Understanding income and employment is crucial for any individual looking to navigate the world of personal finance. Everfi, an online learning platform, offers a comprehensive program that covers various aspects of income and employment. In this article, we will explore some of the key answers to questions you may have about Everfi’s income and employment module.

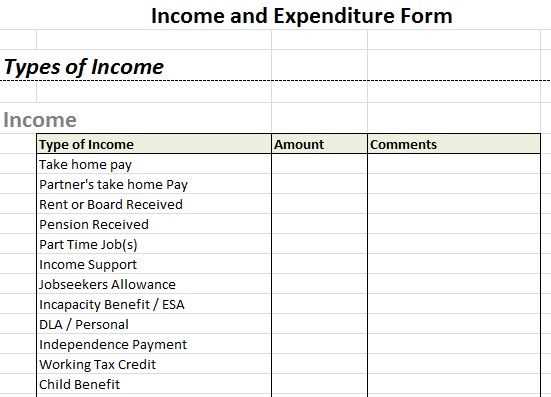

One important aspect of Everfi’s program is teaching individuals about different sources of income. From salaries and wages to bonuses and commissions, the module provides a detailed explanation of each source and how they contribute to overall earnings. Understanding these sources can help individuals make informed decisions regarding their careers and financial goals.

Furthermore, Everfi’s income and employment module touches on important topics such as taxes and deductions. It covers the basics of the tax system, including how to calculate income tax and navigate different tax brackets. The module also educates users about common deductions, such as those related to healthcare expenses or student loan interest, that can help reduce taxable income.

In addition to income and taxes, Everfi’s program also offers insights into career paths and job preparation. Whether you’re looking to enter the workforce or considering a career change, the module provides guidance on building a professional network, creating a standout resume, and mastering the art of job interviews. These skills are essential for securing and maintaining employment in today’s competitive job market.

In summary, Everfi’s income and employment module offers an invaluable resource for individuals seeking to enhance their understanding of personal finance. By covering topics such as different sources of income, taxes and deductions, and career preparation, the program equips users with the knowledge and skills necessary to make informed financial decisions and achieve their financial goals.

Everfi Income and Employment Answers

If you are looking for answers to the Everfi Income and Employment module, you have come to the right place. This module addresses important topics related to income and employment, including taxes, paychecks, and benefits. It is designed to help you understand the basics of personal finance and make informed decisions about your financial future.

One key concept covered in this module is understanding the different types of taxes. Taxes are fees that individuals and businesses must pay to the government to fund public services. They are typically deducted from your paycheck and include federal, state, and local taxes. By understanding how taxes work, you can better budget and plan for your financial responsibilities.

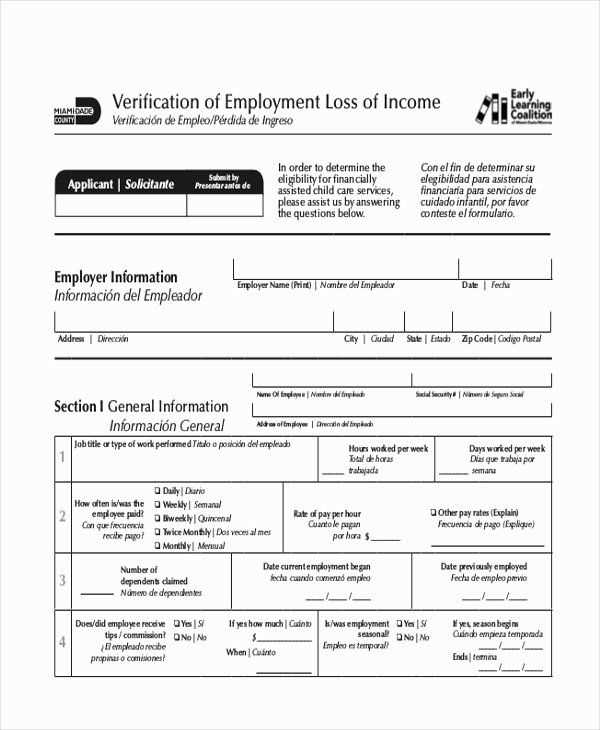

Another important topic covered in this module is understanding paychecks. A paycheck is a document issued by an employer to pay an employee for their work. It includes information about how much you have earned and the various deductions that have been taken out, such as taxes and contributions to retirement or healthcare plans. Understanding your paycheck can help you track your income and make sure you are being paid correctly.

In addition to taxes and paychecks, this module also covers the topic of benefits. Benefits are non-wage compensations provided to employees in addition to their regular salary or hourly wages. They can include things like health insurance, retirement plans, and paid time off. Understanding the benefits offered by your employer is important for making informed decisions about your overall compensation package.

Key Takeaways:

- The Everfi Income and Employment module covers important topics related to taxes, paychecks, and benefits.

- Taxes are fees that individuals and businesses must pay to the government to fund public services.

- Paychecks include information about how much you have earned and the various deductions that have been taken out.

- Benefits are non-wage compensations provided to employees in addition to their regular salary or hourly wages.

- Understanding these concepts can help you make informed decisions about your financial future.

If you have any more specific questions or need further assistance with the Everfi Income and Employment module, feel free to reach out for help. The module is designed to provide you with the knowledge and tools to make informed decisions about your income and employment.

Understanding Income and Earning Potential

Income is the money that you earn for your work or from other sources, such as investments or rental properties. Understanding income and your earning potential is important for managing your finances and planning for the future.

Income can come from various sources, including salaries, wages, bonuses, commissions, and tips. It is typically paid on a regular basis, such as weekly, biweekly, or monthly. It is important to understand the terms of your employment or any contracts you have for freelance work to know what your income will be and when it will be paid.

Factors Affecting Earning Potential

There are several factors that can affect your earning potential. Education and skills play a significant role in determining how much you can earn. Generally, individuals with higher levels of education or specialized skills have the potential to earn higher incomes.

Experience is another factor that can impact your earning potential. As you gain more experience in your field, you may become more valuable to employers and have the opportunity to earn a higher income. This is particularly true in professions that have a clear career progression, such as medicine or law.

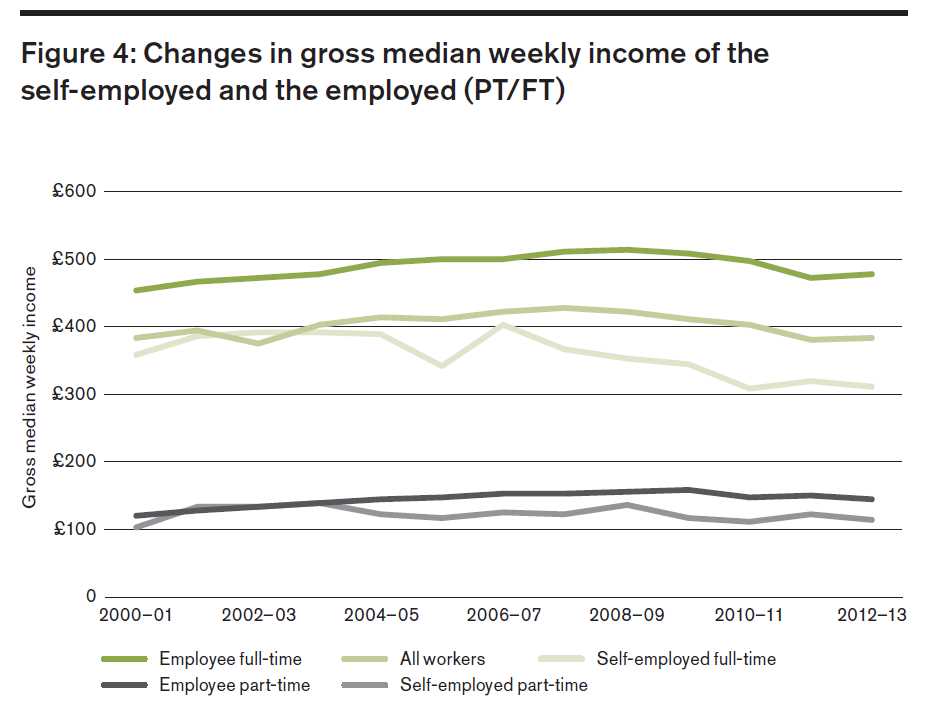

The industry or sector in which you work can also affect your earning potential. Some industries, such as finance or technology, tend to offer higher salaries and more opportunities for advancement. It is important to consider the earning potential of different industries when choosing a career path.

Planning for the Future

Understanding your income and earning potential is crucial for financial planning. It allows you to budget effectively, save for retirement, and set financial goals. By knowing how much you can potentially earn, you can make informed decisions about spending and saving.

It is also important to consider other factors, such as taxes and living expenses, when planning for the future. Taxes can significantly impact your income, so it is important to understand how much of your earnings will be deducted for taxes. Additionally, living expenses can vary depending on your location and lifestyle, so it is important to budget for these expenses accordingly.

In conclusion, understanding income and earning potential is essential for managing your finances and planning for the future. Factors such as education, skills, experience, and industry can all affect how much you can earn. By considering these factors and planning effectively, you can make smart financial decisions and work towards achieving your financial goals.

Factors Affecting Income

There are several factors that can greatly influence a person’s income. One of the most significant factors is education level. Research has consistently shown that individuals with higher levels of education tend to earn higher incomes. This is because higher education allows individuals to develop specialized skills and knowledge that are in demand in the job market. Whether it’s a college degree, vocational training, or professional certifications, investing in education can lead to higher-paying job opportunities.

Another factor that affects income is work experience. As people gain more experience in their chosen field, they often become more skilled and knowledgeable, which can result in higher pay. Employers generally value individuals who have relevant experience and are willing to pay them more for their expertise. Additionally, those with a long work history may have built up a strong professional network, which can also lead to higher-paying job opportunities.

Geographic location is another important factor when it comes to income. The cost of living can vary significantly from one place to another, and this can have a direct impact on how much money individuals earn. For example, the salaries in cities with a high cost of living like New York or San Francisco are typically higher than in smaller towns or rural areas. It’s important for individuals to consider the cost of living when evaluating potential job opportunities in different locations.

Furthermore, industry and job type can also affect income. Certain industries, such as technology or finance, tend to offer higher salaries compared to others. Additionally, leadership roles or positions that require specialized skills or qualifications often come with higher income levels. It’s important for individuals to research and understand the income potential within their desired industry and job type before making career decisions.

In summary, factors such as education level, work experience, geographic location, industry, and job type can significantly impact a person’s income. By considering these factors and making informed decisions, individuals can position themselves for higher earning potential in their chosen field.

Types of Employment

There are various types of employment that individuals can pursue depending on their skills, qualifications, and preferences. These different types of employment can offer different benefits, challenges, and opportunities for career growth.

1. Full-time Employment: Full-time employment refers to a job where an individual works for a standard number of hours per week. Typically, full-time employees work around 40 hours per week. Full-time employment often comes with benefits such as health insurance, paid leave, and retirement plans. It provides a stable income and is suitable for individuals who prefer a consistent work schedule.

2. Part-time Employment: Part-time employment involves working fewer hours than full-time employment. Part-time jobs can be ideal for individuals who need flexibility in their schedules or who have other commitments, such as education or caregiving responsibilities. While part-time employment may not offer the same level of benefits as full-time employment, it can still provide a source of income and an opportunity to gain experience in a specific field.

3. Temporary Employment: Temporary employment involves working for a specific period of time or on a project basis. Temporary jobs can be found in various industries and can provide individuals with an opportunity to gain experience in different roles or industries. While temporary employment may not offer the same level of job security as full-time or part-time employment, it can be a stepping stone towards permanent employment or a way to bridge the gap between jobs.

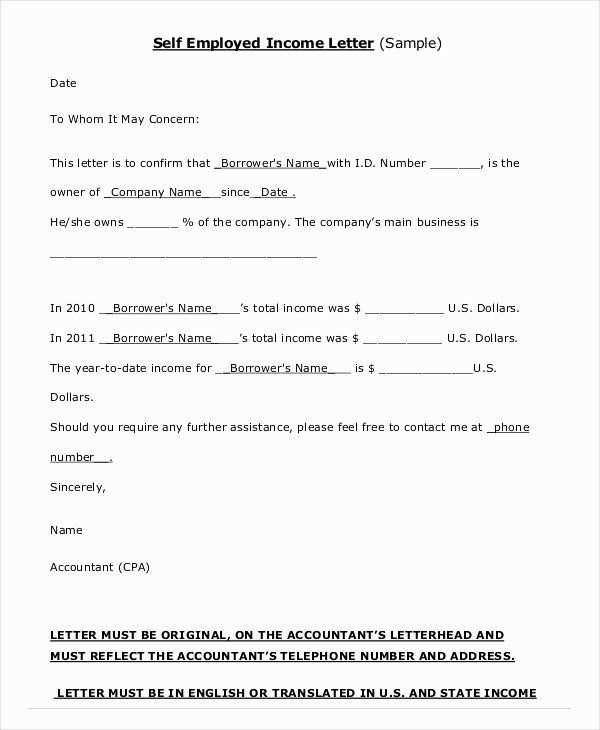

4. Freelance or Self-employment: Freelance or self-employment refers to individuals working independently and offering their services to clients on a project basis. Freelancers have the freedom to choose their clients, set their own rates, and work on their own terms. However, they are responsible for finding their own clients, managing their finances, and ensuring a steady stream of projects. Freelancing can offer flexibility and the potential for higher income but also involves managing uncertainties and the responsibility of running a business.

5. Contract Employment: Contract employment involves working for a specific duration or for a specific project as per the terms of a contract. Contract employees are hired for a fixed period of time and are often hired to fulfill a specific role within an organization. Contract employment can offer the opportunity to work on interesting projects, gain specialized skills, and work with different organizations. However, contract employees may not receive the same level of benefits as permanent employees and may have to constantly look for new contracts once their current contract ends.

6. Internship: An internship is a temporary position that offers individuals an opportunity to gain practical experience in a specific field. Internships are often undertaken by students or recent graduates to gain hands-on experience and make connections in their respective industries. While internships may be unpaid or offer a low stipend, they can provide valuable learning opportunities and can be a stepping stone towards long-term employment.

These are just a few examples of the different types of employment available. It’s important for individuals to assess their skills, goals, and preferences to identify the type of employment that aligns with their needs and aspirations.

Job Applications and Resumes

When applying for a job, it is important to carefully fill out the job application and create a well-crafted resume. These two documents play a crucial role in the hiring process and can significantly impact your chances of getting an interview or securing a job offer.

A job application typically collects personal information, such as your name, contact details, and employment history. It also includes sections where you can provide details about your education, skills, and qualifications. It is important to answer all the questions accurately and honestly, as any discrepancies or false information can often lead to immediate disqualification from the hiring process.

Creating a professional resume is another essential step when applying for a job. Your resume should include a clear and concise summary of your work experience, educational background, and relevant skills. It is important to highlight your accomplishments and any relevant certifications or training you have received. Using action verbs and quantifying your achievements can make your resume more impactful and impressive to potential employers.

Additionally, tailoring your resume to match the job requirements and including keywords from the job description can increase your chances of getting noticed by hiring managers. Paying attention to the formatting and overall design of your resume is also crucial, as it should be easy to read and visually appealing. Consider using bullet points, headers, and appropriate spacing to make the information more organized and accessible.

Tips for Job Applications and Resumes:

- Read the job application carefully and ensure all fields are filled out.

- Provide accurate and honest information.

- Highlight your relevant skills and qualifications.

- Showcase your accomplishments and use action verbs.

- Tailor your resume to match the job requirements.

- Include keywords from the job description.

- Pay attention to formatting and design.