Journalizing transactions is a crucial skill in the field of accounting. It is the process of recording financial transactions in a systematic and organized manner. By creating a journal, businesses can keep track of their daily activities, which helps in producing accurate financial statements and making informed business decisions.

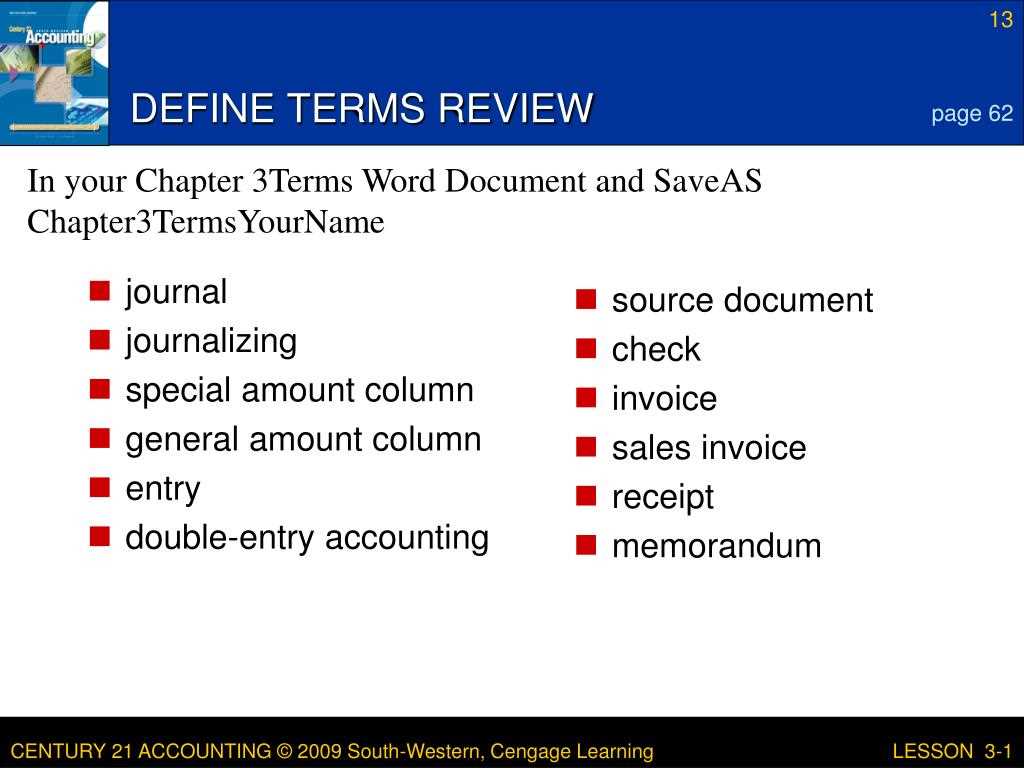

In Chapter 3 of the accounting textbook, students are introduced to the concept of journalizing transactions and learn about various types of accounts such as assets, liabilities, and equity. They also learn about the double-entry system, which requires every transaction to have two equal and opposite effects.

Test A Part Three of Chapter 3 evaluates the students’ understanding of journalizing transactions. This test consists of several questions that require students to analyze different scenarios and record the corresponding journal entries. By answering these questions, students demonstrate their ability to apply accounting principles and accurately record transactions.

Chapter 3 Test Answers: Part Three Journalizing Transactions

In Part Three of the Chapter 3 test, you were required to use your knowledge of journalizing transactions to record various transactions in the appropriate general journal format. Here are the answers to the test:

Question 1:

The transaction involved the purchase of inventory on credit. The journal entry to record this transaction would be as follows:

| Date | Account Title | Debit | Credit |

|---|---|---|---|

| mm/dd/yyyy | Inventory | $X | |

| Accounts Payable | $X |

Question 2:

The transaction involved the sale of goods for cash. The journal entry to record this transaction would be as follows:

| Date | Account Title | Debit | Credit |

|---|---|---|---|

| mm/dd/yyyy | Cash | $X | |

| Sales | $X |

Question 3:

The transaction involved the payment of an expense in cash. The journal entry to record this transaction would be as follows:

| Date | Account Title | Debit | Credit |

|---|---|---|---|

| mm/dd/yyyy | Expense | $X | |

| Cash | $X |

These are just a few examples of the types of transactions you may have encountered in Part Three of the Chapter 3 test. Remember, journalizing transactions is an important skill in accounting as it allows you to accurately record and track financial transactions. Practice and repetition are key to mastering this skill.

Understanding Journalizing Transactions

Journalizing transactions is a critical step in the accounting process. It involves recording financial transactions in a chronological order in the journal. When journalizing transactions, it is important to follow certain guidelines and principles to ensure accuracy and consistency.

The first step in journalizing transactions is to identify the accounts affected by the transaction. This involves determining which accounts are being debited and credited. Debits and credits must always be equal in amount, as they represent the dual aspect of every transaction. The account titles and amounts are then recorded in the journal.

For example, if a business purchases inventory on credit, the account “Inventory” would be debited, and the account “Accounts Payable” would be credited.

Once the accounts have been identified and the amounts recorded, it is important to provide a clear and concise description of the transaction. This helps in understanding the nature of the transaction and provides context for future reference. The transaction description should be specific and include relevant details.

Another important aspect of journalizing transactions is maintaining proper documentation for each transaction. This includes invoices, receipts, and other supporting documents that provide evidence of the transaction. These documents serve as a reference for future audits and inquiries and help in ensuring the accuracy of the journal entries.

Furthermore, it is essential to ensure that the transactions are recorded in the appropriate accounting period. Transactions should be recorded in the period in which they occur, following the accrual basis of accounting. This helps in accurate financial reporting and prevents errors or omissions in the financial statements.

In conclusion, understanding the process of journalizing transactions is vital for maintaining accurate and reliable financial records. By following the guidelines and principles, businesses can ensure that their journal entries are accurate, complete, and compliant with accounting standards.

Important Concepts in Journalizing Transactions

In accounting, journalizing transactions is the process of recording financial transactions in a journal. It is a crucial step in the accounting cycle as it provides an organized record of business activities. There are several important concepts to keep in mind when journalizing transactions:

- Double-entry system: The double-entry system is the foundation of journalizing transactions. It states that for every debit entry, there must be a corresponding credit entry. This ensures that the accounting equation (Assets = Liabilities + Equity) remains in balance.

- Transaction analysis: Before journalizing a transaction, it is important to analyze the transaction and determine its impact on the accounts. This involves identifying the accounts involved, the monetary amounts, and the direction of the transaction (increase or decrease).

- Account titles and numbers: Each account in the journal should be assigned a unique title and number for easy reference. This helps in organizing and identifying the accounts when journalizing transactions.

- Debits and credits: Debits and credits are used to record increases and decreases in accounts. The general rule is that assets and expenses are increased by debits and decreased by credits, while liabilities, equity, and revenues are increased by credits and decreased by debits.

- Explanation and narration: In the journal entry, it is important to provide a brief explanation or narration of the transaction. This helps in understanding the context and purpose of the transaction.

- Posting to ledger accounts: After journalizing the transactions, the next step is to transfer the information to the respective ledger accounts. This involves recording the debits and credits in the appropriate accounts.

By understanding and applying these important concepts in journalizing transactions, accountants can ensure accurate and reliable financial records, which are essential for making informed business decisions.

Journalizing Transactions Step-by-Step

In the world of accounting, journalizing transactions is a crucial step in the recording process. It is the process of analyzing and recording business transactions in a journal, which serves as the preliminary record in the accounting cycle. Journalizing transactions allows businesses to keep a systematic record of their financial activities and ensure accurate financial reporting.

1. Identify the transaction: The first step in journalizing transactions is identifying the transaction. This involves understanding the nature of the transaction and its impact on the financial position of the business. For example, if a business sells goods on credit, the transaction involves both an increase in accounts receivable and sales revenue.

2. Determine the accounts involved: Once the transaction is identified, the next step is determining the accounts involved. This requires analyzing the transaction and identifying the specific accounts that are affected by the transaction. In the example mentioned earlier, the accounts involved would be accounts receivable and sales revenue.

3. Determine the amount: After identifying the accounts, the next step is determining the amount to be recorded in each account. This involves calculating the value of the transaction and allocating it to the corresponding accounts. Continuing with the previous example, the amount recorded in accounts receivable would be the value of the goods sold on credit.

4. Record the transaction in the journal: Once the transaction, accounts, and amounts have been determined, it is time to record the transaction in the journal. The journal provides a chronological record of all transactions, and each transaction is recorded using a specific format. It typically includes the date, accounts debited and credited, a brief description of the transaction, and the amounts recorded in each account.

5. Post to the ledger: After journalizing the transactions, the next step is posting them to the ledger. The ledger is a book that contains all the accounts of the business, and posting refers to transferring the information from the journal to the respective accounts in the ledger. This step helps maintain a complete and organized record of the business’s financial transactions.

Overall, journalizing transactions is an essential step in the accounting process that ensures accurate financial reporting and provides businesses with a systematic record of their financial activities. By following the step-by-step process of identifying, determining accounts and amounts, recording in the journal, and posting to the ledger, businesses can maintain an organized and transparent accounting system.

Tips and Tricks for Journalizing Transactions

Journalizing transactions is an essential part of the accounting process. It involves recording the business transactions in a journal, which serves as a chronological record of all the financial activities of the company. Here are some tips and tricks to help you effectively journalize transactions:

1. Understand the Transaction

Before you start journalizing a transaction, it is crucial to fully understand the nature of the transaction. Analyze the documents related to the transaction, such as invoices, receipts, and bank statements. This will help you determine the accounts to be debited and credited.

2. Follow the Rules of Debits and Credits

Remember the fundamental accounting equation: Assets = Liabilities + Equity. Use this equation to determine whether an account needs to be debited or credited. Assets and expenses increase with debits, while liabilities, equity, and revenues increase with credits. Stick to the rules of debits and credits to ensure accurate journal entries.

3. Use Clear and Concise Descriptions

When journalizing transactions, provide clear and concise descriptions for each entry. This will make it easier for others to understand the transaction at a later date. Include relevant details, such as the date, amount, and purpose of the transaction.

4. Maintain Consistent Formatting

Consistency is key when it comes to journalizing transactions. Establish a standard format for your journal entries and stick to it. This will make it easier to review and analyze the entries in the future. Consistent formatting also ensures that your journal is organized and easy to navigate.

5. Review and Reconcile Regularly

Once you have journalized a transaction, take the time to review and reconcile your entries regularly. This will help you identify any errors or discrepancies and correct them in a timely manner. Regular reviews also ensure the accuracy and integrity of your financial records.

By following these tips and tricks, you can improve your skills in journalizing transactions and maintain accurate financial records for your business.

Common Errors to Avoid in Journalizing Transactions

Journalizing transactions is an essential step in the accounting process, as it allows organizations to keep an accurate record of their financial activities. However, there are several common errors that can occur during this process, which may lead to inaccurate financial statements and misrepresentation of an organization’s financial position. It is crucial to be aware of these errors and take measures to avoid them.

1. Omitted transactions: One of the most common errors in journalizing transactions is when certain transactions are completely omitted from the journal. This can happen due to oversight or negligence, but it can have a significant impact on the accuracy of financial statements. It is important to ensure that all transactions are properly recorded in the journal to maintain the integrity of the accounting records.

2. Incorrect amounts: Another common error is recording the incorrect amounts in the journal. This can happen due to data entry mistakes or incorrect calculations. In order to avoid this error, it is essential to double-check all amounts and calculations before recording them in the journal. Additionally, it is helpful to have another person review the entries to catch any potential errors.

3. Wrong accounts: Assigning transactions to the wrong accounts is another common error that can occur during journalizing. This can happen when there is confusion about which account a transaction should be recorded under, or when there is a lack of understanding of the organization’s chart of accounts. To avoid this error, it is important to have a clear understanding of the account classifications and consult the chart of accounts when in doubt.

4. Lack of documentation: Proper documentation is essential for recording transactions accurately. Not having adequate supporting documentation can lead to errors in journalizing. It is crucial to maintain receipts, invoices, and other relevant documents for each transaction to ensure proper recording and to provide evidence if needed for auditing purposes.

5. Failure to record reversals or adjustments: Transactions that require reversals or adjustments should not be overlooked during the journalizing process. Failure to record these transactions can lead to discrepancies in the financial statements and misrepresentation of an organization’s financial position. It is essential to identify and record these transactions accurately to present a true and fair view of the financial statements.

Avoiding these common errors in journalizing transactions is essential for maintaining accurate accounting records and financial statements. By being aware of these errors and implementing proper controls and review processes, organizations can ensure the integrity of their financial information and make informed business decisions.

Practice Exercises for Journalizing Transactions

In order to become proficient in journalizing transactions, it is important to practice. Below are some practice exercises to help you strengthen your skills in recording transactions in a journal.

Exercise 1:

On January 1, 20XX, XYZ Company received $5,000 in cash as an investment from its owner.

- Journal Entry: Debit Cash $5,000, Credit Capital $5,000

Exercise 2:

On January 10, 20XX, XYZ Company paid $1,000 in cash for office rent for the month.

- Journal Entry: Debit Rent Expense $1,000, Credit Cash $1,000

Exercise 3:

On January 15, 20XX, XYZ Company purchased $2,500 worth of inventory on credit.

- Journal Entry: Debit Inventory $2,500, Credit Accounts Payable $2,500

Exercise 4:

On January 20, 20XX, XYZ Company sold $3,000 worth of inventory for cash.

- Journal Entry: Debit Cash $3,000, Credit Sales $3,000

By practicing these exercises, you can develop a better understanding of how to journalize different types of transactions. Remember to always analyze each transaction and determine the appropriate accounts to debit and credit.

Journalizing transactions is a fundamental skill in accounting, and regular practice is crucial to becoming proficient. As you continue to practice, you will become more comfortable with the process and develop a better understanding of how different transactions affect the accounts in the financial records.

Q&A:

What is journalizing transactions?

Journalizing transactions is the process of recording financial transactions in the general journal.

Why is journalizing transactions important?

Journalizing transactions is important because it helps to keep track of all the financial transactions of a company in a systematic and organized manner.

What are practice exercises for journalizing transactions?

Practice exercises for journalizing transactions involve recording various transactions in the general journal, such as sales transactions, purchase transactions, and expense transactions.

How can I practice journalizing transactions?

You can practice journalizing transactions by using sample transactions provided in textbooks or online resources. You can also create your own transactions and record them in the general journal.

What are the benefits of practicing journalizing transactions?

The benefits of practicing journalizing transactions include improving your understanding of the accounting process, developing your skills in recording transactions accurately, and preparing you for real-world accounting situations.

What are practice exercises for journalizing transactions?

Practice exercises for journalizing transactions are exercises that provide practice in recording transactions in a journal. These exercises help develop the skills and knowledge needed to effectively journalize transactions in accounting.