Income statements, also known as profit and loss statements, are financial documents that provide a summary of a company’s revenues, expenses, and net income. They are an essential tool for understanding a company’s financial performance and evaluating its profitability. In this article, we will discuss the answers to common questions about income statements and how to interpret their information.

1. What is the purpose of an income statement?

An income statement is used to show the financial performance of a company over a specific period of time, usually a quarter or a year. It provides a snapshot of the company’s revenues, expenses, and net income, allowing stakeholders to evaluate its profitability and make informed decisions about its financial health.

2. What information can be found on an income statement?

Income statements typically include several key components. These include revenue, which represents the total amount of money generated by the sale of goods or services. Expenses, on the other hand, include costs and expenses incurred to operate the business, such as salaries, rent, and utilities. Gross profit is calculated by subtracting the cost of goods sold from revenue, while net income is the final result after subtracting all expenses from revenue.

3. How can income statements be analyzed?

Income statements can be analyzed by comparing them to previous periods’ statements or to industry benchmarks. This helps identify trends and assess the company’s financial performance over time. Additionally, ratios and percentages can be calculated using the information from the income statement, such as gross profit margin (gross profit divided by revenue) or net profit margin (net income divided by revenue), providing further insights into the company’s profitability and efficiency.

4. Why are income statements important?

Income statements are important as they provide crucial information for various stakeholders, including investors, creditors, and management. They help investors evaluate the profitability and financial health of a company before making investment decisions. Creditors, on the other hand, use income statements to assess a company’s ability to pay back its debts. Lastly, management relies on income statements to analyze the company’s performance and make strategic decisions to improve profitability.

In conclusion, income statements are essential financial documents that provide a summary of a company’s financial performance. By analyzing the information on an income statement, stakeholders can gain insights into a company’s profitability, financial health, and make informed decisions. Understanding income statements is crucial for anyone involved in financial analysis and decision-making in a business.

Understanding Income Statements: Answers to Essential Questions

An income statement, also known as a profit and loss statement or P&L statement, is a financial statement that provides a summary of a company’s revenues, expenses, and net income over a specific period of time. It is an essential tool for understanding the financial performance of a business and making informed decisions.

What is the purpose of an income statement?

An income statement is used to show the profitability of a company by presenting the revenue generated, the expenses incurred, and the resulting net income or loss. It helps investors, shareholders, and other stakeholders understand the financial health of a company and its ability to generate profits.

What are the key components of an income statement?

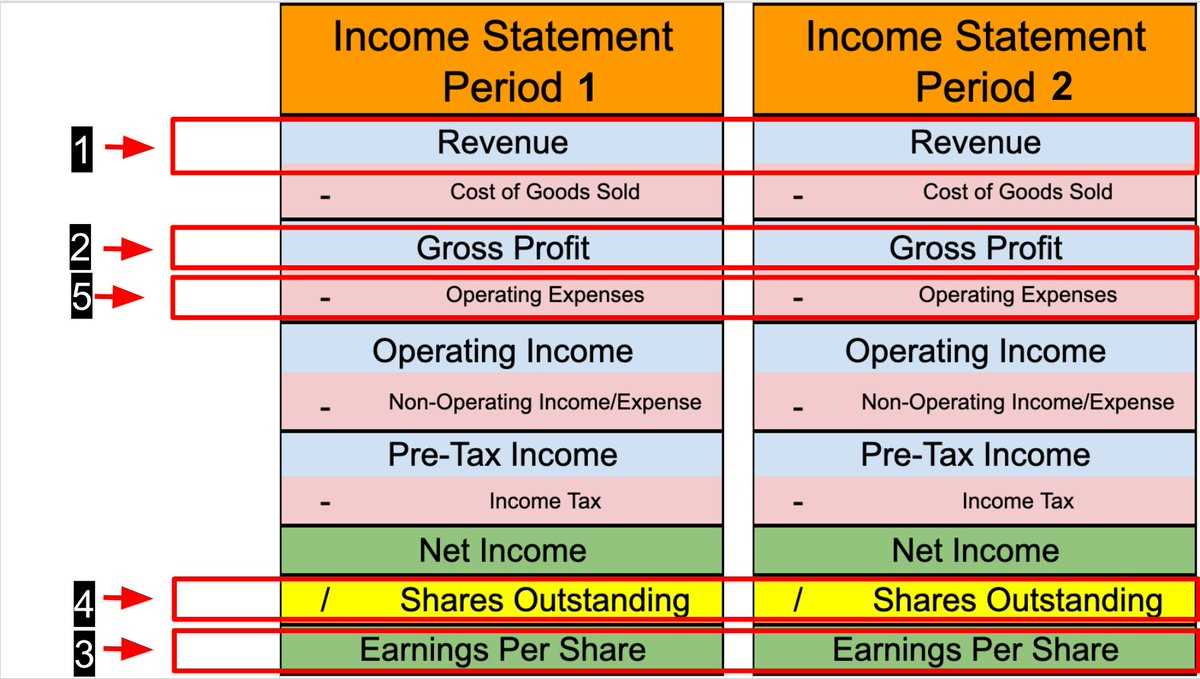

The key components of an income statement include:

- Revenue: The total amount of money earned from the sale of goods or services.

- Cost of Goods Sold (COGS): The direct costs associated with producing or delivering the goods or services.

- Gross Profit: The revenue minus the cost of goods sold.

- Operating Expenses: The costs incurred in running a business, such as salaries, rent, and utilities.

- Operating Income: The gross profit minus the operating expenses.

- Other Income and Expenses: Non-operating income or expenses, such as interest income or interest expenses.

- Net Income: The total income after subtracting all expenses.

How is an income statement different from a balance sheet?

An income statement shows the financial performance of a company over a specific period of time, while a balance sheet provides a snapshot of a company’s financial position at a specific point in time. The income statement focuses on revenues, expenses, and net income, whereas the balance sheet presents assets, liabilities, and shareholders’ equity.

Why is it important to analyze the income statement?

Analyzing the income statement helps stakeholders evaluate a company’s profitability, efficiency, and financial stability. It allows for comparisons between different periods or companies and aids in decision-making processes, such as investing, lending, or assessing the performance of management.

What is an Income Statement and Why is it Important?

An income statement is a financial statement that provides a summary of a company’s revenues and expenses over a specific period of time. It shows how much money a company has earned, how much it has spent, and what its net income or loss is for that period. The income statement is also known as a profit and loss statement or P&L statement.

The income statement is important because it allows stakeholders, including investors, creditors, and company managers, to assess the financial performance and profitability of a business. By analyzing the information in the income statement, stakeholders can make informed decisions about whether to invest in the company, lend it money, or make strategic business decisions.

The income statement consists of several key components:

- Revenue: This includes the money a company earns from selling its products or services.

- Cost of Goods Sold (COGS): This includes the direct costs associated with producing or delivering the products or services sold by the company.

- Gross Profit: This is the difference between revenue and the cost of goods sold, representing the profit margin before operating expenses.

- Operating Expenses: These include expenses such as salaries, rent, utilities, marketing, and other costs incurred in the day-to-day operations of the business.

- Net Profit or Loss: This is the final result after all expenses have been subtracted from revenue. A positive net profit indicates that the company has made a profit, while a negative net profit indicates a loss.

By analyzing the income statement, stakeholders can assess the company’s financial health and performance over time. They can identify trends, such as increasing or decreasing profitability, and compare the company’s performance to industry benchmarks or competitors. This information is crucial for making decisions about investing in the company, extending credit, or managing the company’s operations effectively.

How to Prepare an Income Statement: Step-by-Step Guide

An income statement, also known as a profit and loss statement, is a financial statement that gives an overview of a company’s revenues, expenses, and net income over a specific period of time. It provides valuable insights into a company’s financial performance and helps stakeholders assess its profitability. To prepare an accurate income statement, follow these step-by-step guidelines:

1. Gather financial data:

Collect all the necessary financial information, including revenue records, expense receipts, and financial statements for the given period. Make sure you have a comprehensive view of the company’s financial transactions during that time.

2. Calculate total revenue:

Start by calculating the total revenue generated by the company during the specified period. This includes all sales of goods or services, as well as any other sources of income, such as interest or dividends. Sum up all these revenue sources to determine the total revenue figure.

3. Determine the cost of goods sold:

If your company sells products, you need to calculate the cost of goods sold (COGS). This includes the direct costs associated with producing or purchasing the products sold during the period, such as raw materials, labor, and production overhead. Subtract the COGS from the total revenue to get the gross profit.

4. Calculate operating expenses:

List all the operating expenses incurred by the company, such as rent, utilities, salaries, marketing expenses, and insurance. Sum up these expenses to determine the total operating expenses.

5. Calculate operating income:

Subtract the total operating expenses from the gross profit to calculate the operating income, also known as operating profit or EBIT (earnings before interest and taxes). This represents the profit generated solely from the company’s core operations.

6. Account for non-operating income and expenses:

If applicable, include any non-operating income, such as gains from the sale of assets or interest income, and non-operating expenses, such as interest paid on loans or loss on the sale of assets. Adjust the operating income accordingly to reflect these items.

7. Calculate net income:

Finally, after accounting for all revenue, expenses, and taxes, subtract the non-operating income and expenses from the operating income to calculate the net income, also known as the bottom line. This represents the company’s overall profit for the specified period.

By following these step-by-step guidelines, you can prepare an accurate and informative income statement that provides a clear picture of a company’s financial performance. Remember to review and verify your calculations to ensure the accuracy of the income statement.

Key Components of an Income Statement Explained

An income statement, also known as a profit and loss statement, is a financial statement that shows the revenues, expenses, and overall profitability of a company over a specific period of time. This statement provides valuable insights into a company’s financial performance and is a crucial tool for investors, analysts, and other stakeholders.

There are several key components of an income statement that help to paint a comprehensive picture of a company’s financial health:

1. Revenue:

Revenue refers to the total amount of money a company earns from its primary operations, such as sales of products or services. It is a crucial component of the income statement as it represents the top line of the statement and shows the company’s ability to generate income.

2. Cost of Goods Sold (COGS):

The cost of goods sold, or COGS, represents the direct costs incurred in producing or delivering the products or services sold by the company. It includes the cost of raw materials, labor, and any other expenses directly related to the production process. COGS is subtracted from revenue to calculate gross profit.

3. Gross Profit:

Gross profit is the difference between revenue and the cost of goods sold. It represents the company’s profitability from its core business operations before taking into account other expenses.

4. Operating Expenses:

Operating expenses include all the costs incurred in running the day-to-day operations of the business, such as rent, utilities, salaries, and marketing expenses. These expenses are subtracted from gross profit to calculate operating income.

5. Operating Income:

Operating income, also known as operating profit, is the profit generated by a company’s core business operations after deducting all operating expenses. It is a key measure of a company’s profitability and operational efficiency.

6. Other Income and Expenses:

Other income and expenses refer to any non-operating items that impact the company’s financial performance. This may include interest income, interest expense, gains or losses from the sale of assets, or any other non-operational income or expense. These items are usually listed separately and not included in operating income.

7. Net Income:

Net income, also known as net profit or net earnings, is the final line of the income statement and represents the company’s overall profitability after taking into account all revenues, expenses, and taxes. It is a key measure of a company’s financial performance and is often used to assess its ability to generate returns for its shareholders.

Understanding the key components of an income statement is essential for analyzing a company’s financial health and making informed investment decisions. By examining these components, investors and analysts can assess a company’s revenue streams, cost structure, operational efficiency, and overall profitability.

Analyzing Income Statements: Important Ratios and Indicators

An income statement provides valuable information about a company’s financial performance over a specific period. By analyzing income statements, investors and analysts can gain insights into a company’s profitability, liquidity, and overall financial health. To assess a company’s financial strength, several ratios and indicators can be derived from the income statement.

Gross Profit Margin: The gross profit margin is calculated by dividing the gross profit by the total revenue. This ratio indicates how efficiently a company utilizes its resources to generate profits after accounting for direct production costs. A higher gross profit margin suggests better profitability.

Operating Profit Margin: The operating profit margin is obtained by dividing the operating profit by the total revenue. It measures a company’s profitability after accounting for both direct production costs and operating expenses. A higher operating profit margin indicates better operational efficiency.

Net Profit Margin: The net profit margin is derived by dividing the net profit by the total revenue. This ratio represents the proportion of revenue that translates into net profit after accounting for all expenses, including taxes and interest. A higher net profit margin indicates better overall profitability.

Return on Assets (ROA): The return on assets ratio is calculated by dividing the net profit by the total assets. It measures how efficiently a company utilizes its assets to generate profits. A higher ROA indicates better utilization of assets and higher profitability.

Return on Equity (ROE): The return on equity ratio is obtained by dividing the net profit by the shareholders’ equity. It reflects the return on investment for shareholders. A higher ROE suggests better returns and indicates that the company is effectively utilizing shareholders’ investment.

Earnings per Share (EPS): Earnings per share is calculated by dividing the net profit by the number of outstanding shares. This ratio measures the portion of a company’s profit allocated to each outstanding share. A higher EPS signifies higher profitability and can influence stock prices.

By analyzing these ratios and indicators derived from the income statement, investors and analysts can assess a company’s financial performance, profitability, and efficiency. However, it is important to analyze these ratios in conjunction with other financial statements and industry benchmarks to obtain a comprehensive understanding of a company’s financial position.

| Ratios/Indicators | Calculation | Interpretation |

|---|---|---|

| Gross Profit Margin | Gross Profit / Total Revenue | Indicates profitability after direct production costs |

| Operating Profit Margin | Operating Profit / Total Revenue | Measures profitability after production and operating expenses |

| Net Profit Margin | Net Profit / Total Revenue | Represents overall profitability after all expenses |

| Return on Assets (ROA) | Net Profit / Total Assets | Measures efficiency in generating profits from assets |

| Return on Equity (ROE) | Net Profit / Shareholders’ Equity | Reflects return on investment for shareholders |

| Earnings per Share (EPS) | Net Profit / Number of outstanding shares | Measures profitability per outstanding share |

Income Statement vs. Balance Sheet: Understanding the Differences

When analyzing a company’s financial performance, two important documents come into play: the income statement and the balance sheet. While both provide valuable insights into a company’s financial health, they serve different purposes and focus on different aspects of the business.

Income Statement: The income statement, also known as the profit and loss statement, presents a summary of a company’s revenues, expenses, and net profit or loss over a specific period of time, usually a quarter or a year. It helps investors and stakeholders understand how well the company is generating profits from its core operations. The income statement follows a simple equation: Revenue – Expenses = Net Profit (or Loss). It includes information such as sales, cost of goods sold, operating expenses, interest expenses, and taxes.

Balance Sheet: On the other hand, the balance sheet provides a snapshot of a company’s financial position at a specific point in time, usually at the end of a reporting period. It presents a company’s assets, liabilities, and shareholders’ equity. The balance sheet follows the equation: Assets = Liabilities + Shareholders’ Equity. It includes information such as cash, accounts receivable, inventory, long-term debt, and retained earnings. The balance sheet helps assess the company’s liquidity, solvency, and its ability to meet its financial obligations.

While the income statement focuses on a company’s profitability, the balance sheet provides information on its overall financial health and stability. The income statement shows how much profit or loss a company has made during a specific period, while the balance sheet provides an overview of its assets, liabilities, and shareholders’ equity at a specific point in time.

It’s essential to analyze both the income statement and the balance sheet together to gain a comprehensive understanding of a company’s financial performance. While the income statement tells you how well a company is performing in terms of generating revenue and controlling expenses, the balance sheet allows you to assess its financial strength and ability to weather financial challenges. Together, these two documents provide a comprehensive view of a company’s financial health and are crucial tools for investors, creditors, and other stakeholders.

Common Mistakes to Avoid When Interpreting Income Statements

Interpreting income statements can be a complex task that requires careful analysis and attention to detail. Many individuals and businesses make common mistakes that can lead to misinterpretation of financial data. To help you avoid these errors, here are some key points to consider:

- Misunderstanding the different components: Income statements consist of various components, such as revenue, expenses, and net income. It is crucial to understand the definitions and calculations of each component to accurately assess the financial performance of a company.

- Ignoring non-recurring or extraordinary items: Income statements may include non-recurring or extraordinary items that can significantly impact the overall financial picture. Ignoring these items can lead to distorted conclusions about a company’s profitability.

- Failure to compare with industry benchmarks: Comparing a company’s income statement to industry benchmarks allows for a more accurate evaluation of its performance. Failure to do so may result in unrealistic expectations or failure to identify areas for improvement.

- Overlooking the quality of earnings: While net income is a key indicator of profitability, it is essential to assess the quality of earnings. Factors such as the sustainability of revenue sources and the reliability of reported figures should be considered to gain a better understanding of a company’s financial health.

- Not considering the impact of accounting policies: Different companies may use different accounting policies, which can affect the presentation of their income statements. It is important to understand these policies and make adjustments accordingly to make meaningful comparisons.

In conclusion, interpreting income statements requires diligence and a comprehensive understanding of financial analysis. By avoiding the common mistakes mentioned above, you can ensure a more accurate assessment of a company’s financial performance and make informed decisions based on the information provided.