In Chapter 2 of his book, Financial Peace University, Dave Ramsey takes a deep dive into the concepts of saving and emergency funds. This chapter provides readers with an answer key to common questions about building an emergency fund and strategies for saving money.

One of the key questions Ramsey answers is how much should be saved in an emergency fund. He emphasizes the importance of having at least three to six months’ worth of expenses saved up in case of unexpected events such as job loss or medical emergencies. Ramsey provides a formula for calculating this amount based on personal income and expenses.

Additionally, Ramsey discusses the different types of emergency funds and how they can be used. He explains that there are short-term emergencies, such as car repairs or medical bills, and long-term emergencies like job loss or major home repairs. The answer key in this chapter helps readers understand how to allocate funds for each type of emergency and the importance of prioritizing savings.

Overall, Chapter 2 of Dave Ramsey’s book serves as a guide for readers to navigate the world of saving and emergency funds. The answer key provides clear and practical advice for setting financial goals and securing a stable future.

Dave Ramsey Answer Key Chapter 2

In Chapter 2 of his book, Dave Ramsey provides valuable insight into the key concepts of personal finance. He begins by emphasizing the importance of budgeting, stating that a budget is the foundation for financial success. Ramsey explains that a budget helps individuals take control of their money, prioritize expenses, and make intentional decisions about saving and spending.

One of the key points Ramsey makes in this chapter is the need to differentiate between needs and wants. He encourages readers to carefully evaluate their expenses and determine which are essential and which are discretionary. By focusing on needs and cutting back on wants, Ramsey believes that individuals can make significant progress towards their financial goals, such as paying off debt and building wealth.

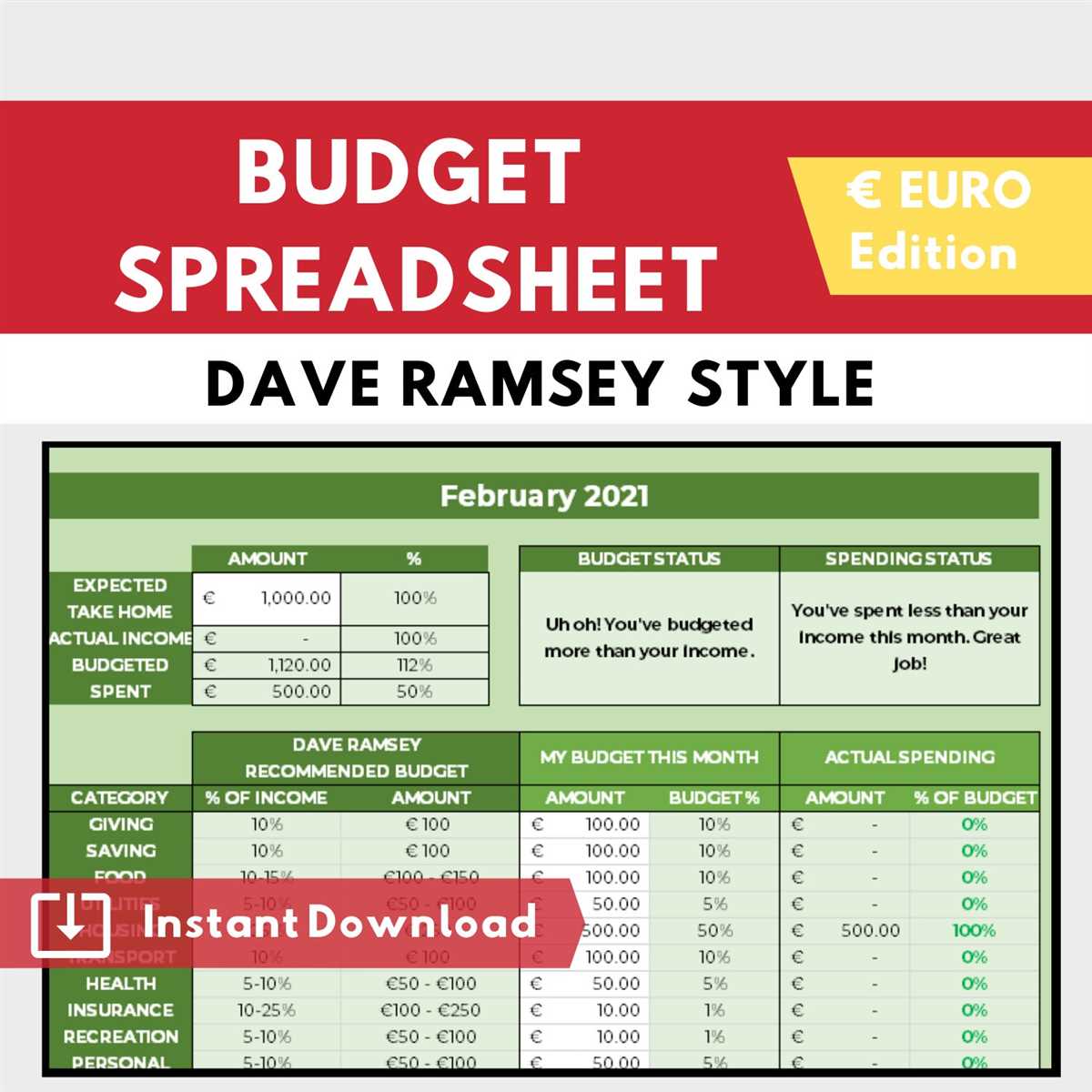

To help readers with the budgeting process, Ramsey introduces the idea of the “envelope system.” This system involves allocating cash to various categories and keeping the money in separate envelopes. This physical representation of money helps individuals visually see how much they have left in each category and promotes mindful spending.

Ramsey also stresses the importance of saving for emergencies and future expenses. He advises readers to establish an emergency fund with three to six months’ worth of living expenses to protect against unexpected events. Additionally, Ramsey advocates for saving for future expenses such as car repairs, home maintenance, and vacations, rather than relying on credit or loans.

In conclusion, Chapter 2 of Dave Ramsey’s book provides practical advice on budgeting, distinguishing between needs and wants, implementing the envelope system, and saving for emergencies and future expenses. These key concepts lay the foundation for individuals to take control of their finances, eliminate debt, and achieve financial peace and stability.

Understanding Dave Ramsey’s Financial Principles

In order to achieve financial freedom and security, it is crucial to understand and apply Dave Ramsey’s financial principles. Ramsey’s approach is based on common sense and practicality, focusing on simple steps that can lead to long-term financial success. By following his principles, individuals can eliminate debt, build wealth, and live a financially secure life.

One of the key principles advocated by Ramsey is the concept of living within one’s means. This means spending less than what one earns and avoiding debt. Ramsey emphasizes the importance of creating a budget and tracking expenses in order to have a clear understanding of where the money is going. By prioritizing needs over wants and making intentional financial decisions, individuals can avoid the common pitfalls of overspending and accumulating debt.

Another core principle highlighted by Ramsey is the concept of emergency savings. He suggests starting with a small emergency fund to cover unexpected expenses, such as car repairs or medical bills. Once the debt is paid off, he encourages individuals to build a larger emergency fund of 3-6 months’ worth of living expenses. This fund serves as a safety net in case of job loss or other financial setbacks, providing peace of mind and preventing the need to rely on credit cards or loans.

Ramsey also emphasizes the importance of paying off debt aggressively. His debt snowball method suggests paying off debts starting with the smallest balance first, regardless of interest rates. By focusing on one debt at a time and putting any extra money towards it, individuals can gain momentum and motivation to continue the debt repayment process. This method provides a sense of accomplishment and sees results quickly, creating a snowball effect that keeps individuals motivated and committed to becoming debt-free.

Additionally, Ramsey emphasizes the importance of long-term wealth building through investments and retirement planning. He encourages individuals to contribute regularly to retirement accounts, such as a 401(k) or Roth IRA, and take advantage of employer matching programs. By investing in diversified mutual funds with a long-term perspective, individuals can benefit from compound interest and grow their wealth over time. Ramsey also recommends seeking professional advice when it comes to investing and regularly reviewing and adjusting investment strategies based on individual goals and risk tolerance.

In summary, understanding and applying Dave Ramsey’s financial principles can lead to a financially secure future. By living within one’s means, creating emergency savings, paying off debt aggressively, and investing for the long term, individuals can achieve financial freedom and build wealth over time. It takes discipline and commitment, but the rewards are well worth the effort.

Key Takeaways from Chapter 2

In Chapter 2 of “Dave Ramsey’s Answer Key”, we are introduced to the concept of financial counseling and the importance of finding a qualified financial advisor. Ramsey emphasizes the need for individuals to seek professional guidance when it comes to managing their money, as many people lack the knowledge and skills necessary to make informed financial decisions on their own.

One key takeaway from this chapter is the importance of setting clear financial goals. Ramsey explains that having specific goals not only helps individuals stay motivated, but also provides them with a road map to follow in order to achieve financial success. He recommends setting both short-term and long-term goals, and regularly reviewing and updating them as needed.

Another important lesson from Chapter 2 is the significance of budgeting. Ramsey stresses that creating a budget is essential for successful money management. He explains the importance of tracking income and expenses, and provides practical tips on how to create a budget that aligns with one’s financial goals. Ramsey also highlights the need to prioritize spending and eliminate unnecessary expenses in order to stay on track with one’s budget.

Overall, Chapter 2 highlights the importance of seeking professional financial advice, setting clear goals, and creating a budget in order to achieve financial success. These key takeaways serve as a foundation for the rest of the book, as Ramsey goes on to provide practical strategies and advice for managing money effectively and building wealth.

Applying Ramsey’s Financial Principles in Real Life

When it comes to managing our finances, it’s important to have a solid plan in place to ensure our long-term financial success. Dave Ramsey’s financial principles provide a practical guide for achieving financial freedom and stability. By following his principles, individuals and families can make educated decisions about their money, pay off debt, and build wealth.

Budgeting: One of the key principles emphasized by Ramsey is the importance of budgeting. By creating a detailed budget, individuals can track their income and expenses, allocate funds towards savings and investments, and avoid unnecessary debt. Ramsey’s budgeting principles focus on giving every dollar a purpose and prioritizing expenses based on needs versus wants.

Emergency Fund: Another crucial aspect of Ramsey’s financial principles is the establishment of an emergency fund. This fund acts as a safety net, providing financial protection in the event of unexpected expenses, such as medical bills or car repairs. Ramsey recommends saving three to six months’ worth of expenses in an easily accessible account to ensure financial stability.

Debt Snowball: Ramsey advises individuals to tackle their debts using the debt snowball method. This approach involves paying off the smallest debts first and then using the money saved to pay off larger debts. By focusing on clearing one debt at a time, individuals gain momentum and motivation to continue their debt repayment journey.

Investing: Ramsey’s financial principles also emphasize the importance of long-term investing for building wealth. He recommends starting with 15% of one’s income towards retirement savings and diversifying investments across various asset classes, such as stocks, bonds, and real estate. By investing consistently and taking a long-term approach, individuals can grow their wealth and secure their financial future.

Insurance: Protecting one’s financial well-being is another vital aspect of Ramsey’s financial principles. He recommends having adequate insurance in place, including health insurance, life insurance, and disability insurance, to safeguard against potential financial risks and emergencies.

Estate Planning: Lastly, Ramsey stresses the importance of estate planning to ensure the smooth transfer of assets and financial responsibilities in the event of one’s passing. Setting up wills, trusts, and establishing durable powers of attorney are crucial steps in protecting one’s financial legacy and ensuring one’s intentions are carried out.

By applying Ramsey’s financial principles in real life, individuals can gain control over their finances, eliminate debt, and work towards achieving their long-term financial goals. It requires discipline, commitment, and a willingness to make necessary sacrifices, but the rewards of financial freedom and stability are well worth the effort.

Common Mistakes to Avoid

When it comes to managing your finances, there are several common mistakes that people often make. These mistakes can negatively impact your financial well-being and set you back on your journey to financial freedom. By being aware of these mistakes, you can take steps to avoid them and set yourself up for success.

1. Not having a budget

One of the biggest mistakes people make is not having a budget in place. A budget is a crucial tool in managing your money and ensuring that you are spending it wisely. Without a budget, it’s easy to overspend and live beyond your means. Make sure to create a detailed budget that outlines your income and expenses, and stick to it.

2. Relying on credit cards

Another common mistake is relying too heavily on credit cards. While credit cards can be convenient and offer rewards, they can also lead to debt if not used responsibly. Many people fall into the trap of spending more than they can afford and carrying a balance on their credit cards. Instead, try to use cash or a debit card for your everyday purchases and save your credit card for emergencies only.

3. Ignoring your debt

Ignoring your debt is a mistake that can have long-term consequences. It’s important to face your debt head-on and come up with a plan to pay it off. Ignoring your debt will only lead to more stress and financial strain. Take the time to create a debt repayment plan and prioritize paying off your debts.

4. Neglecting to save

Saving money is essential for your financial future, yet many people neglect this aspect of their finances. It’s important to save for emergencies, retirement, and other long-term goals. Set up automatic savings contributions from your paycheck and make it a priority to save a portion of your income each month. Avoid the mistake of not prioritizing savings.

5. Not seeking financial advice

Finally, not seeking financial advice is a common mistake that can hinder your financial success. It’s important to seek guidance from professionals or experts who can help you make informed decisions about your money. Whether it’s a financial planner, accountant, or Dave Ramsey’s resources, don’t be afraid to ask for help and learn from those who have experience in managing finances.

By avoiding these common mistakes and being proactive in managing your finances, you can set yourself up for a strong financial future. Take the time to educate yourself, make a plan, and stick to it. Your financial well-being depends on it.

Further Resources for Financial Management

In addition to the valuable information provided in Dave Ramsey’s “Answer Key” for Chapter 2, there are further resources available to help you improve your financial management skills. Whether you are just starting your journey to financial freedom or are looking for advanced strategies, these resources can provide you with the knowledge and tools to successfully manage your money.

1. Books:

- “The Total Money Makeover” by Dave Ramsey – This New York Times bestseller provides a step-by-step guide to transforming your financial situation and achieving debt freedom.

- “Rich Dad Poor Dad” by Robert Kiyosaki – This book challenges conventional wisdom about money and offers insights on how to think like the rich to build wealth.

- “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko – This book explores the habits and characteristics of millionaires and provides practical advice on how to build wealth.

2. Online Courses:

- “Financial Peace University” by Dave Ramsey – This online course offers video lessons and interactive tools to help you create a budget, get out of debt, and build wealth.

- “Investing in Stocks: The Complete Course for Beginners” on Udemy – This course provides a comprehensive introduction to investing in the stock market and covers topics such as stock selection, risk management, and portfolio diversification.

- “Personal Finance and Budgeting Basics” on Coursera – This course covers the fundamentals of personal finance, including budgeting, saving, and investing, and is taught by experts in the field.

3. Financial Apps:

- Mint – This app helps you track your spending, create budgets, and set financial goals to stay on top of your finances.

- YNAB (You Need A Budget) – This app focuses on zero-based budgeting and helps you allocate every dollar towards specific categories, making it easier to track and manage your money.

- Acorns – This app rounds up your purchases to the nearest dollar and invests the spare change into diversified portfolios, making it easy to start investing.

By utilizing these resources and continuously educating yourself about financial management, you can take control of your finances and work towards achieving your financial goals. Remember, financial success is a lifelong journey, and ongoing learning and improvement are essential.