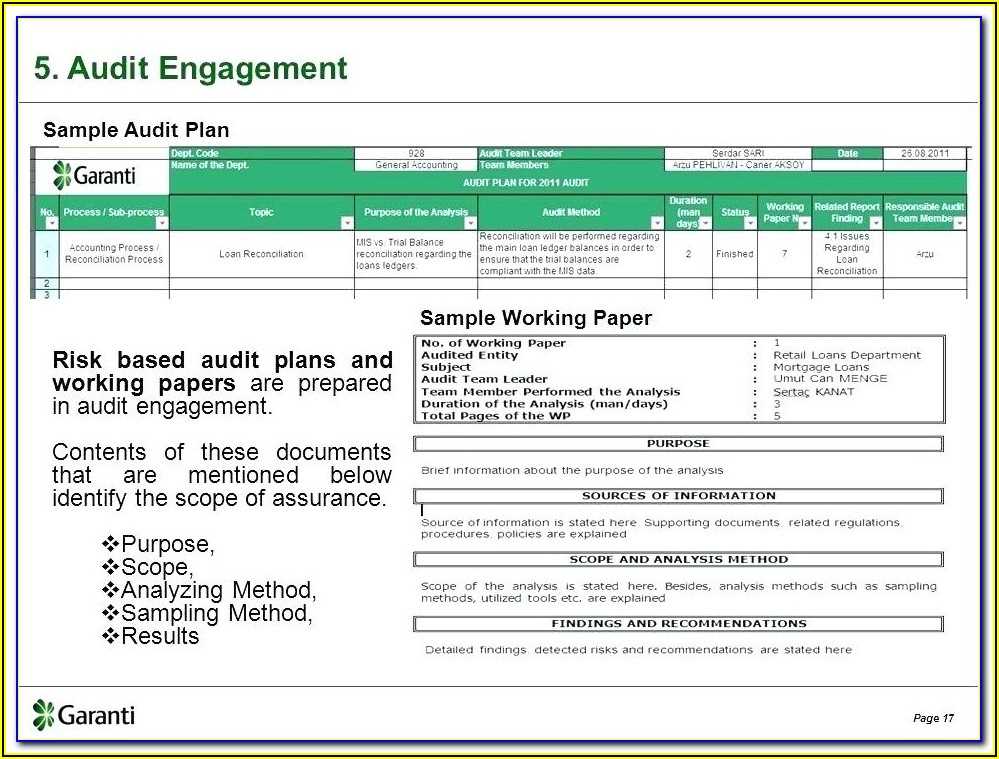

Working papers are an integral part of the accounting process. They serve as a record of the procedures and analyses conducted by accountants when preparing financial statements. These papers provide a detailed overview of the steps followed, calculations made, and sources used to arrive at the final results.

When it comes to Working Papers 2 2 Accounting, there are various questions that arise. To simplify the process, many seek answers to help them better understand the concepts involved and ensure accuracy in their work. In this article, we will delve into some common questions surrounding Working Papers 2 2 Accounting and provide comprehensive answers to help you.

One of the frequently asked questions is, “What are the main components of Working Papers 2 2 Accounting?” The main components include a working trial balance, adjusting entries, adjusting trial balance, financial statements, and closing entries. These components work together to provide a complete picture of an organization’s financial situation, ensuring accuracy and transparency.

Working Papers 2 2 Accounting Answers: Everything You Need to Know

Working Papers 2 2 Accounting Answers is a comprehensive solution for students and professionals looking to improve their accounting skills. This software program offers a range of features that help users learn and practice accounting concepts. Whether you are a beginner or an experienced accountant, this tool can be extremely beneficial in strengthening your understanding of accounting principles and preparing for exams or professional certifications.

One of the key features of Working Papers 2 2 Accounting Answers is the extensive collection of practice exercises and quizzes. These exercises cover various topics such as journal entries, financial statements, balance sheets, and income statements. By working through these exercises, users can test their knowledge and identify areas for improvement. The program also provides detailed solutions and explanations for each exercise, allowing users to learn from their mistakes and reinforce their understanding of key accounting concepts.

In addition to the practice exercises, Working Papers 2 2 Accounting Answers also includes interactive tutorials and video lessons. These resources provide step-by-step guidance on important accounting topics and techniques. Users can watch the video lessons and follow along with the tutorials to gain a deeper understanding of complex accounting concepts. The program also offers demonstrations and examples that illustrate how to apply accounting principles in real-world scenarios.

Another noteworthy feature of Working Papers 2 2 Accounting Answers is its customizable study plans. Users can create personalized study plans based on their individual learning needs and goals. The program allows users to set specific objectives, track their progress, and receive targeted feedback and recommendations. This feature is particularly useful for students preparing for exams or professionals looking to enhance their accounting skills in specific areas.

In conclusion, Working Papers 2 2 Accounting Answers is a comprehensive learning tool that can greatly benefit students and professionals in the field of accounting. With its extensive collection of practice exercises, interactive tutorials, and customizable study plans, this software program offers a complete solution for improving accounting knowledge and skills. Whether you are a student, an aspiring accountant, or a seasoned professional, this tool can help you master accounting concepts and achieve your goals in the field of accounting.

Understanding Working Papers 2 2 Accounting

In the field of accounting, working papers play a crucial role in the preparation and review of financial statements. Working papers are documents that support the accounting processes and provide evidence of the work performed. They serve as a trail of the accountant’s thought process, calculations, and analysis. One popular software used for working papers is Working Papers 2 2 Accounting, which offers a comprehensive solution for accountants to streamline their work.

Working Papers 2 2 Accounting provides various features and tools to facilitate the accounting process. It allows accountants to create, organize, and store different types of documents such as checklists, spreadsheets, and narratives. These documents can be easily linked and cross-referenced, making it easier to track the flow of information and ensure accuracy in the financial statements. Additionally, the software allows for easy collaboration among team members, enhancing efficiency and reducing errors.

One of the main benefits of Working Papers 2 2 Accounting is its ability to automate calculations and data analysis. The software can perform complex calculations, such as depreciation or loan amortization, saving accountants significant time and effort. It also offers built-in data analysis tools, allowing accountants to identify trends, outliers, and discrepancies quickly. This helps ensure the accuracy and integrity of the financial statements.

Furthermore, Working Papers 2 2 Accounting enhances data security and confidentiality. It allows for access controls and permissions, ensuring that only authorized individuals can view and edit sensitive financial information. The software also offers data backup and recovery options, protecting against data loss or corruption. This is particularly important in today’s digital age, where data breaches and cyber threats are a constant concern.

- In conclusion, Working Papers 2 2 Accounting is a valuable tool for accountants in the preparation and review of financial statements. It streamlines the accounting process, automates calculations and data analysis, and enhances data security. By utilizing this software, accountants can improve efficiency, accuracy, and collaboration in their work.

The Importance of Working Papers 2 2 Accounting

Working papers 2 2 accounting is an essential tool for accountants to maintain accurate records and provide evidence of their work. These papers are the foundation of auditing and financial reporting, as they help ensure the integrity and reliability of financial statements.

One of the key benefits of working papers 2 2 accounting is that they provide a detailed trail of the accountant’s procedures and calculations. This can be crucial in case of an audit or review, as it allows examiners to understand the steps taken to arrive at the final results. Furthermore, these papers also serve as a reference point for future financial analysis or when answering inquiries from stakeholders.

In addition, working papers 2 2 accounting facilitate collaboration and communication within the accounting team. By documenting their work and sharing it with colleagues, accountants can ensure transparency and consistency in their processes. This is especially important in larger organizations where multiple accountants may be working on the same financial statements.

Working papers 2 2 accounting also play a role in risk management and internal control. By maintaining a comprehensive record of their work, accountants can identify any potential errors or discrepancies early on, allowing them to rectify the issues before they become significant problems. Furthermore, these papers can serve as evidence in case of legal disputes or regulatory investigations.

In conclusion, working papers 2 2 accounting are a crucial component of the accounting process. They provide a detailed record of the procedures and calculations performed, facilitate collaboration and communication within the accounting team, and contribute to risk management and internal control. Accountants should prioritize the creation and maintenance of these papers to ensure the accuracy and reliability of financial statements.

Working Papers 2 2 Accounting Benefits for Businesses

Working Papers 2.2 is a comprehensive accounting software that offers numerous benefits for businesses. It provides a structured and organized approach to financial record-keeping, allowing companies to efficiently track their income, expenses, and assets. With its user-friendly interface, the software simplifies the accounting process and saves time for businesses.

One of the main benefits of Working Papers 2.2 accounting is its ability to generate accurate financial reports. The software automatically calculates and updates financial data, ensuring that businesses have up-to-date information on their financial health. This feature is particularly useful during tax season or when businesses need to present financial reports to stakeholders or potential investors. The ability to generate accurate reports also helps businesses make informed decisions based on reliable financial information.

Another advantage of Working Papers 2.2 accounting is its integration with other software and systems. The software allows for seamless integration with various accounting tools, such as payroll software or inventory management systems. This integration reduces the need for manual data entry, minimizing the risk of errors and improving efficiency. Businesses can also integrate the software with their banking systems, allowing for automatic updates of transactions and balances.

Working Papers 2.2 accounting also offers robust security features. It provides encryption and password protection, ensuring that financial data is secure and only accessible to authorized personnel. The software also allows for user roles and permissions, allowing businesses to control who has access to sensitive financial information. This level of security is essential for businesses that handle sensitive financial data and want to protect against unauthorized access or data breaches.

In summary, Working Papers 2.2 accounting offers numerous benefits for businesses. It provides a structured approach to financial record-keeping, generates accurate financial reports, integrates with other systems, and offers robust security features. By using this software, businesses can streamline their accounting processes, make informed decisions based on reliable financial information, and protect their sensitive data.

Common Challenges in Working Papers 2 2 Accounting

Working Papers 2 2 accounting software is widely used by accountants and financial professionals to streamline their work and manage their financial data. However, like any other software, it has its own set of challenges that users may encounter. Here are some common challenges faced by users of Working Papers 2 2 accounting.

1. Data Entry Errors

One common challenge in Working Papers 2 2 accounting is data entry errors. Mistakes in entering financial data can lead to incorrect calculations and reports, which can have serious implications on financial decision-making. It is essential for users to double-check their data entry and validate the accuracy of the information entered.

2. Integration with Other Systems

Another challenge faced by users is the integration of Working Papers 2 2 accounting with other systems. Many organizations use multiple software systems for different purposes, such as payroll, inventory management, and customer relationship management. Ensuring seamless integration and data synchronization between these systems can be a complex task.

3. Security and Data Protection

Working Papers 2 2 accounting deals with sensitive financial information, making security and data protection a critical challenge. Users need to ensure that their data is stored securely and protected from unauthorized access or data breaches. Implementing proper security measures, such as encrypted data storage and access controls, is crucial to mitigate these risks.

4. Training and Support

While Working Papers 2 2 accounting software offers many functionalities, utilizing them to their full potential may require training and support. Users may face challenges in understanding the software’s features and functionalities. Providing proper training and ongoing support can help users overcome these challenges and maximize the benefits of the software.

In conclusion, Working Papers 2 2 accounting software has its own set of challenges, including data entry errors, integration with other systems, security and data protection, and the need for training and support. Recognizing and addressing these challenges can help users effectively utilize the software and optimize their financial management processes.

Strategies for Effective Working Papers 2 2 Accounting

Working papers are an essential tool for accountants to ensure accurate and thorough record keeping. They serve as a documentation of the accounting process, providing a trail of evidence that can be used for reference and auditing purposes. To create effective working papers in the context of 2 2 accounting, accountants should follow certain strategies.

1. Organization: Maintaining a well-organized set of working papers is crucial for easy navigation and retrieval of information. Accountants should label and number each document, categorize them according to relevant sections (such as income statement, balance sheet, and cash flow statement), and arrange them in a logical sequence.

2. Clarity: Working papers should be clear and understandable to anyone who needs to review them, whether it’s a colleague, manager, or auditor. Accountants should use clear and concise language, avoid unnecessary jargon, and provide explanations or annotations where necessary to clarify any complex calculations or entries.

3. Accuracy: Accuracy is paramount in accounting, and working papers are no exception. Accountants should ensure that all calculations, figures, and information included in the working papers are accurate and match the corresponding financial statements. Any discrepancies or errors should be promptly addressed and corrected.

4. Consistency: Consistency is key in accounting, and working papers should adhere to consistent formatting and presentation standards. Accountants should use the same formats, layouts, and formulas across all working papers to maintain uniformity and make it easier for others to understand and follow the documentation.

5. Relevance: Working papers should only include information that is relevant to the accounting process and supporting the financial statements. Accountants should avoid including unnecessary or irrelevant documents, calculations, or notes to prevent clutter and confusion.

By following these strategies, accountants can create effective working papers that provide a clear, accurate, and organized documentation of the accounting process in the context of 2 2 accounting. These working papers not only serve as a tool for the current accounting cycle but also provide a valuable resource for future reference and auditing purposes.