Are you struggling to find the answer to a financial aid crossword puzzle? Look no further – we have the complete answer key right here! Whether you’re a student looking for assistance with your education costs or a crossword enthusiast eager to solve the puzzle, this answer key will be your ultimate guide.

This answer key contains all the solutions to the financial aid crossword puzzle, including important terms and concepts related to financial aid. From scholarships and grants to student loans and work-study programs, this key will help you navigate through the challenging crossword and expand your knowledge of financial aid options.

By using this answer key, you can not only solve the crossword puzzle but also gain a better understanding of the different types of financial aid available. Whether you’re preparing for college, considering a career change, or simply interested in the topic, this answer key is a valuable resource to have.

What is a financial aid crossword puzzle?

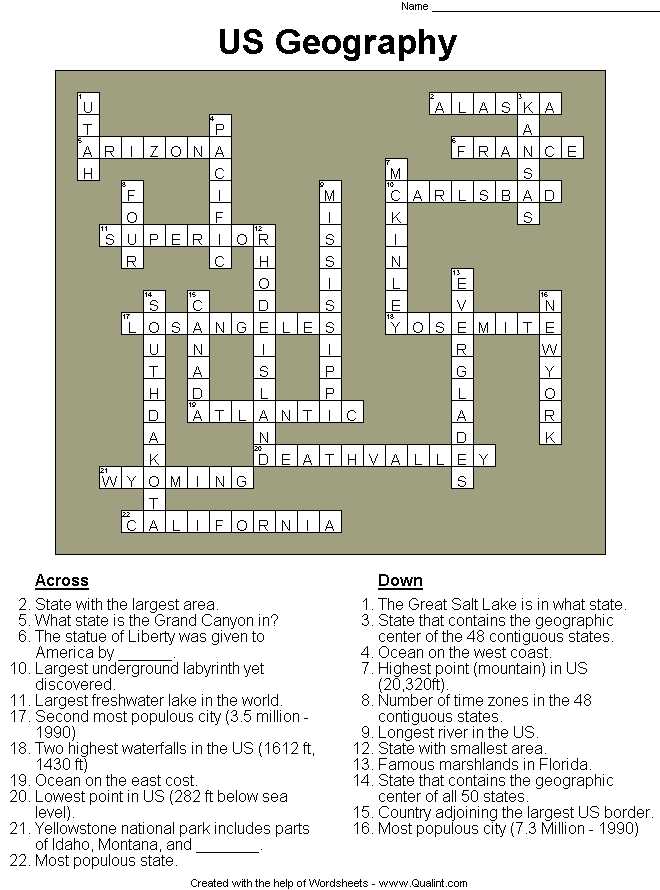

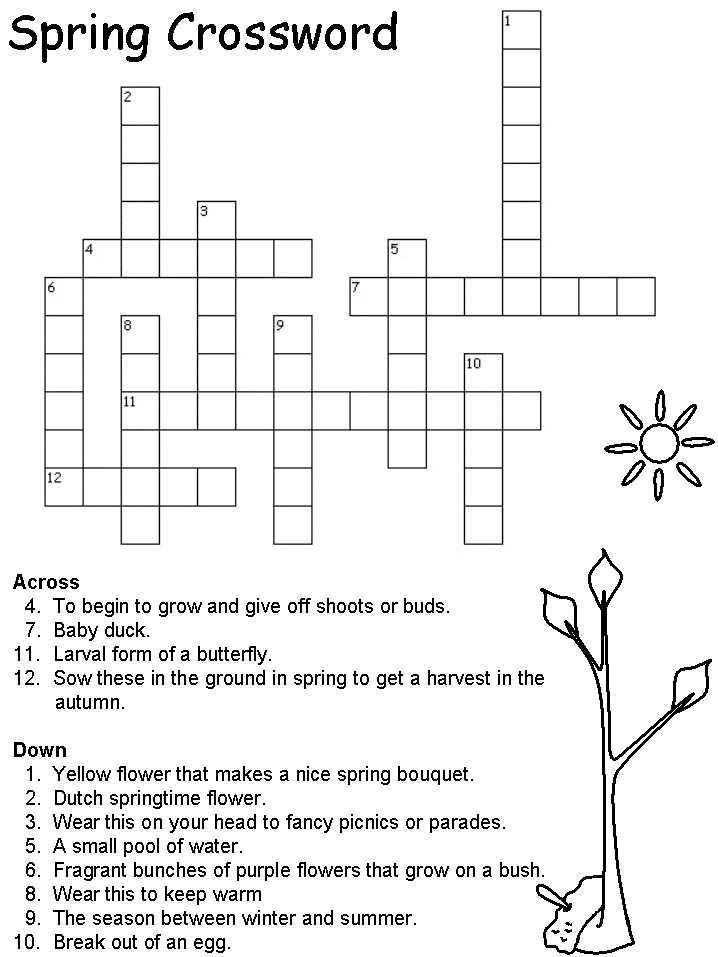

A financial aid crossword puzzle is a game or activity that tests one’s knowledge and understanding of various financial aid terms and concepts. It typically consists of a grid of squares, with each square representing a letter of a word or phrase related to financial aid. The objective of the puzzle is to fill in the grid with the correct letters to form the words or phrases that correspond to the given clues.

These puzzles are often used as educational tools to help students learn and familiarize themselves with the vocabulary and terminology used in financial aid applications and processes. They can be a fun and engaging way to review and reinforce the information covered in financial aid workshops or counseling sessions, and can also serve as a study resource for students preparing for exams or assessments related to financial aid.

Financial aid crossword puzzles can cover a wide range of topics, including types of financial aid (such as grants, scholarships, and loans), application procedures, eligibility criteria, terms and conditions, and more. They can be designed for different levels of difficulty, allowing individuals to challenge themselves and improve their understanding of financial aid concepts over time.

These crossword puzzles can be found in various formats, including printable worksheets, online interactive games, and mobile applications. They can be completed individually or in groups, making them a versatile tool for both independent study and collaborative learning.

Importance of an answer key

Having an answer key for a crossword puzzle is vital for several reasons. It serves as a reference tool for individuals trying to solve the puzzle, helping them verify their answers and stay on track. Without an answer key, participants may become frustrated and give up, as they have no way of knowing if their answers are correct.

An answer key also offers a learning opportunity. By comparing their responses to the correct answers, solvers can identify where they went wrong and learn from their mistakes. This process encourages critical thinking and problem-solving skills, as individuals analyze clues and patterns to arrive at the correct solutions.

Additionally, an answer key can be used as a teaching resource. In an educational setting, it allows teachers to evaluate students’ progress and understanding of the subject matter. By reviewing the answer key together, teachers can provide explanations and feedback, clarifying any misunderstandings and reinforcing key concepts.

- Helps verify answers and stay on track

- Provides a learning opportunity to identify mistakes and improve

- Serves as a teaching resource for evaluation and feedback

In conclusion, an answer key is a valuable tool that enhances the puzzle-solving experience. It not only helps individuals solve crosswords effectively but also promotes learning and serves as a teaching tool. Having an answer key ensures that participants can stay motivated and engaged, making the overall experience more enjoyable and rewarding.

Understanding Financial Aid Terms

When it comes to applying for financial aid and scholarships, understanding the terms used in the application process is essential. Here are some key financial aid terms that you should familiarize yourself with:

- Free Application for Federal Student Aid (FAFSA): The FAFSA is the form that students must complete in order to apply for federal financial aid. It collects information about a student’s family income and assets to determine their eligibility for grants, loans, and work-study programs.

- Scholarship: A scholarship is a form of financial aid that does not need to be repaid. It is typically awarded based on merit, such as academic achievement, athletic ability, or talent in a specific field.

- Grant: A grant is a form of financial aid that does not need to be repaid. It is typically awarded based on financial need and can come from the federal government, state governments, or colleges and universities.

- Loan: A loan is a form of financial aid that must be repaid with interest. There are different types of loans, including federal loans and private loans. It is important to carefully consider the terms of a loan before accepting it.

- Work-study: Work-study is a federal program that provides part-time jobs to students with financial need. These jobs are typically on-campus and the earnings can be used to help pay for educational expenses.

Understanding these financial aid terms will help you navigate the application process and make informed decisions about your financial aid options. It is important to read and understand all the terms and conditions of any financial aid or scholarship offers before accepting them to ensure you are making the best choices for your education and future financial well-being.

Grants and Scholarships

Grants and scholarships are financial aids that do not need to be repaid, making them highly sought-after by students. They are considered a gift or “free money” and can greatly lighten the financial burden of education.

Grants are typically awarded based on financial need. They are provided by the government, institutions, or private organizations. Students often need to submit a Free Application for Federal Student Aid (FAFSA) to determine their eligibility for grants. Some common types of grants include Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), and state grants. These grants can cover a significant portion of tuition fees, textbooks, and living expenses.

Scholarships, on the other hand, are awarded based on academic or extracurricular achievements, talents, or specific criteria set by organizations. They can be provided by colleges, universities, private donors, or external organizations. Scholarships can cover a wide range of expenses, including tuition, fees, books, and sometimes even living expenses. They can be one-time awards or renewable for multiple years. Scholarship applications often require essays, letters of recommendation, transcripts, and other supporting documents.

Both grants and scholarships are highly competitive, and it is essential for students to explore various sources and meet all the application requirements. They can significantly reduce the financial burden of education and make it more accessible to deserving students.

Loans

Loans are a common form of financial aid that students can use to help pay for their education. Unlike scholarships or grants, loans need to be repaid with interest. However, loans can be a valuable resource for students who may not have access to other forms of funding.

There are different types of loans available to students, including federal student loans and private student loans. Federal student loans are offered by the government and often have lower interest rates and more flexible repayment options. Private student loans, on the other hand, are provided by banks or other financial institutions and may have higher interest rates and stricter repayment terms.

Subsidized Stafford Loans are a common type of federal student loan. These loans are available to undergraduate students with demonstrated financial need, and the government covers the interest while the student is in school and during certain deferment periods. Unsubsidized Stafford Loans are also available to undergraduate and graduate students, but the student is responsible for paying the interest that accrues on the loan.

Students should carefully consider their options and borrow only what they need to cover their educational expenses. It’s important to remember that loans are a financial obligation and will need to be repaid after graduation. Students should also be aware of the terms and conditions of their loan, including the interest rate, repayment period, and any fees or penalties associated with the loan.

- Key phrases: loans, financial aid, pay for their education, scholarships, grants, repaid with interest, valuable resource, federal student loans, private student loans, lower interest rates, flexible repayment options, subsidized Stafford Loans, unsubsidized Stafford Loans, demonstrated financial need, interest accrues, educational expenses, financial obligation, repayment period, fees or penalties.

Work-Study Programs

The work-study program is a form of financial aid that allows students to work part-time jobs to help cover their educational expenses. This program is typically offered by colleges and universities and provides students with the opportunity to gain work experience while earning money to pay for their education.

One of the main advantages of work-study programs is that students can work on campus, which allows for convenient scheduling and eliminates the need for commuting. Additionally, these programs often provide students with flexible work hours that can be tailored to their class schedules.

Participating in a work-study program can provide students with a variety of benefits:

- Financial Assistance: The income earned through work-study jobs can help offset the cost of tuition, books, and other educational expenses.

- Work Experience: Work-study jobs often provide students with valuable work experience in their field of study, which can enhance their resume and increase their chances of future employment.

- Networking Opportunities: Through their work-study jobs, students have the opportunity to network with professionals in their field, which can lead to valuable connections and potential job opportunities after graduation.

- Time Management Skills: Balancing work and academics teaches students valuable time management skills that can benefit them in their future careers.

It’s important to note that work-study programs usually have a limited number of positions available, and eligibility is often based on financial need. Therefore, it is recommended that students apply for work-study as early as possible to increase their chances of securing a position.

Overall, work-study programs provide a valuable opportunity for students to earn money and gain experience while pursuing their education. They offer financial assistance, practical skills, and networking opportunities that can greatly contribute to a student’s academic and professional success.

How to use the financial aid crossword puzzle

Using the financial aid crossword puzzle can be a fun and interactive way to test your knowledge of financial aid terms and concepts. Whether you are a student looking to apply for financial aid or a parent seeking information, this crossword puzzle can help you understand the terminology and requirements of the financial aid process.

To use the crossword puzzle, start by printing it out or opening it on your computer. You can then read through the clues and fill in the corresponding answers in the crossword grid. If you are unsure about a particular answer, you can refer to the answer key for guidance. It is important to note that using the answer key should be a tool for learning and understanding, rather than just quickly filling in the answers.

Here are some tips for making the most of the financial aid crossword puzzle:

- Take your time: Use the crossword puzzle as an opportunity to engage with the material and take your time to think through each clue. This will help you remember the information more effectively.

- Refer to resources: If you are encountering unfamiliar terms or concepts, don’t hesitate to use additional resources like financial aid websites or textbooks to learn more.

- Discuss with others: Consider completing the crossword puzzle with a friend or family member. This can lead to meaningful discussions about financial aid and enhance your understanding.

- Review your answers: Once you have completed the crossword puzzle, go through the answer key to check your responses. Take note of any incorrect answers and use this as an opportunity to learn and improve your knowledge.

- Repeat the activity: To reinforce your understanding of financial aid, repeat the crossword puzzle at a later time. This will help solidify the information in your memory.

By using the financial aid crossword puzzle, you can make the process of learning about financial aid more engaging and enjoyable. It is an effective tool for familiarizing yourself with the terms and concepts that are essential for navigating the financial aid process successfully.

Tips for beginners

Starting out on your financial aid crossword puzzle journey can be both exciting and overwhelming. Below are some tips to help beginners get started and navigate through the process.

1. Read the instructions carefully

Take the time to carefully read and understand the instructions provided with the crossword puzzle. This will give you a clear understanding of what is expected and how to approach solving the puzzle.

2. Familiarize yourself with financial aid terms

Make sure you have a good understanding of the various terms and concepts related to financial aid. This will help you recognize the clues provided in the crossword puzzle and make it easier to find the correct answers.

3. Start with the easy clues

When you first begin solving the crossword puzzle, start with the clues that seem the easiest to you. This will give you a sense of accomplishment and boost your confidence as you find the correct answers.

4. Use the process of elimination

If you are unsure of a particular answer, use the process of elimination. Cross out the options that you know are incorrect and focus on the remaining choices. This will increase your chances of selecting the correct answer.

5. Take breaks

Don’t be afraid to take breaks when working on the crossword puzzle. Sometimes stepping away for a few minutes can help clear your mind and provide a fresh perspective when you return.

Remember, solving a crossword puzzle takes time and practice. Don’t get discouraged if you don’t immediately find all the answers. With patience and perseverance, you will become more skilled at completing financial aid crossword puzzles. Good luck!