In the world of accounting and finance, accurately recording transactions is crucial for the success of any business. Every financial event – whether it’s buying inventory, receiving payment from a customer, or making a loan payment – needs to be properly documented to ensure accurate financial reporting.

Chapter 3 of the journalizing transactions answer key provides a comprehensive guide to understanding and applying the principles of journalizing transactions. This key is an invaluable resource for students, professionals, and anyone looking to enhance their understanding of accounting.

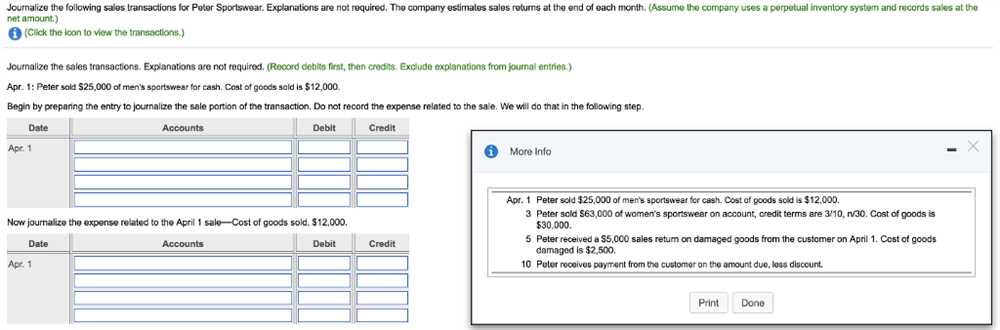

The chapter begins with an introduction to the concept of journalizing and the importance of keeping precise records. It then delves into step-by-step instructions on how to identify the accounts affected by a transaction, determine the debit and credit entries, and record the transaction in a journal.

The key also includes various examples and exercises to reinforce the concepts learned. These practical exercises allow readers to apply their knowledge and develop their skills in an interactive manner. Additionally, the answer key provides detailed explanations and solutions to ensure learners can verify their work and gain a deeper understanding of the material.

Whether you are a student studying accounting or a professional looking to refresh your skills, the Chapter 3 journalizing transactions answer key is an essential tool. By mastering the techniques outlined in this key, you will be able to confidently record financial transactions and contribute to the overall success of any organization.

Chapter 3 Journalizing Transactions Answer Key

In Chapter 3, we learned about the process of journalizing transactions in accounting. Journalizing transactions is the first step in the accounting cycle and involves recording all financial transactions in the appropriate journal.

The key to journalizing transactions is to categorize them correctly and record them accurately. Each transaction should be analyzed to determine which accounts are affected and how they are affected. This information is then recorded in the journal using a standardized format.

The journal entry consists of a date, the accounts involved, a brief description of the transaction, and the amounts debited and credited to each account. The debits and credits must always balance, ensuring that the accounting equation (Assets = Liabilities + Equity) remains in balance.

One important aspect of journalizing transactions is the use of double-entry bookkeeping. This means that for every debit entry, there must be a corresponding credit entry of equal value. This ensures that the accounting records are accurate and that the financial statements reflect the true financial position of the company.

To practice journalizing transactions, it is important to understand the specific rules and guidelines for each type of account. For example, asset accounts are increased with debit entries and decreased with credit entries, while liability accounts are increased with credit entries and decreased with debit entries.

By following the proper procedures for journalizing transactions, accountants can ensure that the financial records are accurate and reliable. This is essential for making informed business decisions, preparing financial statements, and complying with legal and regulatory requirements.

Understanding Journalizing Transactions

Journalizing transactions is an essential process in accounting that involves recording financial transactions in a company’s books. This process helps to maintain an accurate and organized record of all the business activities and transactions that occur. By properly journalizing transactions, accountants can capture all the necessary information needed for financial reporting and analysis.

When journalizing transactions, it is important to follow certain guidelines to ensure accuracy and consistency. First, each transaction should be recorded on a separate line in the journal, with the date of the transaction clearly indicated. Next, the accounts involved in the transaction should be identified and recorded, along with the amounts debited and credited. Debits and credits should always be recorded in separate columns to maintain the balance in the accounting equation.

For example:

| Date | Accounts | Debit | Credit |

|---|---|---|---|

| January 1, 2022 | Cash | $500 | |

| Accounts Receivable | $500 |

The above example shows a journal entry for a transaction where $500 is received in cash and recorded as a debit to the Cash account and a credit to the Accounts Receivable account. This journal entry provides a clear record of the transaction and can be used to update the general ledger and prepare financial statements.

In conclusion, understanding how to journalize transactions is crucial for maintaining accurate financial records in accounting. Following proper guidelines and recording transactions accurately ensures that all business activities are properly documented and can be used for financial reporting and analysis.

Definition of journalizing transactions

Journalizing transactions is the process of recording financial transactions in a journal. A journal is a book of original entry where transactions are first recorded before they are transferred to the general ledger. It serves as a chronological record of all financial transactions of a business.

The purpose of journalizing transactions is to maintain an accurate and complete record of all financial activities of a business. Each transaction is recorded in the journal using a specific format, known as journal entry. A journal entry includes the date of the transaction, the accounts affected, and the monetary value or amount.

The process of journalizing transactions begins with analyzing and interpreting the source documents, such as invoices, receipts, and bank statements. These documents provide evidence of the transaction and serve as a basis for recording it in the journal. The accountant or bookkeeper then determines the appropriate accounts to be debited and credited based on the nature of the transaction.

Once the journal entry is recorded, it is posted to the general ledger, where all the accounts are summarized and organized. From the general ledger, financial statements can be prepared, such as the income statement and balance sheet, which provide an overview of the company’s financial performance and position.

In summary, journalizing transactions is an essential step in the accounting process, as it ensures that all financial transactions are properly recorded, classified, and summarized. It serves as a foundation for accurate financial reporting and analysis.

Purpose of Journalizing Transactions

Journalizing transactions plays a crucial role in the accounting process as it allows businesses to record and organize their financial activities accurately. By journalizing transactions, businesses can keep a systematic and detailed record of all their monetary transactions, including sales, purchases, expenses, and payments.

The primary purpose of journalizing transactions is to ensure proper bookkeeping and maintain an accurate account of the financial health of a business. Without proper journalization, it becomes challenging to track and analyze the inflow and outflow of money, making it difficult to make informed business decisions.

Classification: Journalizing transactions assists in classifying each financial transaction based on its nature and purpose. This classification helps businesses understand the different types of transactions they undertake and facilitates accurate reporting and analysis.

Auditability: Journalizing transactions provides a solid foundation for auditing accounts. With a well-maintained journal, it becomes easier for auditors to examine and verify financial records, ensuring transparency and preventing fraudulent activities.

Legal Compliance: Journalizing transactions is critical for businesses to fulfill their legal obligations. Accurate records allow businesses to prepare financial statements, tax returns, and other regulatory documents as per requirements, thereby avoiding penalties and legal issues.

Financial Analysis: Journalized transactions serve as the basis for generating financial reports, such as balance sheets, income statements, and cash flow statements. These reports provide valuable insights into a business’s financial performance and help stakeholders make informed decisions.

In conclusion, journalizing transactions serves several essential purposes, including proper classification, auditability, legal compliance, and financial analysis. It forms the backbone of a business’s financial records, enabling accurate and comprehensive tracking of its financial activities.

Benefits of journalizing transactions

Journalizing transactions is a crucial step in the accounting process that involves recording all financial transactions in a chronological order. This systematic approach offers several benefits for businesses:

- Accuracy: Journalizing transactions ensures accuracy in recording financial data. Each transaction is carefully recorded with the correct date, accounts, and amounts, reducing the risk of errors or discrepancies in the future.

- Organization: By journalizing transactions, businesses can maintain a well-organized record of their financial activities. This makes it easier to track, analyze, and report on the company’s financial position and performance.

- Compliance: Journalizing transactions helps businesses stay compliant with accounting standards and regulations. It provides a clear audit trail that can be used to verify the accuracy and completeness of financial statements.

- Decision-making: Journalized transactions provide valuable information that can be used for decision-making purposes. By analyzing the journal entries, businesses can identify trends, patterns, and financial insights that can guide strategic planning and resource allocation.

- Transparency: Journalizing transactions promotes transparency within the organization. It allows stakeholders, such as investors, creditors, and tax authorities, to understand the financial activities and performance of the business. This enhances credibility and trust.

In conclusion, journalizing transactions is an essential practice that offers numerous benefits for businesses. It ensures accuracy, organization, compliance, facilitates decision-making, and promotes transparency. By diligently recording financial transactions, businesses can maintain reliable financial records and make informed decisions for the success and growth of their organization.

The Importance of Accurate Journal Entries

Accurate journal entries are essential for maintaining the integrity of a company’s financial records. They serve as a detailed record of every financial transaction, providing a clear audit trail and ensuring compliance with accounting principles and regulations. These entries are the foundation for the preparation of financial statements and play a crucial role in decision-making processes.

One key reason for the importance of accurate journal entries is the need to have reliable information for financial reporting. Inaccurate or incomplete entries can lead to misstatements in financial statements, which can mislead stakeholders and have serious consequences for the organization. Journal entries provide the necessary documentation to support the numbers reported in financial statements, making it crucial to record transactions accurately and comprehensively.

Accurate journal entries also facilitate the identification and correction of errors or discrepancies in the accounting records. By properly documenting and categorizing transactions, companies can quickly identify any mistakes or inconsistencies and take appropriate corrective measures. This ensures that the financial records reflect the true financial position and performance of the company, allowing management to make informed decisions based on reliable data.

Furthermore, accurate journal entries enable effective financial analysis and performance evaluation. With precise and complete records of transactions, companies can analyze their financial data to identify trends, measure profitability, and assess the efficiency of different operations. This information is valuable in identifying areas of improvement, optimizing resources, and making strategic decisions to drive the company’s growth and profitability.

In conclusion, accurate journal entries are of utmost importance for maintaining financial integrity, complying with accounting standards, and facilitating informed decision-making. By recording transactions accurately and comprehensively, companies can ensure reliable financial reporting, identify and correct errors, and leverage financial analysis for improved performance and profitability.

Impact of accurate journal entries on financial statements

Accurate journal entries play a crucial role in the preparation of financial statements. Journal entries capture the day-to-day transactions of a business and serve as the foundation for creating accurate financial statements, such as the income statement, balance sheet, and statement of cash flows.

By recording transactions accurately in the journal, businesses can ensure that their financial statements reflect the true financial position and performance of the company. This is essential for making informed decisions, both internally and externally, as financial statements are used by investors, creditors, and other stakeholders to assess the financial health of a business.

One important aspect of accurate journal entries is proper classification and categorization. Transactions need to be recorded in the appropriate accounts, such as revenues, expenses, assets, liabilities, and equity, to ensure that the financial statements are presented in a clear and meaningful way. This allows users of the financial statements to easily understand the nature and impact of each transaction on the overall financial performance of the business.

Another crucial impact of accurate journal entries on financial statements is the maintenance of accounting integrity and compliance. Incorrect or fraudulent journal entries can distort financial statements and mislead stakeholders. It is important for businesses to adhere to accounting principles and guidelines, such as Generally Accepted Accounting Principles (GAAP), and ensure that their journal entries accurately reflect the economic reality of the transactions.

Overall, accurate journal entries are the backbone of financial reporting and provide a reliable basis for decision-making. By diligently recording transactions and adhering to accounting principles, businesses can maintain the integrity of their financial statements, provide transparency to stakeholders, and make sound financial decisions based on accurate and reliable information.