Hyperinflation is an economic phenomenon that has affected numerous countries throughout history, causing devastating consequences for their economies and populations. This nonfiction reading test provides a comprehensive examination of hyperinflation, exploring its causes, effects, and potential solutions.

One of the key causes of hyperinflation is an excessive increase in the money supply, which leads to a rapid devaluation of the currency. This excessive money printing often occurs when governments need to fund large budget deficits or finance wars. As a result, the value of the currency diminishes rapidly, causing prices to skyrocket and making it increasingly difficult for people to afford basic necessities.

The effects of hyperinflation are far-reaching and can have severe consequences for a country’s economy and its citizens. Prices rise at a staggering pace, making it difficult for individuals to purchase goods and services. People’s savings lose their value, as the purchasing power of the currency diminishes rapidly. Businesses struggle to operate, as the cost of production increases exponentially. Unemployment rates soar, as companies are forced to lay off workers or shut down completely. Inflation erodes the trust and stability of the financial system, ultimately leading to social unrest and political instability.

While hyperinflation may seem like an insurmountable problem, there are steps that can be taken to mitigate its impact and prevent its occurrence. Sound fiscal and monetary policies are crucial to maintaining price stability and ensuring economic growth. Governments must exercise financial discipline, avoiding excessive borrowing and spending. Central banks must adopt responsible monetary policies, controlling the money supply to prevent inflationary pressures. Additionally, countries can implement structural reforms to promote economic diversification and reduce reliance on a single industry or export. These measures, combined with international cooperation and support, can help countries prevent hyperinflation and stabilize their economies for the benefit of their citizens.

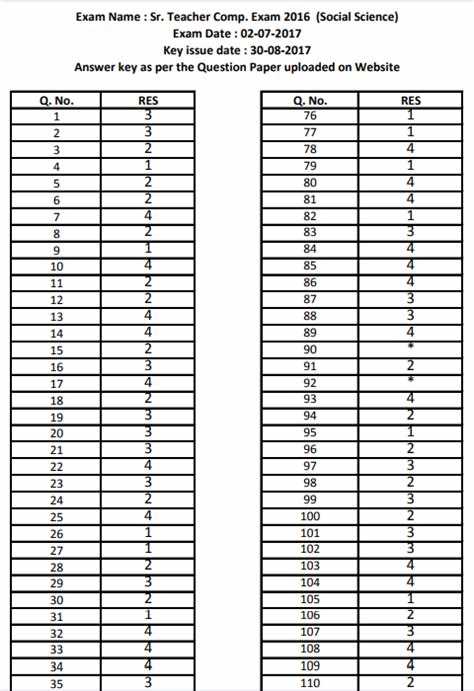

Nonfiction Reading Test Hyperinflation Answer Key

In this nonfiction reading test, students had the opportunity to learn about hyperinflation and its effects on a country. The test covered various aspects, including the causes, symptoms, and consequences of hyperinflation. To evaluate their understanding, students were presented with a series of multiple-choice questions, each with four possible answers. With the answer key provided, students can now check their responses and assess their comprehension of the topic.

The answer key for the nonfiction reading test on hyperinflation is as follows:

- Question 1: B – Printing excessive amounts of money

- Question 2: D – Rapid decrease in the value of currency

- Question 3: A – Prices of goods and services skyrocketing

- Question 4: C – Economic instability and social unrest

- Question 5: B – Germany

- Question 6: C – Zimbabwe

- Question 7: D – Venezuela

- Question 8: A – Wheelbarrows

- Question 9: D – Prices were doubling every few hours

- Question 10: B – Scarce and in high demand

This answer key serves as a useful tool for students to gauge their understanding of hyperinflation. By comparing their answers to the correct responses, students can identify areas where they may need further review or clarification. Through this self-assessment, students can enhance their knowledge of the topic and develop their critical thinking skills in relation to economic issues.

What is Hyperinflation?

Hyperinflation is an extreme and rapid increase in the prices of goods and services in a country. It is characterized by a very high and accelerating inflation rate, usually exceeding 50% per month. Hyperinflation often occurs as a result of a severe economic crisis, such as war, political instability, or excessive government spending.

In hyperinflationary environments, the value of the local currency depreciates rapidly, leading to a loss in purchasing power and a rise in prices. This makes it difficult for individuals and businesses to plan and budget as the cost of essential items can change dramatically from day to day. Hyperinflation can have devastating impacts on the economy and the population, leading to poverty, unemployment, and social unrest.

To better understand hyperinflation, here are a few key features and effects:

-

Runaway prices: In hyperinflation, prices can double or triple within a matter of days or even hours. This makes it challenging for people to afford basic necessities and leads to a decrease in their standard of living.

-

Loss of confidence in the currency: Hyperinflation erodes people’s trust in the local currency as a reliable store of value. Many individuals and businesses resort to using foreign currencies or other assets to protect their wealth.

-

Hoarding and shortages: As prices skyrocket, people tend to hoard goods, fearing that their value will continue to rise. This hoarding behavior exacerbates shortages and further drives up prices, creating a vicious cycle.

-

Financial instability: Hyperinflation disrupts the functioning of financial systems and institutions. Banks may struggle to keep pace with rapidly changing prices and may become unable to provide loans or financial services.

Overall, hyperinflation is a destructive economic phenomenon that has severe consequences for individuals, businesses, and governments. It undermines confidence in the economy, destroys savings, and hampers economic growth. Preventing and stabilizing hyperinflation requires sound fiscal and monetary policies, as well as political stability and effective governance.

Causes of Hyperinflation

Hyperinflation refers to a rapid and uncontrollable increase in the general price level of goods and services within an economy. It is often caused by a combination of factors that can have devastating effects on the stability and functionality of a country’s economy. Several key causes of hyperinflation include:

- Excessive money supply: One of the primary causes of hyperinflation is the excessive printing of money by a government. When the government creates more money than the goods and services available in the economy, the value of the money decreases, leading to a rise in prices.

- Lack of confidence in the currency: Hyperinflation can also be caused by a loss of confidence in the national currency. When people no longer believe that the currency will retain its value, they rush to spend it or exchange it for more stable assets, which further fuels inflation.

- Government deficits: Governments that consistently spend more money than they collect in taxes create budget deficits. To fund these deficits, they often resort to borrowing or printing money, which can contribute to hyperinflation.

- Uncontrolled government spending: When a government spends excessively on subsidies, welfare programs, or public projects without proper financial management, it can lead to hyperinflation. This is because the increased demand for goods and services outpaces the supply, causing prices to skyrocket.

- War and political instability: Conflict and political instability can disrupt the normal functioning of an economy and lead to hyperinflation. Wars often require increased government spending, borrowing, and the printing of money, which can exacerbate inflationary pressures.

- Speculative behavior: In some cases, hyperinflation can be triggered by speculative behavior in financial markets. Speculators may anticipate or react to inflation by hoarding goods or assets, thereby driving up prices and further fueling inflation.

These causes of hyperinflation are not mutually exclusive and can combine to create a perfect storm of economic instability. Therefore, it is essential for governments to implement sound fiscal and monetary policies to prevent hyperinflation and maintain the stability of their economies.

Impact of Hyperinflation

Hyperinflation, the rapid and out-of-control increase in prices, has significant impacts on individuals, businesses, and the overall economy. One of the immediate effects of hyperinflation is the erosion of purchasing power. As prices soar, the value of money diminishes, making it harder for people to afford daily necessities. This can lead to widespread poverty and inequality, as those with fixed incomes or limited access to resources are hit the hardest.

Another consequence of hyperinflation is the disruption of economic stability. Inflation erodes confidence in the currency, leading to a loss of faith in the financial system. This can result in hoarding of goods and assets, as people seek to protect their wealth from further devaluation. Businesses struggle to operate in such an unstable environment, and foreign investors are reluctant to engage in economic activities in countries plagued by hyperinflation.

Hyperinflation also has long-term effects on society. The erosion of trust in the financial system and the government can contribute to political instability and social unrest. When people feel that their economic well-being is threatened, they may turn to radical ideologies or engage in criminal activities as a means of survival. Healthcare, education, and infrastructure suffer as governments prioritize managing hyperinflation and addressing immediate economic concerns.

The impact of hyperinflation can be seen in historical examples such as the hyperinflation in Weimar Germany in the 1920s and more recent cases like Zimbabwe in the 2000s. Learning from these experiences, it becomes clear that effectively managing inflation and ensuring economic stability are crucial for the well-being of individuals and the overall prosperity of a nation. Governments, central banks, and policymakers need to implement sound monetary policies and fiscal measures to prevent hyperinflation and its devastating consequences.

Historical Examples of Hyperinflation

Hyperinflation is a phenomenon that has occurred throughout history in various countries. It is characterized by extremely rapid and out-of-control inflation, often leading to the devaluation of a country’s currency. Several notable historical examples of hyperinflation include:

1. Weimar Republic, Germany (1921-1924)

Following World War I, Germany experienced one of the most well-known cases of hyperinflation in history. As a result of war debts and the reparations imposed by the Treaty of Versailles, the German government resorted to printing money to meet its obligations. This led to a rapid devaluation of the currency, with prices doubling every few days. Eventually, the German mark became practically worthless, causing widespread economic and social chaos.

2. Zimbabwe (2007-2009)

Zimbabwe experienced a severe hyperinflation crisis from 2007 to 2009. The government’s policy of printing money to finance its deficit resulted in astronomical inflation rates, reaching an estimated peak of 89.7 sextillion percent per month. This led to a collapse of the economy, widespread poverty, and shortages of basic goods. The Zimbabwean dollar ultimately became worthless, and the country had to adopt foreign currencies for everyday transactions.

3. Venezuela (ongoing crisis)

Currently, Venezuela is facing a hyperinflation crisis that has been ongoing for years. Political instability, mismanagement of the economy, and a reliance on oil exports have contributed to the country’s economic downfall. Inflation rates have soared to staggering levels, reaching over a million percent annually. The Venezuelan bolívar has become practically worthless, and the country has been plagued by shortages of food, medicine, and basic necessities.

These historical examples demonstrate the devastating consequences of hyperinflation on a country’s economy and its people. They serve as a reminder of the importance of responsible fiscal and monetary policies to maintain stability and prevent such extreme inflationary episodes.

How to Protect Your Finances from Hyperinflation

Hyperinflation is a serious economic condition that can lead to the rapid depreciation of a country’s currency and a sharp rise in prices. If you live in a country experiencing hyperinflation or are concerned about the potential for it in the future, it is important to take steps to protect your finances. Here are some strategies to consider:

Diversify Your Investments

One way to protect your finances from hyperinflation is to diversify your investments. This means spreading your money across different types of assets, such as stocks, bonds, real estate, and commodities. By diversifying, you can minimize the impact of hyperinflation on any one investment and potentially preserve your wealth.

Invest in Hard Assets

In times of hyperinflation, the value of paper money can quickly erode. Investing in hard assets, such as gold, silver, or other precious metals, can provide a hedge against inflation. These assets tend to hold their value and may even appreciate during times of economic instability.

Hold Foreign Currency

If you have concerns about the stability of your country’s currency, it may be wise to hold some of your wealth in foreign currency. This can help protect your purchasing power and provide an alternative if your domestic currency becomes significantly devalued. Consider diversifying across different foreign currencies to further mitigate risk.

Monitor and Adjust Your Budget

In a hyperinflationary environment, prices can rise rapidly. It is important to closely monitor your expenses and adjust your budget accordingly. Cut back on non-essential expenses and prioritize essential items. Look for ways to minimize the impact of rising prices, such as buying in bulk or seeking out alternative, cheaper products.

Consider Investments with Inflation-Adjusted Returns

When choosing investments, consider those that offer inflation-adjusted returns. This means investments that have the potential to keep up with or outpace inflation. Examples include inflation-indexed bonds, stocks of companies with pricing power, and real estate properties that can generate rental income.

Overall, protecting your finances from hyperinflation requires careful planning and diversification. By implementing these strategies, you can better safeguard your wealth and mitigate the impact of hyperinflation on your financial well-being.