Financial algebra is a specialized branch of mathematics that focuses on the application of mathematical principles to solve real-world financial problems. It provides students with the essential skills needed to make informed financial decisions, such as understanding interest rates, calculating loan payments, and budgeting.

The Financial Algebra Workbook 4-1 is a comprehensive resource that provides students with a variety of problems and exercises to help them practice and master the concepts covered in the textbook. This workbook is designed to reinforce the learning objectives and key concepts taught in class, and to provide students with the opportunity to apply their knowledge to real-world scenarios.

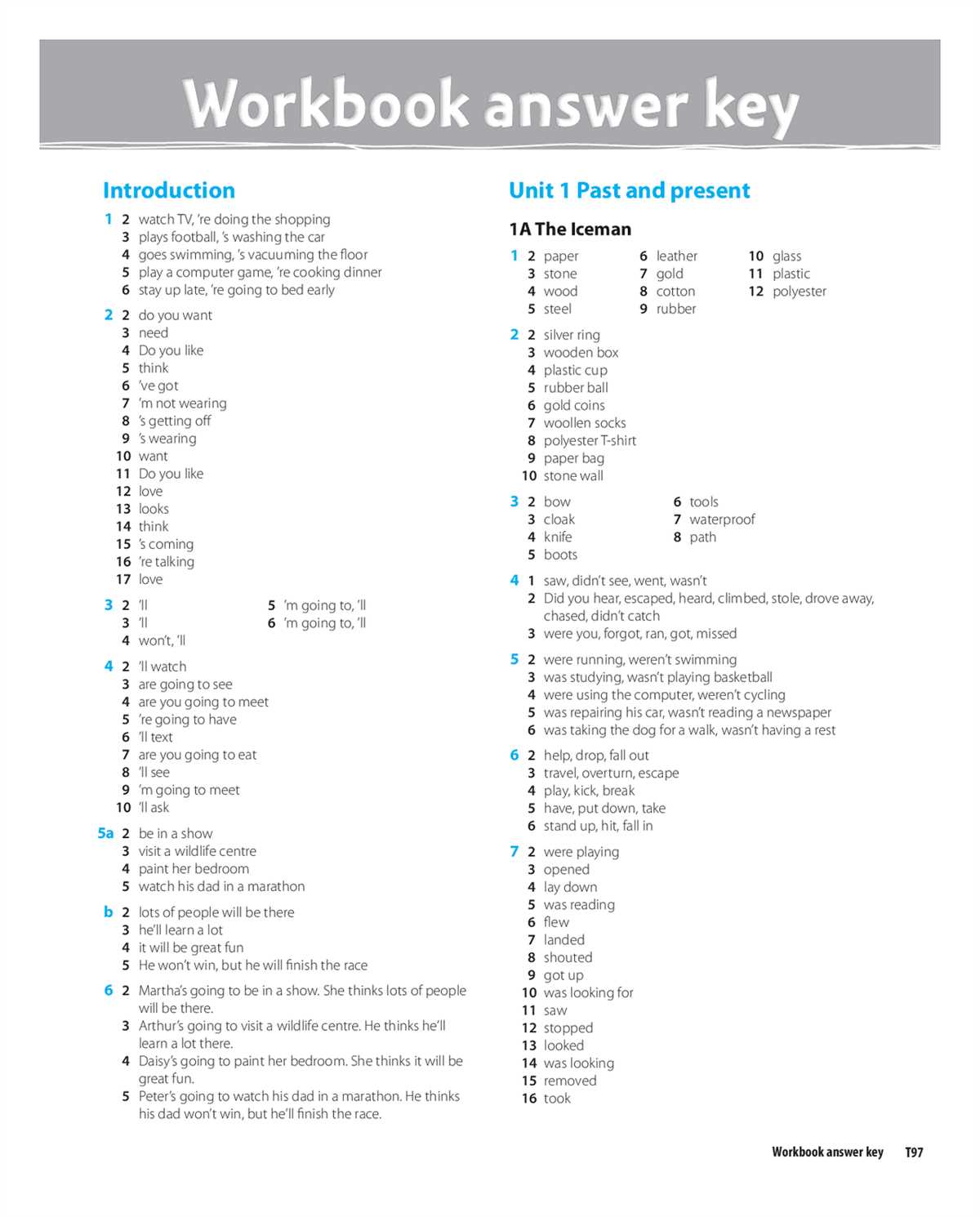

The answers to the Financial Algebra Workbook 4-1 are an invaluable tool for both students and teachers. They allow students to check their work and assess their understanding of the material, while also providing teachers with a guide to evaluate student progress and identify areas that may require additional instruction or support. The answers provide step-by-step explanations and calculations to ensure students fully understand the concepts and can apply them correctly.

Financial Algebra Workbook 4-1 Answers

Financial Algebra Workbook 4-1 is a comprehensive resource that provides students with a wide range of practice problems to reinforce their understanding of financial algebra concepts. This workbook consists of various exercises that cover topics such as compound interest, annuities, loans, and investments.

When working through this workbook, it is important for students to have access to the answers for each problem. This allows them to check their work, identify any mistakes they may have made, and learn from their errors. The Financial Algebra Workbook 4-1 Answers are provided at the end of the book, allowing students to easily refer to them as needed.

The answers in the workbook are presented in a clear and concise manner, making it easy for students to understand how to arrive at the correct solution. Each answer is accompanied by a step-by-step explanation, helping students learn the process of solving financial algebra problems.

The Financial Algebra Workbook 4-1 Answers serve as a valuable resource for both students and teachers. Students can use them to check their understanding and improve their problem-solving skills, while teachers can use them as a guide when grading assignments or assessing student comprehension. With the help of these answers, students can confidently navigate the complex world of financial algebra.

Understanding Financial Algebra Workbook 4-1

In the education field, financial algebra workbooks are commonly used as resources to teach students about various mathematical concepts related to finance and economics. One such workbook is Financial Algebra Workbook 4-1, which focuses on specific topics such as compound interest, annuities, and investments. This workbook aims to provide students with a solid foundation in financial algebra, enabling them to apply mathematical principles to real-life financial scenarios.

Financial Algebra Workbook 4-1 begins with an introduction to compound interest, explaining the concept and providing step-by-step examples to help students understand how it works. Students learn about interest rates, compounding periods, and the formula used to calculate compound interest. The workbook also covers practical applications of compound interest, such as determining the future value of an investment or calculating the amount of interest earned over a given period of time.

Another important topic covered in Financial Algebra Workbook 4-1 is annuities. Students learn about different types of annuities, including ordinary annuities and annuities due. They learn how to calculate the future value of an annuity, the present value of an annuity, and the amount of periodic payments required to accumulate a certain sum of money. The workbook provides clear explanations and examples to help students grasp the concepts and apply them in practical scenarios.

Additionally, Financial Algebra Workbook 4-1 delves into the topic of investments. Students learn about different investment options such as stocks, bonds, and mutual funds. They learn about risk and return, diversification, and the concept of the time value of money. The workbook provides exercises and problems that require students to analyze investment scenarios, calculate returns, and make informed decisions based on financial data.

In conclusion, Financial Algebra Workbook 4-1 is a valuable resource for students studying financial algebra. It covers important topics such as compound interest, annuities, and investments, providing clear explanations and examples to help students understand and apply mathematical concepts in real-life financial situations. By working through this workbook, students can develop their skills in financial algebra and gain the knowledge necessary to make informed financial decisions in the future.

Importance of Having the Correct Answers

In the realm of financial algebra, having the correct answers is of utmost importance. This applies not only to the comprehension and completion of a workbook or assignment, but also to the overall understanding of financial concepts and their application in real-life scenarios.

One of the primary reasons why having the correct answers is important in financial algebra is the need for accuracy. Financial problems often involve complex calculations and formulas, which can easily lead to errors if not approached with precision. For instance, a single miscalculation in interest rate or discount factor can significantly alter the final outcome, leading to unreliable results and potentially incorrect financial decisions. Therefore, having the correct answers ensures that the calculations are accurate and reliable, providing a solid foundation for further analysis and decision-making.

Another reason why having the correct answers is crucial in financial algebra is the opportunity for learning and growth. When students receive accurate feedback on their work, they can identify any misconceptions or gaps in their understanding and take steps to rectify them. By comparing their answers with the correct ones, students can analyze where they went wrong and figure out the correct approach. This iterative process of learning from mistakes and striving for accuracy allows students to deepen their understanding of financial concepts, improve their problem-solving skills, and develop a more solid grasp of the subject matter.

Additionally, having the correct answers serves as a benchmark for assessing one’s progress and proficiency in financial algebra. By consistently comparing their answers with the correct ones, students can gauge their performance and identify areas that require further improvement. This self-evaluation helps students track their growth, build self-confidence, and stay motivated to continue learning and mastering the subject. It also allows teachers to assess the effectiveness of their instruction and tailor their teaching strategies to address any common misconceptions or difficulties that students may be facing.

In conclusion, having the correct answers plays a fundamental role in financial algebra. It ensures accuracy in calculations, fosters learning and growth, and serves as a benchmark for assessing one’s progress and proficiency in the subject. By striving for the correct answers and actively learning from any mistakes, students can deepen their understanding, develop strong problem-solving skills, and make informed financial decisions in real-life situations.

Strategies for Solving Problems in Workbook 4-1

Workbook 4-1 presents a variety of financial algebra problems that require critical thinking and problem-solving skills. By employing effective strategies, you can approach these problems with confidence and achieve accurate solutions. Here are some strategies to consider:

1. Read the problem carefully:

Before attempting to solve a problem, it is crucial to understand the information provided. Pay close attention to the given data, the question being asked, and any additional instructions. Make sure to identify the necessary variables and formulas that will be required to solve the problem.

2. Break down the problem:

Complex financial algebra problems can often be simplified by breaking them down into smaller, more manageable steps. Analyze the problem and identify any sub-problems or intermediate calculations that need to be solved before reaching the final solution. This approach will help you stay focused and organized throughout the problem-solving process.

3. Apply relevant formulas and concepts:

Financial algebra problems often involve using specific formulas and concepts. Make sure you understand and apply the appropriate formulas to solve the problem accurately. If necessary, review the relevant formulas and concepts before attempting to solve the problem.

4. Show all your work:

When solving problems in Workbook 4-1, it is important to show your work step by step. This allows you to track your progress and makes it easier to identify any potential errors. Additionally, showing your work helps you receive full credit for your efforts, even if the final answer is incorrect.

5. Double-check your solution:

After finding a solution, take the time to double-check your work. Carefully review all calculations and ensure that the final answer is reasonable and aligns with the initial problem. Look for any potential errors or mistakes that may have been made during the problem-solving process. Taking this extra step can help you catch any inaccuracies and improve your problem-solving skills.

By employing these strategies, you can enhance your problem-solving abilities and successfully tackle the financial algebra problems presented in Workbook 4-1. Practice and persistence will lead to improved skills and confidence in solving complex financial problems.

Detailed Solutions for Selected Problems in Workbook 4-1

Below are detailed solutions for selected problems in Workbook 4-1:

Problem 1:

Q: Determine the present value of an investment that pays $500 every year for 5 years, assuming a discount rate of 4%.

A: The present value of the investment can be calculated using the formula:

PV = FV / (1 + r)^n

where PV is the present value, FV is the future value, r is the discount rate, and n is the number of years. Plugging in the values, we get:

PV = $500 / (1 + 0.04)^5 = $500 / 1.21665 = $410.04

Therefore, the present value of the investment is $410.04.

Problem 2:

Q: Calculate the future value of an investment that has an initial investment of $2000 and an interest rate of 6% for 10 years.

A: The future value of the investment can be calculated using the formula:

FV = PV * (1 + r)^n

where FV is the future value, PV is the present value, r is the interest rate, and n is the number of years. Plugging in the values, we get:

FV = $2000 * (1 + 0.06)^10 = $2000 * 1.7908478 = $3581.70

Therefore, the future value of the investment is $3581.70.

These are just two examples of the detailed solutions provided in Workbook 4-1. The workbook covers various topics in financial algebra, including compound interest, annuities, and present and future values of investments. Each problem is accompanied by step-by-step solutions to help students understand and apply the concepts. The workbook is a valuable resource for anyone looking to improve their understanding of financial algebra and develop their problem-solving skills in this area.

Tips for Improving Problem-Solving Skills in Financial Algebra

Financial algebra requires strong problem-solving skills to effectively understand and apply mathematical concepts to real-world financial situations. Here are some tips to help you improve your problem-solving skills in financial algebra:

- Understand the problem: Before attempting to solve a problem, make sure to thoroughly understand the given information and the question being asked. Take time to read and analyze the problem, identifying key variables and relationships.

- Break down complex problems: If a problem seems complex or overwhelming, break it down into smaller, more manageable parts. Identify any patterns or relationships that may exist within the problem and tackle each component separately.

- Apply mathematical concepts: Use your knowledge of financial algebra concepts to determine which formulas or equations can be applied to solve the problem. Pay attention to units and ensure that calculations are done accurately.

- Utilize problem-solving strategies: There are various problem-solving strategies that can help in financial algebra, such as working backwards, drawing diagrams, or creating tables. Experiment with different strategies to find the most effective approach for each problem.

- Practice with real-world scenarios: Apply financial algebra concepts to real-life situations to gain a better understanding of their practical applications. Look for opportunities to analyze financial data, such as budgeting, investing, or calculating loans.

By following these tips and consistently practicing problem-solving in financial algebra, you can enhance your skills and confidently tackle complex financial scenarios. Remember to approach problems systematically, stay focused, and seek additional resources or assistance when needed. With determination and practice, you can become proficient in financial algebra problem-solving.

Resources for Further Practice and Learning

Now that you have completed the Financial Algebra Workbook 4-1, you may be looking for additional resources to enhance your understanding of the topics covered. Here are some recommended resources for further practice and learning:

1. Online Courses

There are several online platforms that offer courses specifically focused on financial algebra. These courses provide comprehensive lessons, practice exercises, and quizzes to help you master the concepts. Some popular platforms to consider include:

- Khan Academy: Khan Academy offers free courses on various mathematical topics, including financial algebra. Their courses feature instructional videos and interactive practice exercises.

- Coursera: Coursera offers both free and paid courses on financial algebra. These courses are usually taught by experienced instructors from top universities and provide a structured learning experience.

- Udemy: Udemy provides a wide range of courses on financial algebra, catering to different skill levels. Many of these courses offer lifetime access, allowing you to learn at your own pace.

2. Books and Study Guides

If you prefer learning from traditional textbooks, there are several books and study guides available on financial algebra. These resources provide detailed explanations of the concepts, step-by-step examples, and practice problems. Some recommended books include:

- Financial Algebra: Advanced Algebra with Financial Applications: This book, authored by Robert Gerver and Richard Sgroi, provides a comprehensive overview of financial algebra concepts. It includes real-world examples and exercises to reinforce learning.

- Financial Algebra Workbook: This workbook, written by McGraw-Hill Education, offers additional practice problems and exercises to supplement your understanding of financial algebra.

- Financial Algebra: Personal Finance Applications Workbook: This workbook, authored by Cengage Learning, focuses on the application of financial algebra concepts to personal finance scenarios. It includes practical examples and activities.

3. Online Practice Resources

There are various websites and apps that provide free practice exercises and quizzes to further strengthen your skills in financial algebra. These resources often feature interactive activities and instant feedback, allowing you to track your progress. Some popular online practice resources include:

- Mathway: Mathway offers a wide range of math problem-solving tools, including a financial algebra section. You can input your own problems or practice with pre-generated questions to test your knowledge.

- IXL Learning: IXL Learning provides a comprehensive online practice platform for various subjects, including financial algebra. It offers an adaptive learning experience that adjusts to your skill level.

- Kuta Software: Kuta Software offers downloadable worksheets and practice materials for financial algebra. These resources can be a valuable supplement to your learning.

By utilizing these resources, you can continue to strengthen your understanding and skills in financial algebra. Remember to practice regularly and seek clarification whenever needed. Happy learning!