Accounting is an essential aspect of any business, but it comes with its fair share of challenges. From complex calculations to tedious data entry, professionals in the field often face various application problems. These issues can hamper the accuracy and efficiency of financial reporting, potentially leading to significant problems for organizations. In this article, we will explore nine common application problems in accounting and provide practical solutions for addressing them.

One of the most prevalent application problems in accounting is data entry errors. Manual data entry can be prone to mistakes, resulting in incorrect financial statements and misinformed decision-making. To mitigate this problem, implementing automated systems and implementing data validation checks can help ensure accurate data entry and minimize errors.

Another common application problem in accounting is the lack of standardization in financial reporting. Without standardized formats and procedures, it becomes challenging to compare financial information across different periods or entities. Establishing consistent reporting standards and utilizing accounting software that supports standardization can greatly enhance the accuracy and usability of financial reports.

Inefficient workflow and system integration issues are additional challenges faced by accounting professionals. Complex approval processes, lack of integration between different software applications, and inadequate communication between accounting teams can lead to delays and errors. Streamlining workflow processes, integrating accounting systems, and fostering effective communication can significantly improve efficiency and reduce errors in the accounting department.

Understanding the problem scenario

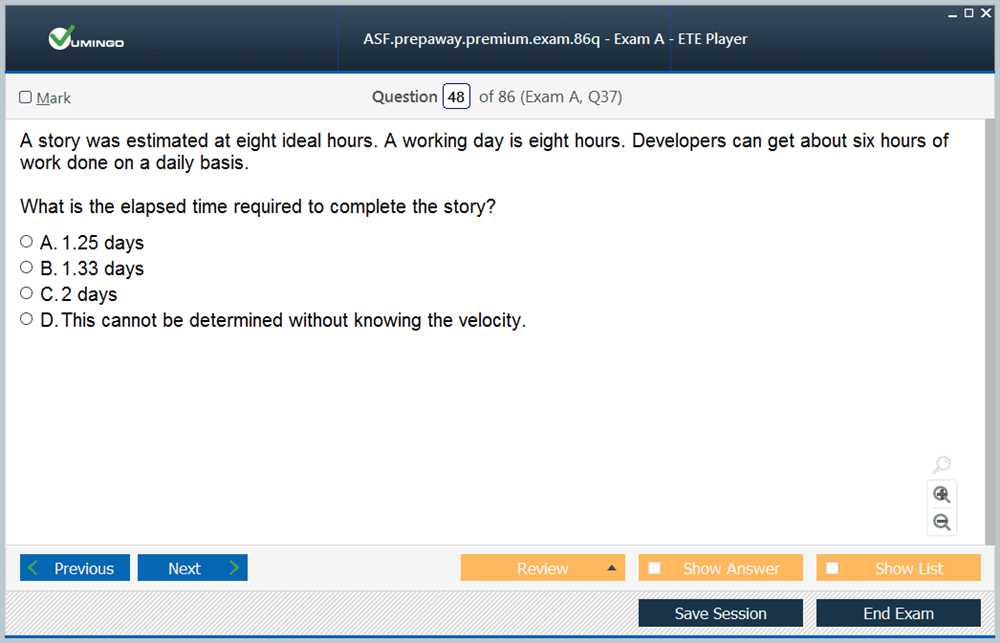

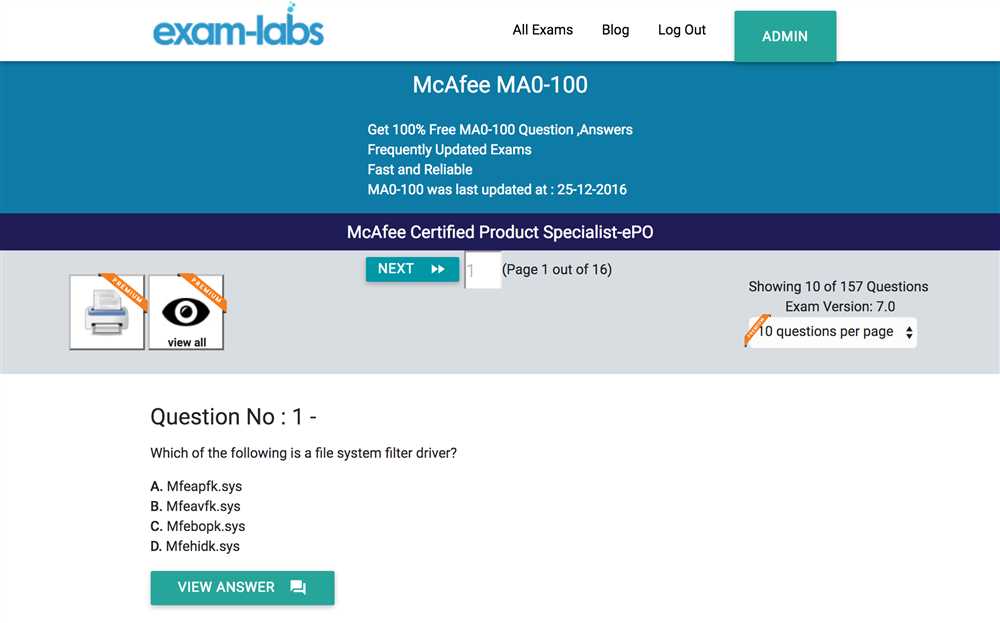

When encountering an accounting problem, it is essential to fully understand the scenario at hand in order to provide accurate answers. This involves carefully reading and analyzing the given information, identifying the key elements and relationships, and determining the specific objectives of the problem.

In the context of the application problem “9 2” in accounting, it is important to pay attention to the specific details provided and the question being asked. This particular problem may involve calculations, analysis of financial statements, or making decisions based on financial information.

The key phrases “application problem” and “accounting answers” indicate that the problem is likely related to real-world scenarios and requires the application of accounting principles and concepts. It may involve concepts such as revenue recognition, expense allocation, financial statement analysis, or budgeting.

To effectively solve the problem and provide accurate accounting answers, it is necessary to apply the relevant accounting principles, formulas, and techniques. This may involve calculating ratios, analyzing trends, interpreting financial statements, or making recommendations based on financial data.

Overall, understanding the problem scenario in accounting involves carefully analyzing the given information, identifying the objectives of the problem, and applying accounting principles to provide accurate answers and solutions.

Analyzing the financial information provided

When analyzing financial information provided, it is crucial to carefully review and understand the various components of the data in order to derive meaningful insights. This includes examining the financial statements, such as the income statement, balance sheet, and cash flow statement, to evaluate the company’s performance, financial position, and cash flows over a specific period of time.

Income statement: The income statement provides information on the company’s revenues, expenses, and net income. By analyzing the income statement, one can assess the company’s profitability, determine the sources of income, and identify the major cost drivers affecting its performance.

Balance sheet: The balance sheet presents the company’s assets, liabilities, and shareholders’ equity at a specific point in time. It helps understand the company’s financial position, including its liquidity, solvency, and ability to meet its obligations. By comparing the assets to liabilities, one can assess the company’s leverage and financial stability.

Cash flow statement: The cash flow statement provides information on the company’s cash inflows and outflows during a specific period. It helps evaluate the company’s ability to generate cash, meet its operating expenses, invest in growth opportunities, and repay its debt. Analyzing the cash flow from operating activities, investing activities, and financing activities provides insights into the company’s cash management and financial flexibility.

Additionally, it is important to analyze the accompanying notes to the financial statements, which provide further details and explanations on various accounting policies, significant transactions, and events. These notes help in understanding the context and significance of the financial data provided, as well as any potential limitations or assumptions made in preparing the financial statements.

In summary, analyzing the financial information provided involves carefully examining and interpreting the income statement, balance sheet, cash flow statement, and accompanying notes. This helps to evaluate the company’s performance, financial position, and cash flows, enabling stakeholders to make informed decisions and assessments about the company’s financial health and prospects.

Applying accounting principles to solve the problem

When faced with an application problem in accounting, it is important to apply the relevant accounting principles in order to find a solution. By following these principles, accountants can ensure accuracy, reliability, and consistency in financial reporting.

One key principle to consider is the matching principle. This principle states that expenses should be recognized in the same period as the revenues they helped generate. For example, if a problem involves recording the cost of goods sold for a specific period, accountants need to identify the corresponding sales for that period and allocate the cost accordingly. This principle helps ensure that the financial statements reflect the economic reality of the business.

Another important principle is the going concern principle. This principle assumes that a business will continue to operate indefinitely unless there is evidence to the contrary. When applying this principle to a problem, accountants need to consider whether any assets or liabilities need to be adjusted or revalued. They must also assess the impact on financial statements if there is any indication of the company’s inability to continue its operations.

Additionally, the consistency principle plays a crucial role in resolving accounting problems. This principle requires that accounting methods and practices be applied consistently from one period to another, ensuring comparability. When faced with a problem, accountants should consider whether a change in accounting method or practice is necessary and if it will result in improved accuracy and reliability of financial information.

Overall, it is essential to apply the relevant accounting principles when solving application problems. These principles provide a framework for accountants to ensure that financial reporting is accurate, reliable, and consistent. By considering principles such as the matching principle, going concern principle, and consistency principle, accountants can find solutions that align with the fundamental principles of accounting.

Interpreting the answers in the context of the problem

When solving accounting application problems, it is important to not only find the numerical answers but also to interpret them in the context of the problem. This allows us to understand the implications and make informed decisions based on the results. Let’s take a look at some examples.

Example 1: Calculating the net income

In the problem, we are given the revenue and expenses for a company and tasked with calculating the net income. Once we have the answer, we need to interpret it in the context of the company’s financial performance. If the net income is positive, it indicates that the company is making a profit. On the other hand, if the net income is negative, it means that the company is experiencing a loss. This information can be used by stakeholders to evaluate the profitability of the business.

Example 2: Analyzing the financial ratios

Another common application problem in accounting involves calculating and analyzing financial ratios. For example, we might be asked to calculate the current ratio for a company. Once we have the answer, we need to interpret it in the context of the company’s liquidity. If the current ratio is above 1, it suggests that the company has sufficient short-term assets to cover its liabilities. However, if the current ratio is less than 1, it indicates potential liquidity issues. This information can be useful for creditors and investors in assessing the financial health of the company.

In conclusion, interpreting the answers in the context of the problem is essential in accounting. It allows us to derive meaningful insights and make informed decisions based on the results. Whether it’s calculating net income or analyzing financial ratios, understanding the implications of the answers is crucial for evaluating the financial performance and health of a company.

Checking for accuracy and completeness

In the field of accounting, it is crucial to ensure the accuracy and completeness of financial information. This involves a careful review and analysis of the data to identify any errors or omissions that may exist. By doing so, financial statements can provide a true and fair view of a company’s financial performance and position.

One way to check for accuracy is to reconcile the various accounts and transactions. This involves comparing the balances and details recorded in different records, such as bank statements, general ledger, and subsidiary ledgers. Any discrepancies should be investigated and resolved promptly to avoid misrepresentation of financial information.

Another important aspect of checking for accuracy and completeness is the review of supporting documentation. This includes invoices, receipts, contracts, and other relevant documents that provide evidence of transactions and events. By cross-referencing these documents with the recorded information, accountants can verify the validity and accuracy of the data.

In addition, accountants should also ensure that the financial statements are complete. This means that all significant transactions and events have been recorded and disclosed properly. They should review the accounting records, including journal entries and other supporting documentation, to ensure that nothing has been overlooked or omitted.

- It is essential to have effective controls in place to prevent errors and omissions in accounting. This includes implementing segregation of duties, regular review procedures, and proper documentation practices. These controls help to ensure that the financial information is accurate, complete, and reliable.

- Regular monitoring and internal audits can also help in detecting any inaccuracies or incompleteness in the accounting records. These activities provide an opportunity to assess the effectiveness of the controls and identify areas for improvement.

- Overall, checking for accuracy and completeness is a critical step in the accounting process. It ensures that the financial information presented is reliable and can be used for decision-making purposes by management, investors, and other stakeholders.

Exploring Alternative Approaches to the Problem

In the field of accounting, finding the right approach to solve a problem is crucial for accuracy and efficiency. While there may be standard methods and procedures in place, exploring alternative approaches can often lead to innovative solutions and improved outcomes.

Thinking outside the box: One alternative approach to solving accounting problems is to encourage employees to think outside the box. By challenging traditional methods and brainstorming creative solutions, new perspectives can be gained and unique approaches can be developed. This can lead to more efficient processes and improved decision-making.

Collaboration and cross-functional teams: Another alternative approach is to form cross-functional teams to address accounting problems. By bringing together individuals from different departments or areas of expertise, a wider range of perspectives and ideas can be considered. This can lead to more comprehensive and holistic solutions that take into account various factors and considerations.

Automation and technology: Utilizing automation and technology can also be an alternative approach to solving accounting problems. By implementing software or tools that automate repetitive tasks or streamline processes, the efficiency and accuracy of accounting practices can be greatly enhanced. This allows accountants to focus on more complex tasks and analysis, resulting in more valuable insights and informed decision-making.

Data analysis and predictive modeling: Applying data analysis and predictive modeling techniques can also be an alternative approach to solving accounting problems. By analyzing historical data and identifying patterns or trends, accountants can make more accurate predictions and forecasts. This can help organizations anticipate potential issues or opportunities and make proactive decisions.

Risk assessment and mitigation: Lastly, taking a risk-based approach to accounting problems can also be an alternative approach. By identifying and assessing potential risks associated with accounting processes or decisions, preventive measures can be put in place to mitigate these risks. This can help organizations avoid costly errors or losses and ensure compliance with regulations.

Concluding thoughts on 9 2 application problem accounting

In conclusion, the 9 2 application problem in accounting is a challenging task that requires a deep understanding of financial principles and analytical skills. It involves analyzing financial statements, calculating ratios, and making informed decisions based on the data provided.

One key takeaway from this problem is the importance of accurate and timely financial reporting. Without accurate financial information, it would be impossible to assess the financial health of a company and make informed decisions. The 9 2 application problem highlights the need for precision and attention to detail in accounting.

Furthermore, the problem emphasizes the significance of ratio analysis in financial decision-making. Ratios such as the current ratio, return on assets, and debt to equity ratio provide valuable insights into a company’s liquidity, profitability, and financial leverage. These ratios are invaluable tools for investors, creditors, and managers in assessing the overall financial performance of a company.

In conclusion, the 9 2 application problem in accounting serves as a reminder of the importance of accurate financial reporting and ratio analysis. It challenges accountants to apply their knowledge and skills in solving real-world financial problems. By mastering these concepts, accountants can contribute to the success and growth of businesses by providing valuable financial insights and driving informed decision-making.