Depreciation is a critical concept in accounting and finance, as it represents the systematic allocation of an asset’s cost over its useful life. One commonly used method for calculating depreciation is the straight line method. In this article, we will explore frequently asked questions about depreciation using the straight line method and provide answers to help you understand and apply this concept.

The straight line method is a simple yet effective way to calculate depreciation. It assumes that the asset’s value decreases evenly over its useful life. To calculate depreciation using this method, you need to determine the asset’s initial cost, its estimated salvage value at the end of its useful life, and the number of years over which you expect to use the asset. By subtracting the salvage value from the initial cost and dividing the result by the useful life, you can obtain the annual depreciation expense.

This method is widely used because it is straightforward and easy to understand. It provides a consistent and predictable depreciation expense, making it useful for budgeting and financial planning purposes. Furthermore, the straight line method is generally accepted for financial reporting purposes and is often required by accounting standards.

However, it is essential to note that while the straight line method is easy to use, it may not accurately reflect the asset’s actual value decrease over time. Some assets may depreciate more quickly in their early years and then stabilize, while others may experience a gradual decline throughout their useful lives. Therefore, it is crucial to consider the nature of the asset and any industry-specific factors when selecting a depreciation method.

What is Depreciation?

Depreciation is an accounting method used to allocate the cost of an asset over its useful life. It represents the gradual decrease in the value or usefulness of an asset due to wear and tear, obsolescence, or other factors. Depreciation allows businesses to spread out the cost of an asset over its expected lifespan, which helps in accurately reflecting the true cost of using the asset in generating revenue.

Depreciation is a non-cash expense that does not involve an actual outflow of cash. Whereas expenses like salaries or rent require cash payments, depreciation is a way to account for the loss in value of an asset over time, without actually spending any money. The depreciation expense is recorded on the income statement and reduces the net income of a company.

The straight-line method is one of the most commonly used methods to calculate depreciation. Under this method, the cost of the asset is divided equally over its useful life. For example, if a machine is purchased for $10,000 and has a useful life of 5 years, the straight-line depreciation expense would be $2,000 per year. This means that at the end of each year, the value of the machine would be reduced by $2,000 until it reaches its salvage value.

It is important to note that depreciation is an accounting concept and does not have a direct impact on the market value of an asset. The market value of an asset may vary based on supply and demand factors, while depreciation is used for internal accounting purposes to allocate the cost of an asset over its useful life.

Definition and meaning of depreciation

Depreciation is an accounting method used to allocate the cost of an asset over its useful life. It represents the decrease in the value of an asset over time due to wear and tear, obsolescence, or other factors. Depreciation is an important concept in financial reporting as it helps provide a more accurate representation of an asset’s value on the balance sheet.

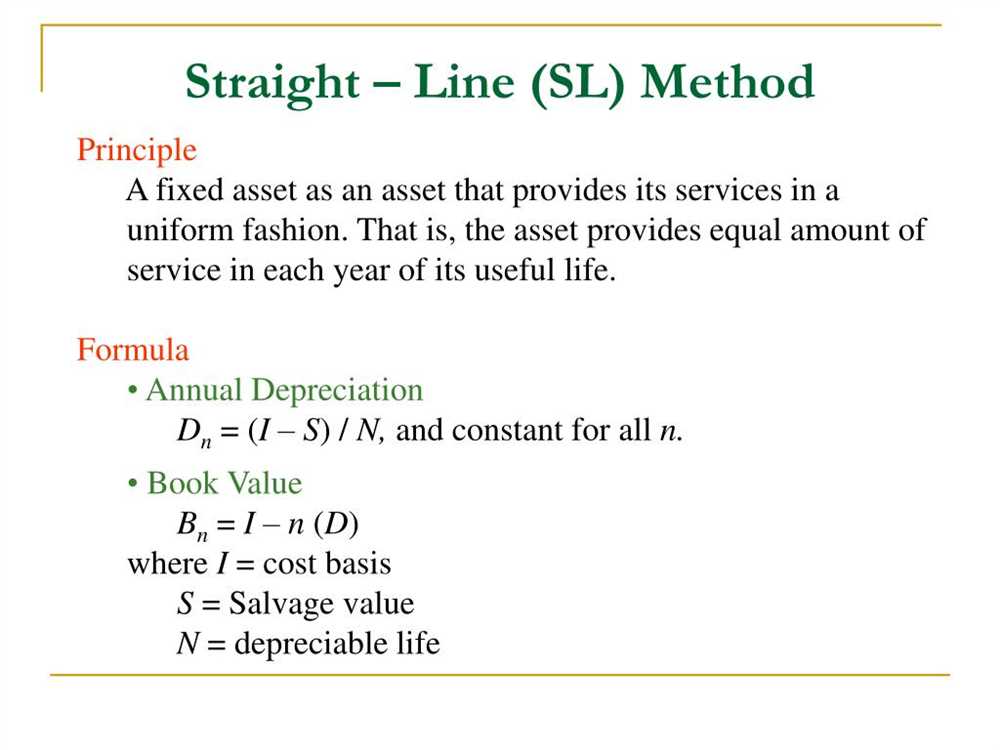

Depreciation can be calculated using different methods, such as the straight-line method, the declining balance method, or the units of production method. The straight-line method is the most common and simplest method, where the cost of the asset is divided equally over its useful life.

The straight-line method of depreciation assumes that the asset’s value decreases by the same amount each year. It calculates depreciation as the cost of the asset minus its salvage value, divided by the number of years of expected useful life. This method is often used when the asset’s value depreciates evenly over time.

Depreciation is recorded as an expense on the income statement and reduces the carrying value of the asset on the balance sheet. By allocating the cost of an asset over its useful life, depreciation helps spread out the expense of acquiring the asset and provides a more accurate reflection of an entity’s financial position.

It is important to note that depreciation is an accounting concept and does not necessarily reflect the actual value or market price of an asset. The actual value of an asset may increase or decrease over time due to various factors, including supply and demand, technological advancements, or changes in the economy. Depreciation merely serves as a systematic way to allocate the cost of an asset over its useful life for accounting purposes.

Straight Line Method

The straight line method is one of the common approaches used for calculating depreciation expense. It is a simple and straightforward method that evenly spreads the depreciation expense over the useful life of an asset. Under this method, the depreciation expense remains constant throughout the asset’s useful life.

To calculate the depreciation expense using the straight line method, the following formula is used:

Depreciation Expense = (Cost of Asset – Salvage Value) / Useful Life

The cost of the asset refers to the initial purchase price of the asset, while the salvage value is the estimated value of the asset at the end of its useful life. The useful life represents the anticipated period over which the asset will generate economic benefits.

For example, let’s consider a company that purchases a new computer system for $5,000, with an estimated salvage value of $500 and a useful life of 5 years. Using the straight line method, the annual depreciation expense would be:

| Cost of Asset | Salvage Value | Useful Life | Depreciation Expense |

|---|---|---|---|

| $5,000 | $500 | 5 years | $900 |

By dividing the difference between the cost of the asset and the salvage value by the useful life, the company would recognize an annual depreciation expense of $900 for the computer system.

The straight line method is widely used because of its simplicity and ease of calculation. However, it doesn’t take into account the actual usage of the asset or its decline in value over time. As a result, it may not provide an accurate representation of the asset’s depreciation.

How does the straight line method work?

The straight line method is a common way to calculate depreciation for businesses. It is a simple and straightforward method that evenly spreads the cost of an asset over its useful life.

The formula for the straight line method is:

- (Cost of Asset – Salvage Value) / Useful Life of Asset = Annual Depreciation Expense

This formula takes into account the initial cost of the asset, the expected salvage value at the end of its useful life, and the estimated useful life of the asset.

For example, let’s say a company purchases a computer for $1,000 and expects it to be usable for 5 years with no salvage value. Using the straight line method, the annual depreciation expense would be:

- (1,000 – 0) / 5 = $200

This means that the company would record a depreciation expense of $200 each year for the computer.

Advantages of using the straight line method

The straight line method is a widely used depreciation method in accounting and finance. It offers several advantages that make it a preferred choice for many businesses.

1. Simplicity: The straight line method is straightforward and easy to understand. It involves allocating an equal amount of depreciation expense over the useful life of an asset. This simplicity makes it easy for accountants and financial professionals to determine and calculate depreciation expenses accurately.

2. Even allocation of costs: With the straight line method, the cost of an asset is evenly allocated over its useful life. This ensures that the depreciation expenses are spread out evenly over time, allowing for better planning and budgeting. It provides a more balanced financial picture and avoids large fluctuations in expenses from year to year.

3. Consistency: Using the straight line method helps businesses maintain consistency in their financial statements. This method provides a reliable and uniform way of depreciating assets, making it easier to compare financial information across different periods and assets.

4. Compliance with accounting standards: The straight line method is widely accepted and compliant with most accounting standards. It is recognized by generally accepted accounting principles (GAAP) and the international financial reporting standards (IFRS), making it an appropriate choice for businesses seeking to comply with regulations and reporting requirements.

5. Accuracy in estimating asset value: This method provides a reasonable estimate of an asset’s value at the end of its useful life. By depreciating assets at a consistent rate, businesses can more accurately estimate the residual value of an asset, which is essential for financial planning and decision making.

In conclusion, the straight line method offers simplicity, even allocation of costs, consistency, compliance with accounting standards, and accuracy in estimating asset value. These advantages make it a preferred choice for businesses when calculating and reporting depreciation expenses for their assets.

Limitations of the straight line method

The straight line method of depreciation is widely used due to its simplicity and ease of calculation. However, it has several limitations that should be taken into consideration when using this method.

1. Equal allocation of depreciation: The straight line method assumes that the asset depreciates evenly over its useful life. However, in reality, many assets may have different rates of depreciation, with a higher depreciation expense in the early years and a lower expense in the later years. This means that the straight line method may not accurately reflect the actual value of the asset over time.

2. Ignoring salvage value: The straight line method does not take into account any salvage value that the asset may have at the end of its useful life. This means that the depreciation expense calculated using this method may be higher than necessary, resulting in an overstatement of expenses and a lower net income.

3. Inaccurate results for short-lived assets: The straight line method may not be suitable for assets that have a relatively short useful life. This is because the depreciation expense calculated using this method may be spread out over a longer period of time, resulting in a lower expense in each period. This can lead to inaccurate financial statements and may not reflect the true depreciation of the asset.

4. Lack of consideration for technological advancements: The straight line method assumes that the asset will be used at a constant rate throughout its useful life. However, in many cases, technological advancements may render the asset obsolete before the end of its useful life. This means that the straight line method may not accurately reflect the decreasing value of the asset due to technological changes.

In summary, while the straight line method of depreciation is a commonly used and straightforward method, it is important to recognize its limitations. These limitations include assumptions about equal depreciation allocation, ignoring salvage value, inaccuracies for short-lived assets, and lack of consideration for technological advancements. Understanding these limitations can help businesses make more informed decisions when it comes to depreciating assets and valuing their financial statements.

Calculation of Depreciation using Straight Line Method

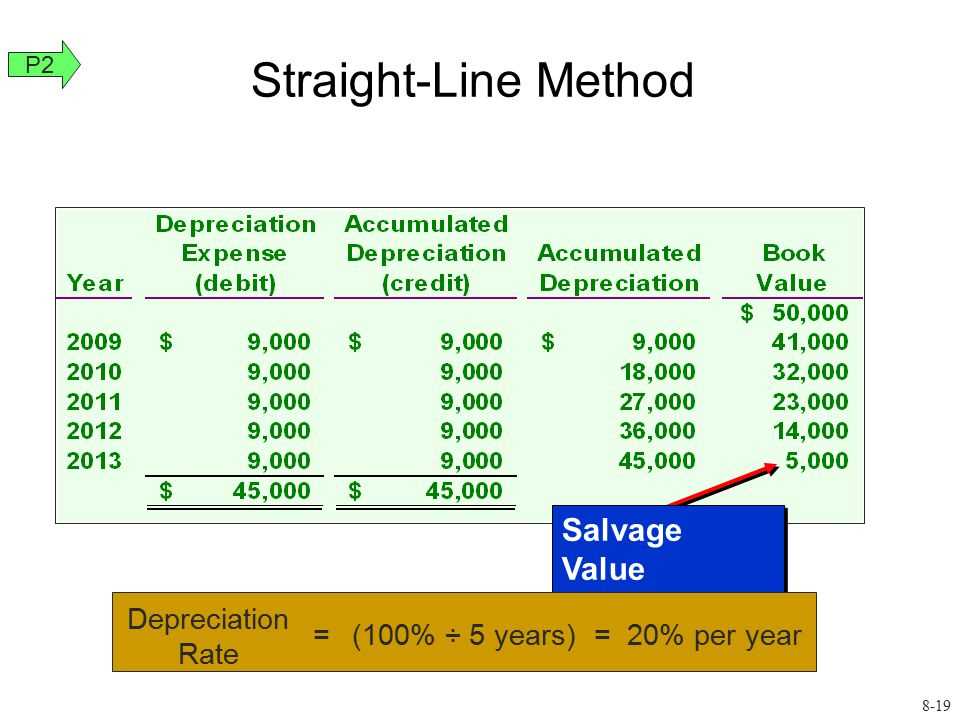

The straight line method is one of the most commonly used methods for calculating depreciation of assets. It is a simple and straightforward method that evenly distributes the cost of the asset over its useful life. This method assumes that the asset’s value decreases by the same amount each year, resulting in a linear depreciation expense.

To calculate depreciation using the straight line method, you need to know three key pieces of information: the initial cost of the asset, its expected useful life, and its estimated salvage value. The initial cost refers to the purchase cost of the asset, while the useful life is the expected time period over which the asset is expected to generate economic benefits. The salvage value is the estimated value of the asset at the end of its useful life.

Once you have these three pieces of information, you can use the following formula to calculate the annual depreciation expense:

Annual Depreciation Expense = (Initial Cost – Salvage Value) / Useful Life

For example, let’s say a company purchases a machine for $10,000 with an expected useful life of 5 years and an estimated salvage value of $1,000. Using the straight line method, the annual depreciation expense would be:

| Initial Cost | Salvage Value | Useful Life | Annual Depreciation Expense |

|---|---|---|---|

| $10,000 | $1,000 | 5 years | ($10,000 – $1,000) / 5 = $1,800 |

Using this calculation, the company would record an annual depreciation expense of $1,800 for the machine. This amount would be recorded on the company’s income statement and reduce the machine’s carrying value on the balance sheet.

Formula for calculating depreciation under the straight line method

Depreciation is a method used to allocate the cost of an asset over its useful life. It represents the gradual reduction in value that occurs over time due to wear and tear, obsolescence, or other factors. One common method of calculating depreciation is the straight line method.

The formula for calculating depreciation under the straight line method is straightforward. It is based on the assumption that the value of the asset depreciates by an equal amount each year. The formula is:

Depreciation Expense = (Initial Cost – Salvage Value) / Useful Life

Where:

- Depreciation Expense is the amount of depreciation that is recognized in the accounting records for a specific period.

- Initial Cost is the original cost of the asset, including any expenses incurred to purchase or acquire it.

- Salvage Value is the estimated value of the asset at the end of its useful life. It represents the amount that the asset is expected to be worth after it has been fully depreciated.

- Useful Life is the estimated number of years that the asset will be used by the company before it becomes obsolete, worn out, or replaced.

By applying the formula, you can calculate the annual depreciation expense for an asset and allocate it over its useful life. This method provides a systematic and easy way to account for the gradual reduction in value of an asset over time.

It’s important to note that depreciation is not an exact science and there are other methods available for calculating it, such as the declining balance method or the sum of years’ digits method. However, the straight line method is widely used due to its simplicity and ease of calculation.