In financial studies, understanding how to determine the balance between costs and revenue is essential for solving practical problems. These situations often require calculating the point where income matches expenses, allowing businesses and individuals to understand when they start making a profit.

Fundamentals of Cost-Volume Relationships

In solving problems related to cost and income, it’s crucial to grasp how different variables such as fixed costs, variable costs, and pricing interact. By understanding these relationships, one can calculate the point where total costs equal total revenue, which is essential for decision-making in many fields, from business to economics.

Key Components to Focus On

- Fixed Costs: Expenses that remain constant regardless of the level of production or sales.

- Variable Costs: Costs that change directly with the level of production or sales.

- Revenue: The income generated from selling goods or services, which plays a critical role in covering costs and achieving profitability.

Common Problems in Financial Calculations

While solving for breakpoints, students often face common challenges. One major issue is miscalculating either the fixed or variable costs. Ensuring that each component is correctly accounted for can significantly impact the outcome of the calculation.

Effective Strategies for Success

To approach these problems successfully, it is helpful to start by understanding the theory and then practice with a variety of scenarios. Working through different examples allows for a deeper comprehension of how changes in costs or pricing can affect the profitability of a business.

Preparing for Success

When reviewing potential problems, focus on practicing the calculation methods, familiarizing yourself with typical figures and scenarios, and ensuring that every calculation step is clear. Regular practice is key to mastering these financial concepts and performing well in assessments.

Mastering Financial Profitability Calculations

To excel in financial assessments, understanding the critical point where expenses match income is essential. This knowledge enables you to make informed decisions and solve various practical problems related to cost management and profit generation.

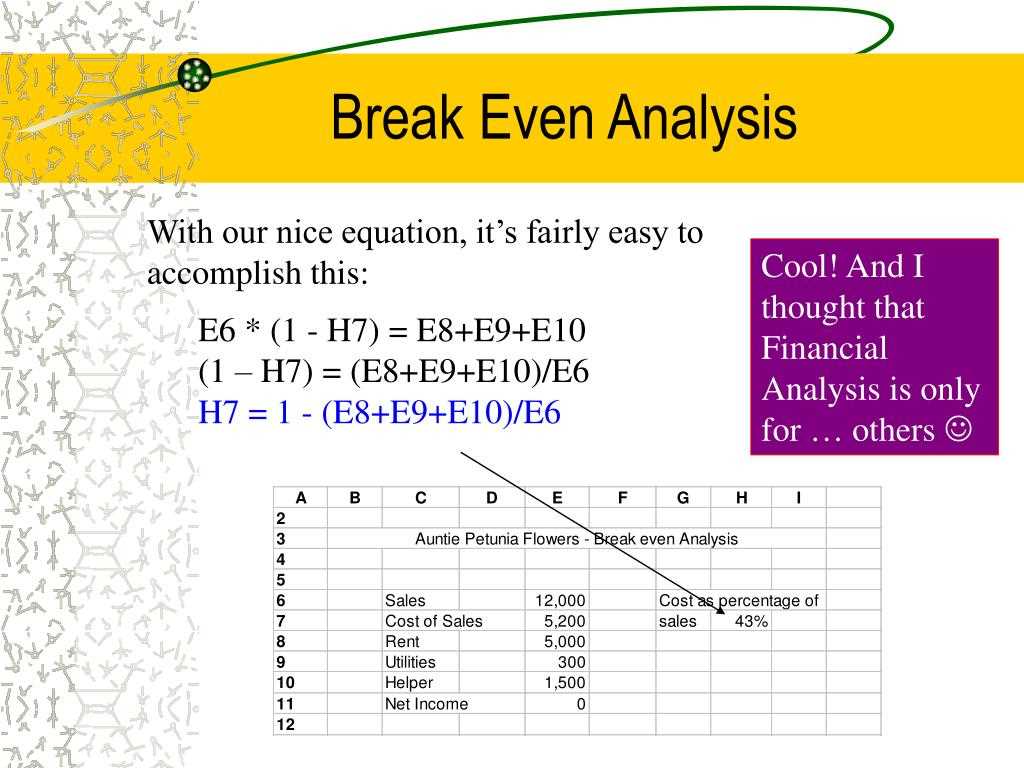

Grasping the fundamentals of financial balance involves recognizing key concepts such as fixed and variable expenses, along with pricing strategies. Once these principles are clear, it becomes easier to calculate the crucial point where total income equals total expenditures.

Learning the key formulas used in profitability calculations is vital. The most common formula involves the relation between fixed costs, variable costs, and the selling price of goods or services. Understanding how these elements interact helps in determining when a business or project will start generating a profit.

In real-world scenarios, the ability to recognize when a company or individual has reached this financial balance can be crucial. For example, when launching a new product or service, understanding when the break-even point is achieved can guide pricing strategies and marketing efforts.

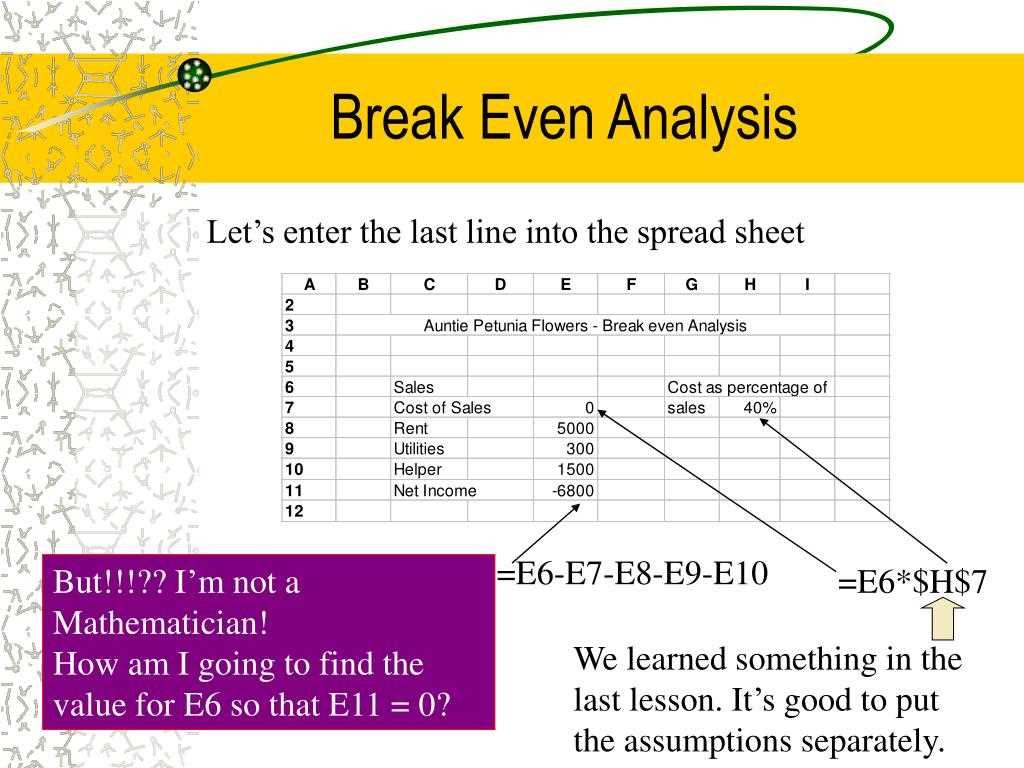

Students often make errors in these calculations, such as overlooking specific costs or misinterpreting data. Common mistakes include incorrect assumptions about fixed and variable expenses or failing to account for changes in pricing structures. Being aware of these pitfalls helps in improving accuracy and reliability in solving these problems.

Approaching these financial problems requires a clear method. First, identify the necessary variables, then apply the appropriate formulas step by step. Practice with a variety of problems can significantly enhance your ability to tackle these types of questions efficiently.

Effective study techniques include regularly practicing with example problems and seeking solutions that highlight the calculation process. By consistently reviewing sample problems, you can build confidence and improve your overall understanding of the subject.