As technology continues to evolve, so does the way we handle our finances. Online banking has become an integral part of our lives, offering convenience, security, and accessibility. However, navigating through your online bank account can sometimes be a daunting task, especially for those new to the digital banking world.

Fortunately, banks have recognized the need for user-friendly interfaces and have implemented interactive features to guide customers through their online banking experience. These interactive tools help simplify tasks such as checking your account balance, transferring funds, paying bills, and managing investments.

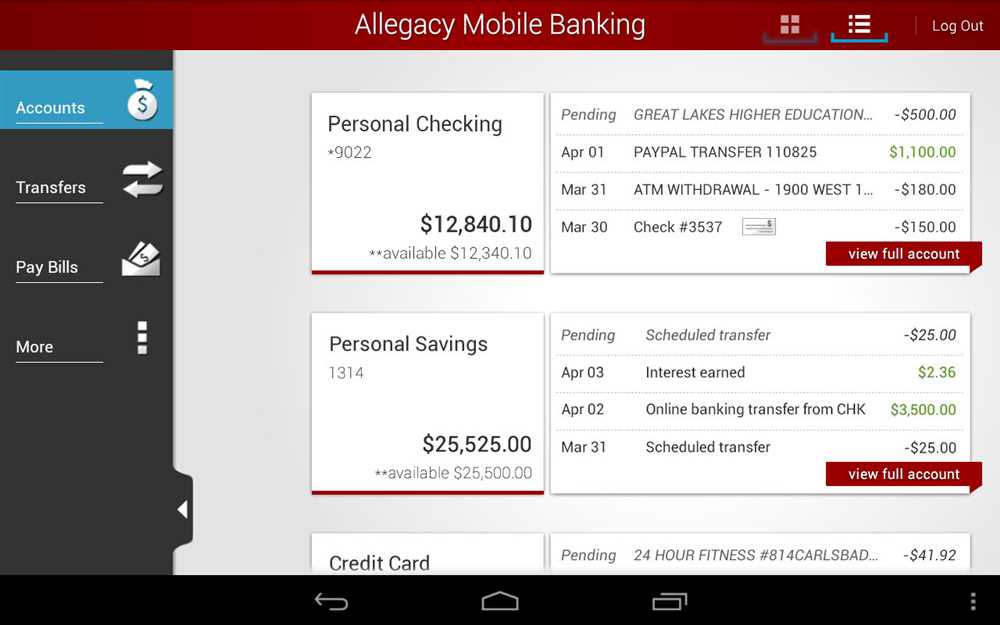

One of the key interactive features of online banking is the ability to view account details at a glance. By logging into your bank’s website or mobile app, you can access a dashboard that provides a summary of your accounts, including balances, recent transactions, and upcoming payments. This allows you to quickly and easily get an overview of your financial situation.

Another useful interactive tool is the ability to filter and search transactions. Whether you’re looking for a specific purchase or trying to track your spending habits, you can use filters and search functions within your online bank account to quickly locate the information you need. This saves you time and effort compared to manually sifting through paper statements or contacting customer service.

In addition to transactional features, many online banking platforms offer interactive budgeting and goal-setting tools. These tools allow you to set financial goals, create budgets, and track your progress over time. By visualizing your spending habits and savings goals, you can make more informed decisions about your finances and work towards achieving financial stability.

In conclusion, interactive features within online banking platforms have revolutionized the way we manage our financial accounts. With the ability to view account details, filter and search transactions, and utilize budgeting tools, navigating your online bank account has never been easier. These features empower customers to take control of their financial health and make informed decisions about their money.

Benefits of Interactive Online Banking

Online banking has become increasingly popular in recent years, providing customers with a convenient and efficient way to manage their finances. One of the greatest benefits of interactive online banking is the ability to access and navigate your bank account from anywhere at any time. This means you can check your account balance, make transactions, and monitor your spending right from the comfort of your own home or while on the go.

Interactive online banking also offers enhanced security features compared to traditional banking methods. With features such as secure login credentials, two-factor authentication, and real-time transaction alerts, customers can feel confident that their financial information is protected. Additionally, many online banking platforms use encryption technology to ensure that personal data is kept private and secure.

Another advantage of interactive online banking is the convenience it offers when it comes to bill payments. Customers can easily set up automatic bill payments, eliminating the need for paper checks or visiting physical bank branches to make payments. This not only saves time but also reduces the risk of late payments and associated fees.

- 24/7 Account Access: With interactive online banking, customers can access and manage their bank accounts 24/7, providing them with convenience and flexibility.

- Enhanced Security: Online banking platforms utilize advanced security features to protect customer information and transactions.

- Convenient Bill Payments: Interactive online banking allows customers to set up automatic bill payments, saving time and reducing the risk of late payments.

- Real-Time Transaction Monitoring: Customers can easily monitor their spending and receive real-time transaction alerts, helping them stay on top of their finances.

- Efficient Money Management: Online banking platforms provide tools and features for budgeting, expense tracking, and financial planning, making money management easier and more effective.

In conclusion, interactive online banking offers numerous benefits such as 24/7 account access, enhanced security, convenient bill payments, real-time transaction monitoring, and efficient money management. As technology continues to advance, online banking will likely become even more interactive, providing customers with even greater convenience and functionality.

Access Your Account Anytime, Anywhere

In today’s fast-paced world, it is essential to have access to your bank account anytime, anywhere. With our interactive online banking platform, you can easily and securely manage your finances on the go. Whether you’re at home, in the office, or on vacation, our online banking services provide convenience and peace of mind.

One of the key benefits of our online banking platform is the ability to access your account 24/7. Gone are the days of waiting for the bank to open or rushing to make it before closing time. With just a few clicks, you can log in to your account and view your balance, check recent transactions, transfer funds, and pay bills. Our platform is designed to be user-friendly, so even if you’re not tech-savvy, you can easily navigate through our interface and complete your banking tasks efficiently.

With our online banking platform, you are not limited to banking during traditional business hours. Whether it’s early in the morning or late at night, you can access your account and take control of your finances whenever it’s convenient for you. Our platform is compatible with desktop computers, laptops, tablets, and smartphones, so you can access your account using any device with an internet connection. Whether you’re sitting at your desk, relaxing on the couch, or waiting in line at the grocery store, you can manage your financial transactions with ease.

It’s important to note that security is our top priority. We have implemented robust security measures to protect your personal and financial information. Our online banking platform uses encryption technology to ensure that your data is transmitted securely. Additionally, we have put in place multi-factor authentication to add an extra layer of protection to your account. You can rest assured knowing that your sensitive information is safe and secure when accessing your account anytime, anywhere.

Experience the convenience and flexibility of banking on your terms. Sign up for our online banking platform today and enjoy the freedom of accessing your account anytime, anywhere.

Real-Time Balance and Transaction Information

When it comes to managing your finances, having access to real-time balance and transaction information is crucial. With our interactive online banking system, you can easily keep track of your account balance and monitor your transactions as they happen. Whether you’re making a payment, transferring funds, or checking your balance, you’ll always have the most up-to-date information at your fingertips.

Instant Balance Updates: With our online banking platform, you no longer have to wait for your monthly statement to see your updated account balance. Our system provides real-time updates, ensuring that you always know how much money you have in your account. This allows you to make informed financial decisions and avoid any surprises.

Transaction History: In addition to real-time balance updates, our interactive banking system also gives you access to your transaction history. You can view all your recent transactions, including deposits, withdrawals, transfers, and bill payments. This allows you to track your spending, identify any unauthorized transactions, and reconcile your accounts more efficiently.

- Track Payments and Transfers: Our online banking system allows you to monitor your payments and transfers in real-time. You can easily see when a payment has been processed or a transfer has been completed, giving you peace of mind and control over your financial transactions.

- Budget Planning: By having access to real-time balance and transaction information, you can effectively plan and manage your budget. You can review your spending habits, identify areas where you can save money, and make necessary adjustments to achieve your financial goals.

- Fraud Protection: Being able to monitor your transactions as they happen is crucial for detecting and preventing fraud. If you notice any suspicious activity in your account, you can notify your bank immediately and take necessary measures to protect your funds.

In conclusion, having access to real-time balance and transaction information through our interactive online banking system is a valuable tool for managing your finances effectively. It provides you with the convenience of instant updates, allows you to track your transactions, and empowers you to make informed financial decisions.

Secure and Convenient Transaction Management

Managing your transactions online has never been easier or more secure. With our interactive online banking platform, you can conveniently access and manage your bank account from the comfort of your own home or on the go. Whether you need to check your balance, transfer funds, or pay bills, our platform offers a wide range of features to make your banking experience hassle-free.

Secure Transactions: We understand that security is a top priority for our customers. That’s why we have implemented state-of-the-art security measures to ensure that your transactions are safe and protected. Our platform uses encryption technology to safeguard your personal and financial information, and we have implemented multi-factor authentication to prevent unauthorized access to your account.

Convenient Account Management: Our online banking platform is designed to make managing your account as convenient as possible. You can easily view your transaction history, track your spending, and set up alerts to notify you of any unusual account activity. You can also schedule recurring payments to save time and effort, and access your statements and tax documents online.

Easy Fund Transfers: With our online banking platform, you can easily transfer funds between your accounts or send money to another person’s account. You can set up recurring transfers for regular payments, or make one-time transfers whenever needed. Our platform also allows you to transfer money to accounts at other banks, making it simple to manage all of your financial transactions in one place.

Efficient Bill Payments: Say goodbye to writing checks and mailing bills. Our online banking platform provides a convenient way to pay your bills electronically. You can set up recurring payments for your regular bills, such as utilities or mortgage payments, or make one-time payments for any other expenses. You can also track your payment history and receive reminders when bills are due, helping you stay organized and avoid late fees.

With our secure and convenient online banking platform, you can have peace of mind knowing that your transactions are protected and easily managed. Take advantage of the features and benefits our platform offers, and experience the convenience of managing your bank account anytime, anywhere.

Key Features of Interactive Online Banking

Interactive online banking offers a range of features and benefits that make managing your finances easier and more convenient. With the ability to access your accounts anytime, anywhere, you can stay updated and in control of your finances 24/7. Let’s explore some of the key features of interactive online banking.

Real-time Account Information

One of the most important features of interactive online banking is the ability to view real-time account information. Whether you want to check your balance, review recent transactions, or monitor incoming and outgoing payments, online banking provides up-to-date information at your fingertips. This feature allows you to have a clear picture of your finances and make informed decisions.

Transaction History

With interactive online banking, you have access to detailed transaction history for all your accounts. This feature allows you to easily track your spending, identify trends, and analyze your financial habits. By having a comprehensive view of your transaction history, you can better manage your budget and plan for future expenses.

Bill Payment

Interactive online banking also offers a convenient bill payment feature. With just a few clicks, you can pay your bills directly from your bank account, saving you time and effort. You can schedule recurring payments, set up alerts for due dates, and even view your payment history. This feature helps you stay organized and avoid missing any payments.

Transfer Funds

With interactive online banking, transferring funds between your accounts or to other individuals is quick and easy. Whether you need to transfer money to a savings account, pay a friend back, or send money to a relative, online banking allows you to do so seamlessly. This feature eliminates the need for paper checks or visiting a physical bank branch.

Enhanced Security

Security is a priority when it comes to interactive online banking. Banks employ advanced encryption and authentication measures to ensure your personal and financial information is kept safe. From secure login processes to multi-factor authentication, online banking offers enhanced security features that help protect your accounts from unauthorized access.

Mobile Banking

Another key feature of interactive online banking is the availability of mobile banking apps. With these apps, you can access your accounts using your smartphone or tablet, making banking on the go even more convenient. Mobile banking apps often have additional features such as mobile check deposit and account alerts, allowing you to manage your finances wherever you are.

Overall, interactive online banking provides a range of features and benefits that simplify and streamline your financial management. From real-time account information to enhanced security measures, online banking offers a convenient and secure way to stay in control of your finances.