Creating a last will and testament is an essential step in planning for the future and ensuring that your final wishes are carried out. In Alabama, having a legally valid will is crucial to protect your assets and provide guidance to your loved ones after you are gone.

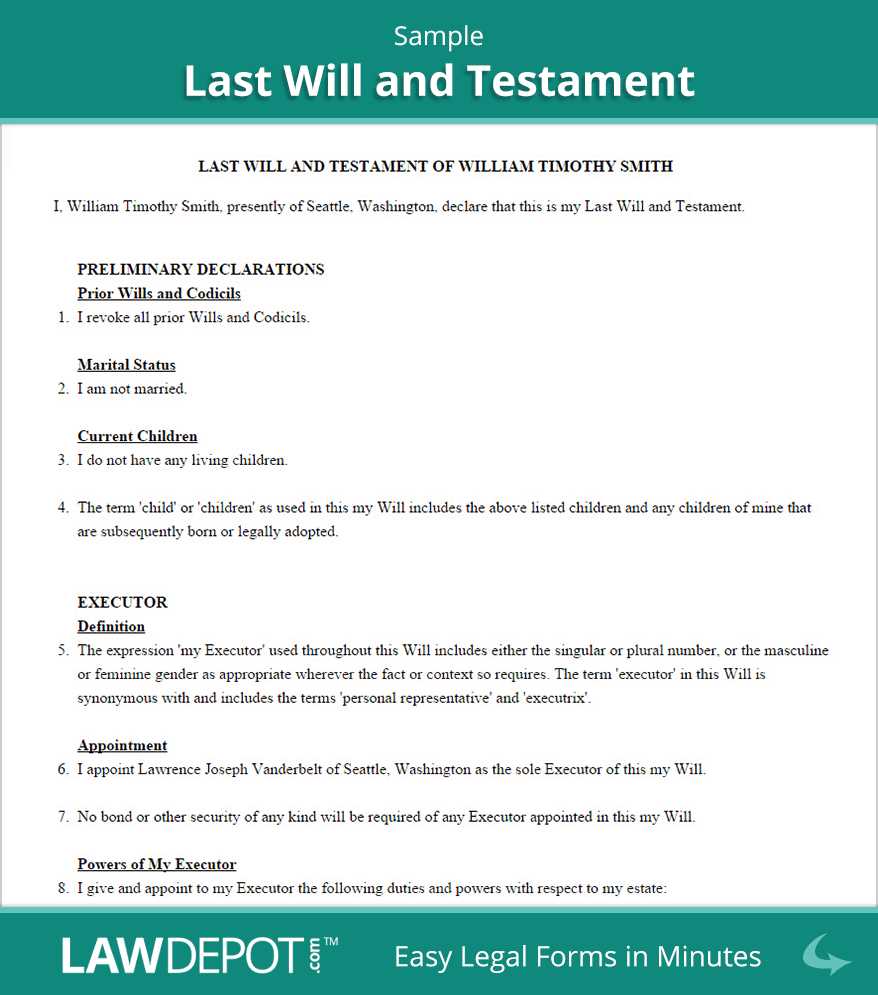

One way to simplify the process of creating your last will and testament in Alabama is by using a template. A last will and testament template is a pre-drafted document that outlines the distribution of your assets, appoints an executor, and specifies any other important instructions you have regarding your legacy.

The last will and testament template in Alabama follows the state’s specific laws and regulations, guiding you through the necessary steps to create a comprehensive and legally binding document. By using this template, you can ensure that your wishes are clearly and effectively communicated, reducing the risk of confusion or legal disputes among your loved ones after your passing.

Remember that a last will and testament is a vital legal document that should be created with careful consideration. While a template can serve as a helpful starting point, it’s crucial to consult with an attorney to ensure that your will meets all the legal requirements and is tailored to your unique circumstances.

Last Will and Testament Template Alabama

Creating a last will and testament is an essential step in ensuring that your wishes are carried out after your passing. In the state of Alabama, there are specific laws and regulations that dictate how a will should be drafted and executed. While it is always recommended to consult with an attorney to create a personalized will, a template can provide a helpful starting point for understanding the structure and content of a will.

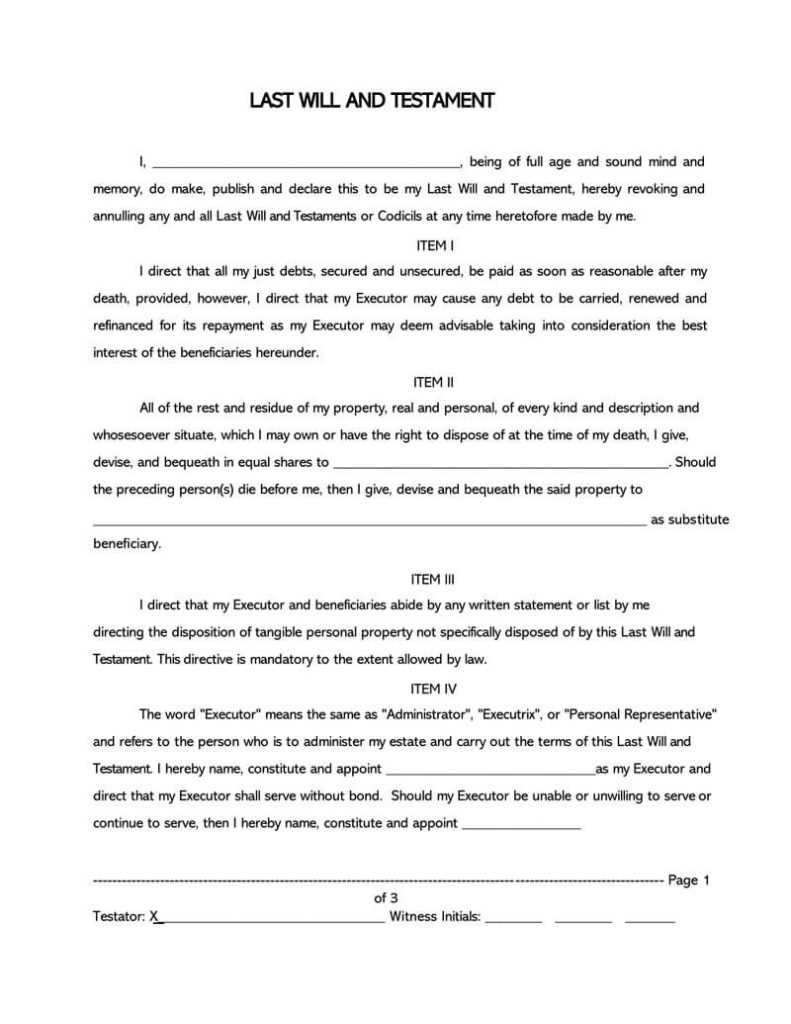

A last will and testament template for Alabama should include several key provisions. Firstly, it should clearly state that the document is your last will and testament and that any prior wills and codicils are revoked. This ensures that your most recent wishes will be followed. Secondly, the template should include a section where you can specify who will inherit your assets, whether they are to be distributed among specific individuals or organizations, or if you have any specific bequests you want to make.

Additionally, you should appoint an executor in your will. The executor is responsible for carrying out the instructions outlined in your will and handling your estate. It is important to choose someone you trust and who is capable of fulfilling this role. The template should also include a section for you to nominate a guardian for any minor children you may have, if applicable.

Remember, a last will and testament is a legally binding document, and it is crucial to ensure that it complies with the laws of Alabama. Consulting with an attorney can help ensure that your will accurately reflects your wishes and meets all legal requirements. By creating a comprehensive and valid will, you can have peace of mind knowing that your assets and loved ones will be taken care of according to your wishes.

The Importance of Having a Will

Creating a will is an essential step in planning for the future and ensuring that your assets and final wishes are properly taken care of. A last will and testament is a legal document that allows you to specify how you want your property and possessions to be distributed after your death. It also allows you to appoint a guardian for any minor children and specify any funeral or burial arrangements.

Having a will in place provides several important benefits. First and foremost, it gives you control over your assets and allows you to make decisions about their distribution. Without a will, your assets may be distributed according to state laws, which may not align with your wishes. By having a will, you can ensure that your property goes to the people or organizations you choose.

A will also helps to minimize confusion and disputes among family members. The grieving process is already difficult, and the absence of a will can lead to disagreements and potential legal battles over the distribution of your assets. Having a clearly written will can help to prevent these conflicts and provide your loved ones with guidance and peace of mind during a difficult time.

Additional reasons why having a will is important:

- Appointing a trusted executor to handle your estate

- Protecting your minor children by appointing a guardian

- Providing for any specific gifts or donations to charity

- Reducing the potential for estate taxes

- Stating your preferences for end-of-life decisions

Overall, creating a will is an important part of ensuring that your final wishes are carried out and that your loved ones are provided for in the way you intend. Consulting with an attorney can help you create a comprehensive and legally sound will that addresses all your concerns and priorities.

Understanding Last Will and Testament

A last will and testament is a legal document that allows an individual, referred to as the testator, to express their wishes regarding the distribution of their assets and the care of their minor children upon their death. It is an essential part of estate planning and ensures that your assets are distributed according to your wishes.

When creating a last will and testament, it is important to consider several key elements. Firstly, the testator must be of sound mind and legal age, typically 18 years or older. The document should clearly state the testator’s full name, address, and date of birth to avoid any confusion or disputes.

The next important aspect is the appointment of an executor, who will be responsible for carrying out the instructions outlined in the will. The executor should be someone trusted by the testator and should have the necessary skills and knowledge to handle the distribution of assets and resolve any potential conflicts.

To ensure that your property and assets are distributed as desired, it is crucial to clearly state how you want your estate to be divided among your beneficiaries. This can include specific bequests, such as leaving a certain amount of money or a particular item to a specific person. It is also important to designate contingent beneficiaries, who will receive the assets in case the primary beneficiaries are unable to inherit.

In addition to asset distribution, a last will and testament can also address other important matters. For example, if you have minor children, you can name a guardian who will have custody and take care of them in the event of your death. You can also include instructions regarding funeral arrangements or the appointment of a trustee to manage any trusts established in the will.

Creating a last will and testament is crucial to ensure that your final wishes are respected. It is recommended to work with an attorney who specializes in estate planning to ensure that your will is legally valid and covers all necessary aspects. By taking the time to draft a comprehensive last will and testament, you can have peace of mind knowing that your assets will be distributed according to your wishes.

Requirements for a Valid Will in Alabama

Creating a legally valid will is an important step in ensuring that your assets are distributed according to your wishes after your passing. In Alabama, there are specific requirements that must be met for a will to be considered valid and enforceable. These requirements include:

- Legal age and mental capacity: The testator, who is the person creating the will, must be at least 18 years old and of sound mind. This means they must understand the consequences of their actions and the value of their property.

- Voluntary execution: The will must be executed voluntarily, without any undue influence or coercion from others. It should reflect the true intentions of the testator.

- Written form: A will in Alabama must be in writing. Verbal or oral wills are not recognized as valid.

- Witnesses: The will must be signed by at least two competent witnesses. These witnesses must be at least 19 years old and cannot be beneficiaries or spouses of beneficiaries named in the will.

- Signature: The testator must sign the will at the end of the document. If the testator is unable to sign, they may direct someone else to sign on their behalf, but this must be done in the presence of the testator and at their direction.

It is crucial to follow these requirements when creating a will in Alabama to ensure its validity. Failing to meet any of these requirements may result in the will being contested or declared invalid, potentially causing complications and disputes among beneficiaries. Consulting with an attorney experienced in estate planning can help ensure that your will meets all the necessary requirements and accurately reflects your wishes.

Creating a Last Will and Testament

A Last Will and Testament is a legally binding document that outlines how your assets and estate will be distributed after your death. It is important to create a Last Will and Testament to ensure that your wishes are carried out and that your loved ones are taken care of.

1. Determine your assets: Before creating your Last Will and Testament, make a comprehensive list of all your assets, including properties, bank accounts, investments, and personal belongings. This will help you determine how you want these assets to be distributed.

2. Appoint an executor: An executor is the person responsible for carrying out the instructions in your Last Will and Testament. Choose someone who is trustworthy and competent to handle the administration of your estate.

3. Identify beneficiaries: Decide who you want to inherit your assets. This can include family members, friends, or charitable organizations. Be specific in your instructions to avoid any confusion or disputes.

4. Consider guardianship: If you have minor children, it is crucial to designate a guardian who will take care of them in the event of your death. Discuss this responsibility with the chosen person beforehand to ensure they are willing and able to take on the role.

5. Consult an attorney: While not mandatory, it is highly recommended to seek legal advice when creating your Last Will and Testament. An attorney can guide you through the process, ensure that your document complies with state laws, and help you avoid any potential pitfalls.

6. Review and update regularly: It is important to review and update your Last Will and Testament periodically, especially after significant life events such as marriage, divorce, or the birth of a child. Additionally, it is a good idea to keep a copy of your Will in a safe and accessible location, and inform your loved ones of its existence.

- Overall, creating a Last Will and Testament allows you to have control over how your assets are distributed after your death. It provides peace of mind that your wishes will be followed and reduces the potential for family disputes.

- By taking the time to create a Last Will and Testament, you are ensuring that your loved ones are taken care of and that your legacy is carried out in the way you desire.

Choosing an Executor or Personal Representative

One of the most important decisions you will make when creating your last will and testament in Alabama is choosing an executor or personal representative. This person will be responsible for carrying out your wishes and managing your estate after your death.

In Alabama, an executor is called a personal representative. It is important to choose someone who is trustworthy, reliable, and organized. This person should have a good understanding of your wishes and be able to make decisions in the best interest of your estate and beneficiaries.

When choosing a personal representative, you may consider a family member, close friend, or even a professional such as an attorney or accountant. It is important to choose someone who is willing to take on the responsibilities of the role and who has the time and ability to fulfill them.

Your chosen personal representative should be aware of their responsibilities and should be willing to consult with professionals such as attorneys and accountants if necessary. They will be responsible for gathering and managing your assets, paying your debts and taxes, and distributing your property to your beneficiaries according to your wishes.

It is important to choose an executor or personal representative who can handle potential conflicts or disputes that may arise during the probate process. They should be able to communicate effectively with your beneficiaries and resolve any issues that may arise.

Overall, choosing an executor or personal representative is a crucial decision in the estate planning process in Alabama. Take the time to consider your options and select someone who is capable of fulfilling the responsibilities of the role and carrying out your wishes.

Distributing Assets and Naming Beneficiaries

When creating a last will and testament in Alabama, it is important to consider how your assets will be distributed after your passing. This involves naming beneficiaries who will inherit specific items or property from your estate.

To distribute your assets, you will need to specify the items or property you wish to leave to each beneficiary. This can include real estate, money, stocks, personal belongings, and more. It is important to be specific in your instructions to avoid any confusion or disputes among your loved ones.

For example: You may choose to leave your house to your spouse, divide your savings equally among your children, and leave specific personal items, such as jewelry or artwork, to specific individuals.

It is important to note that certain assets may already have designated beneficiaries, such as life insurance policies, retirement accounts, or payable-on-death bank accounts. These assets will be distributed according to the beneficiary designations you have previously made, rather than through your last will and testament.

For example: If you have named your spouse as the beneficiary of your life insurance policy, the proceeds from that policy will go directly to your spouse upon your passing, regardless of what your last will and testament states.

In addition to naming beneficiaries for your assets, you may also want to consider naming alternate beneficiaries in case your primary beneficiaries predecease you or are unable to inherit for any reason.

For example: If you have designated your children as the primary beneficiaries of your estate, you may want to name a trusted friend or family member as an alternate beneficiary in case your children are unable to inherit.