Investing is a crucial aspect of building wealth and securing financial stability. It involves making strategic choices with your money to generate returns over time. As a beginner investor, it is essential to understand the basics of investing to make informed decisions and maximize your potential gains.

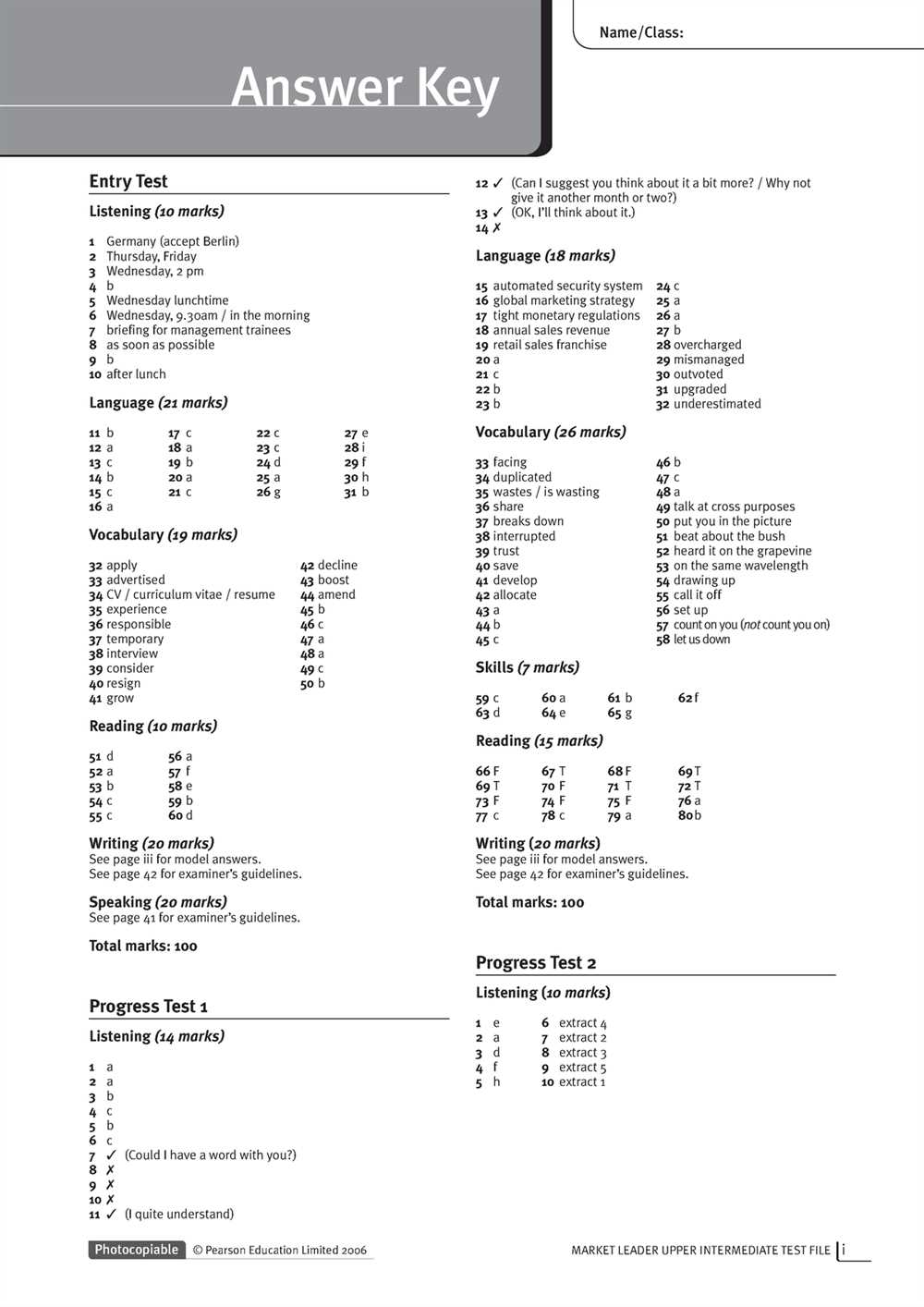

The “Read 25 Investing Basics Answer Key” provides a comprehensive guide to help you navigate the world of investing. This answer key covers key concepts such as stocks, bonds, mutual funds, diversification, and risk management. Each answer is carefully crafted to provide clarity and simplicity, allowing you to grasp investing fundamentals without feeling overwhelmed.

By reading and studying the 25 investing basics answer key, you will gain a solid foundation in investing and learn how to create a well-diversified investment portfolio. Understanding the different asset classes and their risks and rewards will enable you to make informed investment decisions, whether you are interested in long-term growth, income generation, or capital preservation.

Investing can seem intimidating, especially if you are new to the game. However, with the right knowledge and guidance, you can navigate the complex world of investing with confidence. The “Read 25 Investing Basics Answer Key” is designed to be your go-to resource, providing clear, concise answers to commonly asked investing questions. Whether you are a beginner or an experienced investor looking to refresh your understanding, this answer key will equip you with the knowledge you need to make sound investment choices and grow your wealth over time.

What is investing and why is it important?

Investing refers to the act of allocating financial resources, such as money or assets, with the expectation of generating a profit or return in the future. It involves putting money or resources into various financial instruments, such as stocks, bonds, mutual funds, real estate, or businesses, with the goal of earning a return over time.

Investing is important for several reasons. Firstly, it can help individuals and businesses grow their wealth and achieve financial goals. By investing wisely, one can potentially earn higher returns than what would be possible through traditional saving methods. This can provide the opportunity for long-term financial security, retirement planning, or funding major expenses like education or buying a house.

Additionally, investing plays a crucial role in fostering economic growth. When individuals and businesses invest their money, it provides capital that can be used for various productive purposes. This capital can be used to start or expand businesses, create jobs, spur innovation, and drive economic development.

Investing also helps to combat inflation. As prices of goods and services tend to increase over time, the value of money decreases. By investing in assets that typically appreciate in value, such as stocks or real estate, individuals can protect their wealth from eroding due to inflation.

Furthermore, investing can offer a means of diversification. By spreading investments across different asset classes or industries, individuals can reduce the risk of loss. This is because different investments can perform differently under different market conditions. Diversification allows individuals to mitigate their exposure to any one investment and potentially enhance overall returns.

Overall, investing is important for individuals, businesses, and the economy as a whole. It provides an avenue for growth, wealth creation, financial security, and economic development. However, it is crucial to conduct thorough research, seek professional advice, and understand the risks involved before embarking on any investment journey.

Investing defined: understanding the basics

Investing is the process of allocating money or resources in order to generate a return over a specified period of time. It is a strategic decision-making process that involves assessing potential risks and rewards, and making informed choices based on available information. Investing can take many forms, including stocks, bonds, real estate, and commodities. It is an essential practice for individuals, businesses, and governments looking to grow their wealth and secure their financial future.

Investment can be defined as the act of putting money into something with the expectation of achieving a profit. Those who invest are called investors, and they can range from individual retail investors to large institutional investors such as pension funds or mutual funds. The goal of investing is to earn a return on the capital invested, which can come in the form of dividends, interest, or capital appreciation.

Investing involves understanding several key concepts and principles:

- Risk and reward: Investing inherently involves risk, as there is always a chance that the investment may lose value. However, higher risk investments generally offer the potential for higher returns. It is important for investors to assess their risk tolerance and make investment decisions accordingly.

- Diversification: Spreading investments across a variety of assets can help reduce risk. Diversification allows investors to mitigate the impact of any single investment’s performance on their overall portfolio.

- Time horizon: Investors should carefully consider their time horizon when making investment decisions. Longer time horizons generally allow for more aggressive investment strategies, while shorter time horizons may necessitate more conservative approaches.

- Research and analysis: Before investing in any asset, it is crucial to conduct thorough research and analysis. This involves evaluating the financial health of companies, assessing market trends, and understanding macroeconomic factors that may impact investments.

In conclusion, investing is a crucial practice for individuals and organizations looking to maximize their financial resources. By understanding the basics of investing and being aware of the associated risks, investors can make informed decisions that align with their goals and objectives.

The importance of investing for financial growth

Investing is a crucial aspect of financial planning and wealth accumulation. It involves putting money into various assets or ventures with the goal of generating income or capital appreciation over time. Investing allows individuals to grow their wealth, protect against inflation, and achieve long-term financial goals.

Diversification is one key concept in investing. By diversifying their investments across different asset classes, such as stocks, bonds, real estate, and commodities, investors can reduce the risk associated with any single investment. This helps to protect their capital from market volatility and potential losses. Investing in a diverse portfolio also provides opportunities for higher returns as different assets perform differently over time.

Compounding is another important aspect of investing. Through compounding, an investor earns returns not only on their initial investment but also on the returns generated by that investment. Over time, compounding can significantly accelerate the growth of wealth. The earlier an individual starts investing, the more time their investments have to compound, which can have a profound impact on their financial future.

Long-term goals can be better achieved through investing. Whether it’s saving for retirement, buying a home, or funding a child’s education, investing provides individuals with the potential to achieve these goals. By investing regularly and consistently, individuals can accumulate wealth over time and have the means to meet their financial objectives.

Risk management is an important consideration in investing. Every investment carries some level of risk, but by understanding and managing risk, investors can make informed decisions and mitigate potential losses. Diversification, as mentioned earlier, is one strategy to manage risk. Additionally, conducting thorough research, staying updated on market trends, and seeking professional advice can all contribute to effective risk management.

Financial growth is the ultimate goal of investing. Through disciplined investing, individuals can generate passive income, build wealth, and secure their financial future. Investing provides opportunities to grow capital and beat inflation, ensuring that one’s money retains its value over time. By understanding investing basics and utilizing different investment vehicles, individuals can make informed decisions to maximize their financial growth potential.

Different types of investments

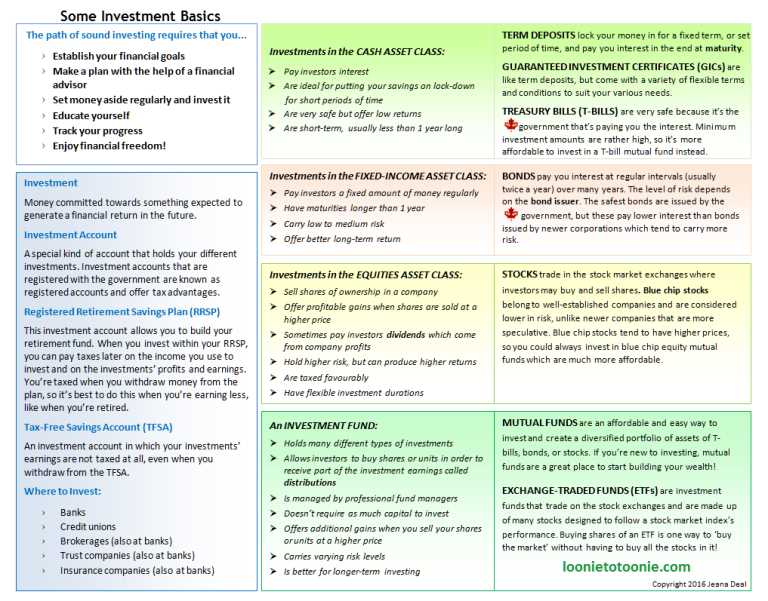

When it comes to investing, there are many different types of options available to individuals. Each investment type has its own characteristics and potential risks and returns. Understanding the different types of investments can help investors make more informed decisions and diversify their portfolios.

Stocks: Stocks represent ownership in a company. When you buy shares of a company’s stock, you become a partial owner of that company. Stocks offer the potential for high returns, but they also come with higher risks. Prices of stocks can fluctuate greatly based on market conditions and company performance.

Bonds: Bonds are debt securities issued by governments, municipalities, and corporations. When you buy a bond, you are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal at maturity. Bonds are generally considered lower-risk investments compared to stocks, but they also offer lower potential returns.

Mutual Funds: Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds offer diversification and can be a good option for those who don’t have the time or expertise to manage their own portfolios.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they trade on an exchange like a stock. They offer diversification and can be bought or sold throughout the trading day. ETFs can track various indexes, sectors, or asset classes, allowing investors to gain exposure to a specific market segment or investment strategy.

Real Estate: Real estate investments involve buying properties or investing in real estate securities, such as real estate investment trusts (REITs). Real estate can provide income through rental payments and potential capital appreciation. However, it can also be illiquid and require significant upfront investment.

Commodities: Commodities are raw materials or primary agricultural products that can be bought and sold. Examples of commodities include gold, oil, wheat, and natural gas. Investing in commodities can provide diversification and act as a hedge against inflation, but they can also be volatile and influenced by factors such as supply and demand.

Options and Futures: Options and futures are derivatives that give investors the right to buy or sell an underlying asset at a predetermined price at a future date. They can be used for speculative purposes or to hedge existing positions. Options and futures can be complex and carry high levels of risk.

These are just a few of the many types of investments available to investors. It’s important to thoroughly research and understand each investment type before making any investment decisions. Consulting with a financial advisor can also provide valuable guidance and help tailor an investment strategy to individual goals and risk tolerance.

Exploring Stocks and Bonds

Stocks and bonds are two of the most common types of investments available in the financial markets. They represent ownership in a company (stocks) or a debt obligation (bonds), and understanding their characteristics is essential for any investor.

Stocks: When you buy stocks, you are essentially buying a share of ownership in a company. This means you become a shareholder and have the potential to earn a portion of the company’s profits. Stocks can be categorized into two main types: common stocks and preferred stocks. Common stocks come with voting rights and provide an opportunity to participate in the company’s growth and receive dividends. Preferred stocks, on the other hand, do not come with voting rights but offer a fixed dividend payment.

Bonds: Bonds, on the other hand, represent a loan made by an investor to a borrower, typically a government or a corporation. When you buy a bond, you are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are considered less risky than stocks as they offer a fixed income stream and have a defined maturity date.

Investors often diversify their portfolios by including both stocks and bonds. This strategy allows them to potentially benefit from the growth potential of stocks while mitigating risk through the steady income and stability provided by bonds. It is important to note that the performance of stocks and bonds can be influenced by various factors such as economic conditions, interest rates, and market sentiment. Therefore, conducting thorough research and analyzing the fundamentals of each investment is crucial before making any investment decisions.

Understanding mutual funds and ETFs

When it comes to investing, mutual funds and exchange-traded funds (ETFs) are two popular options for investors. Understanding the differences between these two types of investment vehicles is essential for making informed decisions about where to put your money.

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds offer investors the opportunity to gain exposure to a broad range of assets without having to buy individual securities themselves. They also provide the benefits of diversification and professional management.

One key characteristic of mutual funds is that they are priced once a day, at the end of the trading day, based on the net asset value (NAV) of the fund. This means that when an investor buys or sells shares of a mutual fund, the transaction takes place at the next calculated NAV price. Mutual funds are typically bought and sold through fund companies or brokerage firms.

ETFs, on the other hand, are investment funds that are traded on stock exchanges, just like individual stocks. ETFs are designed to track the performance of a specific index, industry sector, or asset class. This means that their prices fluctuate throughout the trading day, reflecting the movement of the underlying assets.

One advantage of ETFs is their flexibility. Investors can buy and sell ETF shares at any time during trading hours, just like they would with a stock. Additionally, ETFs often have lower expense ratios compared to mutual funds, making them an attractive option for cost-conscious investors.

Whether you choose to invest in mutual funds or ETFs, it’s crucial to assess your investment goals, risk tolerance, and time horizon before making a decision. Both types of funds offer unique advantages and disadvantages, so it’s essential to conduct thorough research and seek professional advice if needed.

Main takeaways:

- Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities.

- Mutual funds are priced once a day based on the net asset value (NAV) of the fund.

- ETFs are investment funds traded on stock exchanges, designed to track the performance of a specific index or asset class.

- ETF prices fluctuate throughout the trading day, reflecting the movement of the underlying assets.

- ETFs offer flexibility in buying and selling shares, often with lower expense ratios compared to mutual funds.