Accounting chapter 10 mastery problem is a common exercise that helps students test their understanding of financial accounting concepts. This problem usually involves recording journal entries and preparing financial statements for a specific scenario. In order to solve the mastery problem, it is important to have a strong knowledge of the principles and practices of accounting.

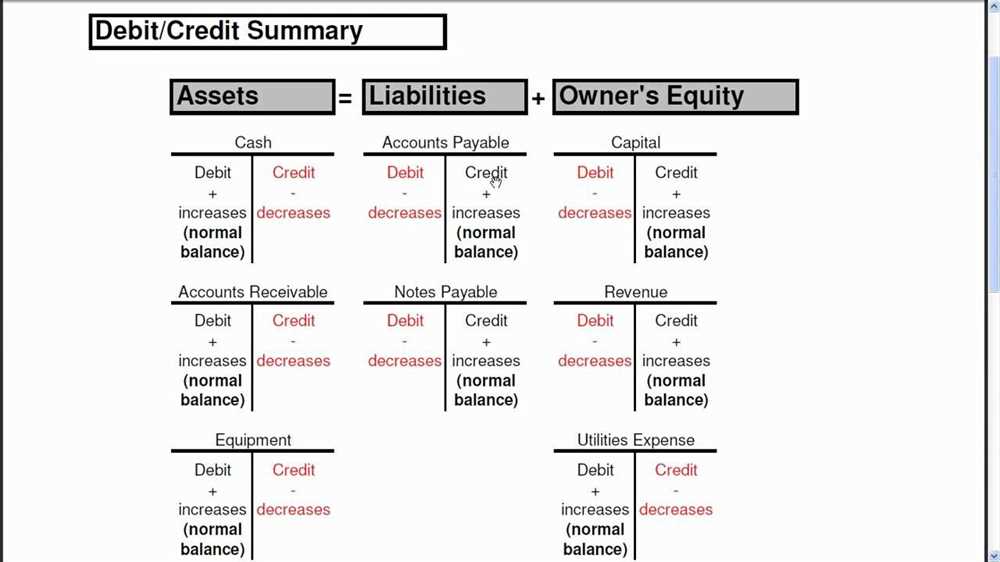

The answers to the accounting chapter 10 mastery problem require a deep understanding of various accounting concepts, such as accrual accounting, adjusting entries, and financial statement preparation. Students are often required to analyze financial transactions and record them in the general journal. They must also understand the impact of these transactions on different financial statements, such as the income statement, balance sheet, and statement of cash flows.

By solving the accounting chapter 10 mastery problem, students can gain practical experience in applying accounting principles to real-world scenarios. This exercise helps them develop critical thinking and problem-solving skills that are essential for a successful career in accounting. Additionally, mastering this problem can improve their overall understanding of financial accounting concepts and enhance their chances of success in future accounting courses or professional certification exams.

Chapter 10 Mastery Problem Answers in Accounting: Everything You Need to Know

Accounting can be a complex subject, but understanding the concepts and principles is crucial for financial success. Chapter 10, often referred to as the “Mastery Problem,” is a challenging section that tests your ability to apply various accounting principles and techniques to real-world scenarios.

This chapter covers a range of topics, including budgeting, forecasting, and cost management. The mastery problem answers in accounting guide you through these concepts, helping you develop the necessary skills to analyze financial data, make informed decisions, and plan for future expenses.

Budgeting: One key aspect of Chapter 10 is budgeting. This involves creating a detailed plan for future income and expenses, allowing businesses to allocate resources effectively and monitor their financial performance. The mastery problem answers in accounting provide step-by-step guidance on how to develop budgets, calculate variances, and make adjustments based on actual results.

Forecasting: Another important topic covered in Chapter 10 is forecasting. This involves using historical data, market trends, and other relevant factors to predict future financial performance. The mastery problem answers in accounting help you understand the techniques and tools used in forecasting, such as regression analysis and trend analysis.

Cost Management: Chapter 10 also delves into cost management, which involves identifying, analyzing, and controlling costs within an organization. The mastery problem answers in accounting teach you how to calculate various cost measures, such as fixed costs, variable costs, and total costs. You will also learn about cost behavior, cost estimation, and cost-volume-profit analysis.

Overall, the mastery problem answers in accounting for Chapter 10 provide a comprehensive overview of budgeting, forecasting, and cost management. By mastering these concepts, you will not only improve your accounting skills but also enhance your ability to make informed financial decisions that can drive success for businesses and individuals alike.

Understanding Chapter 10 Mastery Problem in Accounting

The Chapter 10 Mastery Problem in Accounting is an important exercise that allows students to apply their knowledge and skills in financial accounting. It is designed to test their understanding of various concepts and techniques used in this field. This problem usually consists of a hypothetical scenario, where students are required to analyze and interpret financial data to prepare financial statements, make journal entries, and perform other accounting tasks.

One key aspect of the Chapter 10 Mastery Problem is its focus on the preparation of financial statements. Students are typically required to prepare a balance sheet, income statement, and statement of cash flows based on the given data. This task requires a deep understanding of the accounting equation, revenue recognition principles, and other relevant accounting concepts. Additionally, students may also be asked to analyze the financial statements and provide meaningful insights into the financial performance and position of the company.

The Chapter 10 Mastery Problem also encompasses other important areas of accounting, such as the recording of adjusting entries and the analysis of financial ratios. Students may be asked to identify and record necessary adjustments, such as accrued expenses, unearned revenue, and depreciation. Furthermore, they may also need to calculate and interpret financial ratios, such as the current ratio, debt-to-equity ratio, and gross profit margin. This helps in developing their analytical skills and understanding of the impact of various transactions on financial statements.

Overall, the Chapter 10 Mastery Problem in Accounting serves as a comprehensive assessment of students’ ability to apply accounting principles and techniques in real-world scenarios. It helps them develop critical thinking, problem-solving, and analytical skills necessary for a successful career in accounting. By completing this exercise, students gain a deeper understanding of the concepts covered in the chapter and enhance their ability to analyze financial data effectively.

The Importance of Chapter 10 Mastery Problem Answers

Chapter 10 in accounting is a significant section that covers various advanced topics and concepts related to financial statements. One of the essential aspects of this chapter is the mastery problem, which allows students to apply their knowledge and skills gained throughout the chapter. The mastery problem helps students test their understanding of the subject matter and practice critical thinking and problem-solving skills.

By completing the mastery problem and having access to reliable answers, students can assess their performance and identify areas where they may need further clarification or practice. The answers provided for the mastery problem serve as a guide for students to compare their solutions and learn from any discrepancies. This ensures that students are on the right track and enables them to correct any mistakes or misconceptions they may have had.

The importance of Chapter 10 Mastery Problem answers can be summarized as follows:

- Evaluating understanding: By referring to the answers, students can gauge their comprehension of the topics covered in Chapter 10. It allows them to assess their strengths and weaknesses and focus on areas that need improvement.

- Learning from mistakes: The answers serve as a tool for students to identify any errors or misconceptions in their approach to solving the mastery problem. By understanding their mistakes, students can learn from them and avoid repeating them in future exercises or assessments.

- Promoting critical thinking: The mastery problem and its answers encourage students to think critically and apply their knowledge in solving complex problems. It enhances their analytical skills and prepares them for real-world accounting scenarios.

- Building confidence: Having access to accurate answers instills confidence in students. It reassures them that they are on the right track and helps them develop a sense of accomplishment when they compare their solutions with the correct ones.

In conclusion, Chapter 10 Mastery Problem answers play a vital role in the learning process of accounting students. They provide guidance, promote self-assessment, and foster critical thinking skills. Having these answers available ensures that students can effectively practice and apply their knowledge, ultimately leading to a deeper understanding of the subject matter.

Key Concepts and Principles in Chapter 10 Mastery Problem

In Chapter 10 Mastery Problem of Accounting, there are several key concepts and principles that are important to understand in order to solve the problem effectively. These concepts and principles include the calculation of depreciation, the recording of disposal of plant assets, and the interpretation of financial statements.

1. Calculation of depreciation

Depreciation is the allocation of the cost of a plant asset over its useful life. In the Mastery Problem, it is necessary to calculate depreciation using various methods, such as the straight-line method, the units-of-production method, and the double declining balance method. Each method has its own formula and requires different inputs, such as the cost of the asset, its salvage value, and its useful life.

2. Recording of disposal of plant assets

When a plant asset is disposed of, it is important to record the transaction correctly in the accounting records. This involves recognizing any gain or loss on disposal and removing the asset from the balance sheet. The Mastery Problem may require the calculation and recording of gains or losses on disposal, as well as updating the asset’s accumulated depreciation and book value.

3. Interpretation of financial statements

Financial statements provide a summary of a company’s financial performance and position. In the Mastery Problem, it is necessary to analyze the financial statements to understand the impact of plant asset transactions on the company’s overall financial standing. This includes assessing the effects of depreciation on the income statement, the balance sheet, and the cash flow statement, as well as interpreting key ratios and trends.

Overall, understanding the key concepts and principles in Chapter 10 Mastery Problem is crucial for accurately solving the problem and gaining a deeper comprehension of accounting for plant assets. By mastering these concepts, students will be better equipped to apply them in real-world scenarios and make informed financial decisions.

Analyzing and Solving Chapter 10 Mastery Problem

Chapter 10 mastery problem in accounting often involves a complex scenario that requires students to apply a range of accounting concepts and principles. To successfully analyze and solve the problem, it is crucial to have a clear understanding of the underlying concepts and their applications.

The first step in analyzing the mastery problem is to carefully read the problem statement and identify the key information and requirements. This may involve identifying relevant financial transactions, understanding the nature of the problem, and determining the specific steps or calculations needed to solve it.

Once the problem statement has been understood, students can begin applying the appropriate accounting concepts and principles to solve the problem. This may involve preparing journal entries, adjusting entries, financial statements, or any other relevant accounting documents or reports.

It is important to approach the mastery problem in a systematic and organized manner. Students should create a logical plan of action, breaking down the problem into smaller, manageable tasks. This will help ensure that no important steps or calculations are overlooked.

Throughout the process of solving the mastery problem, students should also pay attention to details and accuracy. They should double-check their calculations, ensure that all relevant information has been considered, and review their work for any errors or inconsistencies.

In conclusion, analyzing and solving the chapter 10 mastery problem requires a solid understanding of accounting concepts and principles, attention to detail, and a systematic approach. By following these steps and applying their knowledge, students can successfully navigate through the problem and arrive at the correct solution.

Step-by-Step Guide to Finding Chapter 10 Mastery Problem Answers

Accounting can be a challenging subject, and mastering the problems in each chapter is essential for success. When it comes to Chapter 10, it’s important to understand the concepts and be able to find the answers to the mastery problems. Here is a step-by-step guide to help you navigate through Chapter 10 and find the answers you need.

Step 1: Read the Problem Carefully

Start by reading the mastery problem thoroughly and identifying the key information. Pay attention to any specific instructions or requirements mentioned in the problem. Understanding the problem is crucial for finding the correct answers.

Step 2: Review the Relevant Concepts

Chapter 10 may cover various topics related to accounting, such as depreciation, disposal of assets, or impairment. Make sure you have a solid understanding of the relevant concepts before attempting to solve the problem. Review your class notes, textbook, or any additional resources you may have to refresh your knowledge.

Step 3: Break Down the Problem

Break down the problem into smaller parts or steps. Identify what information is given and what information you need to find. This will help you organize your approach and make the problem more manageable.

Step 4: Apply the Formulas or Procedures

Chapter 10 may involve specific formulas or procedures to calculate the answers. Apply these formulas or procedures to the given information and solve for the required values. Make sure to show your work and include any necessary calculations.

Step 5: Check Your Answer

Once you have found the answers to the mastery problem, double-check your work. Make sure your calculations are accurate and that you have followed all the necessary steps. If possible, compare your answer to a model answer or ask your instructor for feedback.

Remember, finding the answers to Chapter 10 mastery problems requires a solid understanding of the concepts and careful attention to detail. By following this step-by-step guide, you can approach the problems with confidence and improve your accounting skills.

Common Mistakes to Avoid in Chapter 10 Mastery Problem

When completing the Chapter 10 Mastery Problem in accounting, it’s important to be mindful of common mistakes that can occur. By recognizing and avoiding these mistakes, you can ensure accuracy and efficiency in your accounting processes.

Inaccurate calculations: One of the most common mistakes is making inaccurate calculations. This can happen when adding or subtracting numbers, calculating percentages, or applying formulas. To avoid this mistake, double-check your calculations and consider using a calculator or spreadsheet software for complex calculations.

Misinterpretation of instructions: Another common mistake is misinterpreting the instructions provided in the Mastery Problem. It’s important to carefully read and understand each instruction to ensure you are completing the problem correctly. If you are unsure about any part of the instructions, seek clarification from your instructor or refer to your textbooks and course materials.

Skipping steps: Completing the Chapter 10 Mastery Problem requires following a series of steps or procedures. Skipping any of these steps can lead to errors in your accounting records and calculations. Take the time to review and complete each step in the problem, ensuring that you have not missed any important information or calculations.

Lack of attention to detail: Paying attention to detail is crucial in accounting. Mistakes can easily occur if you overlook or misinterpret important information. Take the time to carefully review each entry, calculation, and piece of information provided in the problem. It may be helpful to use highlighters or underline important details to ensure they are not missed.

Failure to reconcile: Reconciliation is an important part of the accounting process, and it is essential to include it in the Chapter 10 Mastery Problem. Failing to reconcile accounts or properly balance them can result in inaccurate financial statements and records. Make sure to check that all accounts are balanced and reconciled before finalizing your answers.

In conclusion, avoiding common mistakes in the Chapter 10 Mastery Problem is crucial for accurate and efficient accounting. By being cautious with calculations, closely following instructions, not skipping steps, paying attention to detail, and reconciling accounts, you can ensure successful completion of the problem and a solid understanding of the concepts covered in Chapter 10.