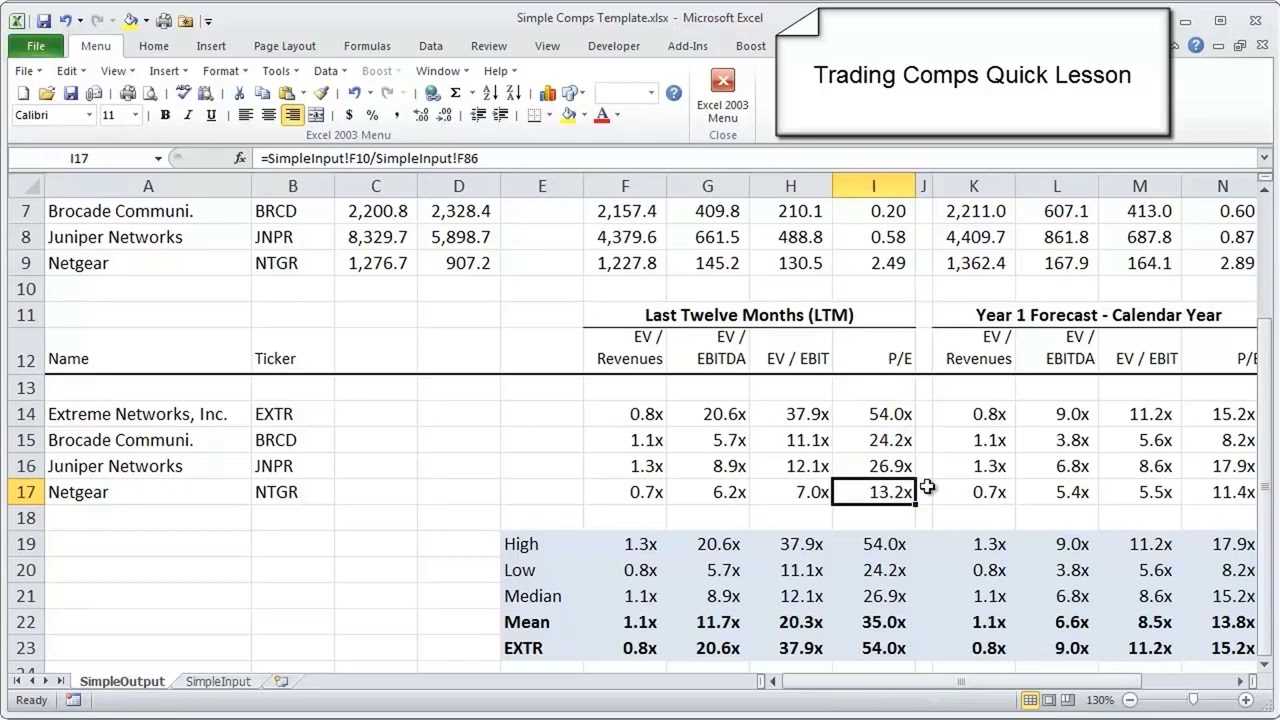

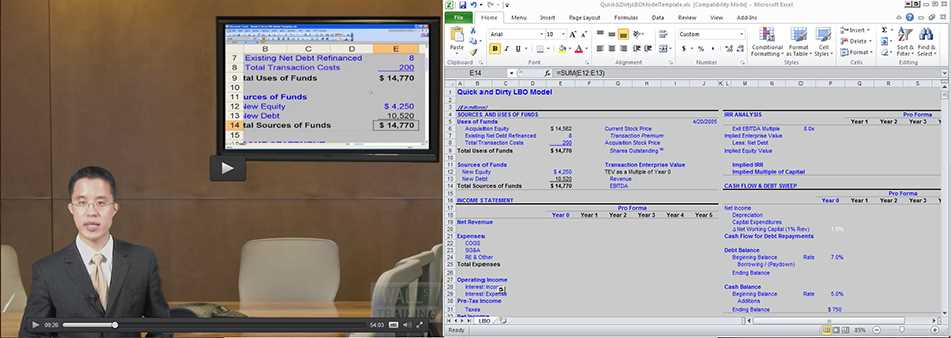

Throughout the program, participants are introduced to critical principles that form the foundation of financial analysis. These concepts range from basic financial principles to complex modeling strategies. By working through detailed examples and real-world scenarios, students gain a deeper understanding of financial metrics, modeling techniques, and the practical application of theoretical knowledge.

Mastering Analytical Tools for Success

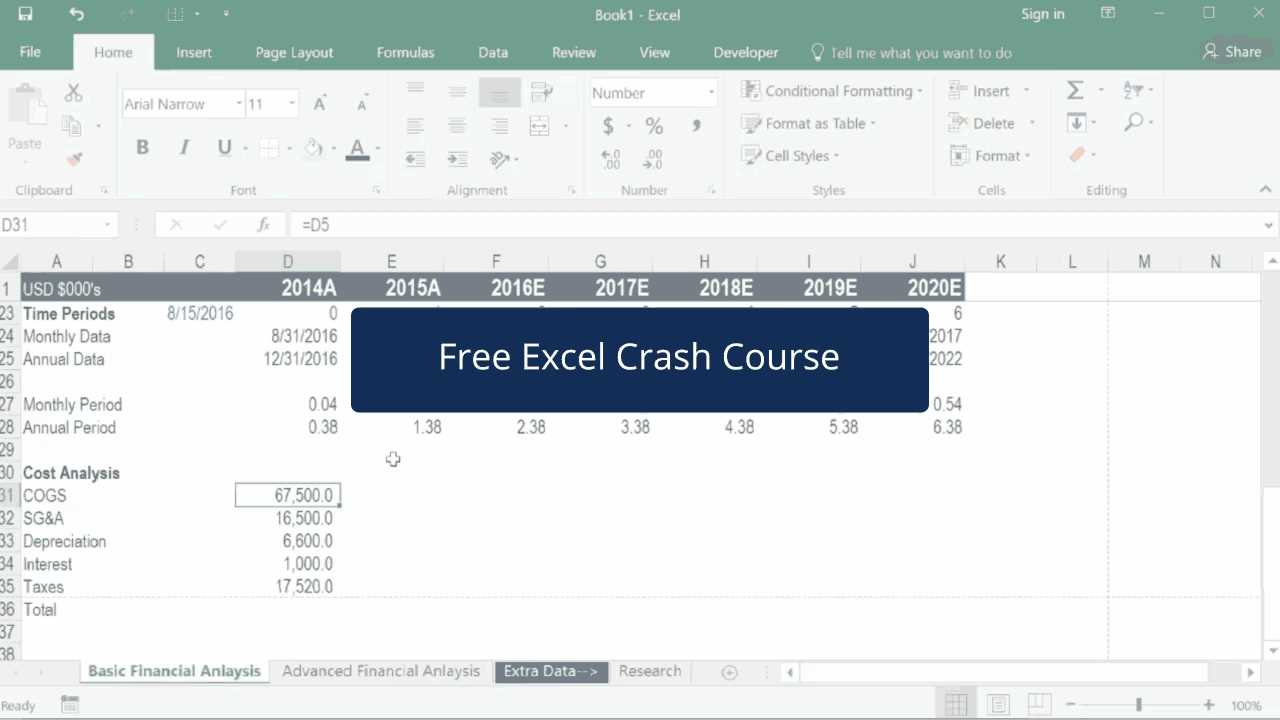

The program offers a deep dive into various analytical tools that are crucial for financial decision-making. From advanced calculations to data visualization, learners acquire the skills necessary to build, assess, and refine models used in investment analysis, business valuation, and financial forecasting. By the end of the training, students are prepared to apply these tools efficiently in a professional setting, enhancing both speed and accuracy.

Key Concepts Covered in the Assessment

To excel in financial analysis, it is essential to master a wide range of critical principles and methodologies. The training focuses on equipping participants with a robust understanding of essential tools, models, and strategies used in financial decision-making. The core concepts addressed are fundamental for anyone looking to enhance their analytical skills in this competitive industry.

Financial Modeling Techniques

One of the key areas of focus is the development of financial models. Participants learn to build various types of models, from simple forecasts to complex valuation models. These models are critical for making informed decisions in areas such as investment planning, risk assessment, and market evaluation.

Data Analysis and Interpretation

The program emphasizes the importance of accurate data analysis, enabling individuals to interpret financial data effectively. By understanding key metrics, trends, and patterns, learners can generate valuable insights that drive business strategy and improve financial performance.

How to Prepare for the Assessment Effectively

Effective preparation for a financial assessment involves a combination of strategic planning, focused practice, and proper resource utilization. A structured study plan allows participants to enhance their understanding of complex concepts and ensure they can apply their knowledge with precision. This approach maximizes retention and builds confidence for tackling challenging tasks.

Essential Steps for Preparation

To optimize your preparation, follow these key steps:

| Step | Action |

|---|---|

| Step 1: | Review core concepts and formulas regularly |

| Step 2: | Practice building and analyzing financial models |

| Step 3: | Focus on time management and efficiency |

| Step 4: | Use sample problems and case studies to simulate real scenarios |

| Step 5: | Test your knowledge with mock assessments |

Following this systematic approach will help ensure you are well-prepared and confident in your ability to perform under exam conditions, while also improving your overall financial analysis skills.

Tips for Mastering Financial Models

Mastering financial modeling is a crucial skill for anyone working in finance. It requires not only understanding theoretical concepts but also being able to apply them using practical tools to build complex, accurate models. The following tips will help streamline your learning process and ensure you’re able to create robust financial models with confidence and precision.

Best Practices for Building Accurate Models

- Start with a solid structure: Begin by outlining the key sections of your model before entering any data. This will help you maintain clarity and organization throughout the process.

- Use consistent formatting: Always stick to a uniform style for cell references, number formatting, and color-coding to avoid confusion.

- Focus on key assumptions: Identify the most important variables that impact your model, such as growth rates, interest rates, and market conditions, and make sure they are well-defined.

- Check for errors regularly: Use Excel’s error-checking functions, such as trace precedents and error indicators, to ensure your formulas are working correctly.

Enhancing Efficiency with Advanced Features

- Leverage keyboard shortcuts: Learn the most common shortcuts to speed up your workflow and reduce the time spent navigating menus.

- Use dynamic ranges: Dynamic named ranges are useful for making your model flexible, especially when dealing with growing datasets.

- Automate tasks with macros: If you frequently perform repetitive tasks, macros can help you automate them, saving you time and reducing the chance of human error.

- Master PivotTables: PivotTables allow for easy data analysis and summarization, essential for working with large datasets.

By following these tips, you can develop a more efficient and effective approach to financial modeling, ensuring that your models are not only accurate but also scalable and easy to maintain over time.

Common Mistakes to Avoid During the Test

When taking a financial assessment, there are several common pitfalls that can negatively affect performance. Awareness of these mistakes and taking proactive steps to avoid them can make a significant difference in your results. Here are the key errors to watch out for during the test and strategies to prevent them.

Critical Errors to Avoid

- Rushing through calculations: One of the most common mistakes is moving too quickly through complex formulas. This often leads to small but significant errors in results. Take your time and double-check each calculation.

- Neglecting to review your work: It’s easy to overlook small details when working under pressure. Always allocate time to review your answers and verify accuracy before submitting your work.

- Ignoring instructions: Carefully read all instructions and follow any provided guidelines. Failing to adhere to specific instructions can lead to losing valuable points, even if your work is correct.

- Overcomplicating models: While it’s tempting to add complexity, often the simplest solution is the best. Focus on clear, concise models that are easy to interpret and free from unnecessary complexity.

How to Stay on Track

- Time management: Allocate time for each section based on its complexity. Stick to your time limits to avoid rushing through important sections at the end.

- Use efficient formulas: Master key formulas and shortcuts to improve efficiency. This will help you save time and reduce the risk of mistakes.

- Stay calm and focused: Test anxiety can lead to careless mistakes. Practice deep breathing and stay calm to maintain clarity and concentration throughout the test.

By recognizing these potential mistakes and taking the necessary steps to avoid them, you will be better equipped to succeed and perform at your best during the test.

Resources for Further Practice and Study

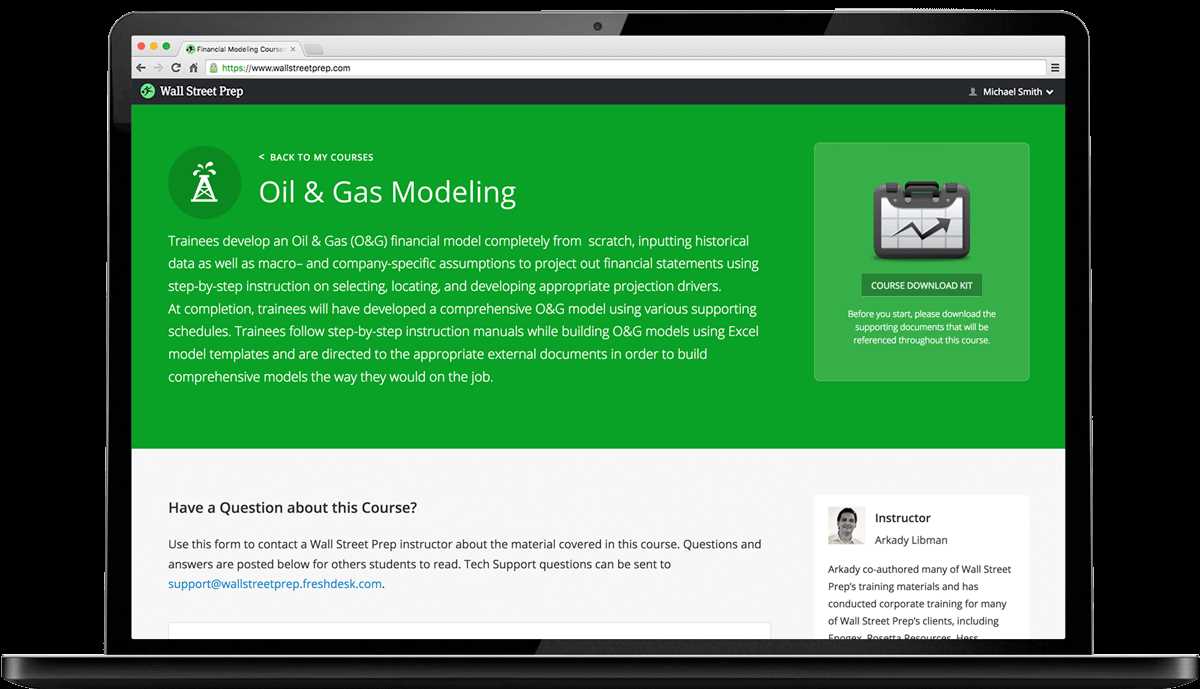

To truly master financial modeling and analysis, continuous practice and access to reliable study materials are essential. There are numerous resources available, ranging from online tutorials to advanced textbooks, that can help reinforce key concepts and improve your skills. Utilizing these resources can significantly boost your proficiency and ensure you’re well-prepared for any challenges ahead.

Some of the most valuable resources for continued learning include interactive platforms offering practice problems, specialized courses, and comprehensive guides. By regularly engaging with these tools, you can deepen your understanding, sharpen your skills, and stay current with industry trends.

In addition to formal resources, online communities, forums, and discussion groups provide opportunities to exchange knowledge, clarify doubts, and learn from peers. These collaborative environments foster a deeper comprehension of complex topics and can help you gain insights into real-world applications.