Investing can be a complex and intimidating subject for many people, but it doesn’t have to be. In Everfi’s Module 3, you will find the answers you need to understand the world of investing and make informed financial decisions. This module covers a wide range of topics, from the basics of stocks and bonds to more advanced concepts like asset allocation and diversification.

One of the key lessons in Module 3 is the importance of starting early when it comes to investing. The power of compound interest can have a significant impact on your wealth over time, so the earlier you start investing, the better off you’ll be in the long run. Everfi provides interactive simulations and real-life examples to help you understand how compound interest works and how it can work in your favor.

In addition to covering the basics of investing, Module 3 also dives into the world of financial markets and how they function. You’ll learn about different types of investment vehicles, such as mutual funds and exchange-traded funds (ETFs), and how to choose the right investments for your goals and risk tolerance. Everfi’s interactive platform allows you to explore different investment options and see how they perform over time.

By completing Module 3, you’ll gain the knowledge and confidence to make informed investment decisions and grow your wealth over time. Whether you’re just starting your investing journey or looking to enhance your existing knowledge, Everfi’s Module 3 answers will provide you with the foundation you need to succeed in the world of investing.

Module 3 Answers Everfi: Important Information for Success

Module 3 of Everfi provides crucial information that is essential for success in various aspects of life. This module covers important topics such as credit scores, insurance, and taxes, which are all fundamental aspects of financial literacy. By understanding and mastering the concepts covered in this module, individuals can make informed decisions and take control of their financial well-being.

One key topic covered in this module is credit scores. A credit score is a numerical representation of an individual’s creditworthiness, and it plays a significant role in various financial transactions, such as obtaining loans or renting an apartment. Understanding how credit scores are calculated and how to maintain a good credit score is vital for financial success. The module provides valuable tips and insights on building and improving credit scores.

Insurance is another critical topic covered in Module 3. Insurance is a means of protecting oneself against financial losses due to unexpected events such as accidents, illnesses, or natural disasters. Learning about different types of insurance coverage, understanding policy terms and conditions, and knowing how to file a claim are all important aspects of financial literacy. This module equips individuals with the necessary knowledge and skills to make informed decisions when it comes to insurance.

Taxes are an inevitable part of life, and understanding how they work is crucial for financial success. Module 3 provides valuable insights into the basics of taxes, including different types of taxes, how they are calculated, and how to file tax returns. By understanding these concepts, individuals can effectively manage their finances and ensure compliance with tax laws.

The information provided in Module 3 of Everfi is essential for success in both personal and professional life. Whether it is managing credit, protecting against financial risks through insurance, or navigating the complexities of taxes, this module equips individuals with the necessary knowledge and skills to make informed decisions and achieve financial well-being.

Understanding the Importance of Module 3 in Everfi

Managing Credit: Module 3 provides valuable insights into the world of credit, teaching individuals how to establish credit, maintain a good credit score, and ultimately, use credit as a tool to achieve financial goals. It emphasizes the importance of building a positive credit history and the potential consequences of misusing credit.

Responsibly Managing Debt: Another key aspect covered in Module 3 is responsible debt management. It educates individuals about the different types of debts, such as student loans and credit card debt, and offers strategies for avoiding unnecessary debt and reducing existing debt burdens. By understanding the impact of debt on personal finances and utilizing effective debt management techniques, individuals can prevent financial hardships and achieve long-term financial stability.

- Financial Literacy: Module 3 also contributes to the overall financial literacy of individuals. It provides a comprehensive understanding of credit and debt-related concepts, terminology, and best practices. By acquiring this knowledge, individuals can make informed financial decisions and avoid common pitfalls associated with credit and debt.

- Budgeting: Furthermore, Module 3 emphasizes the importance of budgeting. It highlights how effective budgeting can help individuals manage their debt and credit obligations while maintaining a balanced financial life. This knowledge is crucial for individuals to stay on track with their financial goals and avoid overspending.

In conclusion, Module 3 of Everfi is an essential component of the program as it equips individuals with the knowledge and skills necessary to navigate the world of credit and debt successfully. By understanding how to manage credit and debt responsibly, individuals can create a solid financial foundation and secure a brighter financial future.

Key Concepts Covered in Module 3

In Module 3, we cover several key concepts related to personal finance and money management. Here are some of the main topics discussed in this module:

Managing and Tracking Your Money

- Creating a budget to track your income and expenses

- Identifying fixed and variable expenses

- Understanding the importance of tracking your spending

- Using tools and apps to manage your money effectively

Credit and Debt

- Understanding how credit works and its importance

- Exploring different types of credit, such as credit cards and loans

- Learning about interest rates and how they affect your debt

- Understanding the consequences of using credit irresponsibly

Protecting Your Financial Information

- Recognizing common scams and frauds

- Understanding the importance of protecting your personal information

- Learning about different types of identity theft and how to prevent them

- Taking steps to safeguard your financial accounts

Insurance and Risk Management

- Identifying different types of insurance coverage

- Understanding why insurance is important in managing financial risks

- Learning about deductibles, premiums, and coverage limits

- Understanding the role of insurance in protecting your assets and future financial stability

Investing and Retirement Planning

- Exploring different investment options, such as stocks and bonds

- Understanding the benefits of long-term investing

- Learning about tax advantages and retirement accounts

- Planning for retirement and setting goals for financial security

These are just a few of the key concepts covered in Module 3. By understanding and applying these concepts, you can make informed decisions about your personal finances and work towards achieving your financial goals.

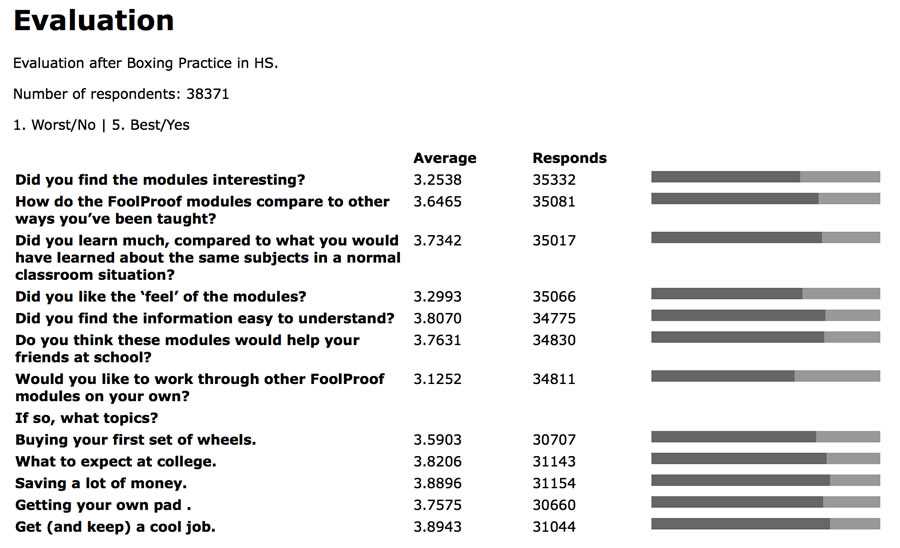

Module 3 Quiz Answers and Strategies for Success

Welcome to the Module 3 Quiz Answers and Strategies for Success guide! In this article, we will provide you with the best tips and tricks to ace the Module 3 quiz and ensure your success in the course. Here, you will find answers to some of the most commonly asked questions in Module 3, along with strategies to help you understand and retain the information better.

1. How can I prepare for the Module 3 quiz?

To prepare for the Module 3 quiz, it is essential to thoroughly review the course material. Take notes while going through the lessons, highlighting key points and important concepts. Make use of the practice quizzes and interactive activities available in the course to test your knowledge and identify areas where you need improvement. Additionally, create a study schedule and dedicate time each day to review the content, ensuring that you cover all the necessary topics before taking the quiz.

2. What are some effective strategies for answering quiz questions?

When answering quiz questions, it is crucial to read each question carefully and understand what is being asked. Pay attention to keywords and phrases that indicate the correct answer. If you are unsure about an answer, eliminate options that are obviously incorrect and make an educated guess. To enhance your chances of getting the correct answer, rely on the knowledge you have gained from the course material and use logical reasoning. Lastly, manage your time effectively during the quiz to ensure you have enough time to answer all the questions.

3. How can I improve my overall understanding of Module 3 concepts?

To improve your understanding of Module 3 concepts, make use of additional resources such as textbooks, online articles, and videos that cover the same topics. Engage in active learning techniques such as summarizing the information in your own words, teaching someone else about the concepts, or discussing the content in study groups. Additionally, asking questions and seeking clarification from your instructor or classmates can also help deepen your understanding.

By following these strategies and utilizing the provided quiz answers, you can enhance your performance in Module 3 and ensure a successful learning experience. Remember to stay focused, manage your time effectively, and seek additional help when needed. Good luck!

Tips for Retaining Information from Module 3

Module 3 of the Everfi course covers important information about financial decision-making. To ensure that you retain this valuable knowledge, here are some tips to help you remember the key concepts:

- Take notes: While going through the module, jot down important points and key terms. Writing things down helps reinforce the information in your mind and provides you with a reference for later review.

- Engage in active learning: Instead of passively watching the videos or reading the text, actively engage with the material. Pause after each section to reflect on what you’ve learned and try to apply it to real-life scenarios.

- Use flashcards: Create your own flashcards with key terms and definitions. Reviewing these flashcards regularly will help you remember the information and improve your understanding of the subject matter.

- Discuss with others: Find a study buddy or join a study group to discuss the module content. Explaining concepts to others helps reinforce your own understanding and exposes you to different perspectives.

- Test yourself: Create quizzes or practice tests to assess your understanding. Testing yourself not only helps identify areas that need additional review but also reinforces the information in your memory.

By implementing these strategies, you can enhance your retention of the information presented in Module 3. Remember, understanding personal finance is crucial for making informed decisions and achieving financial well-being.

Applying Module 3 Knowledge in Real-Life Scenarios

Module 3 of EverFi covers important topics related to personal finance and responsible money management. The knowledge gained from this module can be applied to real-life scenarios to make informed financial decisions and achieve long-term financial goals. One key concept covered in this module is budgeting.

Understanding how to create and stick to a budget is crucial in managing personal finances effectively. By applying the principles taught in Module 3, individuals can analyze their income and expenses, prioritize their spending, and ensure they are living within their means. This skill is essential for individuals to avoid overspending, accumulate savings, and avoid falling into debt.

Another valuable skill learned from Module 3 is the ability to assess and compare financial products. Whether it’s choosing a credit card, a loan, or a savings account, knowing how to evaluate different options can help individuals make informed decisions and select the best product for their needs. Understanding concepts such as interest rates, fees, and terms and conditions can ensure individuals are getting the most favorable terms and avoiding unnecessary costs.

Module 3 also covers the importance of building and maintaining a good credit score. This knowledge can be applied in real-life scenarios such as applying for a mortgage, renting an apartment, or even getting a job. By understanding the factors that impact credit scores and how to build and maintain a positive credit history, individuals can increase their chances of accessing favorable financial opportunities in the future.

In conclusion, Module 3 provides individuals with essential knowledge and skills for managing their personal finances effectively. By applying this knowledge in real-life scenarios, individuals can make informed financial decisions, stick to a budget, choose the best financial products, and build a positive credit history. These skills are instrumental in achieving long-term financial goals and maintaining financial well-being.

Module 3 Case Studies and Examples

In Module 3, we will explore different case studies and examples to deepen our understanding of financial literacy concepts and how they can be applied in real-life situations. By examining these real-world scenarios, we can gain valuable insights into the importance of financial planning, budgeting, and making informed financial decisions.

One case study we will explore is that of Sarah, a college student who is struggling to manage her student loans and monthly expenses. Through this case study, we will learn about the importance of creating a budget, prioritizing expenses, and exploring options for student loan repayment. By analyzing Sarah’s situation, we can identify strategies she can implement to effectively manage her finances and achieve financial stability.

Example 1: Saving for Retirement

Another example we will examine is that of John and Lisa, a married couple in their 30s who want to start saving for retirement. Through this example, we will learn about the different retirement savings options available, such as 401(k) plans and individual retirement accounts (IRAs). We will also explore the concept of compound interest and how it can help individuals grow their retirement savings over time. By analyzing John and Lisa’s situation, we can identify the steps they can take to start saving for retirement and ensure a secure financial future.

Example 2: Credit Card Debt Management

Lastly, we will delve into the example of Mike, a young professional who is struggling with credit card debt. Through this example, we will learn about the importance of understanding interest rates, minimum payments, and the potential consequences of carrying high levels of credit card debt. We will explore strategies for managing and reducing credit card debt, such as creating a repayment plan and exploring balance transfer options. By analyzing Mike’s situation, we can identify the steps he can take to regain control of his finances and achieve financial freedom.