Released in 2015, “The Big Short” is a highly acclaimed film based on the book of the same name by Michael Lewis. The movie tells the story of the 2008 financial crisis and the few individuals who successfully predicted and profited from it. It delves into the complex world of Wall Street, showcasing the greed and corruption that led to the collapse of the housing market and subsequent global economic downturn.

As the movie tackles such a complex and important topic, it naturally raises many questions among its viewers. In this article, we aim to address some of the most frequently asked questions about “The Big Short”, providing insightful answers that shed light on the events and characters portrayed in the film.

One of the most common questions surrounding the movie is whether it accurately portrays the events of the 2008 financial crisis. While some liberties were taken for the sake of storytelling, overall, the film was hailed for its accuracy. It successfully captures the spirit of the crisis and highlights the systemic issues that led to the collapse of the housing market. Additionally, the movie received praise for its educational nature, as it effectively explains complex financial concepts in a way that is accessible to the general public.

The Big Short Movie: Questions and Answers

The Big Short is a 2015 movie that focuses on the events leading up to the financial crisis of 2008. It tells the story of a group of financial outsiders who predicted the housing market crash and decided to bet against the banks. The movie raises several questions about the nature of the crisis and the financial system as a whole. Here are some common questions and their answers:

1. What caused the financial crisis of 2008?

The financial crisis of 2008 was caused by a combination of factors. One major factor was the housing market bubble, which was fueled by the availability of subprime mortgages. These mortgages were given to borrowers with low credit ratings, and many of them were unable to repay their loans. As the number of defaults increased, the value of mortgage-backed securities (which were tied to these loans) plummeted, leading to massive losses for banks and other financial institutions.

2. How did the characters in the movie predict the crisis?

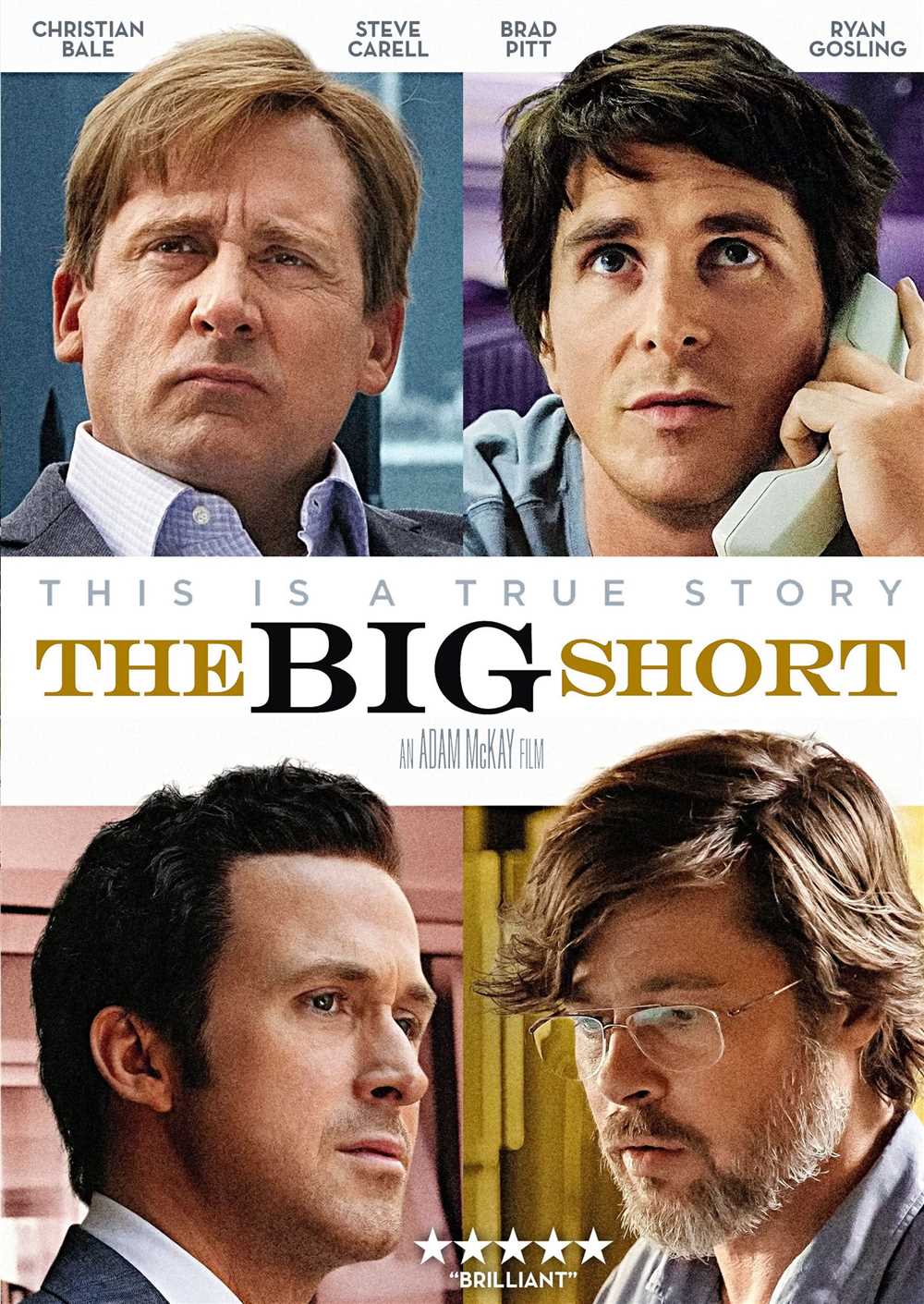

The characters in the movie, played by Christian Bale, Steve Carell, Ryan Gosling, and Brad Pitt, were able to predict the crisis by conducting extensive research and analysis of the housing market. They noticed that the number of subprime mortgages being issued was increasing rapidly, and that the quality of these mortgages was declining. They also uncovered evidence of the fraudulent practices being used by banks to package and sell mortgage-backed securities. These findings led them to believe that the housing market was headed for a crash.

3. What did the characters do to profit from the crisis?

The characters in the movie decided to bet against the banks by purchasing credit default swaps (CDS). These financial instruments allowed them to profit if the housing market crashed and mortgage-backed securities defaulted. They faced skepticism and resistance from the financial industry, but ultimately their bets paid off and they made billions of dollars when the crisis hit.

4. What lessons can be learned from the movie?

The Big Short highlights several important lessons about the financial system. It shows the dangers of greed and the willingness of banks to take excessive risks in pursuit of profit. It also demonstrates the importance of skepticism and independent thinking in a market that is driven by hype and speculation. The movie serves as a reminder of the need for financial regulation and oversight to prevent another crisis from occurring.

What is “The Big Short” movie about?

“The Big Short” is a 2015 film directed by Adam McKay, which is based on the book of the same name by Michael Lewis. The movie revolves around the financial crisis of 2007-2008, and portrays a group of individuals who foresaw the collapse of the housing market and bet against it.

Set in the backdrop of the United States housing bubble, the film follows the stories of three separate groups of people: Michael Burry, a socially awkward hedge fund manager who discovers the impending crisis; Jared Vennett, a banker who becomes aware of the unstable mortgage-backed securities market; and Mark Baum, a cynical hedge fund manager who agrees to join Vennett’s plan.

- Michael Burry, played by Christian Bale, is a brilliant but eccentric hedge fund manager who conducts extensive research and predicts that the subprime mortgage market is in a bubble and will soon collapse. He decides to bet against the market, profiting if he is proven right.

- Jared Vennett, portrayed by Ryan Gosling, is a Wall Street trader who catches wind of Burry’s predictions and decides to get involved. He helps connect Burry with several investors who are also interested in shorting the housing market.

- Mark Baum, played by Steve Carell, is a hedge fund manager who initially dismisses Vennett’s findings but eventually becomes convinced of the impending crisis. Baum then joins forces with Vennett and his team to bet against the housing market and expose the corruption and greed within the financial industry.

The film explores the complex financial instruments and practices that contributed to the crisis, as well as the personal struggles and conflicts faced by the characters as they navigate the chaos and greed of Wall Street. It sheds light on the flaws and systemic issues within the financial industry, questioning the ethical and moral implications of the crisis.

Who are the main characters in the movie?

In the movie “The Big Short”, there are several main characters who play key roles in the unfolding of the financial crisis and subsequent events. These characters are based on real-life individuals.

1. Michael Burry

Michael Burry is an eccentric hedge fund manager who predicts the imminent collapse of the housing market. He is played by Christian Bale. Burry conducts extensive research and analysis, discovering that the subprime mortgage bonds are essentially worthless. Despite facing skepticism and opposition from his investors, Burry bets against the housing market, making him one of the first to profit from the crisis.

2. Mark Baum

Mark Baum is a cynical hedge fund manager who becomes suspicious of the housing market and decides to investigate further. He is played by Steve Carell. Baum eventually decides to bet against the housing market, but he is torn between profiting from the crisis and the moral implications of doing so. Baum’s character provides a critical perspective on the greed and corruption within the financial industry.

3. Jared Vennett

Jared Vennett, played by Ryan Gosling, is a slick and arrogant Wall Street banker who becomes aware of Burry’s plan and decides to capitalize on it. He acts as a narrator and guide throughout the movie, breaking the fourth wall and explaining complex financial concepts to the audience. Vennett is driven by personal profit and sees the impending crisis as an opportunity rather than a cause for concern.

4. Charlie Geller and Jamie Shipley

Charlie Geller and Jamie Shipley, played by John Magaro and Finn Wittrock, are two young investors who stumble upon the idea of betting against the housing market. They seek the help of retired banker Ben Rickert (played by Brad Pitt) to execute their plan. Geller and Shipley’s characters represent the outsiders who are not part of the Wall Street establishment but manage to capitalize on the impending crisis.

These are just a few of the main characters in “The Big Short”. Each character brings a unique perspective to the financial crisis, highlighting different aspects of the industry and its impact on society.

Is “The Big Short” based on a true story?

“The Big Short” is indeed based on a true story. The movie is an adaptation of the book with the same name, written by Michael Lewis. The book and the movie both chronicle the events leading up to the 2008 financial crisis and the few individuals who saw it coming and profited from it. The story is based on real-life events and real people who were involved in the financial industry at that time.

The movie follows the lives of several key characters, such as Michael Burry, Mark Baum, Jared Vennett, and Ben Rickert, who each discovered the impending collapse of the housing market and decided to bet against it. These characters were real people who played a significant role in predicting and profiting from the financial crisis.

The filmmakers took great care to stay true to the events and accurately depict the real-life individuals involved. They consulted with the actual people portrayed in the movie to ensure accuracy and authenticity. While some scenes and dialogue may have been dramatized for the purposes of storytelling, the overall narrative and the key events portrayed in the movie are based on real events and the people who experienced them.

How accurate is “The Big Short” movie in depicting the financial crisis?

The Big Short is a movie that attempts to portray the events leading up to the 2008 financial crisis and the subsequent collapse of the housing market. While the movie does take some creative liberties for the sake of storytelling, it is largely accurate in depicting the causes and consequences of the crisis.

One of the strengths of the movie is its ability to explain complex financial concepts in an accessible way. The film breaks down the intricacies of mortgage-backed securities and credit default swaps, making it easier for viewers to understand how these financial instruments played a role in the crisis. Additionally, the movie accurately portrays the greed and misconduct of financial institutions, as well as the lack of regulatory oversight that allowed the crisis to occur.

The accuracy of the movie is further supported by the fact that it is based on real events and real people. The Big Short is adapted from a book by Michael Lewis, who extensively researched the financial crisis and interviewed many of the individuals involved. The movie also includes real-life footage and news reports from the time, further grounding it in reality.

While The Big Short may condense certain events or simplify certain aspects of the crisis for the sake of storytelling, it overall provides an accurate portrayal of the financial crisis and the factors that contributed to it. It serves as a reminder of the dangers of unchecked greed and the need for stronger regulations in the financial industry.

Key Takeaways from “The Big Short”

The Big Short is a thought-provoking movie that sheds light on the financial crisis of 2008. It not only provides an entertaining narrative but also offers several key takeaways and lessons to be learned.

1. Financial complexity can lead to catastrophic consequences

The movie emphasizes the role of complex financial instruments and the lack of understanding and transparency within the banking industry. It demonstrates how the excessive use of synthetic collateralized debt obligations (CDOs) and credit default swaps (CDS) contributed to the collapse of the housing market and subsequent global financial crisis.

2. The importance of questioning the status quo

In the movie, a few select individuals recognized the flaws in the financial system and started investigating. They refused to accept the prevailing narrative and were willing to challenge conventional wisdom. This highlights the significance of critical thinking and questioning the established norms, even when it goes against popular belief.

3. Greed can blind even the most experienced professionals

One of the key lessons from the movie is the dangers of unchecked greed. It shows how even experienced professionals in the financial industry were motivated by personal gain, leading them to make reckless decisions and overlook warning signs. It serves as a reminder that ethical conduct should always take precedence over short-term financial gains.

4. The power of standing up for what is right

The Big Short portrays a group of individuals who stood up against the corrupt practices of the banking industry. Despite facing ridicule and opposition, they persisted in their mission to expose the truth and protect innocent investors. This highlights the importance of integrity and the profound impact that individuals can have when they choose to do what is right.

5. The need for financial reform and accountability

The movie underscores the necessity of regulatory reform and increased accountability within the financial sector. It raises important questions about the role of government oversight, the responsibility of financial institutions, and the need for transparency to prevent future crises. It serves as a reminder that lessons must be learned from past mistakes to prevent history from repeating itself.

In conclusion, “The Big Short” provides valuable insights into the causes and consequences of the financial crisis, urging viewers to critically examine the complex world of finance and the importance of financial reform.

How did “The Big Short” movie impact the public’s perception of the financial crisis?

The release of “The Big Short” movie had a significant impact on the public’s perception of the financial crisis. By bringing the complex and often misunderstood subject of the financial crisis to the big screen, the movie helped to educate and increase awareness among the general public. The film provided a simplified yet accurate portrayal of the events leading up to the crisis, highlighting the irresponsible practices of banks and the systemic flaws in the financial industry.

One of the main impacts of “The Big Short” was that it exposed the greed and corruption within the financial system. The movie showed how investment banks and mortgage lenders were more interested in making quick profits rather than ensuring the long-term stability of the economy. This portrayal helped to shift public opinion and create a sense of outrage towards those responsible for the crisis. It also emphasized the importance of financial regulation and the need for accountability in the banking industry.

The movie also helped to humanize the victims of the financial crisis. By following the stories of real people who were affected by the crisis, “The Big Short” showed the devastating impact it had on individuals and communities. This human element resonated with the audience and helped to foster empathy and understanding towards those who lost their homes, jobs, and savings.