Financial mathematics is an essential field of study for anyone pursuing a career in finance or economics. It focuses on applying mathematical concepts and techniques to analyze and solve financial problems. At its core, financial mathematics involves the use of mathematical models to make predictions and make informed decisions about investments, risk management, and financial planning.

Unit 1 exam in financial mathematics serves as a comprehensive assessment of the foundational concepts and techniques covered in the course. It tests the students’ understanding of essential mathematical tools and their ability to apply them in real-world financial scenarios. The exam evaluates their skills in financial calculations, interpreting and analyzing data, and making informed financial decisions.

This exam covers a wide range of topics, including compound interest, present value, annuities, yield, and risk management. Students are expected to demonstrate their proficiency in performing calculations related to these concepts accurately. Additionally, they are required to interpret and analyze financial data, such as interest rates, time value, and the impact of risk on investment decisions.

Overall, the Unit 1 exam in financial mathematics plays a crucial role in assessing students’ mathematical proficiency in a financial context. It not only evaluates their ability to solve complex financial equations but also tests their critical thinking skills, data analysis abilities, and their understanding of the fundamental relationships in finance. By successfully completing this exam, students demonstrate their readiness to tackle more advanced financial concepts and challenges in their future careers.

What is financial mathematics?

Financial mathematics, also known as mathematical finance, is a field of study that combines mathematical concepts and techniques with financial theories and models. It involves the application of mathematical tools and methods to solve problems related to finance, investment, risk management, and financial decision-making.

Financial mathematics plays a crucial role in various areas of finance, such as investment banking, asset management, derivatives trading, and insurance. It helps professionals analyze and make informed decisions regarding financial products, investments, and risk management strategies.

Some of the key areas covered in financial mathematics include probability theory, statistics, calculus, optimization, and stochastic processes. These mathematical tools enable analysts and practitioners to model and simulate complex financial systems, forecast market trends, price options and derivatives, and assess investment risks.

Financial mathematics also involves the development and implementation of computational algorithms and mathematical models to analyze and interpret financial data. It helps professionals in finance and trading to formulate strategies, generate investment portfolios, and assess the profitability and risk of various financial instruments.

In summary, financial mathematics is a multidisciplinary field that combines mathematical techniques with financial theories to analyze, model, and solve problems related to finance and investment. It provides professionals in the financial industry with a solid foundation to understand and navigate the complexities of the financial markets and make informed decisions.

The Importance of Financial Mathematics in Today’s World

Financial mathematics plays a crucial role in today’s world, where businesses and individuals constantly make financial decisions that can have a significant impact on their financial well-being. Whether it is managing personal finances, investing in stocks, or analyzing the risk of a financial product, having a solid understanding of financial mathematics is essential.

One of the key areas where financial mathematics is important is in personal finance management. Individuals need to understand concepts such as compound interest, budgeting, and long-term financial planning to make informed decisions about saving, investing, and spending their money. Financial mathematics helps individuals calculate the optimal amount to save, the return on investment for different financial products, and the time it will take to achieve their financial goals.

In addition, financial institutions and businesses heavily rely on financial mathematics to analyze and manage risk. For example, banks use mathematical models to assess the creditworthiness of loan applicants and to calculate interest rates. Investment firms use mathematical models to evaluate the potential risks and returns of different investment strategies. Without a solid understanding of financial mathematics, these institutions would not be able to make informed decisions and manage their risks effectively.

Overall, financial mathematics is essential in today’s world to make informed financial decisions, manage personal finances, and analyze and manage risk. It allows individuals and businesses to navigate the complex financial landscape and optimize their financial outcomes. Therefore, it is crucial for individuals to acquire a solid understanding of financial mathematics to ensure their financial success.

Exam format and structure

The financial mathematics unit 1 exam is a comprehensive assessment that evaluates students’ understanding of key mathematical concepts and their application in the financial field. The exam consists of multiple-choice questions, short-answer questions, and problem-solving questions.

The multiple-choice questions assess students’ knowledge of basic financial mathematics concepts such as interest rates, compound interest, annuities, and loans. These questions require students to select the correct answer from a set of options, testing their understanding of formulas and calculations.

The short-answer questions require students to provide concise explanations or calculations for specific financial scenarios. These questions test their ability to apply mathematical concepts to real-world situations and demonstrate their understanding of the principles behind various financial calculations.

The problem-solving questions are the most challenging part of the exam. They require students to analyze complex financial problems, identify the appropriate mathematical techniques to solve them, and apply those techniques to arrive at a solution. These questions often involve multiple steps and may require students to manipulate equations, perform calculations, or interpret data.

The exam is designed to assess students’ analytical thinking, problem-solving skills, and ability to apply mathematical concepts in a financial context. It is important for students to review the course materials, practice solving different types of problems, and familiarize themselves with the format and structure of the exam in order to perform well.

Types of questions that may be asked

In the Financial Mathematics Unit 1 exam, students can expect to encounter a range of different question types. These questions are designed to test their understanding and application of key mathematical concepts in the context of finance and economics. Some of the common question types include:

- Single calculation: These questions require students to perform a single calculation based on given information. This could involve calculating interest rates, future values, present values, or other financial measures.

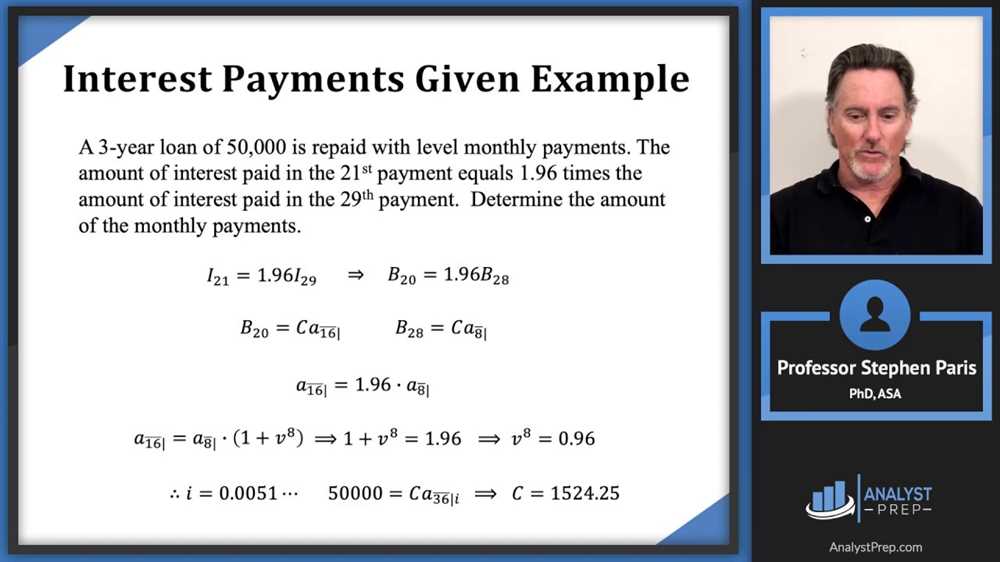

- Complex calculations: These questions involve multiple steps and calculations. Students may be asked to apply various financial formulas and equations to solve a complex problem. This could include calculating loan repayments, annuities, or investment returns.

- Scenario-based questions: These questions present a real-world scenario or case study and require students to analyze the given information and apply their knowledge of financial mathematics to solve the problem. Students may need to make assumptions and use critical thinking skills to determine the best course of action.

- Graphical analysis: Questions in this category involve interpreting and analyzing graphs, charts, and diagrams related to financial data. Students may need to identify trends, calculate growth rates, or make predictions based on the given graphical representation.

- Short answer questions: These questions require students to provide brief, concise answers to specific questions. They may be asked to define key terms, explain concepts, or describe the steps involved in solving a particular financial mathematics problem.

It is important for students to be familiar with these question types and to practice solving similar problems before the exam. Working through past papers, completing practice questions, and seeking additional support from teachers or tutors can help students develop the skills and confidence needed to excel in the Financial Mathematics Unit 1 exam.

Time allotted for the exam

The time allotted for the Financial Mathematics Unit 1 exam is an important factor to consider in order to plan your exam strategy effectively. This exam consists of 100 multiple choice questions and you will have 2 hours to complete it. It is crucial to manage your time wisely and allocate sufficient time for each question.

During the exam, it is recommended to spend approximately 1-2 minutes per question. This allows you to read and understand each question thoroughly, analyze the given options, and select the most appropriate answer. It is important to avoid spending too much time on a single question, as it can disrupt your pace and hinder your progress in completing the exam within the allotted time.

To make the most of the time allotted, it is helpful to practice solving similar multiple-choice questions under timed conditions before the exam. This will allow you to familiarize yourself with the format and style of the questions, improve your speed, and enhance your overall performance.

Remember, time management is a key aspect of achieving success in any exam. By planning your approach, practicing effectively, and staying focused during the Financial Mathematics Unit 1 exam, you can maximize your chances of achieving a favorable outcome.

Key concepts and topics covered

The Financial Mathematics Unit 1 exam covers several key concepts and topics that are essential for understanding and analyzing financial markets and instruments. These concepts include time value of money, interest rates, cash flows, risk and return, and investment analysis.

One of the central concepts covered in the exam is the time value of money. This concept emphasizes the idea that money available at different points in time has different values. Students will learn how to calculate and compare the present and future values of cash flows, as well as the different methods used for discounting and compounding.

Interest rates are another critical area of study in financial mathematics. Students will explore the different types of interest rates, including simple interest and compound interest, and learn how to calculate and understand the impact of interest rate changes on investment returns and cash flows.

Cash flows and investment analysis are also important topics covered in the exam. Students will learn how to calculate and analyze the cash flows associated with different investment projects and evaluate their financial viability. They will also learn about different methods of investment analysis, such as net present value (NPV) and internal rate of return (IRR), to make informed investment decisions.

Risk and return is another key concept covered in the exam. Students will learn about the different types of risk associated with investments and how to measure and manage this risk. They will also explore the relationship between risk and return, including the concept of the risk-return tradeoff.

Time value of money

The concept of time value of money is essential in financial mathematics as it helps in understanding the relationship between time and money. It recognizes that the value of money changes over time due to factors like inflation, interest rates, and opportunity cost.

Interest rates: The time value of money is influenced by interest rates. When money is invested or saved, it has the potential to earn interest over time. Interest rates represent the cost of borrowing or the return on investment and affect the present value of future cash flows.

Inflation: Inflation is another factor that affects the time value of money. Over time, the purchasing power of money decreases due to the rise in the general price level. As a result, the future value of money decreases, leading to a lower present value.

- Opportunity cost: The time value of money also considers the concept of opportunity cost. Money invested or spent today is no longer available for other uses, resulting in the opportunity cost of potential future gains or investments. Understanding the time value of money helps individuals and businesses make informed decisions about allocating their resources.

- Present value and future value: The time value of money allows for the calculation of present value and future value. Present value represents the current worth of a future cash flow, while future value represents the value of an investment or cash flow at a future point in time, considering the time value of money.

Overall, the time value of money is a critical concept in financial mathematics that helps individuals and businesses analyze the worth of money over time. It takes into consideration factors like interest rates, inflation, and opportunity cost to accurately assess the present and future value of cash flows.

Interest rates and compounding

The concept of interest rates and compounding is fundamental in financial mathematics. Interest rates refer to the cost of borrowing money or the return on investment, expressed as a percentage. In simple terms, it is the amount charged or earned for the use of money over a given period of time. Understanding interest rates is crucial for making informed financial decisions, whether it’s obtaining a loan or investing money.

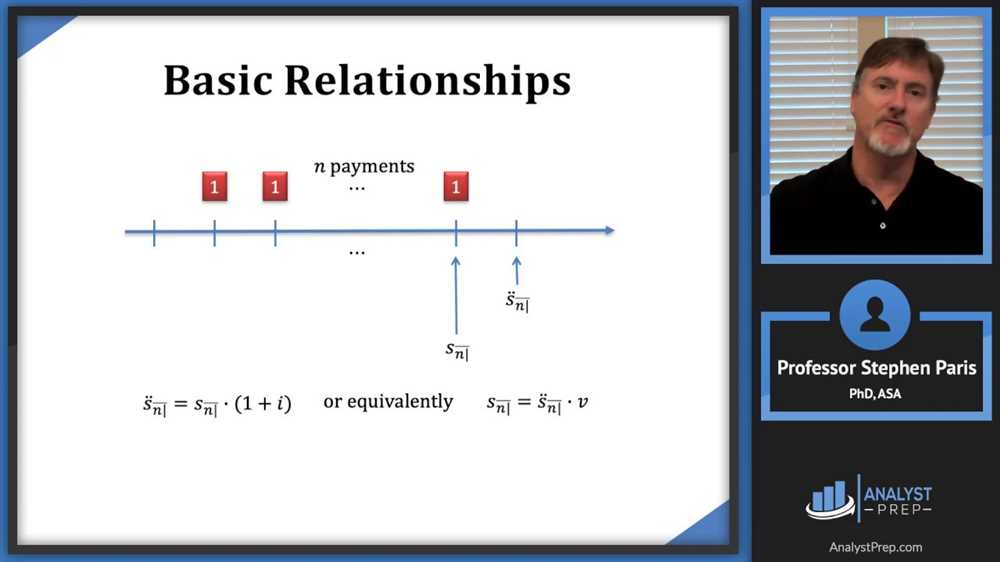

Compounding, on the other hand, refers to the process of earning interest on both the initial principal and any accumulated interest from previous periods. This compounding effect allows investments or debts to grow exponentially over time. The more frequently interest is compounded, the faster the growth or accumulation of the investment or debt.

Interest rates can be fixed or variable, meaning they can either stay the same throughout the entire period of borrowing or change over time based on market conditions. Factors that influence interest rates include inflation, supply and demand of money, and the risk associated with the borrower or investment.

For example, in a low-interest-rate environment, borrowing money becomes more affordable, encouraging businesses and individuals to invest and spend. On the other hand, high-interest rates can be a deterrent for borrowing and may result in slower economic growth.

Compounding can have significant impacts on the final amount of an investment or loan. By reinvesting the interest earned, you can accelerate the growth of your investment. Meanwhile, in the case of loans, compounding can result in a much larger repayment amount due to the added interest on top of the principal.

In summary, understanding interest rates and compounding is essential in financial mathematics. It helps individuals and businesses make informed decisions about borrowing and investing, considering the potential growth or repayment implications over time.