The accounting chapter 4 test is a crucial assessment for students studying accounting. It covers important concepts and principles related to accounting methods and procedures. This test is designed to evaluate students’ understanding of the topics covered in chapter 4 of their accounting textbook.

Chapter 4 of an accounting course typically focuses on topics such as the general ledger, posting journal entries, and analyzing transactions. Students are expected to demonstrate their knowledge and comprehension of these topics, as well as their ability to apply accounting principles to various scenarios.

The accounting chapter 4 test may consist of multiple-choice questions, calculations, and short-answer questions. Students must be prepared to analyze and interpret financial data, identify errors in account balances, and select the appropriate journal entry for a given transaction. This test assesses students’ ability to accurately record transactions and maintain the general ledger.

It is important for students to review and study the material in chapter 4 before taking this test. They should familiarize themselves with the concepts, procedures, and calculations discussed in the chapter. Additionally, students may benefit from practicing sample problems and reviewing previous assignments to reinforce their understanding of the material.

Overview of Accounting Chapter 4 Test

In the accounting chapter 4 test, students will be assessed on their understanding of various key concepts and principles related to financial accounting. This chapter focuses on topics such as the recording of transactions, journal entries, and the preparation of a trial balance.

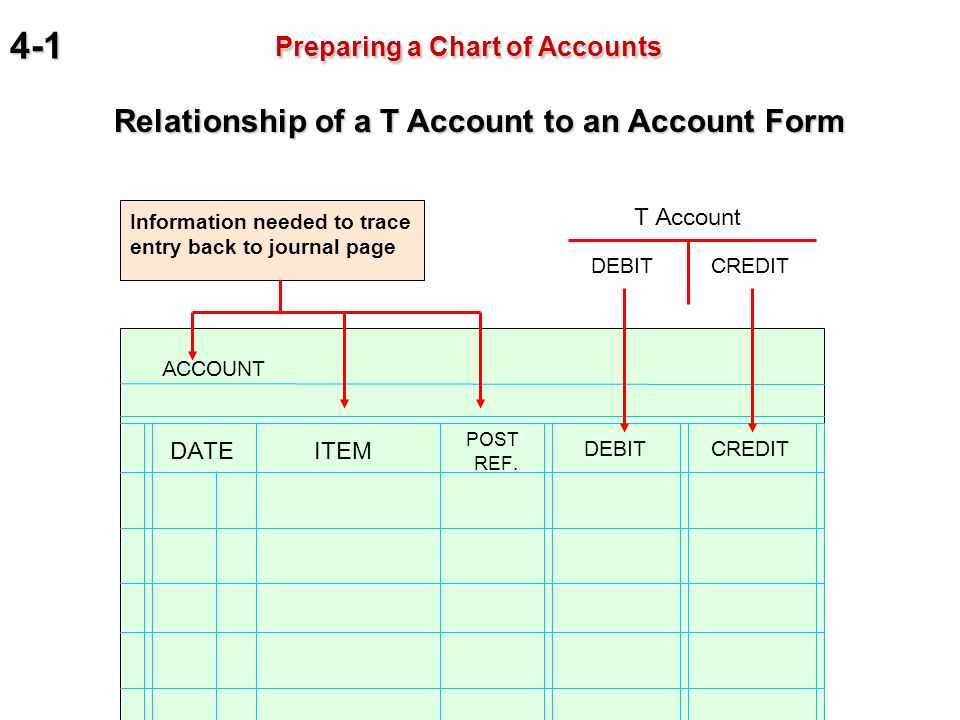

One of the main areas covered in the test is the process of recording transactions. Students will need to demonstrate their ability to analyze business transactions and record them accurately using the double-entry bookkeeping system. This involves identifying the accounts affected by each transaction and ensuring that both the debit and credit entries are properly recorded.

Another important aspect of the chapter that will be tested is the preparation of journal entries. Students will be required to understand how to use the general journal to record transactions in chronological order. They will need to know the proper format for journalizing transactions, including the use of appropriate account titles, dates, and dollar amounts.

A key skill assessed in the chapter 4 test is the ability to prepare a trial balance. Students will be asked to demonstrate their understanding of how to list all the accounts from the general ledger and properly calculate the total debits and credits. They will need to identify any errors or imbalances in the trial balance and make the necessary adjustments to correct them.

Overall, the accounting chapter 4 test is designed to assess students’ knowledge and comprehension of the recording of transactions, journal entries, and trial balance preparation. It will require them to apply their understanding of these concepts to various scenarios and demonstrate their ability to accurately record and analyze financial information.

The Significance of Accounting Chapter 4 Test

Accounting chapter 4 test is an integral part of the accounting curriculum that plays a crucial role in measuring students’ understanding and application of concepts related to chapter 4. This test serves as an important evaluation tool to assess students’ comprehension and knowledge about various topics, including financial statements, cash flow analysis, and financial ratios.

Importance of Conceptual Understanding:

The accounting chapter 4 test enables students to demonstrate their conceptual understanding of the fundamental principles and concepts covered in the chapter. By answering questions related to financial statements and analysis, students gain a deeper understanding of how accounting information is used to assess the financial performance and position of a business.

Application of Accounting Techniques:

The chapter 4 test also assesses students’ ability to apply accounting techniques and tools in real-world scenarios. Through solving problems and analyzing case studies, students learn how to interpret financial data, calculate ratios, and make informed business decisions based on the insights provided by the accounting information.

Evaluation of Analytical Skills:

The accounting chapter 4 test evaluates students’ analytical skills in analyzing financial data and drawing meaningful conclusions. Students are often required to analyze different financial statements, interpret trends, and identify potential areas of improvement or concern. This test fosters the development of critical thinking and problem-solving skills that are vital for success in the accounting profession.

Preparation for Advanced Concepts:

Accounting chapter 4 serves as a foundation for advanced accounting concepts and principles. Successfully passing the chapter 4 test ensures students have a strong understanding of the fundamental concepts, which will facilitate their learning and comprehension of more complex topics in subsequent chapters.

In conclusion, the accounting chapter 4 test holds significant importance as it measures students’ understanding, application, and analytical skills related to financial statements and analysis. This test not only evaluates students’ knowledge but also prepares them for advanced accounting concepts and provides a solid foundation for their future studies and career in accounting.

Key Topics Covered in Accounting Chapter 4 Test

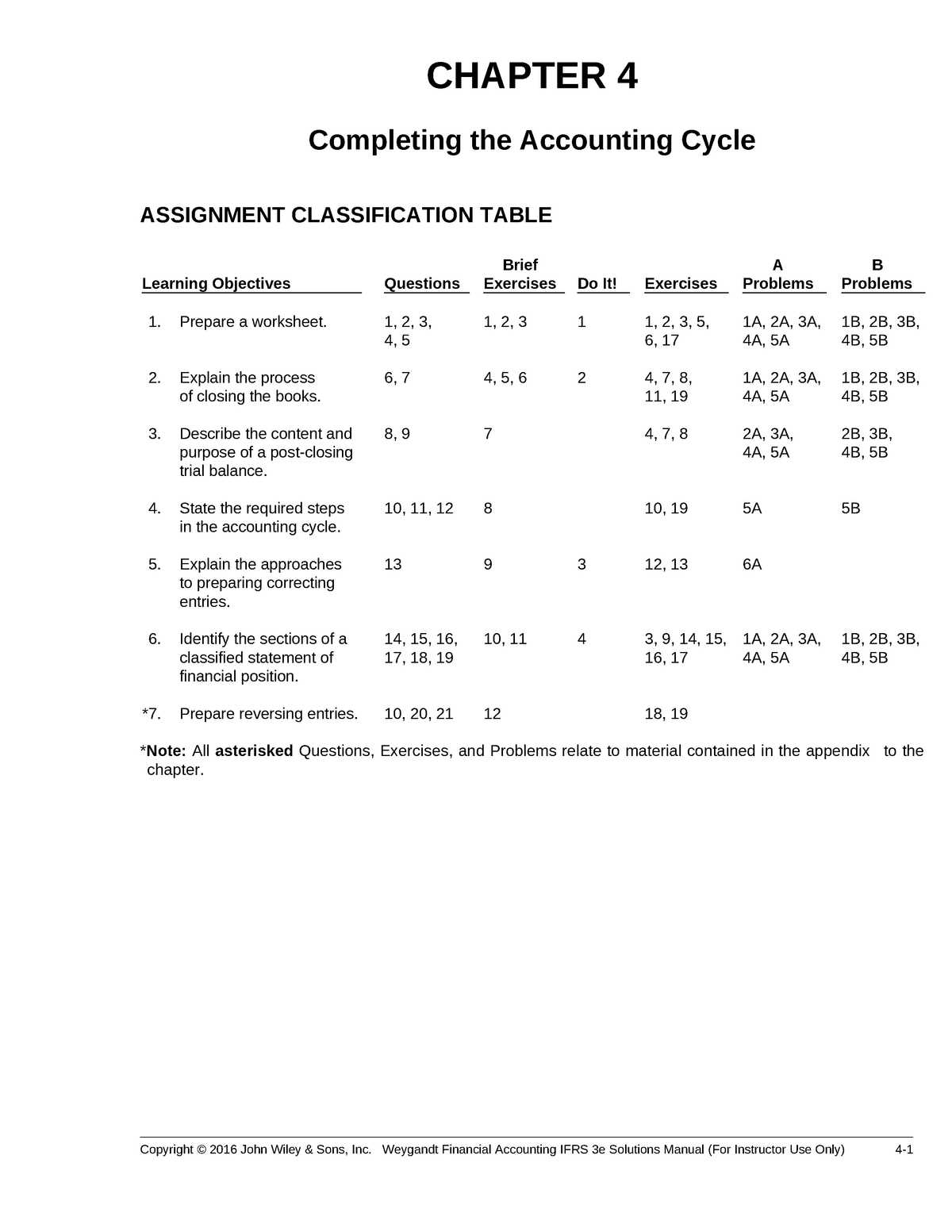

The accounting chapter 4 test covers several key topics that are fundamental to understanding and applying accounting principles. These topics include the accounting cycle, adjusting entries, closing entries, and financial statement preparation. Students will need to demonstrate their knowledge and ability to execute these concepts to successfully complete the test.

One of the primary topics covered in the chapter 4 test is the accounting cycle. This involves the sequential process of recording, classifying, summarizing, and interpreting financial transactions. Students will need to understand each step of the accounting cycle and its purpose in order to accurately complete the test questions and problems.

Adjusting entries

Another important topic covered in the chapter 4 test is adjusting entries. Adjusting entries are made at the end of the accounting period to ensure that the financial statements reflect accurate and up-to-date information. Students will need to know how to identify and record adjusting entries for various scenarios, such as accrued expenses, prepaid expenses, accrued revenues, and unearned revenues.

Closing entries are also a key topic covered in the chapter 4 test. Closing entries are made at the end of the accounting period to transfer the balances of temporary accounts (such as revenue and expense accounts) to the retained earnings account. Students will need to understand the purpose and process of closing entries in order to successfully complete the test.

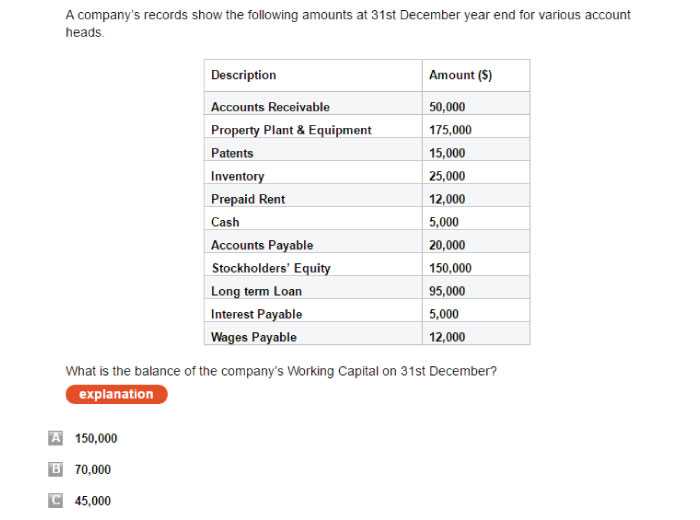

Lastly, the chapter 4 test will require students to demonstrate their ability to prepare financial statements. This includes preparing an income statement, statement of retained earnings, and balance sheet. Students will need to understand the format and components of each financial statement, as well as how to calculate and present the relevant financial information.

In summary, the accounting chapter 4 test covers important topics such as the accounting cycle, adjusting entries, closing entries, and financial statement preparation. Students will need to have a strong understanding of these concepts in order to successfully complete the test and demonstrate their knowledge of accounting principles.

Methods and Techniques Tested in Accounting Chapter 4 Test

In the Accounting Chapter 4 Test, students can expect to encounter various methods and techniques commonly used in accounting. These methods and techniques are essential in accurately recording and analyzing financial transactions and ensuring the integrity of financial statements.

1. Journal Entries: One of the key methods tested in this chapter is the preparation of journal entries. Journal entries are used to record the debits and credits of each transaction in the general journal. Students may be asked to identify the accounts to be debited and credited for a given transaction and accurately record the transaction in the appropriate format.

2. T-Accounts: T-Accounts are another important technique that students will likely encounter in the test. T-Accounts are used to analyze the effects of each transaction on specific accounts. Students may be asked to create T-Accounts for different accounts and record the debits and credits associated with various transactions.

- 3. Trial Balance: The Trial Balance is a technique used to ensure that the total debits equal the total credits in the general ledger. Students may be required to prepare a trial balance based on the account balances and verify its accuracy.

- 4. Adjusting Entries: Adjusting entries are made at the end of an accounting period to update certain accounts and ensure that financial statements reflect the correct financial position. Students may be tested on their ability to prepare and record adjusting entries for various scenarios.

- 5. Closing Entries: Closing entries are made at the end of an accounting period to transfer the balances of temporary accounts to the retained earnings account. Students may be asked to prepare and record closing entries for different accounts.

Overall, the Accounting Chapter 4 Test evaluates students’ understanding and competency in applying these methods and techniques. It is important for students to practice solving problems and familiarize themselves with the concepts to excel in the test.

Sample Questions and Scenarios in Accounting Chapter 4 Test

In the accounting chapter 4 test, students will be presented with various questions and scenarios to assess their understanding of key concepts and principles. These questions and scenarios aim to evaluate their knowledge and application of topics such as depreciation, inventory valuation, and financial statement analysis.

Here are some examples of the types of questions and scenarios that may be included in the accounting chapter 4 test:

- Question 1: Calculate the depreciation expense for a piece of equipment using the straight-line method over its useful life of 5 years.

- Scenario 1: A company has inventory with a cost of $10,000 and a net realizable value of $8,000. Calculate the lower of cost or market value for the inventory.

- Question 2: Explain the difference between the periodic and perpetual inventory systems.

- Scenario 2: A company is considering acquiring a new asset. Compare the advantages and disadvantages of leasing versus purchasing the asset.

- Question 3: Analyze the financial statements of a company and identify any potential red flags or areas of concern.

These questions and scenarios require students to apply their knowledge of accounting principles and concepts to solve problems and make informed decisions. The test aims to assess their ability to analyze financial information, interpret accounting data, and make sound financial decisions based on the given scenarios.

Tips and Strategies for Success in Accounting Chapter 4 Test

Preparing for an accounting test requires careful planning and studying. Accounting chapter 4 focuses on specific topics such as revenue recognition, accrual accounting, and the matching principle. To succeed in the chapter 4 test, it is important to have a solid understanding of these concepts and be able to apply them to various scenarios.

1. Review the textbook and lecture notes: Go through the relevant chapters in your textbook and review any lecture notes or class materials provided by your instructor. Pay close attention to the key concepts and examples discussed in class.

2. Practice problem-solving: Accounting is a practical subject, so it is essential to practice solving accounting problems. Look for practice exercises or sample problems that cover the topics in chapter 4. This will help you become familiar with the format of the test and give you the opportunity to apply your knowledge.

3. Understand the accounting cycle: Chapter 4 may involve questions related to the accounting cycle, so make sure you have a clear understanding of each step. Familiarize yourself with the process of recording transactions, preparing financial statements, and adjusting entries.

4. Seek clarification: If you have any doubts or questions about the material, don’t hesitate to seek clarification from your instructor or classmates. Accounting can be complex, and it’s better to address any confusion before the test rather than during.

5. Develop time management skills: Plan your study schedule well in advance of the test to ensure you have enough time to cover all the necessary material. Break down your study sessions into manageable chunks and try to avoid cramming at the last minute.

6. Take advantage of resources: Utilize additional resources such as online tutorials, study guides, or practice exams to reinforce your understanding of the material. These resources can provide alternative explanations and examples that may help clarify difficult concepts.

7. Practice active learning: Instead of passively reading the material, engage in active learning techniques such as summarizing key points, creating flashcards, or teaching the material to someone else. These activities can enhance your understanding and retention of the material.

Focusing on these tips and strategies will help you feel more confident and prepared for your accounting chapter 4 test. Remember to stay organized, ask for help when needed, and practice problem-solving to reinforce your knowledge.

Resources and Study Materials for Accounting Chapter 4 Test Preparation

Preparing for an accounting test can be intimidating, but with the right resources and study materials, you can feel confident and well-prepared. Here are some recommended resources to help you succeed on your accounting Chapter 4 test:

1. Textbook

Your accounting textbook is a valuable resource for studying for the test. Review the relevant chapter thoroughly, focusing on key concepts, definitions, and examples. Take notes and highlight important information to facilitate understanding and retention.

2. Lecture Notes

If you have attended lectures or classes on Chapter 4, revisit your lecture notes. Pay attention to any additional examples or explanations provided by your instructor that may not be covered in the textbook. Reviewing your lecture notes can reinforce your understanding of the material and help you identify any areas of weakness.

3. Practice Problems

Practice is essential for mastering accounting concepts. Look for practice problems and exercises related to Chapter 4 in your textbook or online. By solving these problems, you can test your knowledge and identify any areas that need further review.

4. Online Resources

There are numerous online resources available to aid in your accounting test preparation. Websites, blogs, and forums dedicated to accounting often provide additional explanations, examples, and practice problems. Take advantage of these resources to supplement your textbook and class materials.

5. Study Groups

Consider joining or forming a study group with classmates who are also preparing for the accounting test. Collaborating with others can help you clarify concepts, discuss challenging topics, and gain different perspectives. Discussing the material with peers can enhance your understanding and retention.

6. Flashcards

Create flashcards for key terms, definitions, and formulas in Chapter 4. Flashcards are a great study tool for quick review and memorization. Quiz yourself regularly using the flashcards to reinforce your knowledge and improve recall during the test.

Remember to allocate sufficient time for studying and review, and break down your study sessions into manageable chunks. Practice actively engaging with the material rather than passively reading or listening. Utilize a combination of these resources to tailor your study approach to your learning style and needs.

By utilizing these resources and study materials, you can maximize your chances of success on your accounting Chapter 4 test. Good luck!