Government spending is a crucial aspect of any country’s economy, as it plays a significant role in shaping the nation’s infrastructure, public services, and overall well-being of its citizens. In the United States, government spending is a complex and multifaceted process that involves various levels of government and is guided by a set of principles.

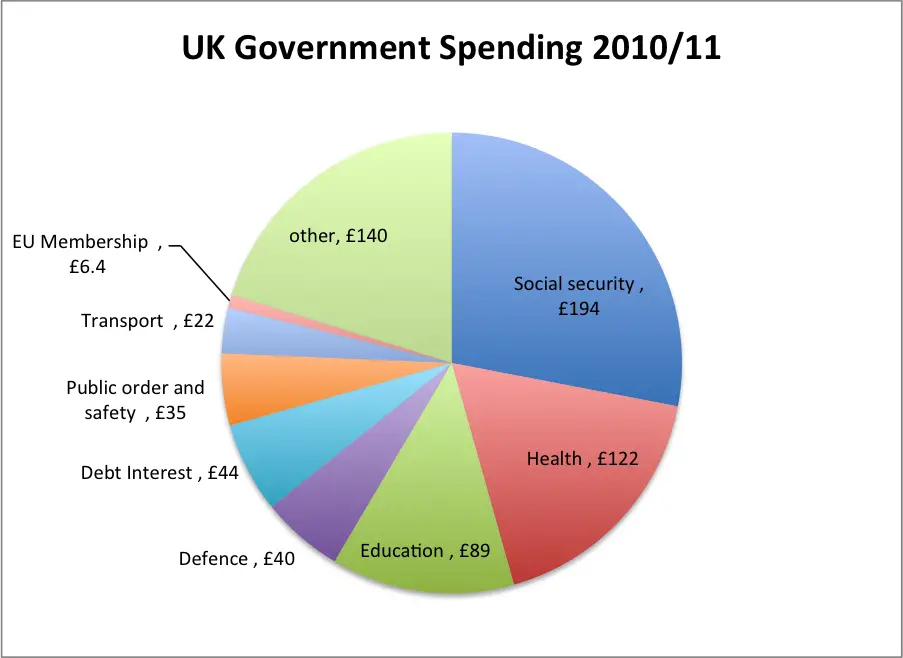

One key question that often arises when discussing government spending is how the government determines how much to spend and where to allocate those funds. To answer this question, it’s important to understand the concept of budgeting. Each year, the federal government goes through a budgeting process to decide how much money will be spent on different categories, such as defense, education, healthcare, and infrastructure.

Government spending is funded through a variety of sources, including taxes, borrowing, and revenue from government-owned enterprises. Taxes imposed on individuals and businesses play a significant role in financing government activities, while borrowing allows the government to cover expenses when there is a deficit. Additionally, revenue generated from government-owned enterprises can be used to fund specific projects or initiatives.

The consequences of government spending are far-reaching, as it can impact economic growth, inflation, and the overall level of public services provided. It is crucial for citizens to understand the basics of government spending in order to actively participate in the decision-making process and hold their elected officials accountable for how taxpayer money is being spent.

Government Spending iCivics Answers: Understanding How the Government Allocates Funds

Government spending is a crucial aspect of a functioning democracy, as it determines how public funds are allocated and used for the benefit of the citizens. iCivics offers valuable resources to help understand the complexities of government spending and the processes involved in budgeting.

One of the main questions addressed by iCivics is how the government decides where to allocate funds. In order to ensure fair and equitable distribution, the government uses a variety of mechanisms such as budgeting, appropriations, and grants. These mechanisms help prioritize funding for areas such as education, healthcare, infrastructure, defense, and social welfare.

Budgeting: Budgeting is the process by which the government creates a plan for spending its revenue. It involves estimating income and expenses for a specific period, usually a fiscal year. iCivics provides interactive exercises and simulations to help students understand the budgeting process and the trade-offs involved in allocating funds to different sectors.

Appropriations: Appropriations refer to the legislative process of allocating funds to specific government agencies or programs. iCivics offers educational materials that explain how appropriations bills are proposed, debated, and passed in Congress. This helps students understand how elected officials make decisions about the distribution of public funds.

Grants: Grants are a form of financial assistance provided by the government to organizations, institutions, or individuals for specific purposes. They are often used to fund research, education, community development, and social services. iCivics provides resources to help students understand how grants are awarded and the impact they have on different sectors of society.

In conclusion, iCivics offers valuable resources to help students understand the intricacies of government spending and the processes involved in allocating funds. By engaging with these materials, individuals can gain a better understanding of how the government prioritizes its spending and the impact it has on different areas of society.

What is Government Spending?

Government spending refers to the financial resources that the government allocates to different sectors and areas in order to meet the needs and demands of the population. It includes the money spent on various public goods and services, such as infrastructure development, healthcare, education, defense, social welfare, and more. Government spending plays a crucial role in shaping the overall economic condition of a country and is an essential tool for governments to achieve their policy objectives.

Types of Government Spending:

- Capital Expenditure: This includes the spending on physical assets and infrastructure projects that are expected to generate economic benefits in the long run, such as building roads, bridges, schools, hospitals, and other public facilities.

- Operational Expenditure: This refers to the day-to-day expenses of the government, including salaries of government employees, maintenance costs, administrative expenses, and other routine expenditures.

- Social Expenditure: This category covers spending on social welfare programs, such as healthcare, education, housing assistance, unemployment benefits, and pensions, aimed at improving the well-being of citizens.

- Defense Expenditure: Governments allocate a significant portion of their budget to national defense, including military operations, equipment, personnel, and research and development.

Impacts of Government Spending:

Government spending has a direct impact on the economy, society, and individuals. It can stimulate economic growth by creating job opportunities, boosting demand for goods and services, and enhancing productivity through investments in infrastructure. Additionally, government spending on social welfare programs can reduce poverty, improve access to quality education and healthcare, and promote social equality.

Overall, government spending is a vital tool for governments to address the needs of their citizens, support economic development, and promote social well-being.

Types of Government Spending

The government allocates its funds for various purposes, known as government spending. These expenditures are essential for the functioning of a country and can be categorized into different types. Understanding the types of government spending is crucial for citizens to have a clear picture of where their tax dollars are being utilized and the impact it has on society.

1. Mandatory Spending: This type of government spending refers to expenses that are required by law. It includes programs such as Social Security, Medicare, and Medicaid, which provide benefits to eligible individuals. These programs are funded through specific taxes and are considered obligatory for the government to provide.

2. Discretionary Spending: Discretionary spending, on the other hand, is not mandated by law and is determined through annual appropriations. This type of spending includes areas such as defense, education, infrastructure development, and scientific research. Discretionary spending is subject to negotiation and can fluctuate from year to year based on the government’s priorities.

3. Interest on Debt: Another significant component of government spending is the payment of interest on the national debt. When the government borrows money to finance its operations, it incurs interest expenses that need to be repaid. These payments contribute to the overall government spending and can have an impact on the economy.

4. Transfer Payments: Transfer payments are funds distributed by the government to individuals or organizations without any direct goods or services being provided in return. This type of spending includes welfare programs, such as unemployment benefits, food stamps, and housing assistance. Transfer payments aim to provide support to those in need and stimulate economic stability.

By understanding the different types of government spending, individuals can evaluate the priorities and impact of the government’s financial allocations. This knowledge is essential for citizens to engage in informed discussions and have a voice in shaping public policies related to government expenditure.

iCivics Answers: How Does the Government Decide Where to Spend Money?

The government’s decision on where to spend money is a crucial aspect of its role in society. With limited resources, it must prioritize and allocate funds to various sectors and programs that serve the country’s needs and goals. The decision-making process involves careful consideration of economic, social, and political factors to ensure that taxpayer money is spent efficiently and effectively.

1. Budgetary Process: The government’s budgetary process is a key component of determining spending priorities. It starts with the creation of a budget proposal by the executive branch, which outlines the funding requirements for different government agencies and programs. This proposal then goes through a series of reviews, negotiations, and approvals by the legislative branch before becoming law.

2. Economic Priorities: Economic factors play a significant role in shaping government spending decisions. The government considers the state of the economy, such as its overall health, growth prospects, and areas that require stimulus or support. It may allocate funds for infrastructure development, job creation programs, or industry-specific initiatives to promote economic growth and stability.

3. Social Priorities: Government spending decisions also reflect society’s needs and priorities. It invests in sectors like education, healthcare, and social welfare programs to ensure the well-being and development of its citizens. Social priorities may vary across countries, but common areas of focus include reducing poverty, improving access to quality education, and providing healthcare services to all.

4. Political Influences: The government’s spending decisions are also influenced by political factors. Elected representatives may have their own agendas, commitments to constituents, or responsibilities towards special interest groups. These factors can influence the allocation of funds to specific projects or programs, even if they might not align perfectly with economic or social priorities.

5. External Considerations: The government also considers external factors when deciding where to spend money. It may take into account international commitments, security concerns, or obligations arising from treaties or agreements. For example, defense spending may be prioritized in times of geopolitical instability, while foreign aid funding may be allocated to support allies or address global challenges.

In summary, the government’s decision-making process for spending money involves a multidimensional approach that considers budgetary, economic, social, political, and external factors. It aims to ensure the optimal use of resources and address the needs and aspirations of the country and its citizens.

The Role of Budgeting in Government Spending

Government spending plays a crucial role in the functioning of a country’s economy. It is through government spending that public services and infrastructure projects are funded, social welfare programs are implemented, and public goods are provided. However, in order for government spending to be effective and efficient, a proper budgeting process must be in place.

Budgeting is the process of allocating financial resources to different government programs and activities. It involves setting spending priorities, estimating revenues, and determining how much money should be allocated to each program. Budgeting provides a framework for decision-making and ensures that the limited resources of a government are used in a responsible and accountable manner.

A well-planned budget helps the government to prioritize its spending according to the needs and goals of the country. It allows for proper allocation of funds to sectors such as healthcare, education, defense, and infrastructure development. Budgeting also helps in identifying areas where spending can be reduced or reallocated to more pressing needs. By making informed choices about where and how to allocate resources, the government can maximize the impact of its spending and promote economic growth.

Moreover, budgeting plays a crucial role in promoting transparency and accountability in government spending. A transparent budgeting process ensures that citizens are aware of how their tax dollars are being spent and can hold the government accountable for its fiscal decisions. It allows for public scrutiny and debate, which leads to better policies and a more responsible use of public funds.

In conclusion, budgeting is an essential tool for government spending. It helps in setting priorities, allocating resources, and promoting transparency and accountability. A well-planned budget ensures that government spending is used effectively and efficiently, ultimately contributing to the overall development and prosperity of a country.

Government Spending and the Economy

Government spending plays a significant role in shaping the economy of a country. Through its spending policies, the government can influence the overall level of economic activity, the distribution of resources, and the well-being of its citizens. Government spending can stimulate economic growth by creating demand for goods and services, supporting infrastructure development, and investing in education and research. It can also help address societal challenges such as poverty, unemployment, and inequality.

One of the key ways that government spending impacts the economy is through fiscal policy. By adjusting its spending levels, the government can regulate aggregate demand and stabilize the economy. In times of recession, the government can increase spending to stimulate economic activity and create jobs. This can be done through infrastructure projects, public works programs, or direct cash transfers to individuals. On the other hand, during periods of inflation or economic overheating, the government can decrease spending to curb demand and control prices.

Government spending also has a multiplier effect on the economy. When the government spends money, it creates income for individuals and businesses, who in turn spend that income on other goods and services. This increases aggregate demand and can lead to further economic growth. Additionally, government spending on infrastructure projects, such as roads, bridges, and public transportation, can improve productivity and efficiency in the economy, boosting long-term economic growth.

In conclusion, government spending is a powerful tool that can be used to shape the economy and address societal challenges. Through fiscal policy and targeted spending, the government can stimulate economic growth, create jobs, and improve the overall well-being of its citizens. However, it is important for governments to carefully consider their spending decisions, ensuring that resources are allocated efficiently and effectively to achieve desired outcomes.