In this article, we will provide answers and explanations to commonly asked questions about Bloomberg Market Concepts (BMC). BMC is an interactive e-learning program designed to provide essential knowledge and skills related to financial markets. It covers topics such as economics, currencies, fixed income, equities, and portfolio management.

What is Bloomberg Market Concepts?

Bloomberg Market Concepts is an online training course offered by Bloomberg Professional Services. It is designed to help individuals develop a foundational understanding of financial markets and the Bloomberg Terminal. The course is self-paced and can be completed in approximately 8-12 hours.

Why should I take Bloomberg Market Concepts?

Bloomberg Market Concepts is an excellent resource for individuals looking to enhance their knowledge and skills in the financial industry. It provides a comprehensive overview of the key concepts and tools used in financial markets, which can be beneficial for students, professionals, and anyone interested in the financial world.

Bloomberg Market Concepts Answers: Tips and Tricks

If you are looking for Bloomberg Market Concepts (BMC) answers, you have come to the right place. BMC is a self-paced online course that provides an introduction to financial markets and the Bloomberg Terminal. It covers various topics such as equities, fixed income, currencies, and commodities. To successfully complete the BMC course, it is important to approach it strategically and ensure that you have a thorough understanding of the concepts.

One tip for answering the BMC questions is to carefully read the question and understand what it is asking for. The questions are designed to test your knowledge and understanding of the course material, so make sure you comprehend the key concepts before attempting to answer them. Use the resources available within the BMC course, such as videos and readings, to review and reinforce your understanding of the topics.

Equity section:

- Familiarize yourself with the various equity valuation methodologies, such as price-to-earnings ratio and discounted cash flow analysis.

- Understand the different types of equity offerings, including initial public offerings (IPOs) and secondary offerings.

- Learn how to analyze a company’s financial statements and key performance indicators (KPIs) to evaluate its financial health.

Fixed Income section:

- Master the basic concepts of fixed income securities, including bond pricing and yield calculations.

- Learn about different types of bonds, such as government bonds, corporate bonds, and municipal bonds.

- Understand the relationship between interest rates and bond prices, and how changes in interest rates affect bond portfolios.

Currencies section:

- Get familiar with the major currency pairs and their exchange rate quoting conventions.

- Learn about currency hedging strategies and how to manage foreign exchange risk.

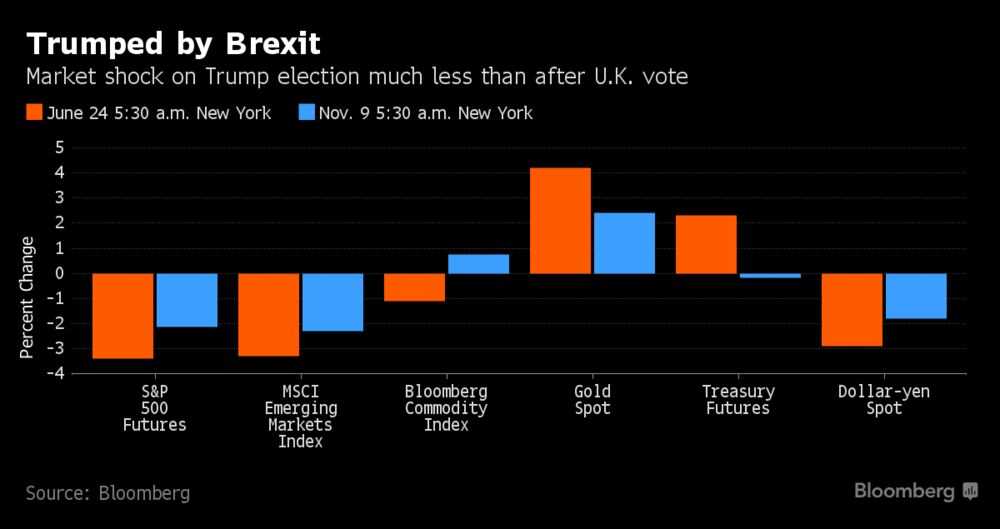

- Understand the factors that influence currency exchange rates, such as interest rates, inflation, and geopolitical events.

Commodities section:

- Gain knowledge of different types of commodities, such as energy, precious metals, and agricultural products.

- Learn about commodity futures contracts and how to interpret commodity price charts.

- Understand the factors that affect commodity prices, including supply and demand dynamics and geopolitical factors.

By following these tips and tricks, you can enhance your performance in answering the Bloomberg Market Concepts questions. Remember to take your time, review the course material, and make use of the resources provided. Good luck!

Understanding Bloomberg Market Concepts (BMC)

Bloomberg Market Concepts (BMC) is an online training program designed to provide individuals with a comprehensive understanding of financial markets and Bloomberg’s data and analytical tools. It offers a wide range of modules covering various topics such as economics, fixed income, equities, currencies, and commodities. The program aims to equip participants with the knowledge and skills needed to make informed investment decisions and navigate the complexities of the financial industry.

Module Structure: BMC consists of four modules, each focusing on different aspects of the financial markets. The modules include Core Concepts, Economics, Currencies, and Fixed Income. Participants can progress through the modules at their own pace, completing quizzes and assessments along the way to test their understanding of the material.

Key Features of BMC:

- Interactive Learning: BMC utilizes a combination of videos, quizzes, and simulations to engage participants and enhance their learning experience. The program encourages hands-on practice with Bloomberg’s tools, ensuring that participants gain practical knowledge and skills.

- Real-World Examples: The program uses real-world examples and case studies to illustrate key concepts and demonstrate their application in the financial markets. This approach helps participants develop a deeper understanding of how market events and trends can impact investment decisions.

- Certification: Upon successful completion of BMC, participants receive a Bloomberg Market Concepts certification, which can be a valuable addition to their resume and demonstrate their proficiency in financial market analysis and Bloomberg’s tools.

Overall, Bloomberg Market Concepts is a comprehensive and interactive online training program that equips individuals with the knowledge and skills needed to navigate the financial markets. Whether you are a finance professional looking to enhance your skills or an individual interested in gaining a better understanding of financial markets, BMC provides a valuable learning opportunity. With its user-friendly interface and practical approach, BMC is a popular choice for those seeking to expand their financial knowledge and stay abreast of industry trends.

How to Use Bloomberg Market Concepts (BMC) for Your Financial Education

Bloomberg Market Concepts (BMC) is an innovative and comprehensive online course offered by Bloomberg that allows individuals to gain a deep understanding of the financial markets and develop essential skills for success in the industry. Whether you are a student looking to enhance your knowledge or a professional seeking to stay updated with the latest trends, BMC provides a valuable learning experience.

One of the key benefits of BMC is its user-friendly interface, which allows learners to easily navigate through the course materials and access a wide range of resources. The course covers various topics such as economics, fixed income, equities, and currencies, providing learners with a holistic understanding of the global financial landscape.

By completing the BMC course, individuals can develop valuable skills such as analyzing financial data, understanding market trends, and making informed investment decisions. The course incorporates interactive modules, quizzes, and real-world examples to enhance learning and application of concepts.

Furthermore, BMC offers the opportunity to earn a Bloomberg Market Concepts certificate upon successful completion of the course. This certificate is recognized by leading financial institutions and can significantly enhance your resume and credibility in the industry.

Overall, Bloomberg Market Concepts is a powerful tool for anyone wanting to expand their financial knowledge and gain a competitive edge in the industry. Its accessible format, comprehensive content, and practical approach make it an essential resource for individuals looking to excel in the dynamic world of finance.

Top Bloomberg Market Concepts (BMC) Exam Questions and Answers

If you are preparing for the Bloomberg Market Concepts (BMC) exam, it is important to familiarize yourself with the top questions and answers that you may encounter. By understanding these key concepts, you will be better equipped to navigate the exam and demonstrate your understanding of the financial markets.

1. What is the Bloomberg Terminal?

The Bloomberg Terminal is a computer software system provided by Bloomberg L.P. that enables professionals in the financial industry to access, analyze, and monitor real-time financial market data and news. It is a powerful tool used by traders, analysts, and portfolio managers to make informed investment decisions.

2. What is the purpose of the Bloomberg Market Concepts (BMC) certification?

The BMC certification is designed to provide individuals with a foundational understanding of the financial markets and the Bloomberg Terminal. It covers various topics such as economics, fixed income, equities, and currencies. By completing the BMC certification, individuals can demonstrate their knowledge and enhance their employability in the finance industry.

3. How can I prepare for the BMC exam?

To prepare for the BMC exam, it is recommended to go through the Bloomberg Market Concepts course on the Bloomberg Terminal. This course provides interactive modules and quizzes that cover the key concepts tested in the exam. Additionally, practicing with sample questions and reviewing the Bloomberg Terminal functions can also help in preparation.

4. What are the benefits of obtaining the BMC certification?

Obtaining the BMC certification can provide several benefits. It demonstrates your commitment to professional development and showcases your knowledge of the financial markets. It can also enhance your resume and make you more competitive in the job market, particularly for roles that require the use of the Bloomberg Terminal.

5. Are there any resources available for further study?

A variety of resources are available for further study and preparation for the BMC exam. Bloomberg provides additional educational materials, such as webinars and tutorials, to help individuals deepen their understanding of the financial markets. Additionally, there are plenty of online resources, books, and courses that cover similar topics and can supplement your study materials.

With these top questions and answers in mind, you can approach the Bloomberg Market Concepts (BMC) exam with confidence and showcase your knowledge of the financial markets.

Tips for Mastering Bloomberg Market Concepts (BMC)

Learning Bloomberg Market Concepts (BMC) can be a challenging task, especially for those who are new to financial markets and data analysis. However, with the right approach and some helpful tips, mastering BMC can become a much smoother process. Here are some tips that can assist you in successfully navigating through the BMC program:

1. Set aside dedicated time for studying

Learning BMC requires a significant amount of time and dedication. It is important to create a study schedule and set aside dedicated time each day or week to focus on the modules. Consistency and regular practice are key to understanding the concepts and retaining the knowledge.

2. Read and watch Bloomberg resources

Bloomberg provides a wide range of resources that can help in understanding the concepts covered in BMC. Take advantage of the reading materials, videos, and webinars available on the Bloomberg Terminal. These resources provide additional explanations and insights that can complement the module content.

3. Complete the practice questions and quizzes

Each module in BMC includes practice questions and quizzes to test your understanding of the material. Make sure to complete these exercises and review your answers to identify any areas of weakness. The practice questions and quizzes simulate real-life scenarios and can help reinforce your understanding of the concepts.

4. Utilize the BMC help desk

If you encounter any difficulties or have questions while going through the BMC modules, don’t hesitate to reach out to the BMC help desk. The help desk is equipped to provide guidance and assistance, ensuring that you have a smooth learning experience.

5. Apply the concepts in real-life situations

Learning BMC is not just about memorizing information, but also about applying the concepts to real-life situations. Seek opportunities to analyze real market data and use the Bloomberg Terminal to practice applying the learned concepts. This hands-on approach will enhance your understanding and enable you to transfer the knowledge to real-world scenarios.

By following these tips and making a conscious effort to immerse yourself in the content, you can master Bloomberg Market Concepts and develop a strong foundation in financial markets and data analysis.

Bloomberg Market Concepts (BMC): An Essential Certification for Financial Professionals

In the fast-paced and ever-evolving world of finance, it is essential for professionals to stay up to date with the latest market trends and developments. In order to succeed in their careers, financial professionals need to have a deep understanding of various financial instruments, market fundamentals, and investment strategies. One certification that provides comprehensive knowledge and skills in these areas is Bloomberg Market Concepts (BMC).

Bloomberg Market Concepts is a self-paced e-learning course offered by Bloomberg, a leading global provider of financial data and analytics. The course covers a wide range of topics, including economics, fixed income, equities, currencies, and commodities. It also provides an in-depth understanding of Bloomberg Terminal, the industry standard for market professionals. Upon completion of the course, participants receive a certification that is recognized by top financial institutions around the world.

The BMC certification is especially beneficial for financial professionals who work in roles such as investment banking, asset management, trading, and research. By completing the course, these professionals gain a competitive edge in the job market and are better equipped to make informed decisions. The certification demonstrates their proficiency in using Bloomberg Terminal and their understanding of market concepts, which are crucial skills in today’s financial industry.

The BMC course is designed for individuals with varying levels of experience and knowledge in finance. Whether you are a recent graduate looking to kickstart your career or an experienced professional seeking to upgrade your skills, this certification is a valuable asset. The self-paced format allows participants to learn at their own pace, making it convenient for busy professionals.

In conclusion, the Bloomberg Market Concepts certification is an essential qualification for financial professionals who want to enhance their knowledge and skills in the dynamic world of finance. By completing the course, individuals gain a competitive advantage, improve their job prospects, and become more proficient in using Bloomberg Terminal. As the financial industry continues to evolve, staying updated with market concepts and tools like Bloomberg Terminal is indispensable for success.

Why Bloomberg Market Concepts (BMC) is Worth the Investment

In summary, Bloomberg Market Concepts (BMC) is a valuable investment for individuals looking to gain a comprehensive understanding of financial markets and develop the skills necessary to succeed in the finance industry. The program offers a wide range of benefits, including:

- Industry-Recognized Certification: Completing BMC grants participants a globally recognized certification, demonstrating their proficiency in financial market concepts. This certification can enhance job prospects and credibility within the industry.

- Comprehensive Coverage: BMC covers a wide range of topics, including economics, fixed income, equities, and portfolio management. The program provides a holistic view of financial markets and allows individuals to develop a well-rounded knowledge base.

- Practical Skills: Through interactive modules and real-world case studies, BMC equips participants with practical skills that can be applied in professional settings. The program focuses on problem-solving, decision-making, and analytical thinking, all of which are essential in finance roles.

- Bloomberg Terminal Familiarity: BMC introduces participants to the Bloomberg Terminal, a widely used tool in the finance industry. Learning to navigate and utilize the Terminal effectively can greatly enhance one’s efficiency and productivity in financial analysis and decision-making.

- Networking Opportunities: BMC provides participants with access to a vast network of finance professionals and experts. This networking opportunity can be invaluable for career growth and development, as it allows individuals to connect with industry insiders and learn from their experiences.

Overall, the investment in Bloomberg Market Concepts is worth it for individuals who are serious about pursuing a career in finance. The program offers a comprehensive curriculum, practical skills, industry recognition, and networking opportunities, all of which can greatly enhance one’s prospects in the finance industry. Whether you are a student looking to build a strong foundation or a professional seeking to expand your knowledge, BMC is a worthwhile investment that can provide long-term benefits.

Q&A:

What is Bloomberg Market Concepts (BMC)?

Bloomberg Market Concepts (BMC) is a self-paced e-learning course offered by Bloomberg that provides individuals with a comprehensive understanding of the financial markets and the tools used in the industry.

Why should I invest in BMC?

Investing in BMC is worthwhile because it equips individuals with the knowledge and skills necessary for success in the financial industry. It covers a wide range of topics, from economics and fixed income to equities and currencies, giving participants a well-rounded education in finance.

How will BMC benefit my career?

BMC can benefit your career by making you more marketable to employers in the financial industry. The course provides you with a certificate of completion that you can add to your resume, demonstrating your commitment to professional development and your understanding of the financial markets.

What makes BMC different from other finance courses?

BMC stands out from other finance courses because it is taught by industry professionals and utilizes the Bloomberg Terminal, a powerful financial tool used by professionals in the industry. This hands-on experience with real-world applications sets BMC apart and provides participants with practical skills they can use in their careers.