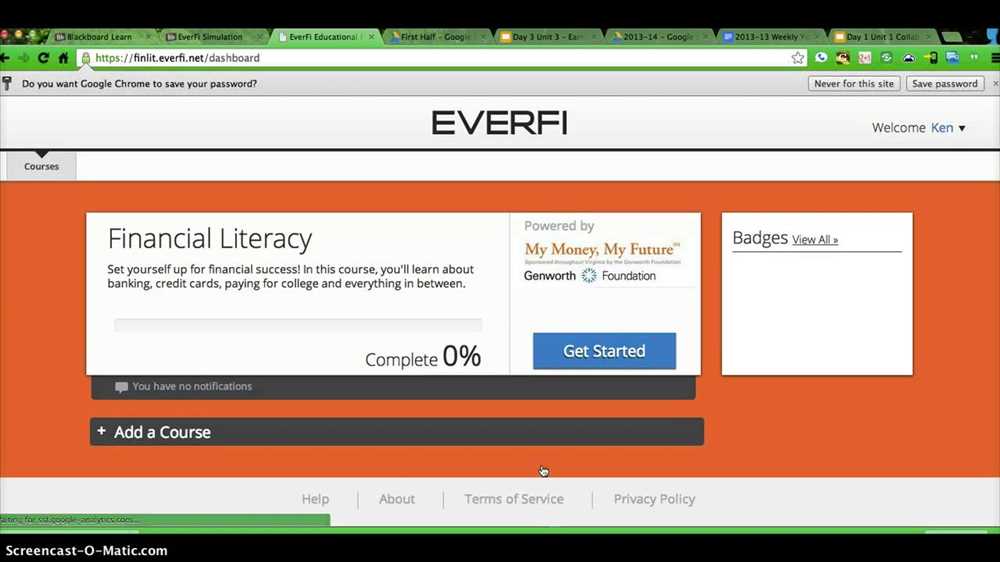

In today’s modern world, financial literacy is becoming increasingly important. Many individuals struggle with managing their finances and making informed decisions about money. That’s where Everfi Module 5 comes in. This educational program aims to equip individuals with the knowledge and skills necessary to build their financial capabilities.

Everfi Module 5 covers a wide range of topics, including budgeting, saving, investing, and managing debt. Through interactive lessons and quizzes, participants learn practical strategies for planning and achieving their financial goals. By understanding the importance of creating a budget, individuals can take control of their spending habits and allocate their money effectively.

Furthermore, Everfi Module 5 provides insights into the world of saving and investing. Participants learn about the power of compound interest and how it can help grow their wealth over time. They also gain an understanding of different investment options and the potential risks and rewards associated with each.

Lastly, Everfi Module 5 delves into the often complex topic of managing debt. Participants are taught strategies for reducing and eliminating debt, as well as how to make responsible borrowing decisions in the future. By understanding the impact of interest rates and fees, individuals can make informed choices when it comes to borrowing money.

Overall, Everfi Module 5 answers provide individuals with the necessary tools and knowledge to navigate the world of personal finance. By applying these lessons, participants can build their financial capabilities and make informed decisions that positively impact their financial well-being.

Everfi Module 5 Answers: Key Points to Remember

In Everfi Module 5, you learn about the importance of credit and the various factors that can impact your credit score. It is essential to understand the key points discussed in this module to effectively manage your credit and make informed financial decisions.

Credit utilization ratio: One important concept covered in this module is the credit utilization ratio. This ratio measures the amount of credit you are using compared to your total available credit. It is recommended to keep your credit utilization ratio below 30% to maintain a good credit score.

Payment history: Your payment history plays a crucial role in determining your credit score. It is vital to pay your bills on time and in full to maintain a positive payment history. Late payments or missed payments can significantly damage your credit score.

Types of credit: The module also emphasizes the importance of having a diverse mix of credit types. Having a combination of credit cards, loans, and lines of credit can positively impact your credit score.

Credit inquiries: Every time you apply for new credit, it results in a credit inquiry on your report. Multiple credit inquiries within a short period can negatively impact your credit score. It is essential to be mindful of the number of credit inquiries you have to protect your credit score.

Credit reporting agencies: The module discusses the three main credit reporting agencies: Equifax, Experian, and TransUnion. These agencies collect and maintain your credit information. It is essential to regularly review your credit reports from each agency to ensure accuracy and address any errors.

Credit reports: Your credit report contains important information about your credit history, including your credit accounts, payment history, and credit inquiries. It is crucial to review your credit report regularly and address any inaccuracies or discrepancies.

Overall, understanding and applying the key points covered in Everfi Module 5 can help you build and maintain a strong credit score. By managing your credit responsibly, you can open doors to better financial opportunities in the future.

Understanding Credit Scores and Reports

Having a good understanding of credit scores and reports is essential for managing your finances and making informed financial decisions. Your credit score is a numerical representation of your creditworthiness, which lenders use to assess your creditworthiness when you apply for a loan or credit card. It is based on various factors such as your payment history, credit utilization, length of credit history, and types of credit used. A higher credit score indicates that you are a lower credit risk, while a lower credit score indicates that you may be a higher credit risk.

Your credit report is a document that provides detailed information about your credit history. It includes information about your credit accounts, payment history, credit inquiries, and public records such as bankruptcies or tax liens. Lenders and creditors use this information to evaluate your creditworthiness and make decisions about whether to approve your applications for credit.

Understanding your credit report:

- Check your credit report regularly to ensure its accuracy and identify any errors or discrepancies.

- Review the information in your credit report to assess your creditworthiness and identify areas for improvement.

- Pay attention to your payment history, as late payments or missed payments can negatively impact your credit score.

- Monitor your credit utilization ratio, which is the percentage of your available credit that you are using. Keeping this ratio low can help improve your credit score.

Improving your credit score:

- Make all your payments on time to establish a positive payment history.

- Pay off existing debts and keep your credit utilization ratio low.

- Avoid opening multiple new credit accounts within a short period, as this can negatively impact your credit score.

- Regularly check your credit report and address any errors or discrepancies promptly.

In conclusion, understanding credit scores and reports is crucial for managing your finances and achieving your financial goals. By keeping track of your credit score and reviewing your credit report regularly, you can make informed decisions to improve your creditworthiness and maintain a healthy financial profile.

Factors Affecting Credit Scores

Credit scores play a crucial role in determining an individual’s financial health and stability. These scores are used by lenders, landlords, and employers to evaluate a person’s creditworthiness and ability to manage debt responsibly. Several factors influence credit scores, and understanding them can help individuals improve their financial standing.

Payment history: One of the most significant factors impacting credit scores is an individual’s payment history. Timely payments on loans, credit cards, and other debts reflect a responsible borrower, whereas late or missed payments can negatively affect credit scores. It is essential to pay bills on time to maintain a good credit score.

Credit utilization: Credit utilization refers to the amount of available credit a person is currently using. Lower credit utilization ratios are generally considered favorable and can boost credit scores. It is advisable to keep credit card balances low and avoid maxing out credit limits, as this can suggest financial instability.

Length of credit history: The length of an individual’s credit history also plays a role in determining credit scores. Generally, the longer the credit history, the better, as it demonstrates a track record of responsible borrowing and repayment. Young adults or those new to credit may have lower scores due to limited credit history.

New credit and inquiries: Opening multiple credit accounts or applying for new credit frequently can have a negative impact on credit scores. Each time a creditor makes an inquiry into an individual’s credit history, it can cause a temporary dip in scores.

Credit mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact credit scores. It showcases the ability to manage different types of debt responsibly. However, it is essential to only take on credit accounts that are necessary and manageable.

Understanding these factors can help individuals take control of their credit scores and make informed financial decisions. By consistently making on-time payments, maintaining low credit utilization, and managing credit responsibly, individuals can improve their creditworthiness and increase their chances of obtaining favorable lending terms and opportunities in the future.

The Importance of Building Good Credit History

Building a good credit history is essential for financial success. Your credit history is a record of your borrowing and repayment activities, which lenders use to determine your creditworthiness. Having a good credit history allows you to access better opportunities for loans, credit cards, and housing. It can also affect your ability to secure employment, rent an apartment, and even get insurance.

Creating a positive credit history:

- Pay your bills on time: Consistently making your loan payments, credit card payments, and utility bills on time demonstrates your responsibility and reliability as a borrower.

- Use credit responsibly: Only borrow what you can afford to repay, and avoid maxing out your credit cards. Lenders want to see that you can manage debt effectively.

- Keep credit card balances low: Maintaining low credit card balances shows that you can control your spending and manage your credit responsibly.

- Establish a diverse credit mix: Having a mix of different types of credit, such as credit cards, loans, and a mortgage, can demonstrate your ability to handle various financial responsibilities.

- Avoid closing old credit accounts: Length of credit history is an important factor in building good credit. Keeping old accounts open, even if they have a zero balance, can help improve your credit score.

The benefits of having good credit:

- Access to better loan terms and interest rates: With good credit, you are more likely to be approved for loans and credit cards with lower interest rates. This can save you money in the long run.

- Ability to rent an apartment or secure housing: Landlords often check credit histories before approving rental applications. Having good credit can make it easier to find a place to live.

- Increased job prospects: Some employers review credit histories as part of the hiring process. A strong credit history can positively impact your chances of securing certain types of jobs.

- Lower insurance premiums: Insurance companies may use credit scores to determine premiums. A good credit history can result in lower insurance costs.

- Ability to qualify for higher credit limits: Good credit enables you to access higher credit limits, giving you more flexibility and options for future borrowing needs.

Overall, building and maintaining a good credit history is crucial for financial stability and success. By following responsible borrowing practices and being proactive about managing your credit, you can reap the benefits of having a strong credit profile.

How to Establish Credit

If you’re looking to establish credit, it’s important to understand the steps you need to take and the best practices to follow. Building credit is crucial for future financial opportunities, such as obtaining loans, renting an apartment, or even getting a job. Here are some tips to help you establish credit:

- Open a Bank Account: Start by opening a bank account in your name. This will help you build a relationship with a financial institution and show that you can manage your money responsibly.

- Apply for a Secured Credit Card: A secured credit card is a great tool for establishing credit. To get one, you’ll need to make a deposit, which serves as your credit limit. Make sure to make regular payments and keep your credit utilization low to build a positive credit history.

- Make Timely Payments: One of the most important factors in building credit is making all of your payments on time. Late payments can negatively impact your credit score and make it harder to establish credit in the future.

- Keep Your Credit Utilization Low: Credit utilization refers to the amount of credit you’re using compared to your credit limit. It’s best to keep your credit utilization below 30% to show that you can manage your credit responsibly.

- Monitor Your Credit: Regularly check your credit report to ensure there are no errors or fraudulent activities. You can request a free credit report from each of the three major credit bureaus once a year. Monitoring your credit will help you stay on top of your progress and identify any areas that need improvement.

Building credit takes time and consistency. By following these steps and practicing healthy credit habits, you’ll be on your way to establishing a strong credit history for a bright financial future.

Responsible Credit Card Usage

A credit card can be a useful financial tool, but it’s important to use it responsibly to avoid getting into debt and damaging your credit score. Here are some key guidelines to follow when using a credit card:

- Pay your bill on time: One of the most important aspects of responsible credit card usage is to make sure you pay your bill on time each month. Late payments can result in late fees and negatively impact your credit score. Set reminders or automate payments to ensure you never miss a due date.

- Keep your credit utilization low: Credit utilization refers to the percentage of your available credit that you are currently using. It’s recommended to keep your credit utilization below 30%. This shows lenders that you are not relying heavily on credit and can manage your finances responsibly.

- Avoid unnecessary debt: While it’s tempting to use your credit card for every purchase, it’s important to only spend what you can afford to pay back. Avoid unnecessary debt by budgeting your expenses and limiting your credit card usage to essential purchases.

- Monitor your credit card statements: Regularly review your credit card statements to identify any unauthorized charges or errors. Reporting any discrepancies as soon as possible can help protect your finances and prevent any additional financial hardship.

- Build a positive credit history: Using a credit card responsibly and paying your bills on time can help you build a positive credit history. This can make it easier to qualify for loans, mortgages, and other lines of credit in the future.

By following these guidelines, you can enjoy the benefits of having a credit card while also maintaining a healthy financial picture. Remember, responsible credit card usage is key to achieving long-term financial success.