Understanding personal finance is crucial for achieving financial success and stability. In Chapter 9 of the “Foundations in Personal Finance” textbook, students gain valuable insights into various aspects of personal finance, such as insurance, voting, and credit scores. This chapter delves into the significance of managing risks, making informed decisions, and building a strong credit history.

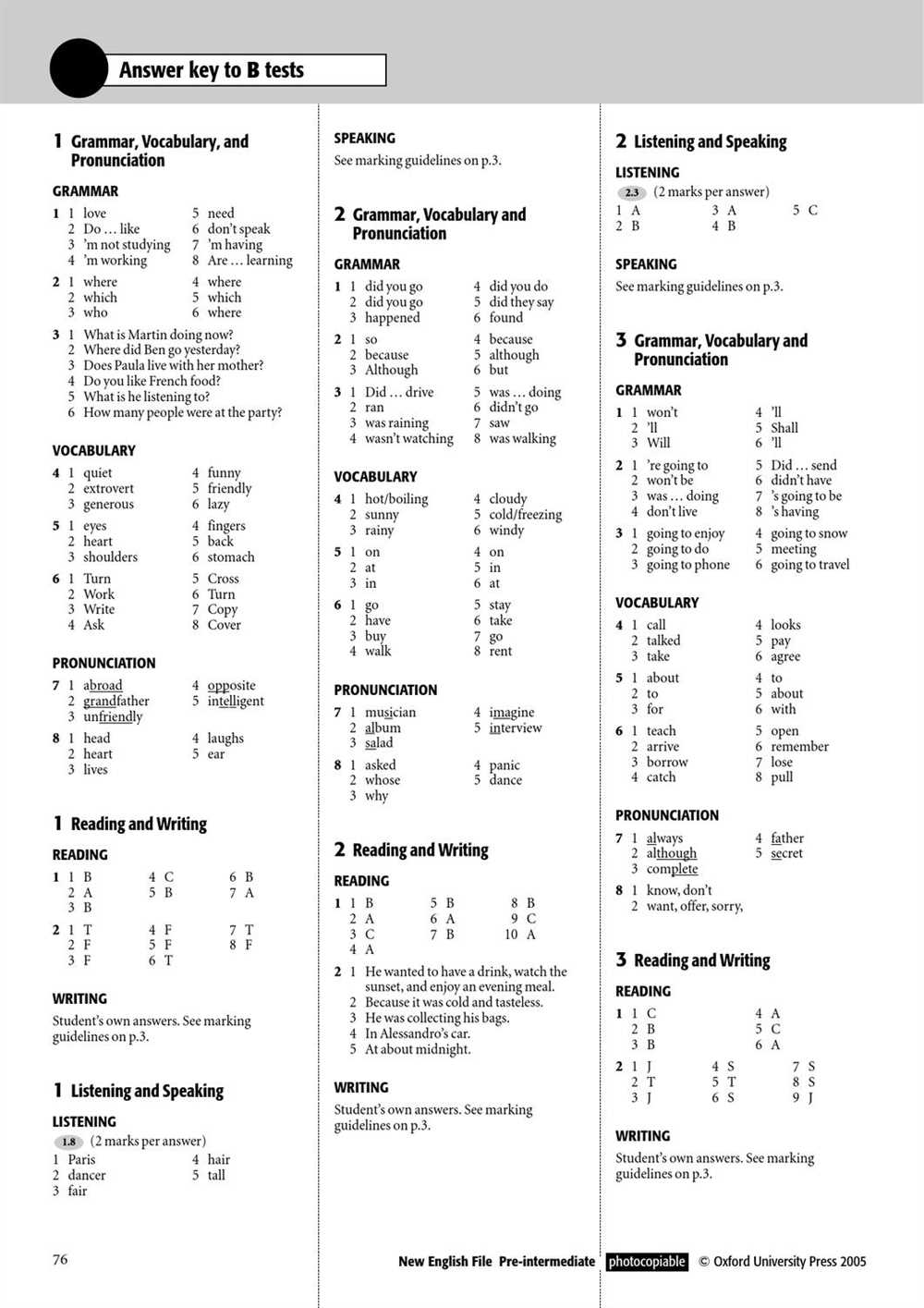

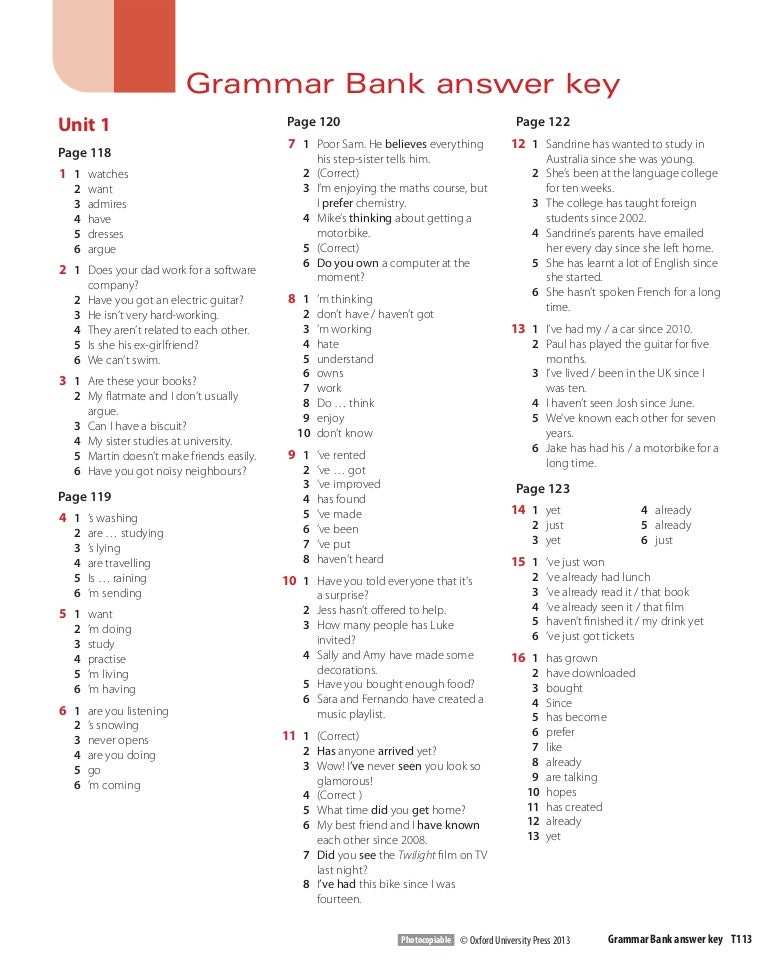

The answer key for Chapter 9 of the “Foundations in Personal Finance” textbook is a valuable resource that provides students with comprehensive explanations and solutions to the exercises and questions found throughout the chapter. This PDF answer key assists students in better comprehending the concepts taught in the chapter and aids them in reinforcing their understanding of personal finance principles.

By utilizing the answer key, students can check their work, identify areas for improvement, and solidify their understanding of key topics, such as the types of insurance coverage, the process of voting, and the factors influencing credit scores. This valuable tool empowers students to take control of their financial future by providing them with the knowledge and skills necessary to make informed financial decisions and navigate the complex world of personal finance.

Chapter 9 Answer Key PDF: Foundations in Personal Finance

In the world of personal finance, it is important to have a solid foundation of knowledge and skills in order to make informed financial decisions. Chapter 9 of the Foundations in Personal Finance textbook provides an answer key in PDF format, which is a valuable resource for students and individuals looking to test their understanding of the material.

The answer key PDF for Chapter 9 offers a comprehensive breakdown of the chapter’s content, including key vocabulary terms, important concepts, and practice exercises. This resource allows individuals to review the material at their own pace and assess their understanding of the chapter’s topics and objectives.

The answer key provides step-by-step solutions to the practice exercises, allowing students to check their work and identify any areas of confusion or misunderstanding. It also offers explanations and additional examples to further clarify the concepts covered in the chapter, helping students develop a deeper understanding of personal finance principles.

By utilizing the Chapter 9 answer key PDF, individuals can strengthen their knowledge and skills in areas such as budgeting, financial planning, and goal setting. It serves as a valuable tool for self-assessment and review, allowing individuals to gauge their progress and identify areas for improvement.

Overall, the Chapter 9 answer key PDF is an essential resource for anyone studying Foundations in Personal Finance. It provides a comprehensive breakdown of the chapter’s content and offers step-by-step solutions to practice exercises, helping individuals develop a strong understanding of personal finance principles and improve their financial decision-making skills.

Understanding Chapter 9: Retirement and Estate Planning

The ninth chapter of Foundations in Personal Finance delves into the important topics of retirement and estate planning. This chapter aims to help individuals develop a clear understanding of the steps and considerations involved in planning for their future financial security and the transition of assets after their passing.

Retirement planning is a crucial aspect of personal finance as it involves making financial decisions and investments to ensure a comfortable and secure retirement. The chapter highlights the importance of starting early and consistently saving for retirement, emphasizing the power of compound interest and the benefits of employer-sponsored retirement plans, such as 401(k)s and IRAs.

Estate planning is another critical component that individuals should proactively address to secure their assets and ensure a smooth transfer to their beneficiaries. The chapter explores various estate planning tools and strategies, such as wills, trusts, and power of attorney documents. It also explains the importance of regularly reviewing and updating estate plans to adapt to changing circumstances.

In addition to retirement and estate planning, Chapter 9 discusses other essential topics related to long-term financial security, including social security benefits, healthcare planning, and risk management through insurance. The text provides practical advice, tips, and real-life examples to help individuals navigate these complex areas and make informed decisions that align with their financial goals.

Overall, Chapter 9 of Foundations in Personal Finance serves as a valuable resource for individuals looking to gain a comprehensive understanding of retirement and estate planning. By equipping readers with the knowledge and tools needed to make sound financial decisions, the chapter empowers them to take control of their financial future and ensure their hard-earned assets are protected and distributed according to their wishes.

Importance of Retirement Planning

Retirement planning is crucial for individuals to ensure financial security and a comfortable lifestyle in their later years. It involves setting aside funds and making investment decisions that will provide a steady income stream during retirement. Without proper planning, individuals may find themselves facing financial difficulties and struggling to meet their basic needs.

Financial security: Retirement planning allows individuals to secure their financial future by building a nest egg. By starting early and consistently saving for retirement, individuals can accumulate wealth that will support their lifestyle after they stop working. This financial security provides peace of mind and reduces stress about the future.

Inflation protection: It’s important to consider the impact of inflation when planning for retirement. Inflation can erode the purchasing power of money over time, meaning that the expenses in retirement may be significantly higher than during working years. By factoring in inflation and making appropriate investment choices, individuals can ensure that their retirement savings grow at a rate that keeps up with or exceeds inflation.

Longevity: With increased life expectancy, retirement can last for several decades. Without proper planning, individuals may outlive their savings and be at risk of financial hardship during their later years. Retirement planning takes into account the potential length of retirement and helps individuals prepare financially for a long period of time without a regular income.

Flexibility and choice: Retirement planning allows individuals to have more control over their future. By making strategic financial decisions, individuals can have the freedom to choose when and how they retire. Whether they want to retire early, have a part-time job, or pursue a new hobby, proper planning can provide the flexibility to make these choices and enjoy retirement to the fullest.

Healthcare expenses: Medical costs tend to increase as individuals age, and it’s important to plan for healthcare expenses during retirement. By considering the potential costs of healthcare and long-term care, individuals can factor these expenses into their retirement savings plan. This helps ensure that there are adequate funds to cover medical needs and maintain a good quality of life during retirement.

Peace of mind: Ultimately, retirement planning provides peace of mind for individuals and their families. By knowing that they have taken the necessary steps to secure their financial future, individuals can focus on enjoying retirement and spending time with loved ones without the constant worry of money matters. It brings a sense of security and allows individuals to make the most of their retirement years.

Benefits of Retirement Planning

Retirement planning is an essential step in securing a financially stable future. By taking the time to plan and prepare for retirement, individuals can enjoy a variety of benefits that will greatly enhance their quality of life during their golden years. Here, we explore some of the key advantages of retirement planning.

1. Financial security

One of the main benefits of retirement planning is the ability to achieve financial security. By carefully saving and investing over an extended period of time, individuals can accumulate a significant nest egg that will provide a stable source of income after retirement. This financial security allows retirees to cover their living expenses, enjoy leisure activities, and handle unexpected expenses without worrying about running out of money.

2. Peace of mind

Retirement planning also brings a sense of peace of mind. By having a solid plan in place, individuals can feel confident that they have taken the necessary steps to provide for their future. This peace of mind stems from knowing that they have enough savings and investments to maintain their desired lifestyle and handle any unforeseen circumstances that may arise.

3. More flexibility and options

With proactive retirement planning, individuals have more flexibility and options in their retirement years. By diligently saving and investing, retirees can have the freedom to choose when and how they want to retire. They may have the option to retire early, pursue new hobbies or passions, travel extensively, or spend more time with loved ones. Retirement planning provides the financial resources to enjoy these options without the stress of financial constraints.

4. Legacy and inheritance

Another benefit of retirement planning is the ability to leave a legacy and provide for loved ones. By effectively managing finances during retirement, individuals can leave behind an inheritance for their children or grandchildren. This can help future generations achieve their own financial goals and provide for their families. Retirement planning allows individuals to leave a lasting impact and ensure a comfortable future for their loved ones.

5. Sense of accomplishment

Lastly, retirement planning offers a sense of accomplishment. By setting financial goals, creating a plan, and working towards those goals, individuals can experience a sense of achievement and satisfaction in knowing that they have successfully prepared for their retirement. This sense of accomplishment can provide a significant boost to mental and emotional well-being.

In conclusion, retirement planning offers a multitude of benefits including financial security, peace of mind, more flexibility in retirement, the ability to leave a legacy, and a sense of accomplishment. Taking the time to plan for retirement is an investment in one’s future and can greatly enhance the overall quality of life during retirement years.

Types of Retirement Accounts

When planning for retirement, it is important to understand the different types of retirement accounts available. These accounts offer various tax advantages and savings options, allowing individuals to accumulate funds for their future needs. Here are some commonly used retirement account options:

- 401(k): A 401(k) is an employer-sponsored retirement account that allows employees to contribute a portion of their salary on a pre-tax basis. Employers may also match a certain percentage of the employee’s contributions. The funds within a 401(k) grow tax-deferred until withdrawal, and contributions are limited to a set annual amount.

- Traditional IRA: An Individual Retirement Account (IRA) is a personal retirement savings account that allows individuals to contribute pre-tax income. The funds in a traditional IRA grow tax-deferred until withdrawal. Contributions to a traditional IRA may be tax-deductible, depending on the individual’s income level and participation in an employer-sponsored retirement plan.

- Roth IRA: A Roth IRA is another type of individual retirement account, but contributions are made with after-tax income. While contributions to a Roth IRA are not tax-deductible, the funds grow tax-free and withdrawals in retirement are also tax-free. There are income limits for eligibility to contribute to a Roth IRA.

- SEP IRA: A Simplified Employee Pension (SEP) IRA is a retirement account for self-employed individuals and small business owners. Contributions to a SEP IRA are tax-deductible and grow tax-deferred until withdrawal. SEPs offer higher contribution limits compared to traditional IRAs.

- Simple IRA: A Savings Incentive Match Plan for Employees (SIMPLE) IRA is an employer-sponsored retirement account that is available to small businesses. Employers must make contributions to employees’ accounts, and employees can also contribute. Similar to a traditional IRA, funds within a SIMPLE IRA grow tax-deferred until withdrawal.

When considering the best retirement account option, it is important to consult with a financial advisor or tax professional to understand the specific rules and regulations associated with each account. Additionally, factors such as income level, employment status, and contribution limits should be taken into consideration.

Strategies for Retirement Savings

Retirement savings is a critical component of financial planning, and there are several strategies individuals can employ to ensure they are adequately prepared for their retirement years.

1. Start early: One of the most important strategies for retirement savings is to start as early as possible. By starting early, individuals have the advantage of time on their side, allowing their investments to compound over many years. This can significantly increase the amount of money saved for retirement.

2. Contribute to retirement accounts: Another effective strategy is to contribute regularly to retirement accounts such as 401(k)s or IRAs. Taking advantage of employer matching contributions or tax advantages can help individuals maximize their retirement savings.

3. Diversify investments: It is also important to diversify investments to mitigate risk. By spreading investments across different asset classes, such as stocks, bonds, and real estate, individuals can help protect their savings from market fluctuations and potential losses.

4. Keep expenses in check: Controlling expenses is another important strategy for retirement savings. By living within their means and avoiding unnecessary expenses, individuals can free up more money to save for retirement.

5. Adjust savings as needed: Finally, it is essential to regularly evaluate and adjust retirement savings as needed. Life circumstances may change, and individuals should reassess their savings goals and make necessary adjustments to ensure they are on track.

In conclusion, strategies for retirement savings include starting early, contributing regularly to retirement accounts, diversifying investments, keeping expenses in check, and adjusting savings as needed. By implementing these strategies, individuals can increase their chances of having a secure and comfortable retirement.