The accounting cycle is a crucial aspect of financial management and plays a significant role in providing accurate and meaningful financial information for organizations. In Chapter 4 of McGraw Hill Connect Accounting, students will delve into the various steps involved in the accounting cycle and learn how to record financial transactions, prepare adjusting entries, and generate financial statements.

One of the key topics covered in this chapter is the importance of understanding the accounting equation, which states that assets equal liabilities plus owners’ equity. Students will learn how to analyze financial transactions using this equation and how it impacts the recording process. Additionally, they will explore the concept of double-entry accounting and how it ensures accuracy and balance in financial statements.

Another crucial aspect covered in Chapter 4 is the preparation of adjusting entries. Students will discover the significance of adjusting entries in aligning financial records with the accrual basis of accounting. They will learn about various types of adjusting entries, including accruals and deferrals, and how they affect the income statement and balance sheet.

In addition to understanding the accounting cycle and adjusting entries, students will also gain insights into the preparation of financial statements. They will explore the formats and components of the income statement, statement of retained earnings, and balance sheet. By understanding these financial statements, students will be able to assess the financial health and performance of an organization.

Overall, Chapter 4 of McGraw Hill Connect Accounting provides students with a comprehensive understanding of the accounting cycle, the importance of the accounting equation, the preparation of adjusting entries, and the generation of financial statements. By mastering these concepts, students will develop the necessary skills to analyze and interpret financial information effectively, contributing to informed decision-making within organizations.

Overview of the McGraw Hill Connect Accounting Answers Chapter 4

In chapter 4 of McGraw Hill Connect Accounting, students are introduced to the concept of accrual accounting and the adjusting process. This chapter builds upon the foundation laid in previous chapters, where students learned about the basics of accounting and how to prepare financial statements.

The chapter begins with an explanation of the difference between cash basis accounting and accrual accounting. Students learn that under cash basis accounting, revenues and expenses are recorded only when cash is received or paid out, while under accrual accounting, revenues and expenses are recognized when they are earned or incurred, regardless of when the cash is received or paid.

The main topics covered in this chapter include:

- The need for accrual accounting

- The difference between cash basis and accrual basis accounting

- The adjusting process and its importance in accrual accounting

- Types of adjusting entries, such as accruals and deferrals

- Preparing financial statements using accrual accounting

Throughout the chapter, students are presented with various examples and exercises to help them apply the concepts they have learned. These examples and exercises provide students with real-world scenarios and ask them to identify the appropriate adjusting entries to be made.

By the end of this chapter, students should be able to understand the fundamentals of accrual accounting and the importance of the adjusting process in preparing accurate financial statements.

Key Concepts and Topics Covered in Chapter 4

In Chapter 4 of the McGraw Hill Connect accounting textbook, several key concepts and topics are covered to provide students with a comprehensive understanding of the subject matter. These concepts are crucial for developing a solid foundation in accounting principles and practices.

1. Revenue Recognition: This chapter delves into the important topic of revenue recognition, which is the process of recording and reporting income from business activities. Students will learn the different methods of revenue recognition, such as the point of sale method and the completion of production method.

2. Matching Principle: The matching principle is another key concept covered in this chapter. It states that expenses should be recognized in the same accounting period as the revenue they help generate. Students will understand the importance of matching expenses with the revenue they generate to accurately portray a company’s financial performance.

3. Accrual Accounting: Chapter 4 also covers accrual accounting, which is the method of recording transactions based on when they occur, rather than when cash is exchanged. Students will learn how to recognize revenue and expenses based on the accrual accounting method, which provides a more accurate depiction of a company’s financial position.

4. Adjusting Entries: Another crucial topic covered in this chapter is adjusting entries. These entries are made at the end of the accounting period to update account balances and ensure that revenues and expenses are properly recorded. Students will learn how to prepare adjusting entries for various scenarios and understand their impact on financial statements.

5. The Accounting Cycle: The chapter concludes with an overview of the accounting cycle, which is the step-by-step process of recording, summarizing, and reporting financial transactions. Students will gain a comprehensive understanding of the accounting cycle and how it is applied in practice.

By mastering the key concepts and topics covered in Chapter 4, students will be able to effectively analyze and interpret financial data, make informed business decisions, and understand the importance of accurate financial reporting.

Importance of Mastering Chapter 4

In the study of accounting, every chapter plays a crucial role in building a strong foundation of knowledge. Chapter 4 in McGraw Hill Connect Accounting is no exception. This chapter focuses on the topic of cash flow and its significance in understanding a company’s financial health. Mastering Chapter 4 is important for several reasons.

- Understanding cash flow: Cash flow is the lifeblood of any business. It represents the movement of money in and out of a company. By mastering Chapter 4, students can grasp the concept of cash flow and its components, such as operating activities, investing activities, and financing activities. This understanding is essential for evaluating a company’s liquidity and financial sustainability.

- Decision-making: Cash flow analysis is crucial for making informed business decisions. Through Chapter 4, students learn how to interpret cash flow statements and use them to assess a company’s performance and make strategic decisions. Being able to analyze cash flow helps managers identify areas for improvement and make sound financial choices.

- Evaluating financial statements: Chapter 4 also equips students with the skills to evaluate and interpret a company’s financial statements accurately. Cash flow information provides insights into the company’s ability to generate cash, meet its financial obligations, and support future growth. By mastering this chapter, students can become proficient in analyzing financial statements and identifying key financial indicators.

- Financial planning: Understanding the intricacies of cash flow is crucial for effective financial planning. Through Chapter 4, students learn how to forecast cash flows, develop budgets, and set achievable financial goals. These skills are essential for managing a company’s resources effectively and ensuring its long-term success.

Overall, mastering Chapter 4 in McGraw Hill Connect Accounting is essential for gaining a comprehensive understanding of cash flow and its implications for financial decision-making. This chapter provides students with the tools and knowledge needed to evaluate a company’s financial health, make informed decisions, and plan for the future. By investing time and effort in mastering this chapter, students can enhance their accounting expertise and excel in their careers.

How Understanding Chapter 4 Can Improve Accounting Skills

Chapter 4 of McGraw Hill Connect Accounting provides essential knowledge and skills that can greatly improve one’s understanding and ability in the field of accounting. By comprehending the concepts and principles covered in this chapter, individuals can enhance their analytical and decision-making skills, which are essential in accounting.

One of the key topics discussed in Chapter 4 is the income statement. This financial statement plays a crucial role in tracking the revenue and expenses of a business over a specific period. By understanding how to analyze and interpret the information presented in an income statement, individuals can gain valuable insights into a company’s profitability, identify trends, and make informed financial decisions.

Another important concept covered in Chapter 4 is the statement of cash flows. This statement provides information about a company’s cash inflows and outflows, enabling individuals to assess its liquidity and ability to generate cash. By grasping the components and significance of the statement of cash flows, individuals can develop a better understanding of a company’s financial health and make informed predictions about its future cash flow positions.

Furthermore, Chapter 4 delves into the topic of financial statement analysis. This analysis is crucial for evaluating a company’s performance, financial stability, and overall health. By learning various techniques and ratios used in financial statement analysis, individuals can assess a company’s profitability, liquidity, solvency, and efficiency. This knowledge empowers individuals to identify strengths and weaknesses in financial statements, make informed investment decisions, and effectively communicate a company’s financial position.

Overall, acquiring a strong understanding of Chapter 4 in accounting can greatly improve individuals’ accounting skills. By mastering the concepts and principles related to income statements, statements of cash flows, and financial statement analysis, individuals can enhance their ability to interpret financial information, make sound financial decisions, and communicate the financial health of a company effectively.

Tips and Strategies for Answering Chapter 4 Questions

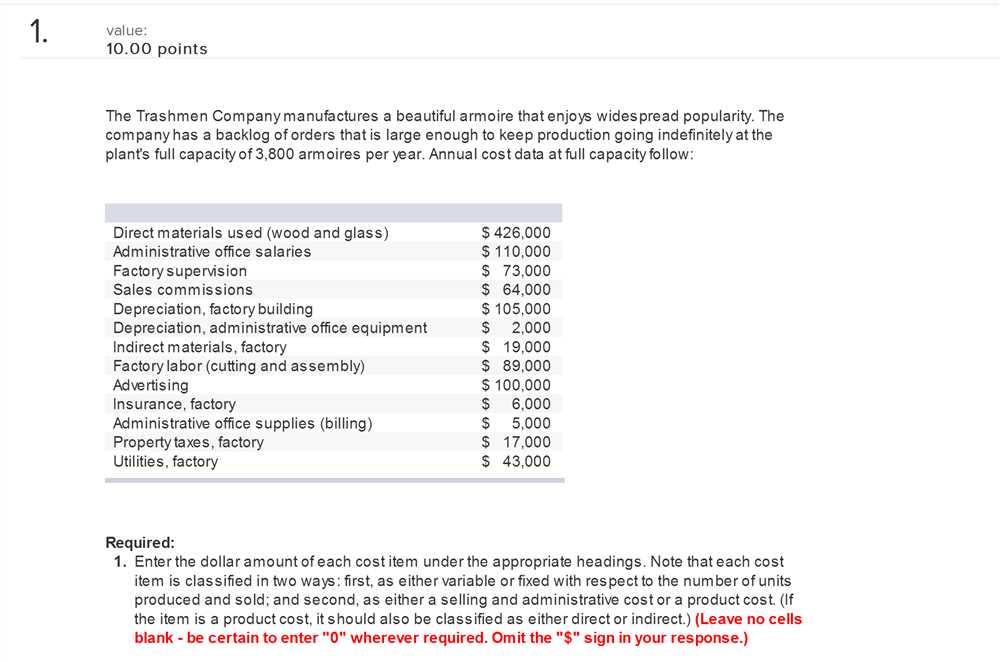

Chapter 4 in the McGraw Hill Connect Accounting textbook covers a range of topics related to financial statements and the accounting cycle. To successfully answer the questions in this chapter, it is important to understand the key concepts and apply them to practical scenarios.

1. Read the question carefully: Before attempting to answer a question, make sure you understand what is being asked. Look for keywords or phrases that indicate the specific information the question is seeking.

2. Review the relevant material: Take the time to go back to the chapter and review the relevant sections that relate to the question. Pay attention to any examples or explanations provided in the text.

3. Analyze the scenario: Many questions in Chapter 4 involve applying the concepts to practical scenarios. Break down the scenario and identify the key elements that are relevant to the question.

4. Use the accounting equation: The accounting equation (Assets = Liabilities + Equity) is a fundamental concept in financial accounting. Use this equation to analyze how transactions affect different elements of the balance sheet.

5. Utilize formatting and organization: When providing written answers, ensure that your responses are well-organized and easy to follow. Use headings, bullet points, and tables if necessary to present your information clearly.

6. Practice calculations: Some questions in Chapter 4 require calculations, such as determining the ending balance of an account or preparing a trial balance. Be comfortable with basic arithmetic and familiarize yourself with relevant formulas or calculations.

In summary, successfully answering Chapter 4 questions in the McGraw Hill Connect Accounting textbook requires a thorough understanding of the concepts, careful analysis of the scenarios, and clear presentation of the information. By applying these tips and strategies, you can improve your ability to answer the questions effectively.

Analyzing Question Types in Chapter 4

In Chapter 4 of McGraw Hill Connect Accounting, various question types are used to test your understanding of the material. These question types include multiple-choice, true or false, and problem-solving questions. Let’s take a closer look at each type and how to approach them:

Multiple-Choice Questions

Multiple-choice questions present you with several options, and you need to select the correct answer. These questions test your knowledge of concepts, definitions, and application of accounting principles. Make sure to read each question carefully and analyze all answer choices before selecting the most appropriate option.

True or False Questions

True or false questions require you to determine whether a statement is true or false based on your understanding of the material. These questions cover various topics, including accounting principles, financial statements, and calculation methods. Take your time to read the statement and evaluate its accuracy before selecting your answer.

Problem-Solving Questions

Problem-solving questions require you to apply your knowledge and understanding of accounting principles to solve numerical problems. These questions often involve calculations, analysis of financial data, and interpretation of financial statements. To successfully answer problem-solving questions, carefully read the problem statement, identify the required information, and apply the appropriate accounting concepts and formulas to arrive at the correct solution.

Overall Approach

Regardless of the question type, it is crucial to thoroughly study the chapter material, review key concepts, and practice applying them in different scenarios. Pay attention to the details and carefully read each question before answering. Take advantage of any resources available to you, such as textbooks, lecture notes, and online resources, to enhance your understanding and prepare effectively for the chapter 4 assessment.