Preparing an income statement is essential for any business owner or financial analyst to determine the profitability and financial health of a company. The 7 3 Income Statements Worksheet Answers provide a comprehensive guide to understanding and calculating various components of the income statement.

The worksheet answers cover important topics such as revenue recognition, cost of goods sold, operating expenses, non-operating income and expenses, and taxes. By following the provided answers, users can learn how to analyze and interpret financial data to make informed decisions regarding the company’s financial performance.

Additionally, the 7 3 Income Statements Worksheet Answers include examples and calculations that illustrate the concepts discussed. This practical approach helps users apply the knowledge gained from the answers to real-world scenarios, improving their understanding of financial statements and analysis.

Whether you are a business owner, accounting student, or financial professional, the 7 3 Income Statements Worksheet Answers can serve as a valuable resource for mastering the intricacies of income statements. By grasping the fundamentals of this vital financial document, you can gain insights into your company’s performance and effectively communicate financial information to stakeholders.

What is an Income Statement Worksheet?

An income statement worksheet is a financial document that helps businesses keep track of their revenue and expenses to determine their profit or loss for a given period. It is an important tool in financial reporting and analysis as it provides a comprehensive overview of a company’s financial performance.

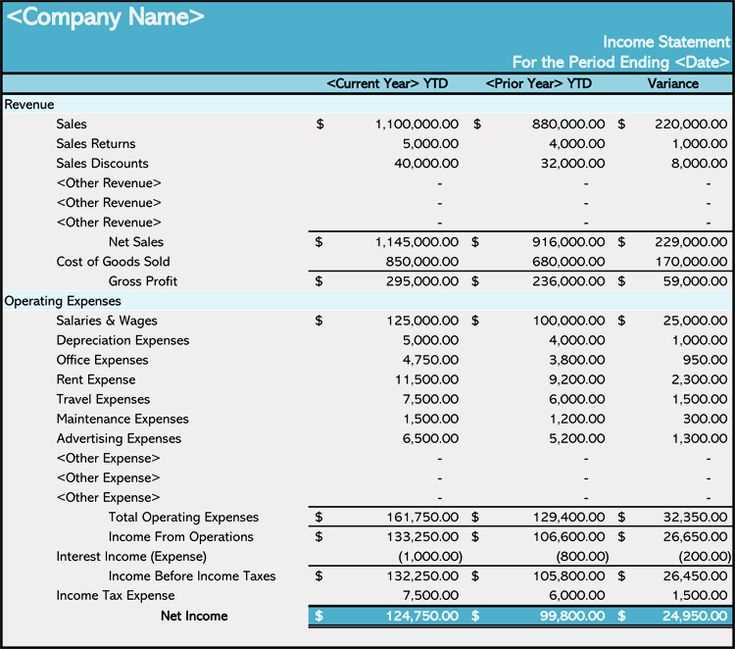

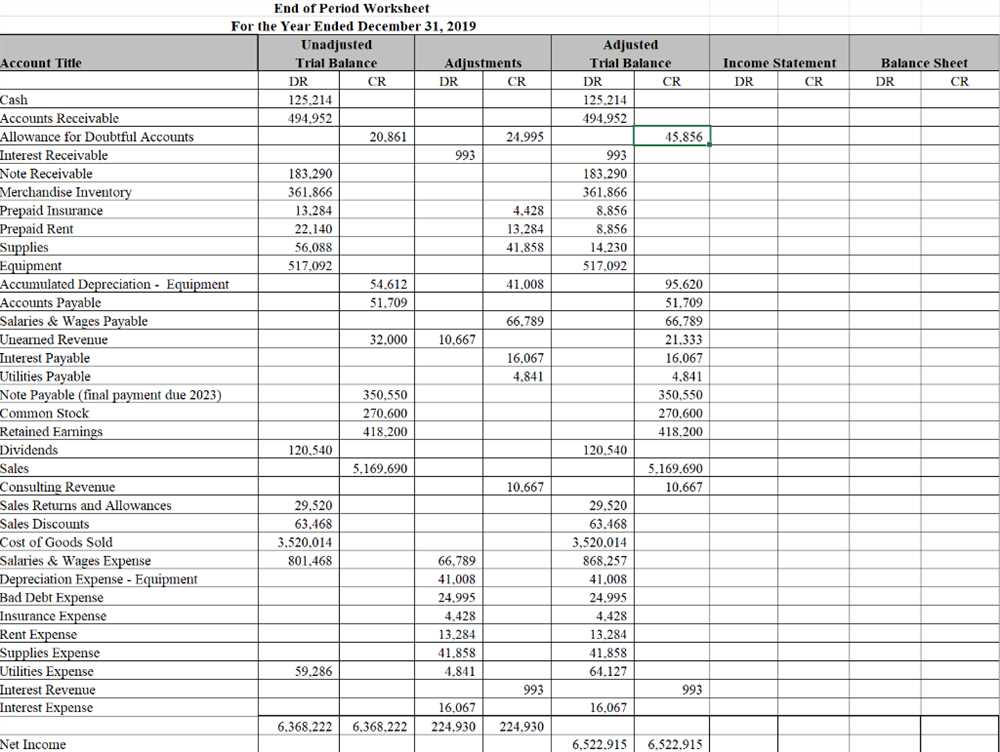

The income statement worksheet typically consists of several sections, including revenue, cost of goods sold, operating expenses, non-operating income or expenses, and taxes. Each section lists various line items that represent different sources of income or expenses. The worksheet also includes subtotals and a final total to calculate the net income or loss for the period.

Revenue: This section of the income statement worksheet lists all the sources of income for the business, such as sales, service fees, or rental income. It records the total amount of money generated from these activities.

Cost of Goods Sold: This section represents the direct costs incurred in producing or acquiring the goods or services that were sold. It includes items such as raw materials, labor, and manufacturing overhead.

Operating Expenses: This section lists all the other expenses that are necessary for running the business, such as rent, salaries, utilities, and marketing costs. These expenses are not directly related to the production of goods or services.

Non-Operating Income/Expenses: This section includes any income or expenses that are not directly related to the core operations of the business. For example, it may include interest income earned from investments or interest expenses paid on loans.

Taxes: This section represents the income taxes owed by the business based on its taxable income.

The income statement worksheet helps businesses analyze their financial performance by comparing revenues and expenses over time. It is also used by investors, creditors, and other stakeholders to assess the profitability and financial health of a company. By understanding the components of an income statement worksheet, businesses can make informed decisions to improve their financial position and achieve their goals.

Understanding the Purpose of an Income Statement Worksheet

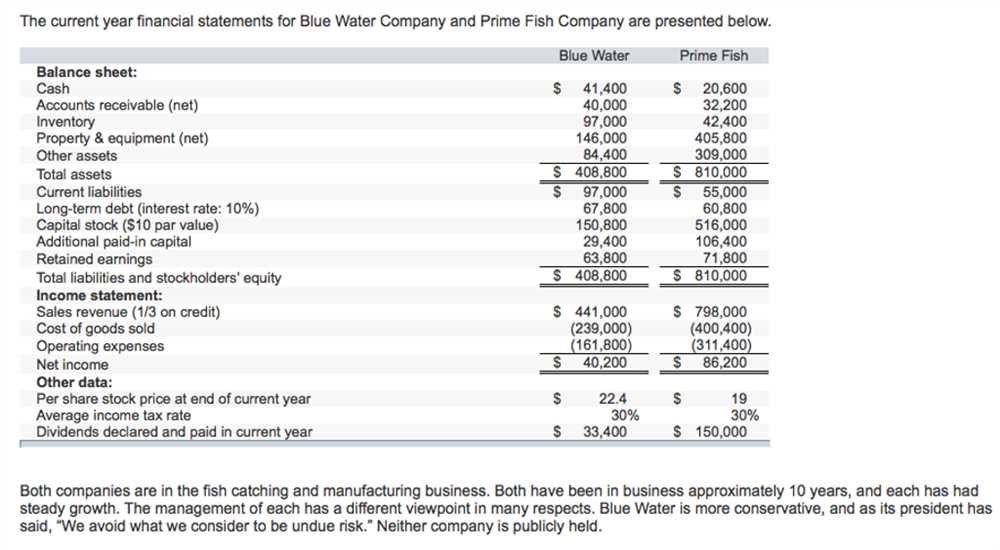

An income statement worksheet is a valuable tool for businesses to assess their financial performance and make informed decisions. It provides a detailed breakdown of a company’s revenues, expenses, and net income over a specific period of time, usually a year. By analyzing the information presented in an income statement worksheet, businesses can gain insight into their financial health, identify trends, and make strategic plans for the future.

The income statement worksheet provides a comprehensive overview of a company’s financial performance by presenting its revenue and expenses in a structured format. It starts with the company’s sales or revenue and subtracts the cost of goods sold to calculate the gross profit. From there, it deducts operating expenses, such as salaries, rent, and utilities, to determine the operating income. Other income, such as interest or investment gains, is then added, and non-operating expenses, such as interest on loans or legal fees, are subtracted. Finally, taxes are deducted to arrive at the net income or loss for the period.

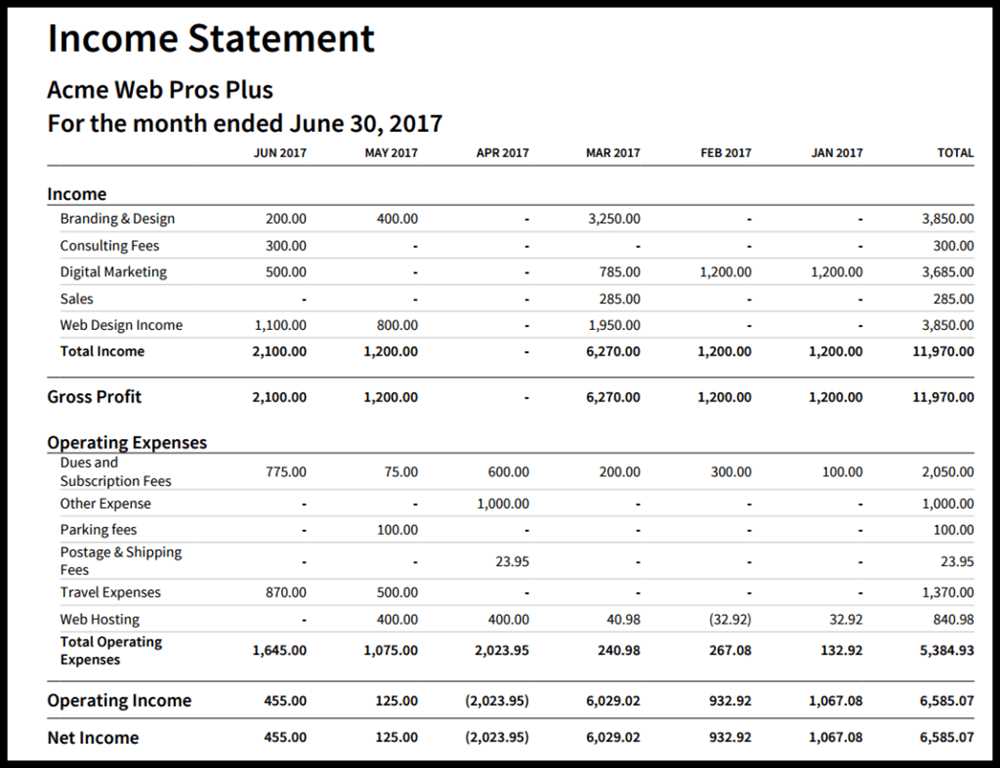

The income statement worksheet plays a crucial role in financial analysis and decision-making for businesses. It helps businesses assess their profitability and identify areas of improvement or concern. By comparing income statements from different years, businesses can track their performance over time and identify trends. For example, if revenues have been consistently decreasing while expenses have been increasing, it may indicate that the business needs to adjust its pricing strategy or control costs.

In addition to financial analysis, the income statement worksheet also provides important information for stakeholders and potential investors. It allows them to assess a company’s financial performance and make informed decisions about investing or partnering with the business. The income statement provides a clear picture of a company’s ability to generate profits and manage expenses, making it an essential component of financial reporting.

In conclusion, the income statement worksheet is a critical tool for businesses to understand their financial performance and make strategic decisions. By providing a detailed breakdown of revenues, expenses, and net income, the income statement worksheet helps businesses assess profitability, identify trends, and attract potential investors. It is an essential component of financial reporting and plays a vital role in the success of any business.

Components of an Income Statement Worksheet

An income statement worksheet is a financial document that is used by businesses to summarize their revenues, expenses, and net income for a specific period of time. It provides a snapshot of the company’s financial performance and helps in analyzing its profitability. The worksheet is an essential tool for financial analysis and is often prepared on a monthly, quarterly, or annual basis.

1. Revenues: The first component of an income statement worksheet is revenues, which represent the total amount of money earned by the business from its sales or services rendered. This includes the sales of goods, fees for services rendered, and other operating income. Revenues are essential for measuring the company’s top-line growth and evaluating its sales performance.

2. Expenses: The second component of an income statement worksheet is expenses, which represent the costs incurred by the business in its operations. This includes costs of goods sold, operating expenses, interest expenses, depreciation, and taxes. Expenses are deducted from the revenues to calculate the net income of the business. Analyzing the expenses is crucial for evaluating the company’s cost management and efficiency.

3. Net Income: The third component of an income statement worksheet is the net income, which represents the profit or loss made by the business during a specific period. It is calculated by deducting the expenses from the revenues. A positive net income indicates profitability, while a negative net income indicates a loss. Net income is a key indicator of the company’s financial health and is used by investors and lenders to assess its viability.

4. Other Financial Information: In addition to the above components, an income statement worksheet may also include other financial information such as earnings per share (EPS), dividends, and retained earnings. These details provide further insights into the company’s financial performance and can be useful for making investment decisions.

Overall, an income statement worksheet is a comprehensive financial document that shows the revenues, expenses, and net income of a business. It helps in evaluating the company’s financial performance and is an essential tool for financial analysis.

Revenue

Revenue is an important financial metric that measures the amount of money a company earns from its primary business activities. It represents the total income generated from the sale of goods or services to customers.

Revenue is recorded on the income statement and is a key component in determining a company’s profitability. It is often referred to as the “top line” because it is listed at the top of the income statement. The amount of revenue a company generates is a reflection of the demand for its products or services and its ability to attract and retain customers.

There are different types of revenue that a company can have, including sales revenue, service revenue, and other operating revenue. Sales revenue is generated from the sale of goods, while service revenue is generated from the provision of services. Other operating revenue includes income from sources other than the company’s primary business activities, such as rental income or interest income.

It is important for companies to carefully track and analyze their revenue to understand the factors that drive their business. By monitoring revenue trends, companies can make informed decisions regarding pricing strategies, marketing initiatives, and investment in new products or services. Additionally, revenue analysis helps investors and stakeholders assess a company’s financial health and performance.

In conclusion, revenue is a critical measure of a company’s financial performance and reflects its ability to generate income from its primary business activities. It provides valuable insights into a company’s profitability, customer demand, and overall financial health.

Cost of Goods Sold

Cost of Goods Sold (COGS) is an important financial metric that reflects the direct costs incurred by a company to produce or provide its products or services. It includes the cost of raw materials, labor, and other expenses directly associated with the production process. COGS represents the initial investment of a company in its inventory and is deducted from the revenue to determine the gross profit.

Calculating COGS can be a complex task, especially for businesses that deal with multiple inventory items and production processes. Generally, COGS is calculated by adding the beginning inventory to the purchases made during a period and then subtracting the ending inventory. This formula helps determine the cost of goods that were sold during the period.

To better understand the concept of COGS, let’s consider an example. Imagine a clothing store that sells shirts. The cost of the shirts, along with any expenses incurred in the manufacturing process, such as fabric, labor, and packaging, would be considered part of COGS. This amount would then be subtracted from the revenue generated from shirt sales to calculate the gross profit.

It’s important to note that COGS only includes direct costs directly related to the production process. Indirect costs, such as rent, utilities, and administrative expenses, are not included in COGS but are accounted for separately in the income statement. By tracking COGS accurately, businesses can assess their profitability and make informed decisions regarding pricing, inventory management, and cost control.

In conclusion, understanding and accurately calculating the cost of goods sold is crucial for businesses to assess their financial performance. By accurately tracking COGS, businesses can analyze their profit margins, identify areas for cost savings, and make informed decisions to optimize their operations.

Operating Expenses

Operating expenses, also known as operating costs or overhead costs, are the ongoing expenses that a business incurs in order to operate on a day-to-day basis. These expenses are separate from the cost of producing goods or services and include items such as rent, utilities, salaries, advertising, and insurance. Operating expenses are a key component of the income statement and are deducted from revenues to determine the company’s operating income.

Types of Operating Expenses:

- Rent: The cost of leasing or renting office space or other facilities.

- Utilities: The cost of electricity, water, gas, and other utilities needed to operate the business.

- Salaries and wages: The expenses related to paying employees, including salaries, wages, and benefits.

- Advertising and marketing: The expenses incurred for advertising campaigns, digital marketing, and promotional activities.

- Insurance: The cost of insuring the business and its assets against various risks.

- Office supplies: The expenses related to purchasing office supplies, such as paper, pens, and other stationery items.

- Depreciation: The allocation of the cost of an asset over its useful life.

- Repairs and maintenance: The expenses for repairing and maintaining buildings, equipment, and machinery.

- Professional fees: The fees paid to lawyers, accountants, consultants, and other professional service providers.

- Travel and entertainment: The costs associated with business-related travel, meals, and entertainment.

It is important for businesses to carefully manage their operating expenses in order to maintain profitability. By monitoring and controlling expenses, businesses can improve their bottom line and achieve sustainable growth. Additionally, analyzing operating expenses can provide insights into the efficiency and effectiveness of the business operations, helping to identify areas for improvement and cost savings.

In conclusion, operating expenses are the ongoing costs incurred by a business to operate on a day-to-day basis. They include items such as rent, utilities, salaries, advertising, and insurance. Managing operating expenses is crucial for businesses to maintain profitability and achieve long-term success.

Other Income and Expenses

Income statements are essential financial documents that provide a detailed overview of a company’s revenue and expenses. While the main focus of the income statement is on operating activities, it also includes other income and expenses that can have a significant impact on the company’s overall financial performance.

Other income refers to the revenue generated from activities outside the company’s core operations. This can include income from investments, rental income, royalties, or any other sources of non-operating income. Other income is usually reported under a separate line item in the income statement and can contribute to the company’s overall profitability.

Other expenses, on the other hand, represent costs incurred by the company that are not directly related to its main operations. These expenses can include interest expense, legal fees, one-time expenses, or any other costs that are not included in the operating expenses. Other expenses are also reported as a separate line item on the income statement and can impact the company’s net profit.

It is important for investors and analysts to pay attention to other income and expenses when analyzing a company’s financial statements. Changes in other income and expenses can provide valuable insights into the company’s diversification strategies, financial health, and overall profitability. An increase in other income, for example, may indicate that the company is successfully generating additional revenue streams, while a significant increase in other expenses may raise concerns about the company’s cost management and efficiency.

Overall, other income and expenses play a crucial role in determining a company’s net profit and its ability to generate sustainable earnings. By analyzing these items along with the operating activities, stakeholders can gain a comprehensive understanding of the company’s financial performance and make informed investment decisions.